Steve Jennings

Twilio (NYSE:TWLO) stock trades like a broken stock thesis, but I have the contrarian view that this is a high quality operator trading at a bargain basement valuation. The company has guided for positive cash flow next year and has a cash-rich balance sheet. The stock trades at less than 4x sales in spite of having guided for 30% organic growth over the next 3 years. I can see TWLO proving to be one of the big winners from the tech crash, but one must find the courage to buy in an environment where seemingly no one wants to buy tech stocks.

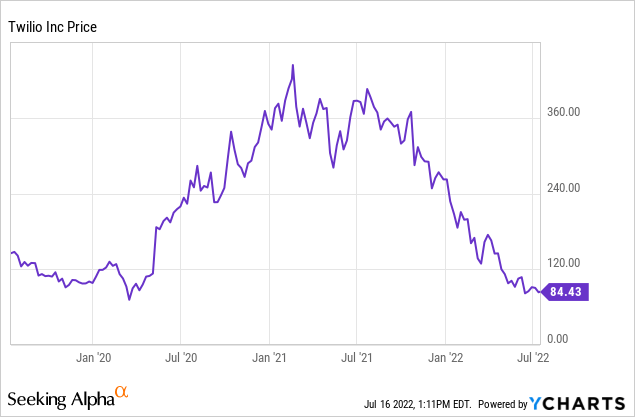

TWLO Stock Price

TWLO peaked at around $440 in early 2021. It probably shouldn’t have traded at that valuation and I did warn on the stock in September. I recommended buying the stock in March but the stock has since crashed another 47%.

That kind of price action has been most typically seen at the bubble-story stocks and now at high quality operators like TWLO – presenting investors with an attractive buying opportunity.

TWLO Stock Key Metrics

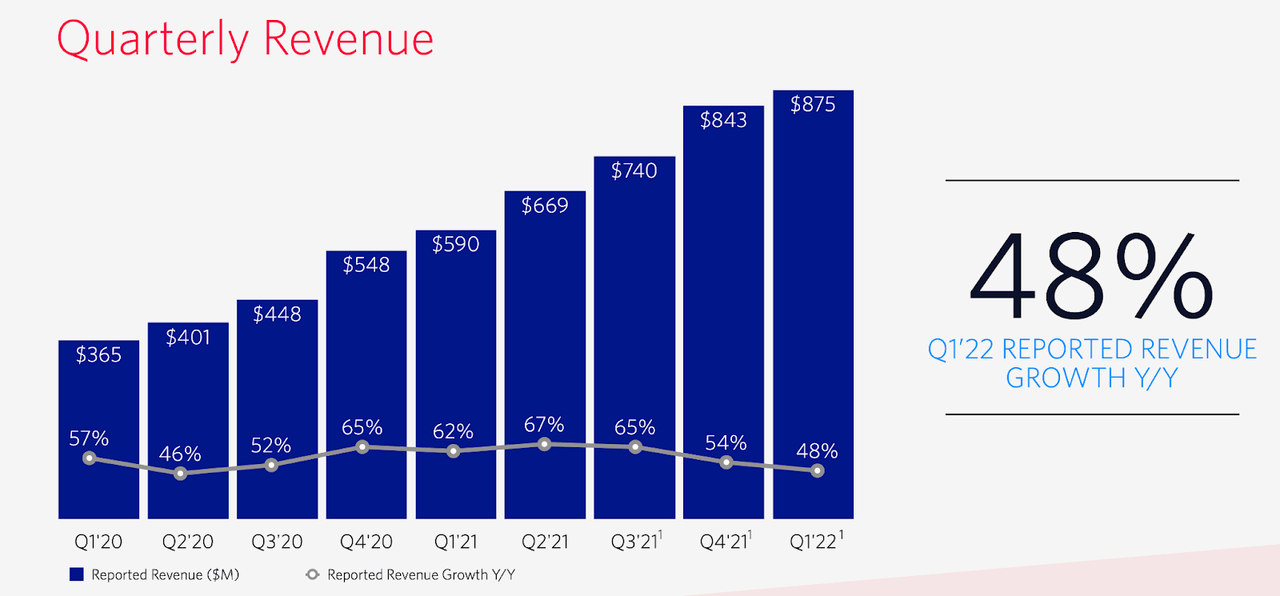

In the latest quarter, TWLO grew revenues by 48% year over year.

2022 Q1 Presentation

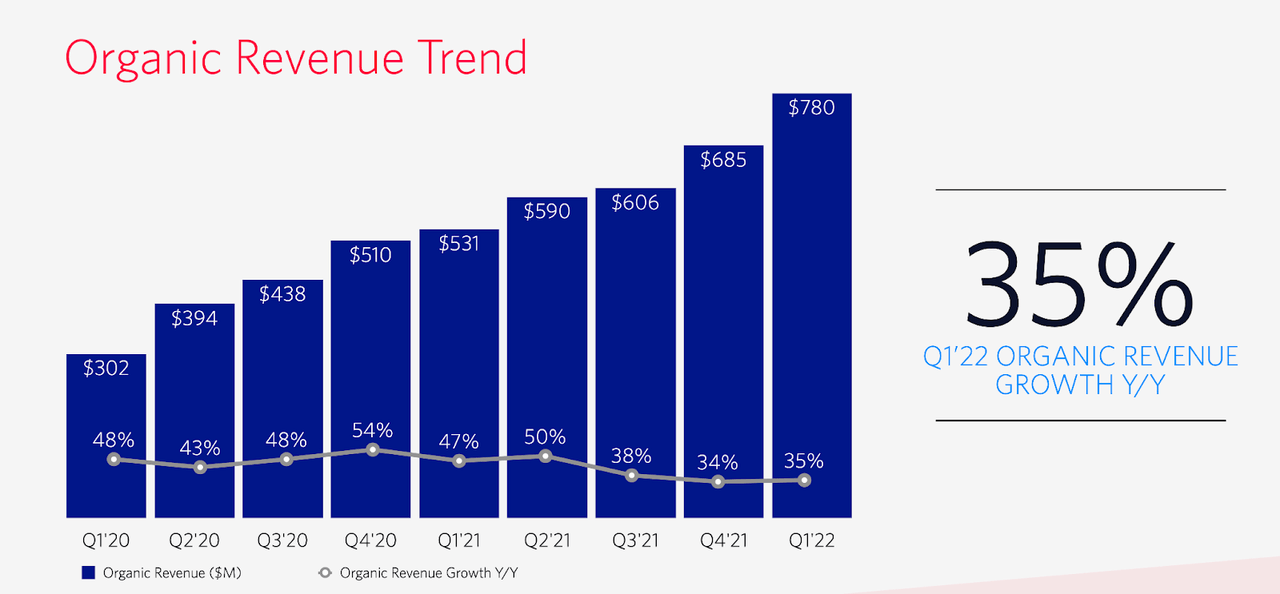

However, much of that included revenues from acquisitions, which TWLO has been funding with stock. As a result, it makes more sense to look at organic revenue growth, which stood at 35% in the quarter.

2022 Q1 Presentation

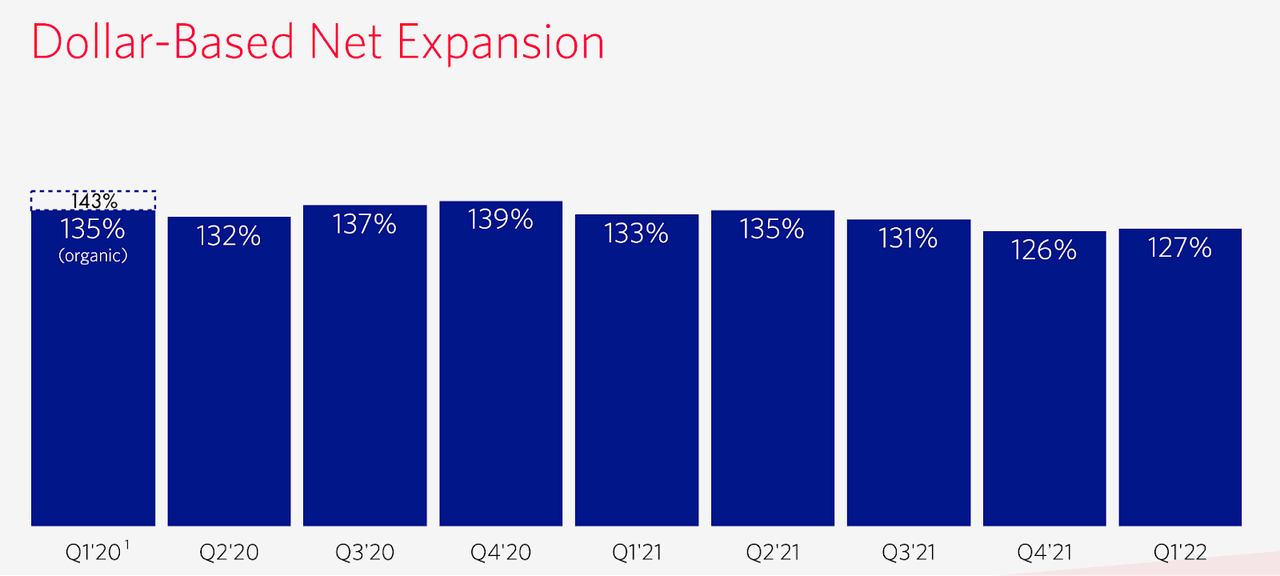

TWLO has previously been a stock market darling due to the high dollar-based net expansion rate, which helps give confidence to the runway for future growth.

2022 Q1 Presentation

TWLO was not profitable in the quarter, losing $217.8 million in GAAP profits, though it did generate $5 million in non-GAAP income. On the conference call, TWLO guided for non-GAAP profitability starting in 2023. That would help fortify the financial strength of the company, as it already has a strong balance sheet with $5.2 billion of cash versus $1 billion of debt.

Is TWLO Stock A Buy, Sell, or Hold?

Whenever you see a stock drop 80% from all time highs, one must wonder if the growth thesis has become impaired. In the case of TWLO, such fears appear overblown. Management reiterated its confidence on the conference call:

“We remain confident in our ability to deliver 30% plus annual organic revenue growth through 2024.”

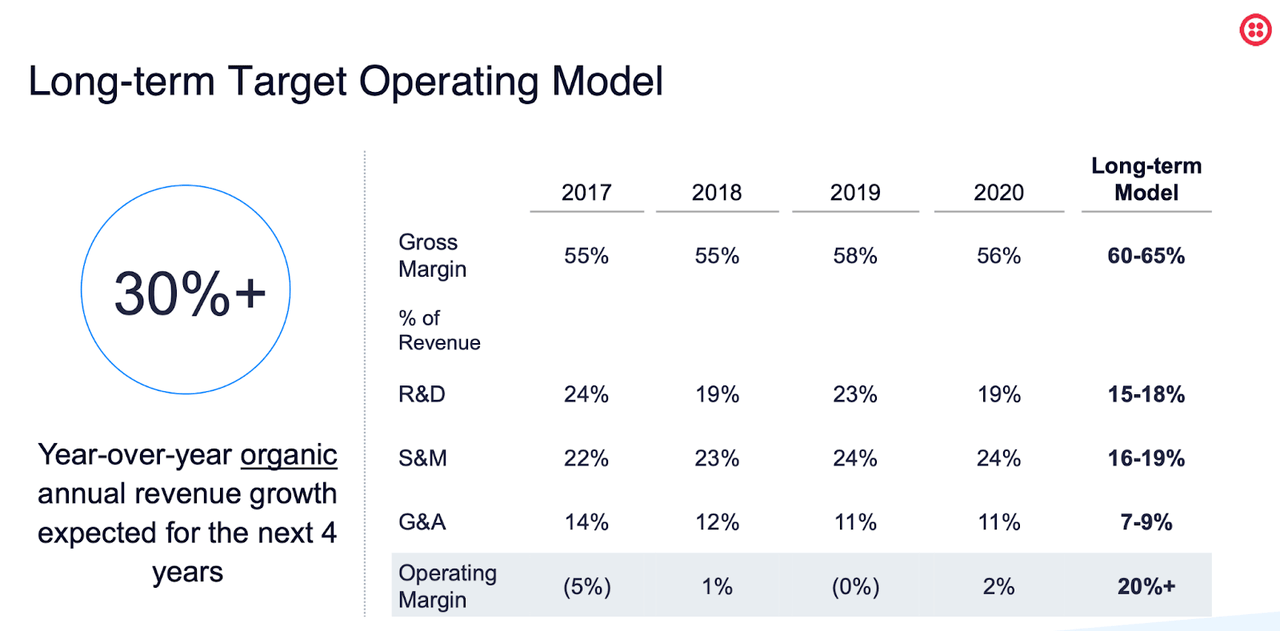

It is not hard to believe them – TWLO’s products are helping to power the digitization and programmatization of customer service, ranging from programmable messaging to programmable voice. TWLO has guided for 30% organic growth through 2024 and operating margins in the 20% range.

2021 Investor Presentation

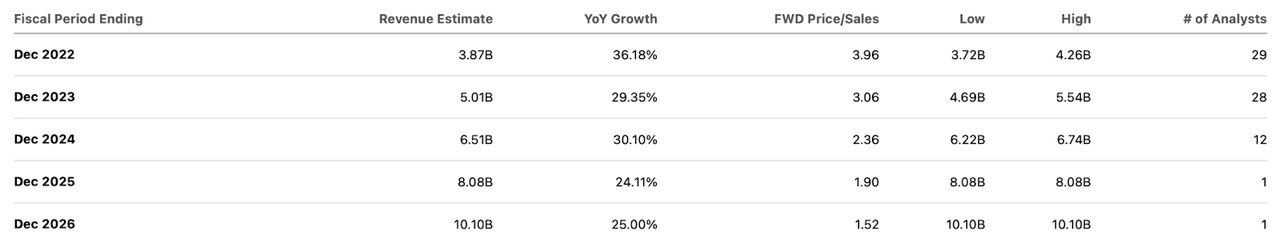

Wall Street consensus estimates are more skeptical, projecting far less growth.

Seeking Alpha

Even if TWLO falls short of its guidance and simply meets consensus estimates, the stock looks cheap here. Assuming 20% long term net margins and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see TWLO trading at 7.2x sales by the end of 2024, representing a stock price of $256 per share. That would present over 50% compounded upside over the next 2.5 years.

The risk here is not valuation. Instead it might be competition and its consumption-based model. TWLO earns more in revenues the more its customers use its products. That places TWLO’s incentives fully aligned with its customers, but I suspect that human nature might not view it that way. It is possible that some of its larger customers might seek to reduce such costs through seeking alternative solutions or developing an in-house solution. There is precedence for that – Uber (UBER) previously did exactly that in 2017.

I would not be surprised to see TWLO make more acquisitions in order to add more depth to its product offerings – it certainly has a strong enough balance sheet for that. Given where the stock trades today, I view such risks as being priced in and more. I rate the stock a strong buy amidst the tech bloodbath.

Be the first to comment