Justin Sullivan

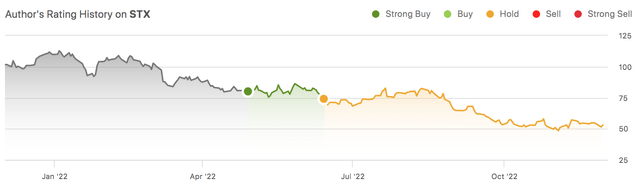

While we like Seagate Technology Holdings plc’s (NASDAQ:STX) position within the storage industry, we continue to be hold-rated on the stock. We expect demand for STX’s primary source of revenue, Hard Disk Drives (“HDDs”), to continue to weaken due to normalizing PC demand post-pandemic and moderating cloud and enterprise storage spending. The stock has dropped nearly 30% since our downgrade in mid-June. We expect more downside ahead and recommend investors wait on the sidelines until HDD demand recovers.

The following graph outlines our rating history of STX stock.

More HDD weakness to be priced in

STX derives the bulk of its revenue from its HDD product line, accounting for 87% of total revenue in 1Q23. Our bearish sentiment on the stock is based on our belief that HDD demand will continue to be weak toward 1H23. STX’s 1Q23 earnings report showed HDD revenue decline by 26% sequentially and 38% Y/Y to $1,722M. We believe STX’s crashing HDD revenue results from near-term demand weakness and customer inventory correction.

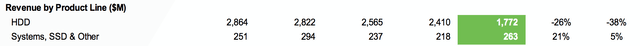

The following table outlines STX’s revenue by product line for 1Q23.

STX Q1FY23 earnings presentation

We don’t believe the weakness is over yet. We expect the STX will continue to underperform as a result of two factors:

1. Normalizing PC market demand

HDDs were traditionally utilized for PCs and smartphones, but more recently, these two markets are replacing HDDs with faster and more instant Solid State Drive (SSDs) storage. HDDs are still widely used in PCs, and hence we attribute part of STX’s declining HDD revenue to weaker demand from its PC markets or legacy market. STX’s legacy market capacity shipped has declined 11% sequentially and 47% Y/Y in 1Q23. We believe the company is feeling pressure from the normalizing PC demand in the post-pandemic environment. Gartner reported worldwide PC shipments declined by 19.5% Y/Y in the 3Q22. We don’t expect STX to enjoy the same demand in its legacy markets as it did during the pandemic. We also believe SSDs are increasingly canalizing HDDs in the PC space. We expect continued weak demand to gate keep STX’s near-term revenue growth.

2. Moderating cloud and enterprise storage spending

Cloud and enterprise storage spending have been taking the spotlight as STX’s fastest growing end-markets, but HDD sales in this arena are also on-decline. STX’s mass capacity revenue is down 25% sequentially and 21% Y/Y in 1Q23. We attribute the normalized demand on cloud and enterprise storage spending fronts to the harsh macroeconomic environment. We believe fewer customers are opting to invest in cloud and storage spending as inflationary pressures and interest rates peak. Mass capacity shipments made up 88% of STX’s total capacity shipped in 1Q23. Our bearish sentiment on the stock is based on our belief that STX will continue to see weak HDD demand from its mass capacity markets toward 1H23.

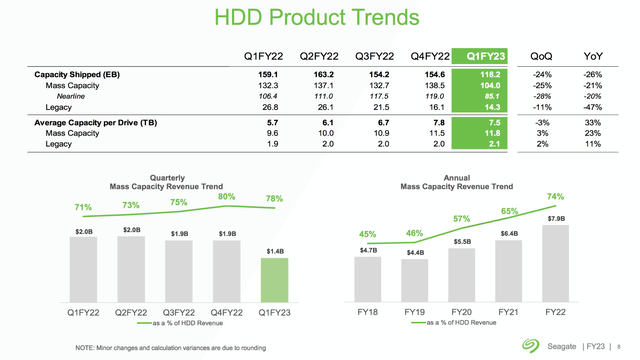

The following graphs outline STX’s mass capacity revenue trends between 1Q22-1Q23.

STX’s Q1FY2023 earnings presentation

Not alone in the negatives

STX is feeling the grunt of weakening storage demand alongside the wider semiconductor peer group. In August, StorageNewsletter reported that HDD shipments declined 15% last quarter. While STX suffered double-digit declines due to weaker HDD demand, so did its competition. Toshiba (TOSBF, TOSYY) is facing similar declines plunging 15% sequentially in shipped capacity. Western Digital Corp (WDC) also saw softer demand for HDDs, with HDD revenue dropping from 2,128M in 4Q22 to 2,014M in 1Q23. We expect the global storage demand to remain weak until macroeconomic headwinds ease.

Valuation

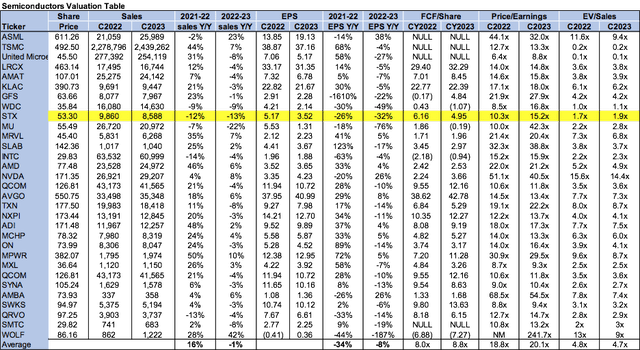

STX is relatively cheap, but we expect more downside to be factored into the stock. On a P/E basis, the stock is trading at 15.2x C2023 EPS $3.52 compared to the peer group average at 20.1x. The stock is trading at 1.9x EV/C2023 Sales versus the peer group average of 4.7x. While the stock is trading well below the peer group, we don’t recommend investors buy the stock on weakness just yet. We believe weak HDD demand will continue and recommend investors wait on the sidelines until the downside risks have been factored in.

The following table outlines STX’s valuation compared to the peer group average.

Word on Wall Street

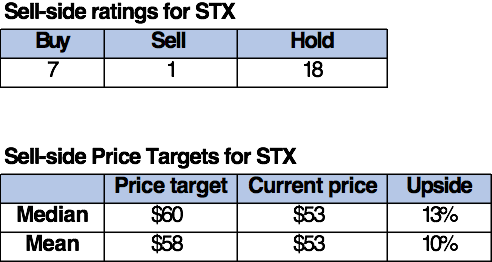

Wall Street shares our bearish thesis on the stock. Of the 26 analysts covering the stock, seven are buy-rated, 18 are hold-rated, and the remaining are sell-rated. The stock is currently priced at $53 per share. The median sell-side price target is $60, while the mean is $58, with a potential 10-13% upside.

The following tables outline STX’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

STX stock has declined nearly 53% YTD and 30% since our downgrade of the stock. We believe STX is facing moderating demand due to weaker PC markets in the post-pandemic environment and sluggish cloud and enterprise storage spending due to macroeconomic headwinds. We don’t see HDD demand recovering in the near term and recommend investors wait for a better entry point on Seagate Technology Holdings plc.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment