AnuchaCheechang

There aren’t many sectors that have had a good year in 2022 when it comes to stock performance and real estate is no exception. One subsector of the REIT space that is looking attractive right now is the cell tower space. American Tower (AMT) is down almost 30% YTD, while Crown Castle (NYSE:CCI) is down nearly 40%. Both companies are looking attractive today, with their dividend yields near all-time highs.

Investment Thesis

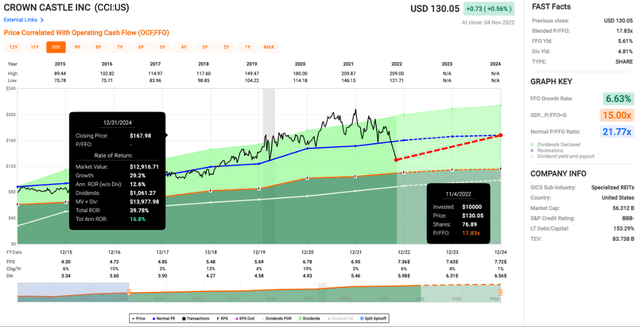

Crown Castle and American Tower are two REITs that fall in the dividend growth category. After the recent sell off, their yields are 4.8% and 2.9%, respectively. Both payouts continue to grow at solid clip and the valuation on both companies is cheap today. Crown Castle is at a 17.8x price/FFO while American Tower is at 20.8x. Both are below their average multiples. I wouldn’t be surprised if both companies deliver double digit returns from a combination of increasing dividends, multiple expansion, and continued FFO/share growth.

I’m very bullish on both companies, but the cheaper valuation and larger yield on Crown Castle is why I would choose it over American Tower if I were putting new money to work in the cell tower REITs. With that being said, I still think it’s hard to go wrong with American Tower. While the large mobile service providers look cheap with low P/E ratios and big dividends, I still think the cell tower REITs are a better way to invest in communication infrastructure and the rollout of 5G.

Crown Castle Overview

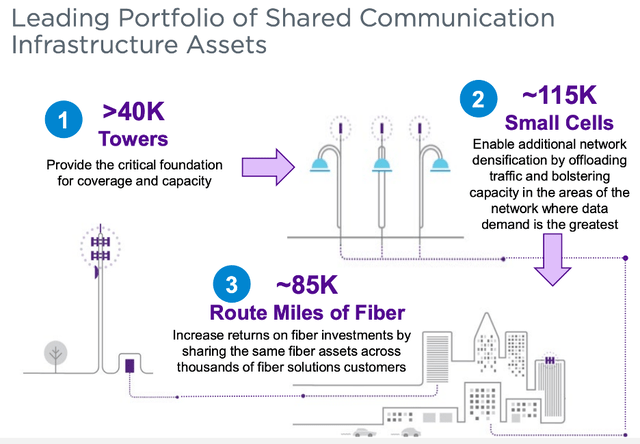

Crown Castle is one of the largest REITs out there with a market cap of $56B. They work exclusively in the US and have been transitioning their focus to small cells in urban areas. They continue to grow the portfolio and I think the tower REITs like Crown Castle and American Tower are a much better way to invest in the future of 5G than debt laden service providers like AT&T (T), Verizon (VZ), or T-Mobile (TMUS).

CCI Portfolio Mix (crowncastle.com)

Q3 Earnings & CCI Guidance

Both cell tower companies reported solid guidance, but Crown Castle was much more descriptive than American Tower when it comes to 2023 guidance. The short version is that the company is expecting organic growth with the tower segment along with faster growth in small cells.

In his assessment on Crown Castle’s third-quarter results, CEO Jay Brown highlighted that “our customers continue to upgrade their macro tower networks, and we expect another year of strong growth in 2023 with 5% organic revenue growth in our Towers segment.”

“Further, we expect small cell growth to accelerate in 2023 by doubling our small cell deployments to 10,000 nodes, more than half of which will be collocated on existing fiber with returns in line with our expectations for lease-up economics,” he added.

Crown Castle continues to grow at a solid clip, and now shares are very cheap after the selloff we have seen recently.

Valuation

The valuation is even more attractive than it was when I wrote my last bullish article on Crown Castle. Shares now sit around $130, which is where shares where in 2019 and briefly during the COVID selloff in 2020. At 17.8x price/FFO the valuation is about as cheap as it ever has been.

Shares have averaged a 21.8x multiple and I wouldn’t be surprised if we see double digit returns from here with the combination of the dividend and some multiple expansion. While Crown Castle has been working on its small cell rollout in the US, American Tower has continued to expand its international tower footprint.

American Tower Overview

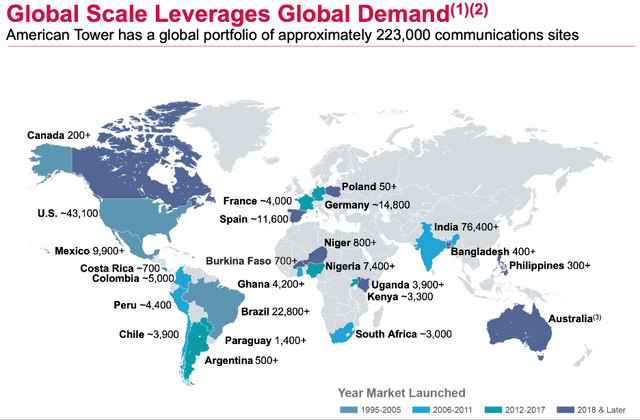

American Tower has taken a different approach to growing its business. They have been busy building (or acquiring) cell towers around the world. Below is a map showing their international footprint. They also acquired CoreSite last year, which was a US based data center REIT. I think the data center assets they added should complement the existing tower infrastructure nicely.

AMT Footprint (americantower.com)

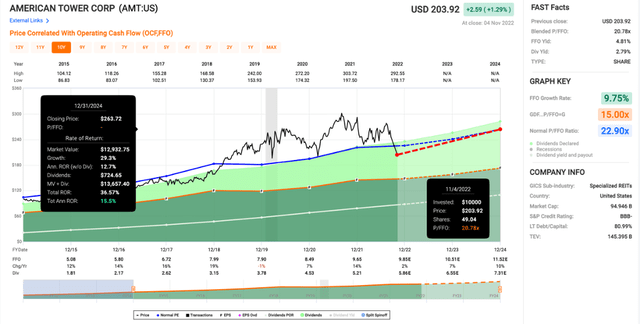

American Tower shares have also had a large selloff, and I’m very bullish with shares around $200. Like Crown Castle, these are basically prices that we last saw in 2019 and the 2020 COVID selloff, and now we have had a couple years of business (and dividend) growth to make things more attractive. Shares now have a price/FFO multiple of 20.8x, which is a couple turns below the 22.9x average multiple.

American Tower is projected to have faster growth than Crown Castle over the next couple years. Like Crown Castle, I think double digit returns are feasible for investors buying today from a combination of FFO/share growth, multiple expansion, and a growing dividend.

Current Yield Or Dividend Growth?

Crown Castle is set to hike the quarterly dividend by 7% to $1.565 heading into 2023 and the company has an impressive track record of dividend growth in recent years. This is on top of a 4.8% yield, which provides a larger current income stream with a side of dividend growth. American Tower, instead of annual raises, has opted for quarterly raises of the dividend.

Their yield currently sits at 2.9%, but they have grown their dividend at a faster clip than Crown Castle. I have come to appreciate the quarterly raises over the last couple years as a shareholder. One thing I would be aware of with American Tower is a higher debt load when compared to Crown Castle, but it is at low interest rates with maturities well spread out over the next couple decades. I think the dividend growth will continue to be impressive as the company continues to grow.

Conclusion

Investors can decide which income stream they prefer, but I think the valuation is attractive enough to justify owning both. If you decide you only want one tower REIT, there are a couple factors I would focus in on. The first is the different footprint of each company. Crown Castle is focused on small cells the US, while American Tower has towers all over the world and recently added acquired a US data center REIT to add to its business mix. The second factor is the valuation.

Crown Castle appears cheaper today with a price/FFO multiple that is a couple turns lower than American Tower’s. Crown Castle’s dividend is also nearly 2% higher, even if American Tower does have the edge when it comes to dividend growth. I own both and I plan to hold onto both for a long time, but if I had to put new money to work right now in the cell tower space, I would probably choose Crown Castle.

Be the first to comment