Joyce Diva/E+ via Getty Images

“Politicians were mostly people who’d had too little morals and ethics to stay lawyers.” ― George R.R. Martin

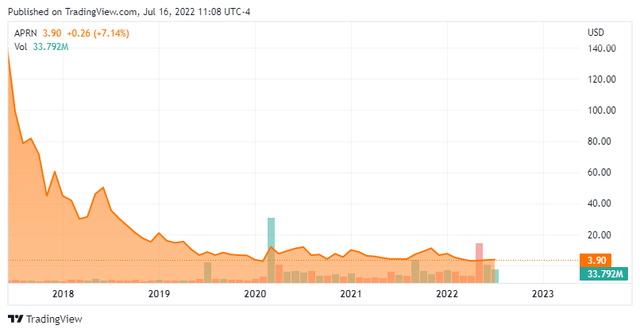

Today, we take our first look at Blue Apron Holdings, Inc. (NYSE:APRN). This one of the many and one of the most well-known names that has sprung up over the past decade as a direct-to-consumer platform that delivers original recipes and ingredients to individuals across the nation. This once novel concept has spread across the country. Unfortunately, it has not resulted in profits to date and original shareholders have been decimated since the stock debuted on the public markets in 2017. Can the company turn things around? We take a look at Blue Apron’s dynamics in the analysis below.

Company Overview

Blue Apron is headquartered in New York City. In addition to recipes and food, the company operates an e-commerce market that provides cooking tools, utensils, pantry items, and other kitchen related products. The company also operates Blue Apron Wine, where customers can buy wine to pair with their entrees. The stock currently trades for just four bucks a share and sports an approximate market capitalization of $135 million.

First Quarter Results

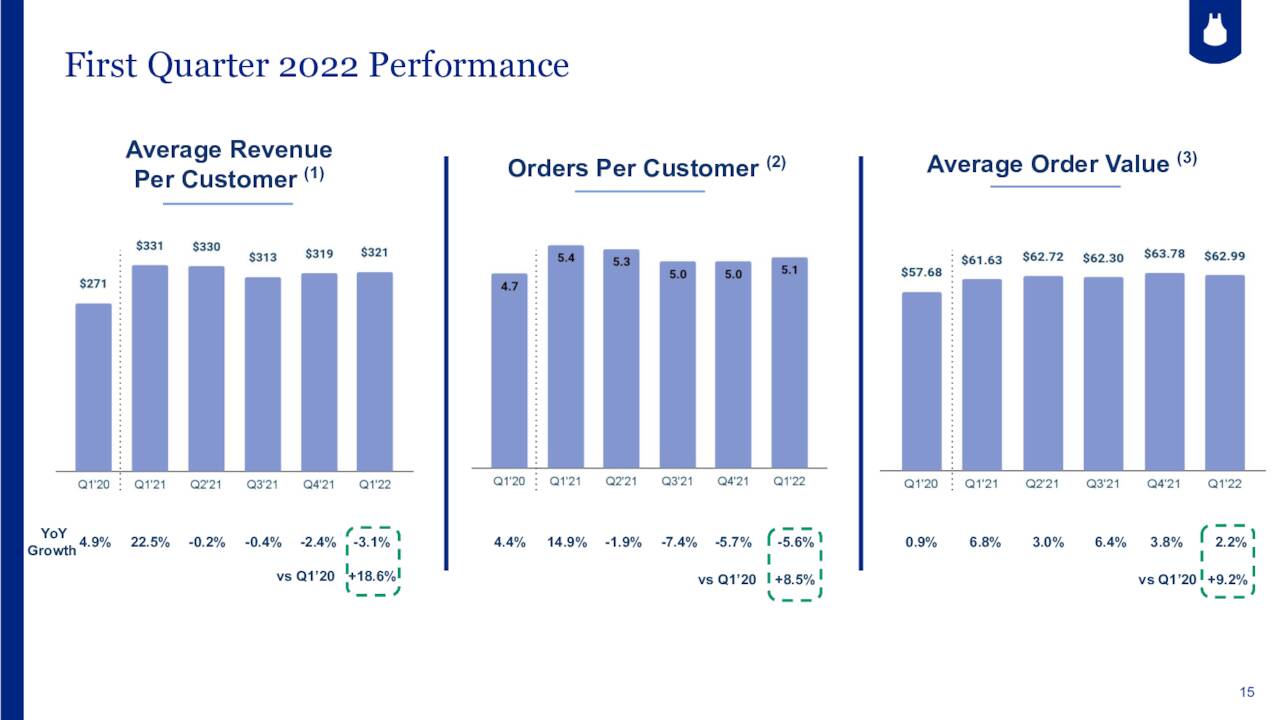

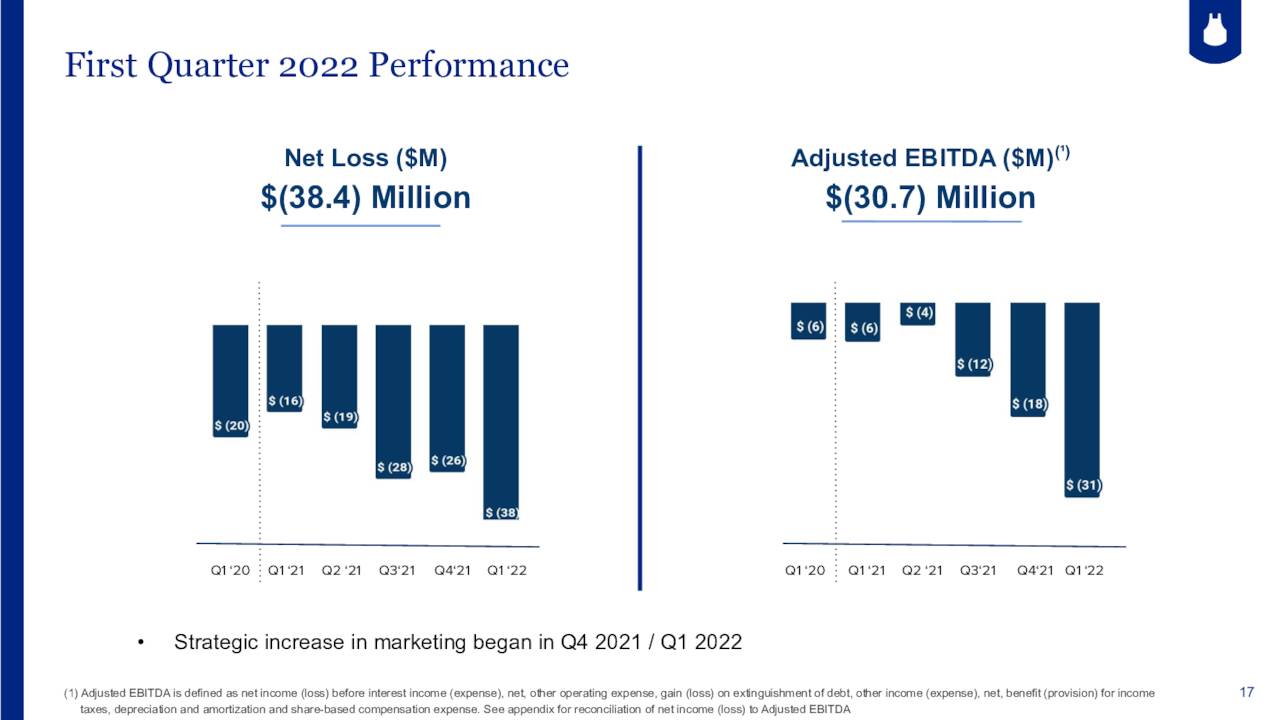

On May 9th, the company posted first quarter numbers. Blue Apron lost $1.19 a share on a GAAP basis, badly missing expectations as revenue fell 9% to just over $117 million, also under the consensus. The company’s net loss more than doubled to $38 million from the same period a year ago. The firms adjusted EBITDA came in with a loss of $30.7 million, compared with an adjusted EBITDA loss of $6.1 million in 1Q21.

Management provided the following guidance for the full fiscal year. They expect:

Top line net revenue growth to be in the mid-teens percentage range compared with full-year 2021. To return to positive year-over-year net revenue growth starting in the second quarter of 2022 and for the rest of 2022.

Some other notable tidbits from the quarter included.

May Company Presentation

Revenue was down from the same period a year ago, but up 10% sequentially from the fourth quarter of 2021. Average Order Value increased 2% from the same period a year ago. Hardly impressive with the CPI running over 9% currently. Blue Apron continues to expand its product and menu selection. The company recently launched a new breakfast offering while adding new four-serving menu options and various Add-ons.

May Company Presentation

Cost of goods sold, excluding depreciation and amortization (COGS), as a percentage of net revenue, rose 460 basis points year-over-year from 62.9% to 67.5%. The increase was due primarily to a rise in shipping and fulfillment costs which have become common across industries over the past year as inflation hits the highest levels in more than 40 years. The company also saw a significant increase in labor and food costs.

Two weeks after earnings, the shares got a minor bump on a question on whether the company would be taken private which I would take with a huge grain of salt. The equity got a larger and more long lasting lift when Blue Apron announced early in June that consumers can now purchase a selection of meal kits on Walmart’s website without a subscription. Blue Apron being the only meal-kit provider on the Walmart Marketplace platform is a win, how big investors will see in coming quarters in regards to additional sales.

Analyst Commentary & Balance Sheet

Once a darling of Wall Street, the company gets sparse attention these days. The only analyst firm commentary I can find on Blue Apron in 2022 is from Canaccord Genuity on May 10th. At that time, Canaccord’s analyst maintained his Buy rating but lowered his price target from $12 to $10 with the following commentary.

The company continues to make strategic progress, and the recent capital raise, return to revenue growth for the balance of the year, and low valuation should be attractive to value-oriented investors.

The shares are up some 15% since that view was published.

May Company Presentation

Bears still believe the stock has further to fall with approximately one third of the outstanding shares currently held short. There has been some small selling from insiders in 2022 but no insider purchases by company officers. After posting a net loss of $38.4 million for the first quarter, the company had just over $55 million in cash and marketable securities on its balance sheet. Soon after the quarter ended, management announced a $70.5 million capital infusion through debt and equity financings, extending debt maturity through 2027.

Verdict

The company seems destined to lose over two bucks a share on revenues of approximately $525 million in FY2022. The one analyst I can find that has a profit projection for FY2023 has that loss narrowing to roughly 75 cents a share on sales growth in the mid-teens in FY2023.

Looking at the company’s history, they seem to be applying the old adage ‘We lose money on every sale, but we make it up on volume‘ to heart. While the deal with Walmart is a nice victory, there is very little reason to buy Blue Apron even with the huge sell-off in recent years until management can show consistent progress in reducing cash burn.

Every investor that has tried to buy the dip in the shares since Blue Apron came public has caught a falling knife. With the country heading into a likely recession, additional headwinds could well be forthcoming for the company’s business model.

“He knows nothing; and he thinks he knows everything. That points clearly to a political career.” ― George Bernard Shaw

Be the first to comment