jaanalisette

Thesis

Twilio Inc. (NYSE:TWLO) will report its Q2 earnings release on August 4. Given the intensifying macro headwinds, we believe the market will continue to parse management’s guidance on its path to profitability.

Twilio’s weak underlying fundamentals have resulted in the significant battering of its stock as it continued to hobble above its COVID lows. But, we don’t think the market would re-rate it unless management can guide for free cash flow (FCF) profitability, as its growth is expected to moderate through FY24. Furthermore, its usage-based pricing model could be hampered by a potential slowdown in corporate spending, impacting its revenue and profitability projections further.

TWLO’s price action suggests a near-term bottom on its long-term chart, but without a bear trap (significant rejection of selling momentum) to help stanch its bearish bias.

As a result, we don’t encourage investors to add exposure heading into its Q2 card. Therefore, we reiterate our Hold rating on TWLO.

A Recession Could hamper Twilio’s Weak Profitability

Given the renewed focus on recessionary themes lately, it could impact companies with exposure to small and medium businesses (SMBs) more significantly.

Morgan Stanley (MS) also cautioned in a recent note, urging investors to focus on companies with a heavier focus on subscriptions, and larger enterprises, as their spending could be more resilient in an economic downturn.

Twilio also cautioned in its filings that investors need to consider its exposure to SMBs and the revenue impact of its usage-based pricing model. It highlighted (edited):

We generate a portion of our revenue from SMBs, which may be affected by economic downturns and other adverse macroeconomic conditions to a greater extent than enterprises. If our customers reduce their use of our products, or prospective customers delay adoption or elect not to adopt our products, as a result of a weak economy or rising inflation and increased costs, this could adversely affect our business. For certain of our products, we primarily charge based on usage-based pricing. Further, as competitors introduce new products or services that compete with ours or reduce their prices, we may be unable to attract new customers or retain existing customers based on our historical pricing. (Twilio FQ1’22 10-Q)

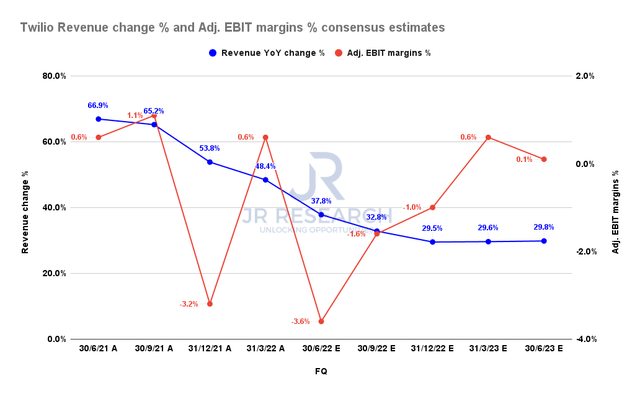

Twilio revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Accordingly, we believe the consensus estimates (bullish) have modeled for the impact of the macro headwinds. As a result, the Street expects Twilio to post revenue growth of 37.8% in FQ2, with an adjusted EBIT margin of -3.6%.

Notwithstanding, we believe the Street is confident that Twilio’s profitability could continue to improve through FQ2’23, despite falling revenue growth projections.

Given Twilio’s weak underlying profitability and the Street’s bullish tilt, we urge investors to model an appropriate discount in their valuation models. In addition, we believe it’s critical to consider the possibility of a prolonged recessionary impact on Twilio’s underlying operating model.

TWLO – Still Priced Like It’s Growing Rapidly

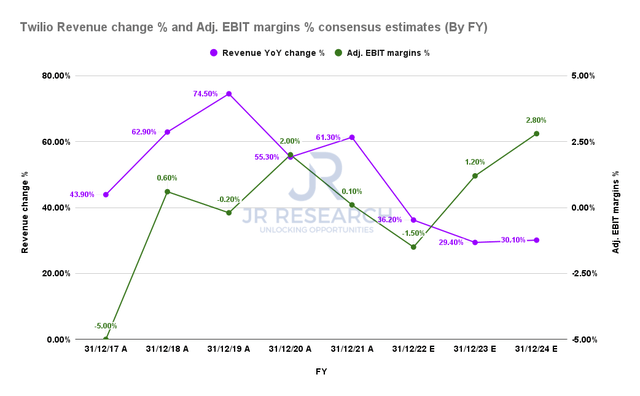

Twilio revenue change % and adjusted EBIT margins % consensus estimates (By FY) (S&P Cap IQ)

Furthermore, the consensus estimates suggest that Twilio’s revenue growth could continue to slow through FY24, reaching 30.1%. Notwithstanding, the bullish analysts expect Twilio to post an adjusted EBIT margin of 2.8% in FY24.

The Street has likely modeled its projections according to management’s medium-term outlook of 30% revenue growth through FY24 and non-GAAP operating profitability by 2023. But, if the recessionary headwinds intensify, we believe Twilio’s guidance could also be at risk. Coupled with its weak fundamentals, we urge investors to carefully parse management’s commentary on its updated guidance (if any).

Also, despite falling more than 80% from its 2021 highs, TWLO last traded at an FY24 FCF yield of 1.07%! Therefore, it’s still not cheap. As a result, we believe such a valuation could be at risk of a steep compression if management revises its guidance markedly due to potentially more persistent macro headwinds.

TWLO – No Constructive Bottoming Process Yet

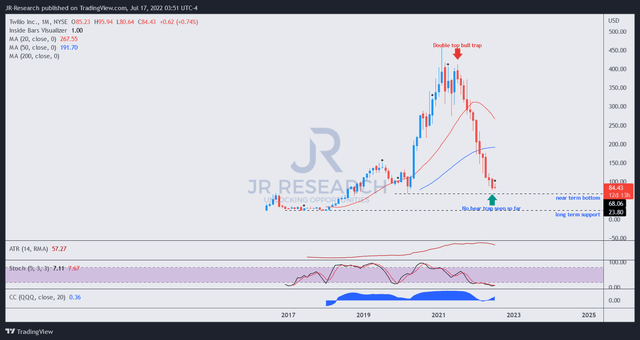

TWLO price chart (monthly) (TradingView)

TWLO’s long-term chart suggests that it could be at a near-term bottom. But, we have yet to observe price action that indicates a sustained bottom. Therefore, we urge investors to be patient.

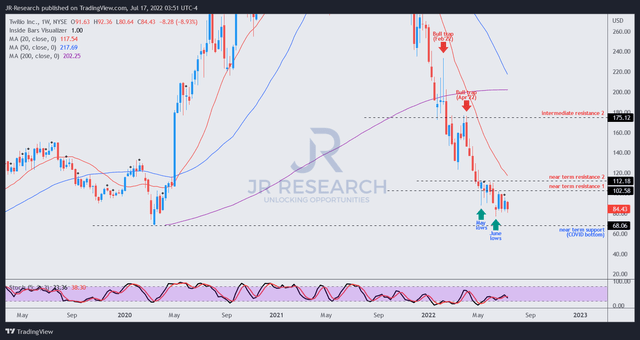

TWLO price chart (weekly) (TradingView)

On its medium-term chart, we observed that TWLO broke below its May lows in June. In addition, it has also formed a lower-high resistance ($102), which could hinder further buying upside in the near term. We also have not observed any bear trap price action, which could help to reverse its bearish momentum.

Therefore, TWLO’s price action remains tentative, and its dominant bearish bias remains intact until proven otherwise.

Is TWLO Stock A Buy, Sell, Or Hold?

We reiterate our Hold rating on TWLO.

We are concerned that Twilio’s weak underlying profitability could be impacted by worsening macro headwinds, hampering its relatively aggressive revenue guidance. As a result, it could markedly affect its valuation if management cuts its outlook.

Our price action analysis has not suggested a sustained bottom or bear trap price action. Therefore, caution is warranted. TWLO is also still mired in a bearish flow.

Be the first to comment