gorodenkoff

The pandemic has caused an acceleration in the adoption of Digital technology. It made digital services a “must have” and not just an optional extra. From Mobile Phones to Ecommerce, Social Media to Video Conferencing, this technology has become part of our everyday life. When we use digital technology, it just “works” but we don’t think about the gigabytes of data flowing from Data Center to Data Center all over the world.

However, the innovation doesn’t stop there from 5G to AI, Internet of Things (IoT) to the Cloud, all these services require even more infrastructure to function at scale. Picking the winning AI or 5G company can be a challenge, and thus I prefer to invest into the “backbone” digital infrastructure which supports these players. Think of this like a “Digital Toll Road” collecting rents and dishing you out dividends, while the tech companies battle it out for market share. “Digital Transformation” is also a key term which has become popular. Enterprises are realising their legacy IT infrastructure is costly, complicated and not flexible, thus many are moving to the “cloud” which is a fancy word for a Data Center.

“Looking toward 2023, most companies will need to build new digital businesses to stay economically viable.” – McKinsey Global Survey, May 2021

The global data center market size was worth $216 billion in 2021 and is predicted to reach $288 billion by 2027, growing at a CAGR of 4.95%.

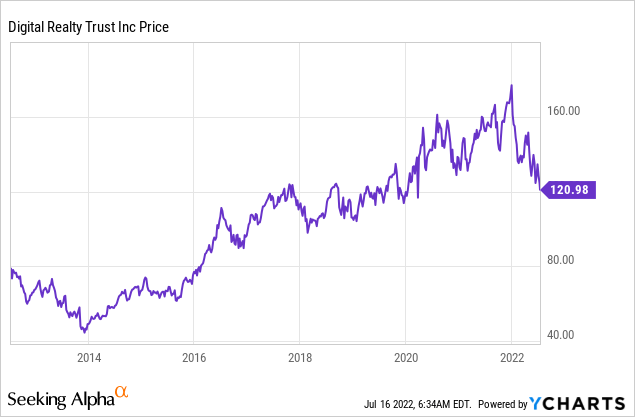

Thus, in this report, I’m going to dive into Digital Realty Trust (NYSE:DLR), a best-in-class owner of Data Centers with over 290 facilities globally. The company acts as the backbone infrastructure for many larger technology providers, from Facebook to Oracle. The stock price has plummeted 30% from the highs in December 2021 and is now trading at the March 2020 lows. From my valuation, the stock is undervalued relative to two large competitors in the industry. Let’s dive into the Business Model, Financials and Valuation for the juicy details.

Business Model

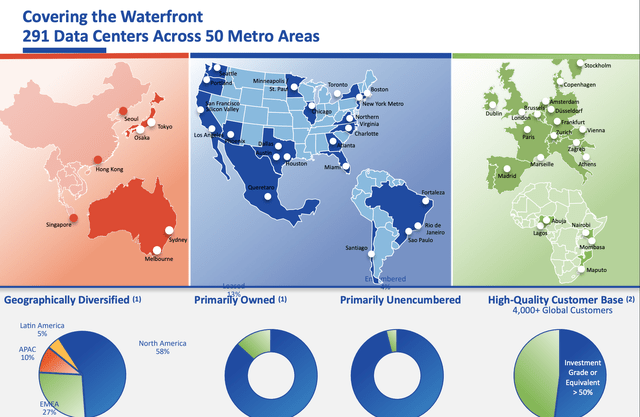

Digital Realty Trust serves a vast customer base of over 4,000 customers, which is diversified across multiple industries from Social Media to IT, Finance and Telecoms. Its largest customers include giants such as; Facebook, Oracle, Verizon, IBM, JPMorgan, LinkedIn, AT&T and many more. These established customers demand best-in-class speed, redundancy and security.

Digital Realty (Investor Report June 2022)

The company’s facilities are well diversified globally across 25 countries and 50 metro areas. With 58% of its facilities in North America, 27% in EMEA, 10% in APC and 5% in Latin America. This global and customer diversification should help to ensure stable cash flows, as when one country or industry is going through a recession, others will be thriving.

Global Diversification (Investor presentation 2022)

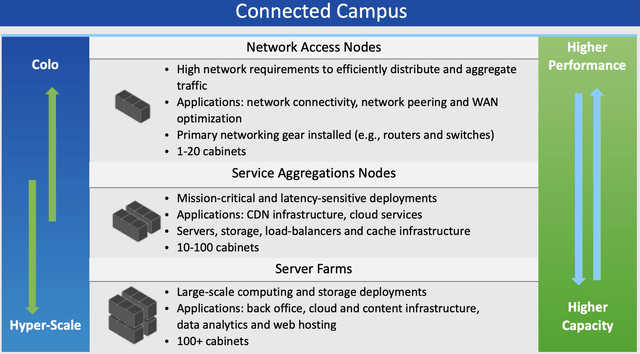

Digital Realty also has a variety of equipment offerings which can appeal to various customers at different price points and stages of their digital transformation journey. From the Network Access Nodes to Aggregation and vast server farms for Hyper-scalers.

Technical details (Investor presentation 2022)

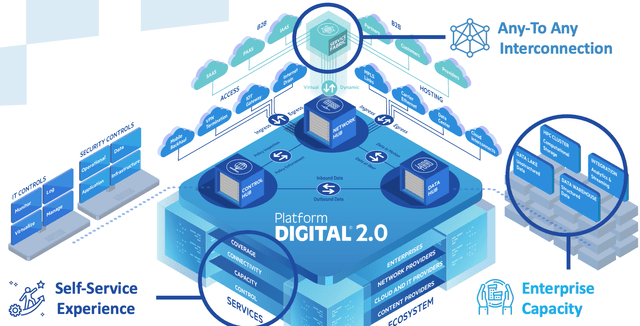

An example of a customer use case can be seen on the animation below. Here a “Self Service” option enables Coverage, Connectivity and Capacity to be dynamically controlled. While its “Any To Any” Interconnection enables low latency data transfer between multiple services.

Platform Digital (Investor Presentation 2022)

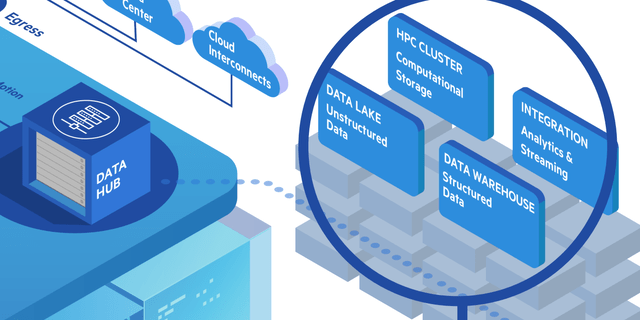

The Data Hub is another high growth area, as legacy companies historically have an issue with “Siloed Data”. Companies are generating more “big data” than ever, but it’s usually stuck in various departments and not utilised. However, by moving data services to the cloud, it can be aggregated and analyzed with various analytics and machine learning processes more easily. For instance, Hewlett Packard Enterprises (HPE) and its GreenLake technology have recently partnered with Digital Realty to help companies with digital transformation and data aggregation.

Data Hub (Investor presentation June 2022)

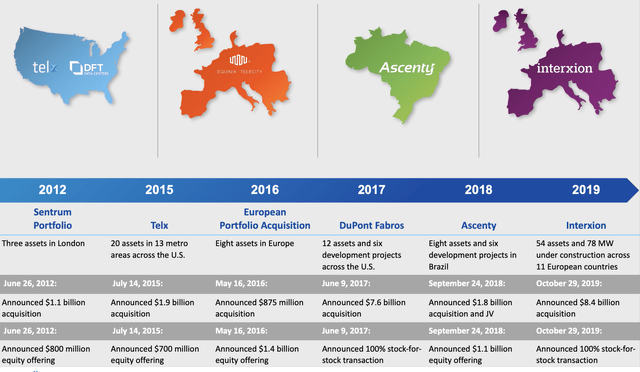

To expand its portfolio, Digital Realty is growing via acquisition and has made a vast number of global investments over the past few years. A few years back I wrote a post on the “consolidation” of the data center industry and the “land grab” tactics companies are using, and now it seems these are playing out.

Digital Realty Acquisitions (Investor report 2022)

Growing Financials

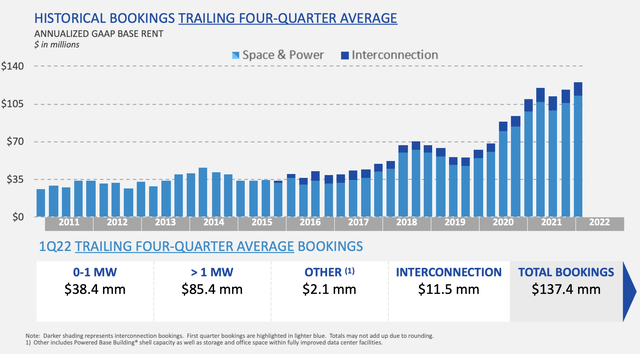

Digital Realty has experienced strong growth in bookings over the past few years, with a major upwards trend seen since the pandemic, which acted as a catalyst for companies to “Digitally transform”.

Bookings (Investor presentation 2022)

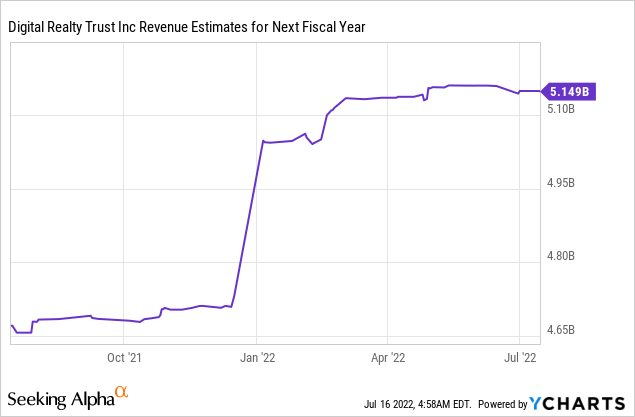

Revenue saw a sharp uptick at the end of 2021 and for the first quarter of 2022, it popped to $1.19 billion, up 11% year over year.

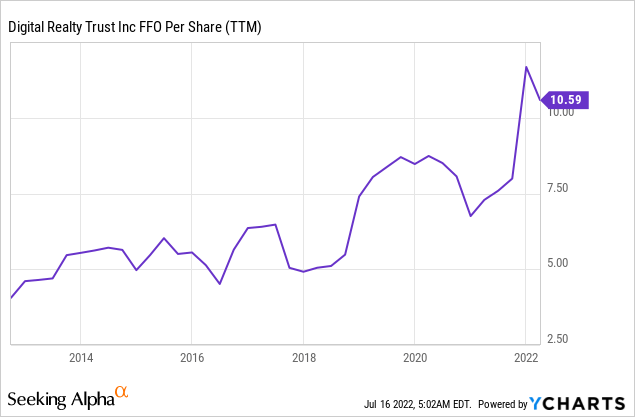

Funds from Operations per share (FFO) saw a slight down tick between the high of $1.78 in Q221 and $1.54 in Q321. However, since then it is starting to recover and was up 6.6% year over year to $1.60 for Q122. Management is expected a further uptick for the rest of 2022, due to record backlog of $391 million in the first quarter.

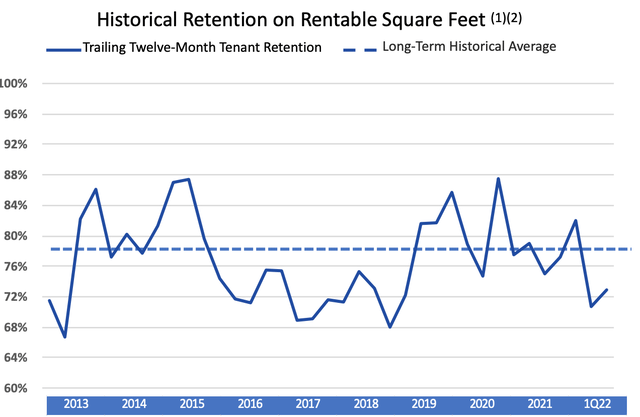

Digital Reality has had a strong retention rate of ~78% historically, which is fantastic as it means the tenants are finding immense value in the service. Transforming legacy IT infrastructure to the cloud is a technical, time-consuming and a costly process. Thus, I believe once installed and set up with a cloud provider, the likelihood of moving providers (even if another is slightly cheaper is rare). Thus, immense “stickiness” is seen in the industry, as you can see with the high retention rate. There has been a slight dip in the trailing 12-month rate, but it does look to be recovering.

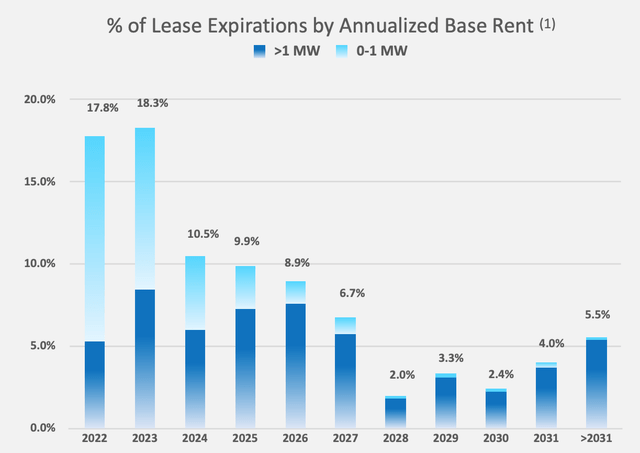

Digital Realty has staggered lease expiration dates, with 17.8% in 2022 and 18.3% in 2023, thus I expect some volatility in the next two years. However, the rest of the lease expiration dates are well diversified across many different years ahead, thus this should guarantee stable operations.

Lease Expirations (Investor presentation)

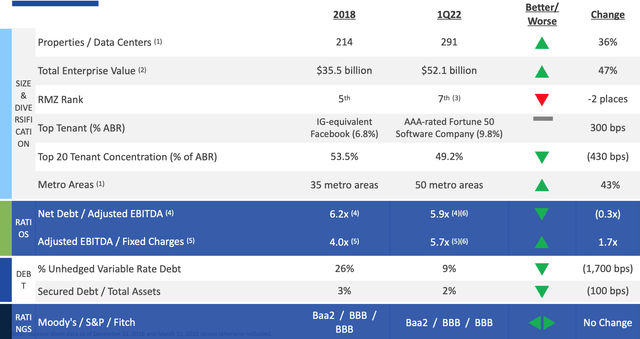

The Enterprise value of Digital Realty has increased by 47% since 2018, from $35.5 billion to $52.1 billion, which is a testament to the company’s acquisition strategy. The top 20 tenant concentration has also decreased by 430 bps to 49%, which is a positive sign as it means more diversification.

Digital Realty (Investor Presentation June 2022)

REITs are well-known for having a large amount of debt, and Digital Realty is no different, with $14.4 billion in long-term debt. The good news is the Net Debt/Adjusted EBITDA ratio has decreased to 5.9x from 6.2x in 2018, which is a positive sign.

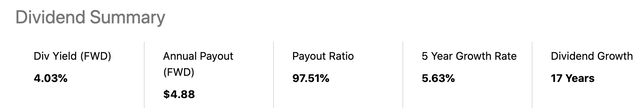

The Dividend Yield (forward) is steady at 4%. Don’t be worried by the very high 97% payout ratio, as by law all REITs must pay out at least 90% of earnings.

Dividend Yield (Investor presentation)

Valuation

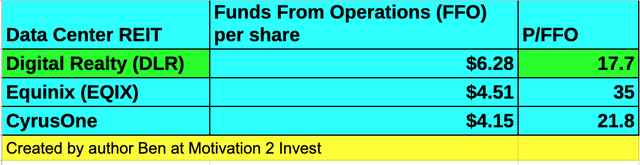

In order to value this REIT, I will compare the Price to Funds from operations across a few data center REITs in the industry. As you can see from the chart I created below, Digital Realty is the cheapest data center REIT of the three, with a P/FFO = 17.7. By comparison, Equinix (EQIX) has a P/FFO = 35 and CyrusOne (CONE) has a P/FFO = 21.8.

Data Center REIT Valuation (created by author Ben at Motivation 2 Invest)

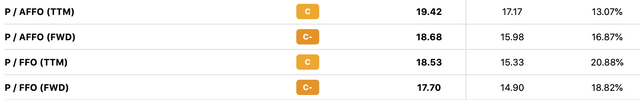

As a general comparison, Digital Realty trades at an average valuation relative to the entire real estate sector. However, I prefer to use the first valuation as the entire real estate sector includes Commercial office buildings, which are trading at cheap multiples.

Digital Realty Valuation (Seeking Alpha)

Risks

Jim Chanos Short Sell Thesis

Infamous short seller Jim Chanos is raising capital to bet against data center REITs. In an interview with the Financial Times on June 29th, Chanos believes the value of the cloud is going to the hyperscalers (Amazon Web Services, Microsoft Azure, Google Cloud) and they will build their own. Thus, he believes the legacy data centers will not be utilized as much. This is an interesting point, but one in which Wells Fargo Analyst, Eric Luebchow, calls “misguided.”

He makes the point that hyperscalers are struggling to build due to long lead times for equipment and power. He notes that the big cloud providers “outsource up to 60% of their capacity demands.” Thus, the short selling thesis by Chanos is contrary to the facts on the ground. However, it is still a risk to be aware of.

Note: Jim Chanos Risk from my recent post on DigitalBridge.

Recession/IT spending cutbacks

Analysts are predicting a “shallow but long” recession, which is forecasted to start in the fourth quarter of 2022. Enterprises may decide to cut back or delay IT spending due to rising input costs and increasing uncertainty. This could mean some volatility is expected within the next year.

Final Thoughts

Digital Realty is a tremendous REIT which provides the backbone infrastructure for many large-scale cloud providers. The REIT’s high Funds from Operations and industry diversified Data Centers offer both quality and stability. The stock is undervalued relative to two large Data Center REITs and thus looks to be a great investment for the long term.

Be the first to comment