simpson33

Investment Thesis

Disney (NYSE:DIS) has a strong advantage over Netflix (NFLX) which could see Disney’s prospects substantially improve.

Disney+’s advertising tier could be a win-win-win for all parties involved, from brands to consumers to Disney itself. Here I explain why that’s the case.

Furthermore, bringing a more affordable package to new prospective consumers during a weaker economic environment will lead to “free advertising” of Disney’s ecosystem to consumers of future Disney merchandise.

For a stock that has gone nowhere fast for nearly 7 years, despite shareholder activism, I believe that there’s way too much pessimism now priced in, and not enough hope.

Advertising Revenues Could be a Meaningful Contributor for Disney

Disney is expected to roll out its Disney+ Basic tier, which includes ads at some point in early December 2022.

And this is what we can now expect if Disney+ is going to have similar prospects to Netflix. Brands love the advertising platform. And it makes a lot of sense for brands, how do you go about reaching consumers that you previously connected with via linear TV?

That means that brands are going to be able to be exposed to mass audiences, in a highly targeted way, as well as having insights into the performance of their ad, while being mindful of privacy.

Being able to measure the performance of the ad will be critical. And ad companies will happily pay up to know what sort of household is watching their ads, when, and how often, and compile enough data to get a clear sense of the ROI figures that brands are getting. And Disney can charge for this, a lot.

For consumers, this is also a win. Video advertising goes well with shows and we are all accustomed to ads showing in between our favorite shows (particularly if you are of a certain age).

For prospective subscribers that are migrating away from linear TV to connected TVs, this cheaper entry point into the Disney ecosystem is also very much welcome.

The Advantage of Disney over Netflix

Disney can continue to invest in its growth prospects, as its advertising business can deliver a lot more than just revenue for Disney.

Getting more consumers on Disney+’s basic tier, with ads, could provide “free advertising” for Disney’s Experiences and Parks.

During the Netflix earnings call, this is what Netflix said,

And I would say that, the initial demand that we’re seeing is very strong. So people are very excited about the proposition of bringing their brands and their ads to a bunch of consumers around the world that are watching our shows.

Consider this, how many more avenues to monetize households does Disney have over Netflix? Think of all the merchandise that consumers can buy from being present in Disney’s ecosystem on a daily basis.

What’s more, this could be particularly effective in Europe, as its embracing a cost of living crisis as well as a potential recession.

Getting Disney to take market share in this difficult downturn could really drive up the value of Disney’s brand.

DIS Stock Valuation – 18x Next Year’s EPS

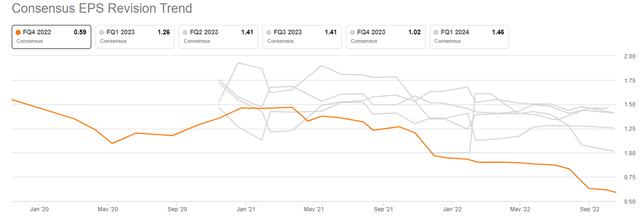

Analysts following Disney are now very bearish.

As you can see in the orange line above, with the passage of time, analysts have been consistently downwards revising Disney’s Q4 2022 EPS estimates.

And while I make no claim to be able to forecast how its Q4 2022 EPS figures will come out in Q4 2022, I do think that this level of negativity is really too severe.

Here’s my argument, I believe that in the same way, Netflix’s advertising business has positively ignited its share price, on the back of what was clearly a mixed bag of results, investors could in time dislodge from their negative outlook towards Disney.

Looking out to next year, Disney is being priced at 18x next year’s EPS. This compares with Netflix that’s priced at 22x next year’s EPS (adjusted for the after-hours jump and the different fiscal year).

The Bottom Line

Here’s my argument: Disney’s advertising business could be the catalyst to unlock shareholder value. Indeed, I believe that Disney’s prospective advertising business could be a better catalyst than shareholder activist Daniel Loeb.

Loeb has been shaking Disney for a number of years, without success. In fact, I declare that Disney’s advertising business could indirectly benefit Disney’s products and experiences.

Simply put, even though I recognize that Disney’s Parks make up a substantial amount of the free cash flow line, its Parks business line has matured, and may even show some weakness in a weaker economic environment.

Accordingly, my argument here is not about Disney’s free cash flow potential, but about what is likely to positively ignite investor enthusiasm for Disney.

I put forward that investors will be positively encouraged by Disney’s advertising business and how the advertising business could be a robust revenue driver for the overall business model.

Be the first to comment