Laurent Viteur/Getty Images Entertainment

Investment Thesis

Disney’s (NYSE:DIS) fiscal Q4 2022 results took investors by surprise. In fact, I’ll highlight that I was bullish on Disney going into the quarter, and believed that the stock was already too cheap relative to its fundamentals.

With the stock already down more than 40% in the past year, one would have expected that a lot of negativity would already be in the stock. But not only were Disney’s results very much middle of the road, but its outlook is where Disney really failed to live up to expectations.

Before we go further, note that Disney’s fiscal year and calendar year are misaligned. I’ll only refer to its fiscal year.

This is the punchline. This is not the time to throw in the towel on Disney.

What’s Happening Right Now?

Disney is in a transition period. It’s intent on capitalizing on its very strong brands. The goal for Disney is to broaden its ecosystem and grow a profitable streaming business.

That being said, the problem is twofold, subscriber growth rates and operating losses in its streaming business.

In the first instance, it appears that Disney+’s Domestic paid subscribers are growing at a more measured growth of 20% compared with its Internationally paid subscribers which were up 57% y/y.

Furthermore, looking ahead to fiscal Q1 2023, Disney+ Core subscribers are expected to decelerate on its pace of increase.

Given that Disney+ is where the bull case is at, anything negative on the bull case has an overarching impact on the share price.

Now, consider this, Netflix’s (NFLX) US and Canada subscribers reach 73 million, while Disney’s 46 million Domestic subscribers appear to be struggling to get the household penetration that Netflix has. And now, Q1 2023 is expected to see Disney+’s growth moderate further.

The second problem that Disney faces is that it’s burning a lot of cash flow. To put this in context, for Disney+’s revenue to grow 8% y/y, its losses were up 134% y/y.

Disney is highly cognizant of investors’ sentiment. Particularly as it has shareholder activist, Daniel Loeb consistently makes public his consternation.

The solution was hoped to be advertising. On this note, this is what Disney’s CFO Christine McCarthy said on the call,

The advertising landscape remains fluid. The sports marketplace, in particular, is delivering strong audiences across our platforms with marketers looking to take advantage of live events and several categories, including political, pharma, insurance and restaurants, have continued to show relatively stable demand while others remain cautious in anticipation of potential economic softness.

And therein lies yet another problem for Disney. The advertising sector is on its knees. From TikTok (Private) to Meta (META), to Snap (SNAP), very few companies in advertising are doing well in the current environment.

This means that advertising is unlikely to be the panacea that Disney seeks.

So, what’s the hope as we look ahead?

Revenue Growth Rates Decelerate

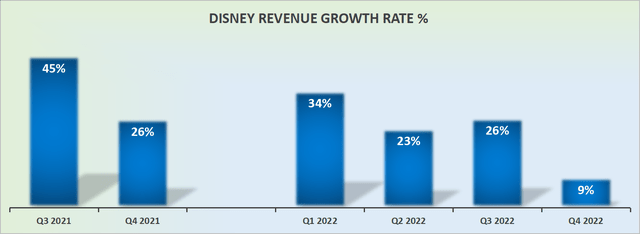

Disney’s revenue growth rates

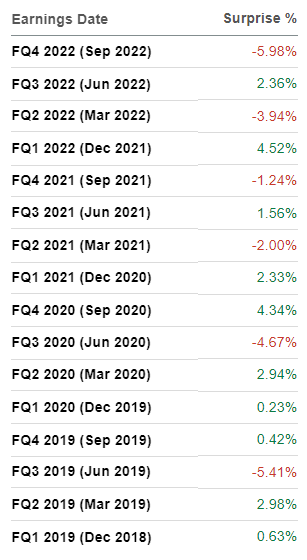

Disney’s revenue growth rates for fiscal Q4 2022 missed analysts’ expectations. That’s one part of the problem. Here’s the other part.

This miss in fiscal Q4 2022, is the biggest topline miss in more than 12 trailing quarters.

Disney’s revenue surprise

The problem here is that fiscal Q4 2022, which covered July, August, and September, was a time when the macro environment was still robust. At least in the first two months of the quarter.

And now as we look ahead to fiscal Q1 2023, we are rapidly getting more and more signals that the economy is weakening. Even amongst households that we previously would believe to have strong consumer balance sheets.

The Bottom Line

This is the one-line takeaway, Disney has a broad portfolio of highly profitable revenue streams. It’s very well set up for the go-forward environment. That’s the bull case.

But between now and the ”go-forward period”, the current environment is a period of substantial uncertainty.

Investors are attempting to grapple with, what will Disney’s consistent revenue growth rates normalize at? Can we hope to see 10% CAGR as the ”new normal” revenue growth rate?

Another key question is what sort of tangible results can we expect from Disney’s advertising opportunity? It’s one thing to state that brands have expressed interest in Disney, it’s quite another to see that interest expressed in revenues.

In this period of transition, investors are reflecting their dismay, impatience, lack of confidence, and frustration, with Disney by dumping their holding.

For my part, I contend that if investors wanted to throw in the towel, the time to have done this was at any point in the prior twelve months.

Indeed, consider this, if an investor throws in the towel and buys another stock, and in 2 years, that new stock is up 30%, they’ll feel great about their stock pick, right?

What about if in two years, Disney returns to $120? This was the price Disney was trading at just 90 days ago. That’s the same 30% return, from this point. I don’t believe this is an impossible feat, particularly given how significantly Disney’s valuation has already come down.

Be the first to comment