deyangeorgiev/iStock via Getty Images

The Town of Impruneta

One of the most original and refined sculptors of the Renaissance, Luca della Robbia (1400-1482), was the initiator of a successful artistic style associated with the production of polychrome glazed terracotta, which continued for several generations of the Della Robbia family.

Most of his works are preserved in Florentine churches and museums, but the small town of Impruneta, in the hills south of Florence at the gateway to Chianti, preserves two of his jewels inside the basilica of Santa Maria. In the chapel of the Blessed Sacrament stands a remarkable Crucifixion among statues of saints, while the chapel of the Madonna conceals a highly venerated image of the Virgin enclosed in a marble tabernacle decorated with statues of Saints Paul and Luke.

Impruneta can be reached from Florence by a road that runs along gentle slopes dotted with farm and manor houses set in a soft carpet of vines and olive trees. It is a Sunday destination for many Florentines, as well as tourists year-round, both for the sweetness of its landscape and the deliciousness of its oil.

Right now, Impruneta’s olive mills are working at full capacity to press olives generously produced by the trees that surround the town, making it one of the major production centers around Florence since Renaissance times. In fact, it was at the time of Luca della Robbia that the town of Impruneta, because of its special clay soil and exposure, was totally devoted to the cultivation of olive trees.

Olive Harvesting

I’ve been living in the hills between Florence and Impruneta for a few years, and for a few years between the end of October and the beginning of November I have been making oil myself. With the hundred or so olive trees on my land, they yield enough oil for family consumption. And every year, I look forward to the harvest when I will find out how many olives I will harvest, and what the yield will be.

And punctually, every year, surprises await me: one time we have plenty of olives but the oil yield is low, the next time we have few olives with a very high yield. We fertilize and prune the olive trees in the same way every year, the soil is always the same, as well as their exposure to the sun. Yet, every year we never know how many olives we will have, how much oil they will produce and of what quality. One year it’s the fault of the heat, another year it’s the rain, with another it’s the wind…

So, we always work the same way, but the results diverge from year to year, and no one can explain why. Thinking about it makes me laugh, and in talking to my neighbors, I reassure them by saying that it’s a bit like the financial markets: you have to take them as they are because you never know what you’re going to get year-by-year.

Dividend Harvesting

And so, we have to accept this 2022 market as well, which began with a generalized collapse in both equities and bonds (in defiance of any diversification and the supposed protection offered to our portfolios). Then followed by a mighty rebound and then a descent again, until the current phase of apparent quiet, with the Volatility Index (VIX) back below 30, a level that often acts as a watershed between calm waters and rough seas.

My compass, as always in such market environments, directs me with three basic guides representing the essence of my personal survival strategy:

1) keeping the tiller straight;

2) collecting dividends; and

3) buying stocks offered at a discount by the market.

Keeping the tiller straight means not panicking: the skies cannot always be clear and thunderstorms will come, but we have to be prepared with umbrellas. This means buying quality titles, looking at the fundamentals (at least for me, in the case of CEFs, their historical NAV performance) and sticking to our line, without “extemporaneous corrections.”

Collecting dividends offers not inconsiderable relief. When the world around us seems to be collapsing, the dividend is the buoy that keeps us afloat. With a constancy of monetary return, any temporary depreciation of capital is borne much better. Of course, distributions are always exposed to the possible risk of cuts. This is another reason why it is good to have a range of quality funds in our portfolio, with a track record that attests to the capabilities of their management.

In many cases, moreover, the knowledge that fresh cash flow can cause us to increase positions at bargain prices is in itself a lifeline for when the storm subsides, allowing us to mediate the load price of our securities downward and thereby increase their yield.

My Personal “Margin of Safety”

Over the past few months, I gradually bought many securities as their prices fell, completing some, but not all, positions. Naturally, I accrued a loss on securities purchased during 2022, while retaining a decent gain on some of the securities placed in my portfolio in the spring of 2020 (and lightened during 2021) at bargain price and at a discount to NAV. My personal “margin of safety.”

Let’s see what these funds are and how they performed since the beginning of the year. As you may know, the Cupolone Income Portfolio (named after Brunelleschi’s Florentine dome) is my strategic, primary investment portfolio consisting of the following sixteen CEFs:

- BlackRock Science And Technology Trust (BST)

- Calamos Dynamic Convertible and Income (CCD)

- Calamos Global Total Return (CGO)

- Eaton Vance Enhanced Equity Income II (EOS)

- Eaton Vance Tax-Adv. Global Dividend Opps (ETO)

- Eaton Vance Tax-Adv. Dividend Income (EVT)

- Guggenheim Strategic Opp (GOF)

- John Hancock Tax-Adv. Dividend Income (HTD)

- PIMCO Corporate & Income Strategy (PCN)

- PIMCO Dynamic Income (PDI)

- John Hancock Premium Dividend (PDT)

- PIMCO Corporate & Income Opportunities (PTY)

- Cohen&Steers Quality Income Realty (RQI)

- Special Opportunities Fund (SPE)

- Cohen&Steers Infrastructure (UTF)

- Reaves Utility Income Trust (UTG)

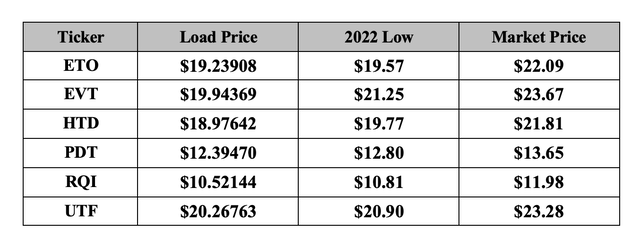

ETO, EVT, GOF, HTD, PCN, PDI, PDT, PTY, RQI, UTF and UTG were purchased in the spring of 2020, and as many as six of them still retain a load price below their current market price. It is true that I do not like to mediate upward, especially in a rising market, as I don’t like to buy following the trend. During this time, however, as the market has gone down a lot, I’ve found it convenient to slowly begin reinvesting the cash that I had set aside to rebuild some initial positions at profitable prices.

So, I have made purchases, but I haven’t fully replenished my positions yet in anticipation of further declines, but these are not occurring at the moment. Being left out is one of the risks I take, but I accept it and it doesn’t bother me too much. If the market goes back up, I will wait for the next opportunity while enjoying gains and distributions.

Here are the six CEFs for which my margin of safety is working. Combined with the dollar’s rise against the euro, they are giving me a gain that can offset the losses on the other funds (even the recently purchased ones), thus keeping my Cupolone Income Portfolio in positive territory. Given how 2022 has gone so far, that seems like no small feat.

From the table, none of the six funds have ever fallen below my load price, which is why the small adjustments made to my portfolio over the past few weeks have averaged my load price slightly upward from the initial price, albeit without large increases. I’ve never made purchases on the wave of euphoria, out of fear of “missing the train” of a substantial rebound. Instead, I have always waited for bearish moments to move in the market.

I did this in the case of the new positions I opened last spring (BST, CCD, CGO, EOS and SPE). In hindsight, I must admit once again that I acted too early, trusting in more favorable scenarios for the second half of the year. This was not the case, although right now the markets seem to have digested all the negative news that emerged during 2022. In any case, we must always be aware that what will move the market tomorrow is not what is already known today, and surprise can always be around the corner, as with the olive harvest.

In the case of CGO (which recently cut its distribution by 20 percent, from 0.10 to 0.08), it was probably not a great buy, and it is definitely the weakest title in this portfolio. Fortunately, I lightened its position during the September rebound, and it was a happy hunch that materialized without loss, thanks to the favorable dollar-euro exchange rate for me. Today, CGO represents a little over 2% of my portfolio and does not cause me undue concern, although I fear that its rise will not be rapid.

Giotto and Masaccio Portfolios

My Giotto Income Portfolio (named after the fourteenth-century Florentine painter and architect) includes the following four ETFs that adopt a covered-call strategy:

- JPMorgan Equity Premium Income ETF (JEPI)

- Global X Nasdaq 100 Covered Call ETF (QYLD)

- Global X Russell 2000 Covered Call ETF (RYLD)

- Global X S&P 500 Covered Call ETF (XYLD)

All four of these ETFs are at loss right now, although in the case of JEPI (4.85% of the overall portfolio) the loss is below 10%, but I am satisfied with this holding.

XYLD (4.23% of the portfolio) lost around 14%, while for QYLD and RYLD, their losses exceed 20%. However, I continue quietly to hold all positions, having confidence in them, even for the weakest, which account for 2.64% (RYLD) and 2.20% (QYLD) of my overall portfolio.

My Masaccio Income Portfolio (named in honor of the Florentine painter who initiated the Renaissance) remains a small “tactical” portfolio that contains these five titles:

- Ares Capital Corp (ARCC)

- Crescent Capital (CCAP)

- Royce Value Trust (RVT)

- XAI Octagon FR & Alt Income Term Trust (XFLT)

- Credit Suisse X Links Crude Oil Shares Covered Call ETN (USOI)

I bought back some of the securities that I liquidated in my summer reset. ARCC and CCAP are stocks, but for an Italian like me, they are not tax-efficient. Nonetheless, their performance induced me to reintroduce them in minimal amounts into my portfolio, reopening new positions even though the euro-dollar exchange rate at this time is certainly not favorable to me.

ARCC has shown excellent resilience to the recent declines, and today is breaking even. CCAP, on the other hand, has suffered a real collapse, which causes me to reflect on its overall resilience. For the future, I am thinking possibly of increasing ARCC’s position but not CCAP’s.

USOI, on the other hand, was bought by me again, albeit in small amounts. This, despite all the misgivings expressed in my last article about the 1-for-20 reverse split implemented by Credit Suisse AG on all its ETNs. However, ETNs are the only securities that allow me, due to the Italian tax system, to use dividends to offset any prior losses. For that reason alone, I thought of reintroducing USOI to my portfolio: the substantial dividends offered by this title could in fact allow me to offset all current losses within a couple of years, obviously hoping that its price does not go to zero in the meantime.

Note, ARCC, CCAP and RVT have quarterly dividends, while those of USOI and XFLT are monthly.

The Takeaway

I must say that I am quite satisfied with the choices I made and with the current composition of my overall portfolio, which contains 25 securities offering a projected yield around 9.50%.

However, I do see some weaknesses: QYLD, RYLD and XFLT are heavy-loss securities but I am confident of their future recovery. On the other hand, the sudden collapses of CCAP and CGO do not seem to me to be good signs about their resilience and leads me to think probably of liquidating them when the time comes.

Considering what 2022 has brought us so far in the financial markets, I can be satisfied if my overall portfolio hovers around parity, thanks also to the strength of the dollar.

Of course, no one can know or anticipate what will happen in the coming months, or what new information will drive price movements. In the event that these resume their downward trend, I will complete purchases of the six Cupolone CEFs that are still above my load price. On the other hand, in the event that prices begin to rise again, I will conserve the cash that I set aside and evaluate the options offered from time to time by the market, while ignoring the extraneous predictions about the direction it will take.

As Warren Buffett says, “I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.”

A point that also applies to olive harvest expectations.

Be the first to comment