AsiaVision

A thing is not necessarily true because a man dies for it.”― Oscar Wilde

Today we look at a financial name that appears attractive enough for a small ‘watch item‘ position. The shares are trading at a support level that has held a few times over the past half decade. An analysis follows below.

Company Overview:

Global Payments Inc. (NYSE:GPN) is an Atlanta based payments technology concern that provides software and services to approximately four million merchant locations and more than 1,350 financial institutions across 170+ countries around the world. The payment processor handled ~60 billion transactions in FY21. Global Payments was formed in 1996 as a division of National Data Corporation and was spun out in 2001, with its first trade executed at $3.75 a share, after giving effect to two 2-for-1 stock splits. Shares of GPN trade just under $100.00 a share, translating to a market cap of just north of $26 billion.

What is Global Payments?

In the parlance of payment transactions, the company is known (primarily) as a merchant acquirer, processing card payments on behalf of said merchants. When a consumer inserts his or her payment card into a point-of-sale [POS] device or provides information in an online transaction, that device is sold or leased to merchants by an acquirer such as Global Payments. After the card and transaction information is captured, the POS device connects to the company’s network to confirm the authenticity of the credit or debit card and ascertain whether there are sufficient funds available to conduct the transaction. Once okayed, the card issuer releases funds through Global Payment’s card network to the member settlement bank (less an interchange fee – typically 1.5%), who in turn pays the merchant the full amount of the transaction. The credit card issuer bills the customer for the transaction, while Global Payment charges the merchant a fee for providing its services (typically 2.0% of the transaction) and reimburses the member settlement bank the 1.5% interchange fee, keeping 0.5%.

Operating Segments

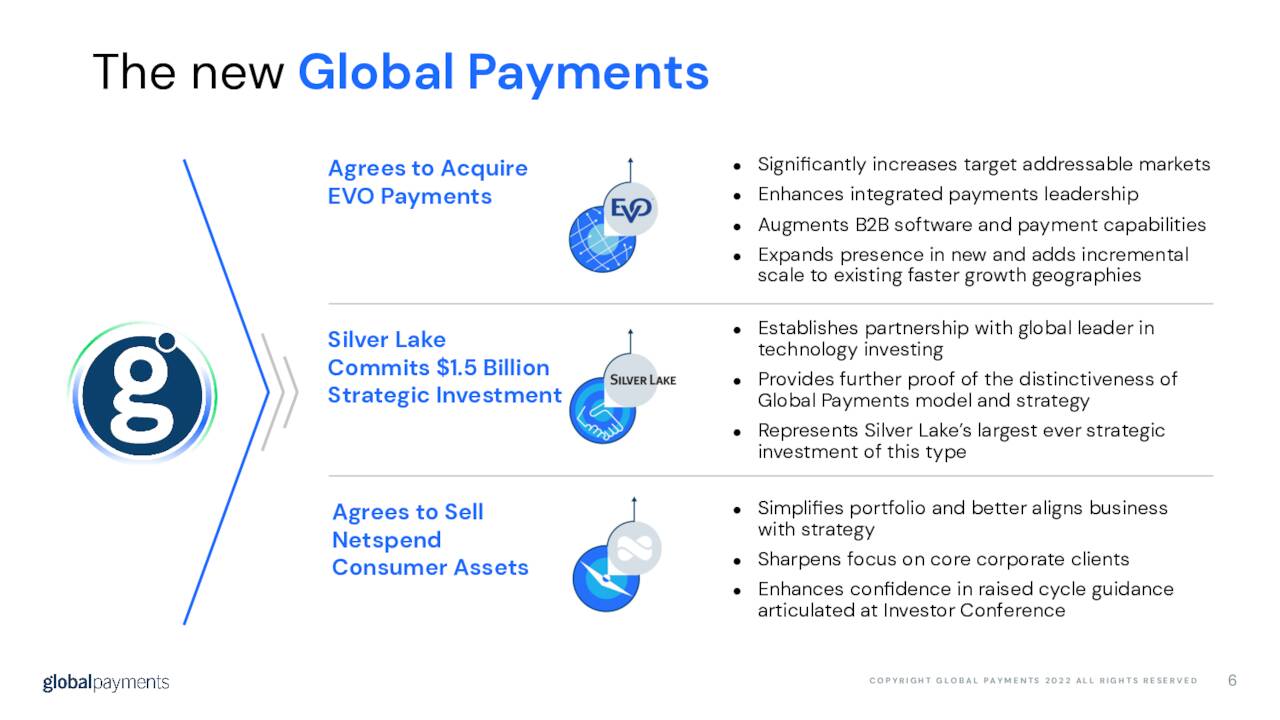

The company operates through three reporting segments, although with the imminent $1 billion sale of its Netspend consumer business – essentially prepaid debit and payroll cards for the ‘underbanked’ – and its pending $4.0 billion acquisition of merchant payment solutions provider EVO Payments [EVOP], the number will drop to two in 1Q23.

Merchant Solutions. The larger unit is Merchant Solutions, which provides authorization, settlement and funding services, customer support, chargeback resolution, terminal rental, payment security services, consolidated billing, and reporting functions – essentially the services provided in the example above – to its merchant base. It also offers enterprise software that streamlines business operations, delivering analytics, customer engagement, payroll, and reporting solutions, with POS functions embedded within. It is one of the largest merchant acquirers in the U.S., competing with the likes of Fiserv (FISV), Fidelity National Information Services (FIS), U.S. Bancorp (USB) subsidiary Elavon, JPMorgan Chase (JPM) subsidiary Chase Paymentech, and Wells Fargo (WFC), amongst others. This segment generated operating income of $1.53 billion on revenue of $4.65 billion in the first nine months of 2022 (YTD22), up 21% and 11% (respectively) from the prior year period. These solid growth rates were achieved despite a $77.3 million currency headwind.

Issuer Solutions. Global Payments’ other segment is Issuer Solutions, which provides third-party processing for credit card issuers. It is the largest such processor in North America. Issuer Solutions was responsible for YTD22 income of $244.2 million on revenue of $1.66 billion, down 1% and up 4% (respectively) from the prior year period.

Its third segment (Consumer Solutions) produced YTD22 income of $67.7 million on revenue of $478.0 million and is now classified as held for sale.

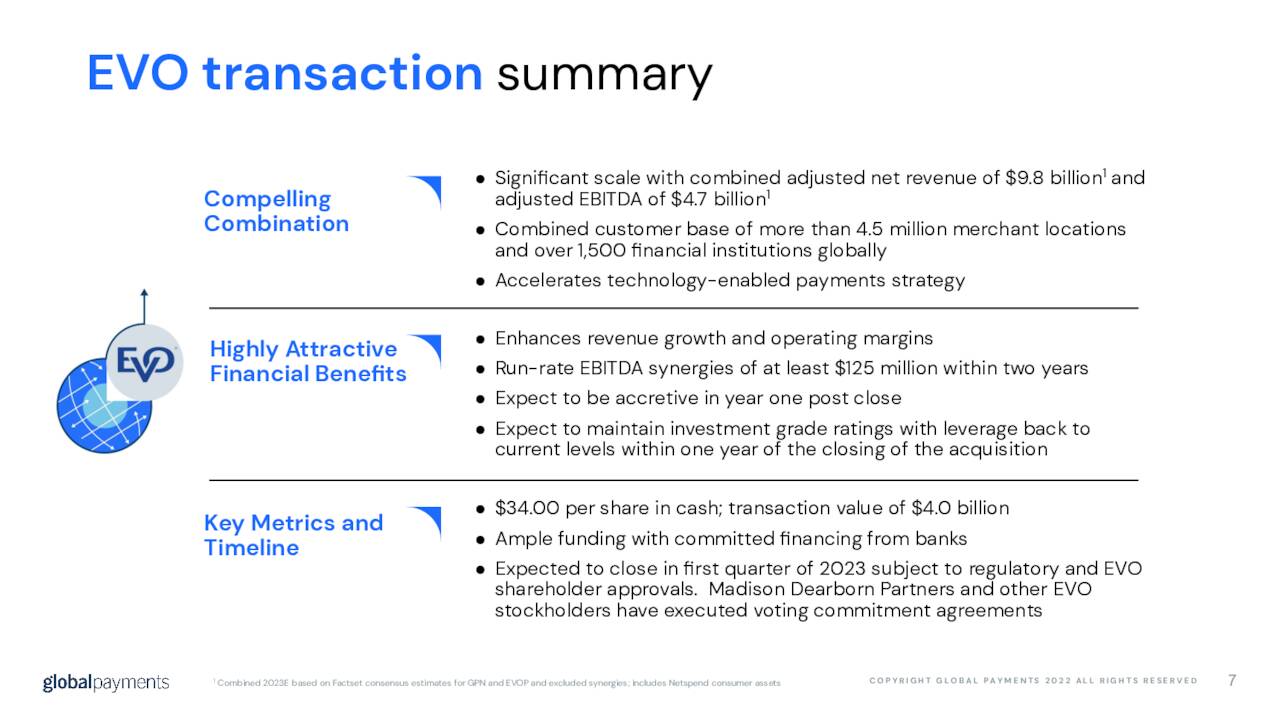

EVO Payments

September Company Presentation

To accelerate its penetration of integrated and B2B payment markets and expand its international presence – most notably in Germany and Poland – Global Payments is acquiring EVO Payments for $34 a share. The combination will have ~4.5 million merchants and over 1,500 financial institutions as customers. The deal is expected to deliver $125 million of run-rate synergies and be accretive in the twelve months post-close. When the dust settles with the EVO purchase and the Netspend disposition, Merchant Solutions will account for approximately three-quarters of the company’s top line with Issuer Solutions comprising the balance.

September Company Presentation

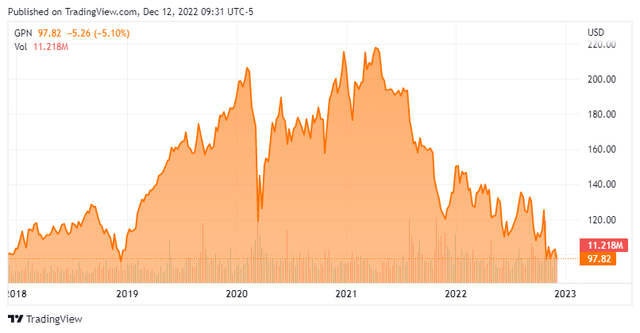

Stock Price Performance

Global Payments was on a solid trajectory, growing earnings (non-GAAP) 28% FY21 vs FY20, which was up 51% over FY19 due to its acquisition of Total Systems. The market rewarded Global Payments by bidding its stock up to an all-time high of $220.81 in April 2021, which represented a 109% rebound off its pandemic-selloff low and a 27.1 forward P/E ratio on FY21 earnings of $8.16 a share. However, with inflation concerns prompting the Fed to execute economically injurious rate hikes, the market anticipated a slowdown in growth and compressed Global Payments’ P/E multiple. Factor in a lot of ‘noise’ in the financials due to the exiting of one business and one geography (Russia), and its stock is now trading at a five-year low despite its earnings on pace to grow ~14% FY22 vs FY21.

3Q22 Earnings & Outlook

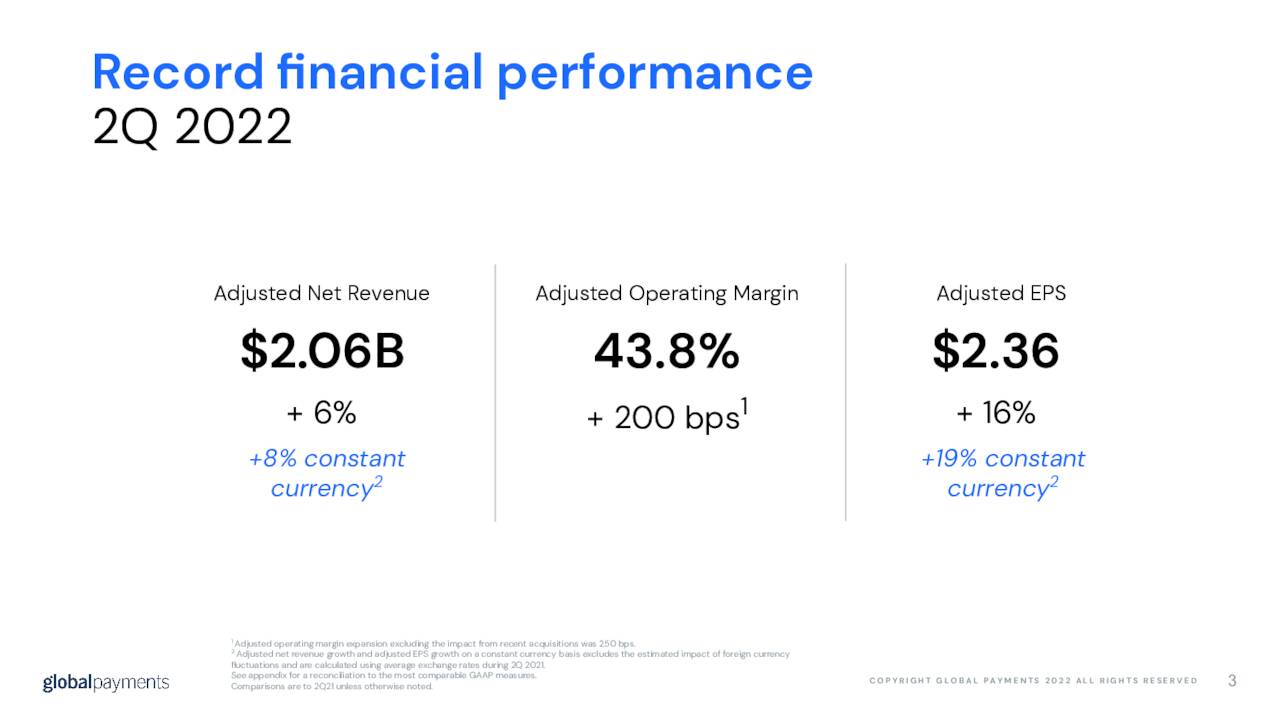

That noise was on display when the company reported 3Q22 financials on October 31, 2022. Global Payments earned $2.48 a share (non-GAAP) on Adj. net revenue of $2.06 billion versus $2.18 a share (non-GAAP) on Adj. net revenue of $2.00 billion in 3Q21, representing 14% and 3% improvements, respectively. However, on a constant currency basis, the growth was stronger – at 18% and 6%. The bottom line matched consensus expectations while the top line beat by $240 million. Also, Adj. operating margin expanded 240 basis points to 45.2%. It should be noted that these results did not reflect the company’s consumer business, which (as mentioned previously) has been classified held for sale. Global Payments also provided other non-GAAP Adj. net revenue and operating metrics that reflected its exit from Russia.

September Company Presentation

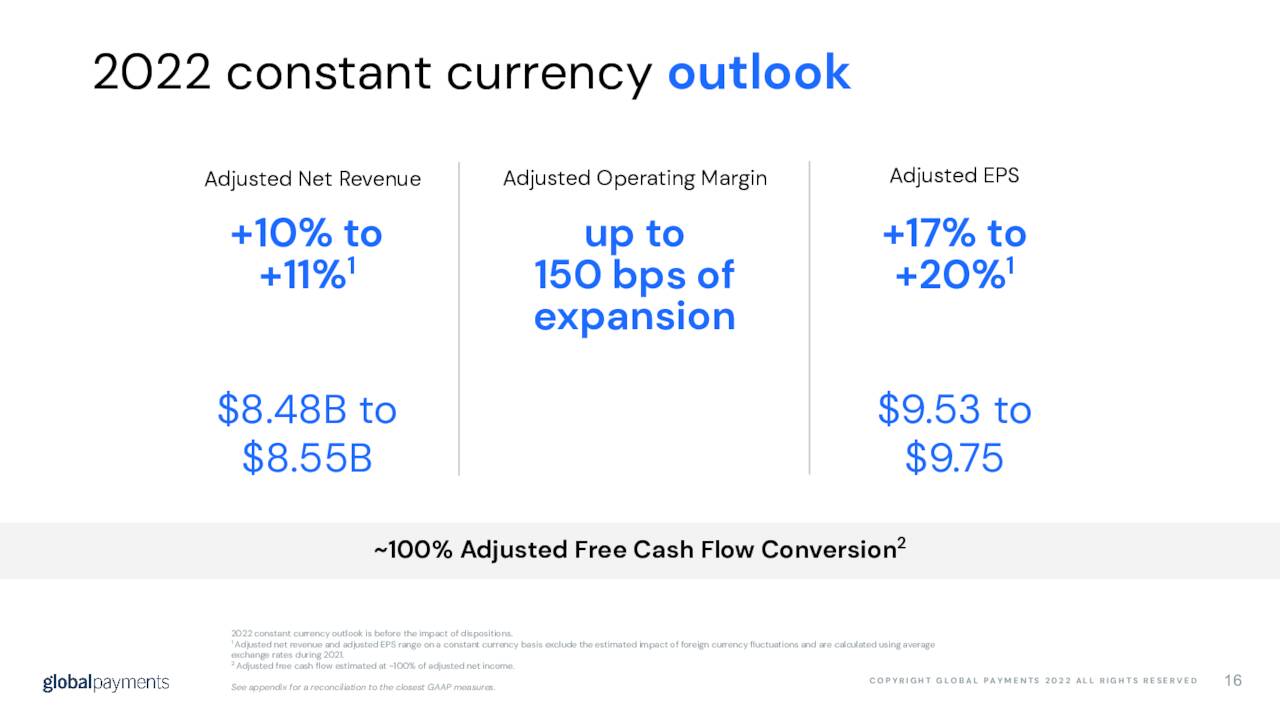

Management reaffirmed its range midpoint guidance of $9.64 a share (non-GAAP) – representing 18% year-over-year improvement – and revenue growth of 10% to 11% for FY22, which also excludes the impacts of Netspend and Russia. All of these projections were on a constant currency basis, but with forex expected to negatively impact earnings by $0.30 a share, the currency-influenced FY22 non-GAAP estimate of $9.34 was more or less in line with Street expectations.

September Company Presentation

No outlook for FY23 was provided, only that the disposition of Netspend and the addition of EVO would be a net neutral from an accretion-dilution standpoint after factoring in synergies. The rationale for this ‘neutral’ asset swap is that EVO has better long-term revenue growth potential and superior margins versus Netspend.

Mostly due to the static in the numbers, the uncertainty surrounding the pending transactions, and no FY23 guidance, shares of GPN cratered 25% to a low of $93.99 a share over the subsequent four trading sessions.

Balance Sheet & Analyst Commentary:

Another concern is the amount of net leverage that Global Payments will hold at the closing of both transactions in 1Q23, which will likely elevate to 3.9. The company currently has debt of $13.4 billion against cash of $2.0 billion on September 30, 2022, for net leverage of 3.1. That said, it generated cash from operations of $1.5 billion during YTD22, which has been more than returned to shareholders through the purchase of 15.9 million shares at a price of $2.1 billion. Furthermore, Global Payments pays a quarterly dividend of $0.25 for a current yield of 1.0%. Management also anticipates net leverage returning to ~3.0 by YE23.

Although the Street is broadly positive on Global Payments, six Street analysts lowered price targets after the 3Q22 report against one raise. With seven buy and seven outperform ratings versus four holds, their median price objective is just under $150 a share. Unlike the company’s non-GAAP estimates that are given on a constant currency basis, Street FY22 non-GAAP estimates largely reflect currency translations and FY23 projections may or may not include EVO. That preamble aside, they currently expect Global Payments to earn $9.33 a share (non-GAAP) on revenue of $8.1 billion in FY22, followed by $10.43 a share (non-GAAP) on revenue of $8.6 billion in FY23, or 12% growth at the bottom line.

The recent selloff was used as a buying opportunity for board member Troy Woods, who purchased $500,000 of stock (5,247 shares @ $95.26) on November 4, 2022, marking the first insider buy in approximately one year.

Verdict:

As Global Payments transitions out of one business line and broadens another after exiting a large geography – all against a tough macroeconomic environment – uncertainty lingers, which has the effect of compressing multiples. Assuming analysts’ earnings estimates for FY23 are close to accurate, the company’s forward P/E multiple has compressed from 27.1 at its all-time in April 2021 to approximately 9.4 currently. Some of the fog will lift when Global Payments provides an FY23 forecast post-closing of its transactions. Despite its solid growth, as long as inflation menaces, it will trade with concerns about a worldwide economic slowdown remaining front and center. Short of a sea change in economic outlook, these crosscurrents amount to a stock with limited downside and limited upside over the next six months, making GPN worthy of a small holding and/or as a covered call candidate.

I do not fear death. I had been dead for billions and billions of years before I was born, and had not suffered the slightest inconvenience from it.”― Mark Twain

Be the first to comment