Gareth Cattermole/Getty Images Entertainment

L’Oréal S.A. (OTCPK:LRLCY) (OTCPK:LRLCF) is not only the biggest cosmetics company in the world but also the 2nd biggest company in France (by market capitalization) and certainly a company that deserves a spot on our watchlist. I published my last article in August 2020 but considered the stock overvalued back then. In the almost 2 years that have passed since then, the stock stagnated, and investors got almost no return (which is in line with the broader market). However, in the meantime, the stock was quite volatile and increased almost 50% and then declined about 30% from its all-time highs.

It was probably not a good idea to invest in L’Oréal in August 2020 which does not mean it has to be a bad idea today. While the stock is trading for a similar price, the fundamental business might have changed, and improved fundamentals could justify that share price today, which could not be justified almost two years ago.

Annual Results

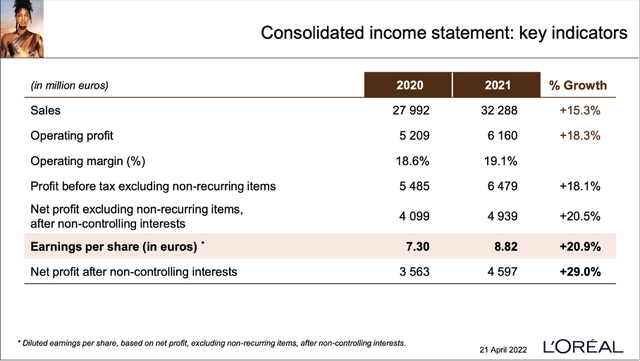

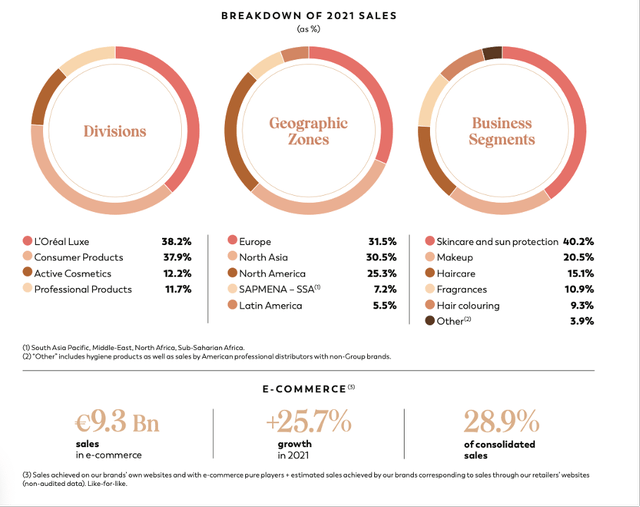

L’Oréal struggled a bit in the years before COVID-19, and 2020 was also a rather difficult year for the French personal care company. However, in fiscal 2021 the business could report impressive numbers and grow with a high pace. Sales increased from €27,992 million in fiscal 2020 to €32,288 million in fiscal 2021 – resulting in 15.3% year-over-year growth. Operating profit also increased from €5,209 million in fiscal 2020 to €6,160 million in fiscal 2021 (18.3% YoY growth). And earnings per share even increased 20.9% year-over-year from €7.30 in fiscal 2020 to €8.82 in fiscal 2021.

L’Oreal Annual General Meeting 2022

Like-for-like growth was 16.1% in fiscal 2021 and about €9.3 billion in sales were already generated online with ecommerce sales increasing 25.7% in fiscal 2021.

And L’Oréal can continue to grow with a high pace. In the first quarter of fiscal 2022 sales increased from €7,615 million in the same quarter last year to €9,061 million this quarter, which is resulting in 19.0% YoY growth (and 13.5% like-for-like growth).

Great Business

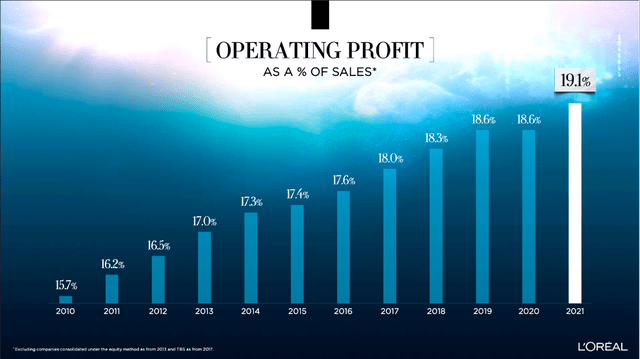

One strong hint that we are dealing with a great business is the constantly increasing operating margin during the last decade. L’Oréal increased its operating margin from 15.7% in 2010 to 19.1% in 2021 and aside from 2020 (the year of the COVID-19 pandemic), the company was able to improve its operating margin every single year.

L’Oreal CAGNY 2022 Presentation

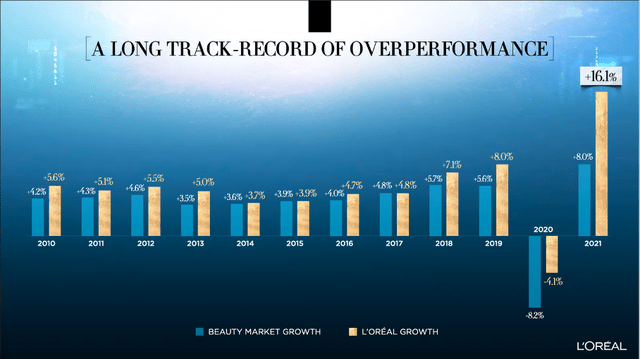

L’Oréal also has a long track record of outperforming its industry. Since 2010 L’Oréal was growing with a higher pace than the overall beauty market (aside from 2015 when the beauty market and L’Oréal both increased 3.9%). And especially in the last few years, the outperformance is becoming more and more obvious.

L’Oreal Annual General Meeting Presentation

It is also worth mentioning that L’Oréal is a “family business” and controlled by the founder’s family, which is always a good sign (as I argued in my article about the strength of family-run businesses). Françoise Bettencourt Meyers and her family own 33.3% of the shares of L’Oréal and therefore have a great influence on the future path of the business.

And finally, L’Oréal has a wide economic moat around the business. That economic moat is based on scale-based cost advantages as well as the portfolio of different brand names. In my last article, I described the economic moat in more detail:

First of all, the competitive advantage stems from a scale-based cost advantage L’Oréal has, as it is the dominant player in the industry. As marketing and advertising costs as well as costs for research and development play an important role and make up a huge part of the overall costs and L’Oréal is producing and selling a large number of units, the unit costs will get cheaper for L’Oréal compared to its smaller peers. And additionally, it will give the company greater purchasing power over its suppliers and probably lower the costs compared to the company’s peers.

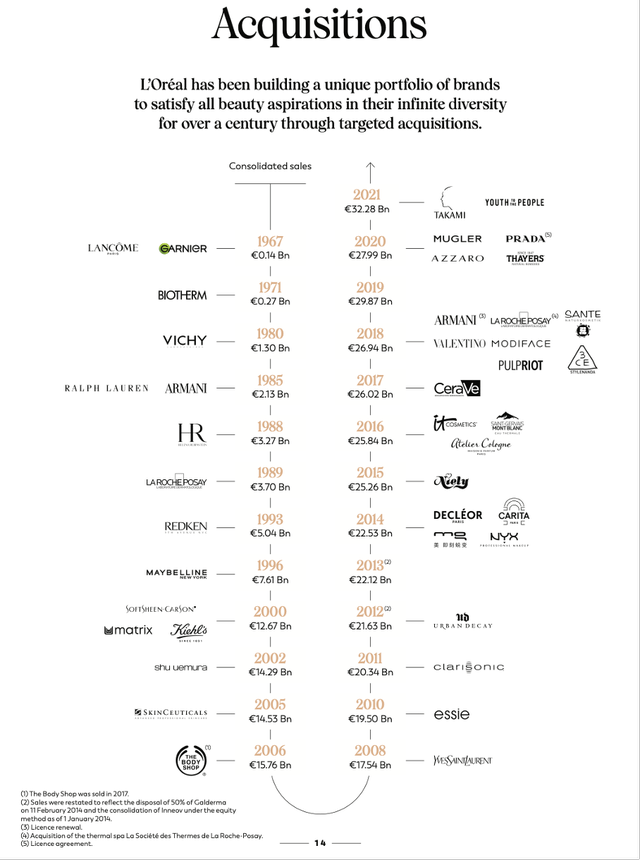

But more important than the scale-advantage is the company’s portfolio of different brands, which are an important intangible asset for the company. L’Oréal has not only several strong brands, but the portfolio is also well-balanced across mass, prestige, salon and dermatological channels and even when facing headwinds in one division (or segment), this could be balanced out by other divisions (or segments). The brands are important and valuable as L’Oréal can charge a premium from its customers because of the brand name. Additionally, it can increase the price a few percentage points (higher than inflation) every single year due to the brand name without losing customers. The company has also disclosed this pricing power as 85% of its organic revenue growth in the past stemmed from a combination of price and mix. Aside from the different brands, L’Oréal has 505 registered patents, which is another intangible asset and important for the company as it is protecting certain products or single components from competition. L’Oréal is also investing a lot of cash into its brands and its reputation as it is the world’s third largest advertiser. Over the past few years, the company spent almost 30% of its revenue on advertising and promotion, which is way above the beauty market average of 19%. L’Oréal has also disclosed that 43% of media spend is for digital marketing and an impressive 75% is allocated to precision advertising.

L’Oréal is also on the 53rd spot of the list of most valuable brands in the world (according to Interbrand). However, it is not only the brand name “L’Oréal” itself that is valuable. The company has a huge list of well-known brand names.

Having a great business is certainly a great asset, but a growing business is also a valuable asset.

Growth

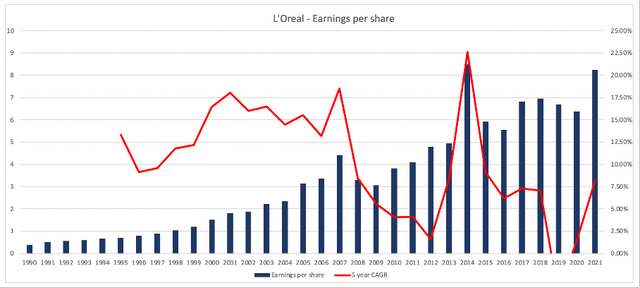

When looking at earnings per share since 1990, we can see that growth rates have been fluctuating. However, since 1990 L’Oréal could increase earnings per share with a CAGR of 10.43% and while growth rates slowed down a bit in the last decade, EPS still increased with a CAGR of 7.24% since 2010.

Analysts are also estimating for L’Oréal to continue growth with a solid pace. According to Seeking Alpha, revenue will increase with a CAGR of 5.81% until fiscal 2031. The cosmetics market is also expected to grow with a CAGR of 5.3% according to two different studies (see here and here).

We can see that L’Oréal also grew by acquisitions in the past. And while the company is growing by making acquisitions at least since 1967, the business is using acquisitions more and more in the last few years. In the past, there have been several years without any acquisitions, but since 2014 L’Oréal not only made at least 22 acquisitions, but the only “acquisition-free” year was 2019.

Aside from growing the top line by either acquisitions or organic growth, L’Oréal could also continue to improve its margins which could contribute to earnings per share growth.

Recession

In the last few weeks, I have already mentioned in several articles about different companies that we must think about a potential recession in the next few quarters. And when analyzing a business, it should be an important part of our analysis. While I still can imagine the stock market rallying in the coming months, I also see a high probability of a steep bear market and recession in fiscal 2023 (not only in the United States).

In the Great Financial Crisis, we saw declining earnings per share in fiscal 2008 as well as in fiscal 2009, and we must assume a similar decline during the next recession. After all, L’Oréal is selling rather high-priced products that are not really essential. Several beauty products are not necessarily the products one would purchase during a recession and when people must cut down spending, these are the products one might stop purchasing.

L’Oreal General Meeting Presentation 2022

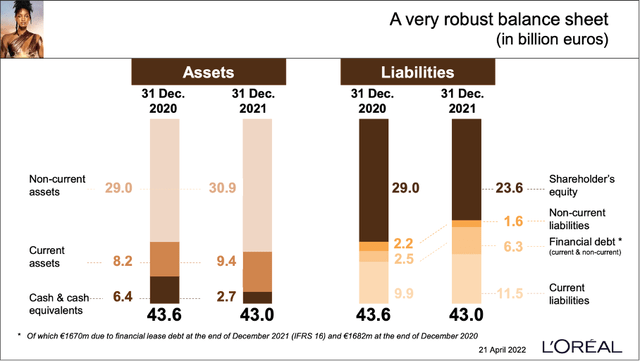

And it is also soothing to know that L’Oréal has a solid balance sheet. And although the balance sheet got worse in the last twelve months, we should not be worried. Cash and cash equivalents decreased from €6.4 billion on December 31, 2020, to €2.7 billion on December 31, 2021. Shareholder’s equity also declined from €29.0 billion to €23.6 billion while financial debt increased from €2.5 billion to €6.3 billion. However, with a D/E ratio of 0.27 and being able to repay all debt with the operating income of one year, we should not be worried.

Dividend

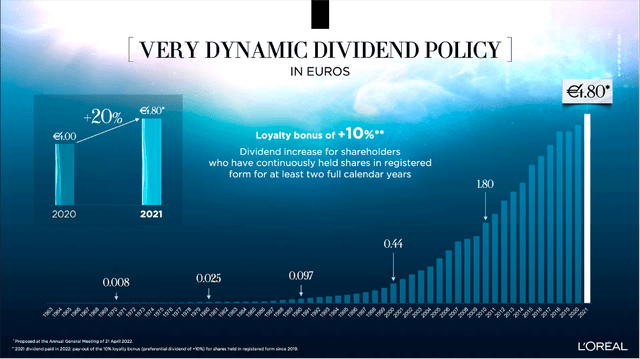

Although L’Oréal is not a dividend aristocrat, it is certainly one of the European companies that has a long history of increasing dividends and being a very stable and reliable dividend payer. Apparently, L’Oréal has been paying an annual dividend since 1963 which means 58 years of continuously paying a dividend. L’Oréal didn’t raise the dividend for fiscal 2019 (due to COVID-19) and kept the dividend only stable, and therefore, we can’t call L’Oréal a dividend aristocrat. But the company increased the dividend constantly in the years before 2019 and since 2010 the dividend was increased with a CAGR of 9.33%.

L’Oreal CAGNY 2022 Presentation

Right now, L’Oréal is paying an annual dividend of €4.80, which is resulting in a dividend yield of 1.55%. Compared to the previous year, the company increased the dividend by 20%. L’Oréal is also paying a loyalty bonus of 10% added to the dividend (resulting in a dividend of €5.28) for shareholders holding the stock for at least two full calendar years.

Intrinsic Value Calculation

We can determine an intrinsic value for L’Oréal by using a discount cash flow calculation. As a starting basis, we are using the free cash flow of fiscal 2021 (€5,653 million). And for the next ten years, we assume 7% growth for L’Oréal followed by 6% growth till perpetuity. This leads to an intrinsic value of €252.37 (assuming a 10% discount rate).

Considering the wide economic moat around the business, we can calculate with 6% growth till perpetuity and 7% growth for the next 10 years, which also seems reasonable as L’Oréal can continue to grow organically as well as by acquisitions and continue to improve its margins. However, this calculation is not considering that L’Oréal will most likely be affected by a recession, and we will probably see declining earnings per share and declining free cash flow. During the Great Financial Crisis, earnings per share for L’Oréal declined about 30%. Let’s assume a similar decline in fiscal 2023. For the following years, we assume a recovery with fiscal 2024 growing 20%, fiscal 2025 growing 15% and fiscal 2026 growing 10%. For the following years till perpetuity, we assume 6% growth. This leads to an intrinsic value of €211.21.

Summing up, I still don’t think L’Oréal is a bargain and a P/E ratio of 35 is also rather expensive – even for a high-quality business.

Conclusion

L’Oréal is not really overvalued right now. And one might argue that you must pay a premium for great companies and that those stocks are hardly ever cheap. This might be true, and everybody must make that decision for oneself. In my opinion, L’Oréal is still a bit too expensive right now, and considering that we are most likely heading towards a recession, I don’t know if right now is the time to buy this undoubtedly great company.

Be the first to comment