Tristan Fewings/Getty Images Entertainment

Introduction

This summer, as many other Lord of the Rings fans, I was eagerly awaiting the new series Amazon (NASDAQ:AMZN) was working on. I then took some time trying to figure out the structure and the model behind this huge investment, in order to assess whether or not it may generate good returns. I, too, like everybody else, was waiting for the quarterly release in order to see how the company as a whole is performing. But I was also waiting for the release and the earnings call to find any information that could help me cross check my forecast on the Lord of the Rings – Rings of Power investment.

A caveat

The research I already shared and this update do not aim at giving an artistic valuation on the series. There has been a lot of fuss about the content, but I don’t think this is the right place to take a stand about it. I want to look at the series from an investor point of view. For this sake, content is measured by viewership and returns (both present and expected). I will try to use any additional data I found to update my research, but we have to know that Amazon is usually quite guarded with its numbers (especially new Prime memberships) and this implies we have to make some assumptions.

I know that Amazon’s earnings report has generated a lot of noise. In this article I will not cover the whole report, but I will look only at the useful information to assess the investment on the series. A disclaimer, I am, in any case, bullish on Amazon and I think that, without FX impact, we would have seen much clearer a business that, although it has spent a lot on capex, is still growing organically and will generate enormous profits by its ever-widening moat that is more and more linked to the building of crucial logistic and cloud infrastructures.

I use the Lord of the Rings series case to show how Amazon works and thinks in many aspects of its business. It may not sound new to some readers who already came across my articles on big tech: given the size of these companies, I tend to focus on one particular move or investment they are making to understand and extrapolate the business culture of each of these companies and the way they expect to make profits.

Summary of previous coverage

Let’s get to the topic of this article: updating the initial research and published in the article “The Value Of The Lord Of The Rings Series For Amazon“.

The first step was to figure out the costs Amazon is facing. Just for the rights to the appendices of The Lord Of The Rings Amazon paid $250 million. Since the series should have five seasons, this cost can be amortized by $50 million per season. Production costs for the first season amounted to $465 million. Since the shooting of the second season has been moved from New Zealand to the U.K. we can expect costs to be a little less, but still significant since Amazon is building from scratch a whole new set. As Amazon Studios Head Jennifer Salke said in a recent interview:

We’re building infrastructure for five seasons. We’re building a small city. We were always going to spend what we needed to spend to get it right.

Thus, my assumption was that for season 2 production costs can be around $400 million.

I expect the other three seasons to cost about the same or a bit more since the shooting of season 3 will not start before two years and the other two series will be shot afterwards. At the moment, it is hard to predict the production costs at the end of the decade. In any case, it is a fair assumption to estimate $865 million already spent for the first two seasons. So, when we hear that Amazon bet $1 billion on the series, it may be already an assumptions that falls more than $100 million short of the real amount.

I then looked at how Amazon earns a return on this investment and I looked at Prime subscriptions. But before diving into the numbers, we have to point out that Amazon has repeatedly stated that Prime members who watch video also spend more on Amazon. Furthermore, Amazon has also explained that Prime Video driver’s better conversion rates of free trials and higher renewal rates, which are around 93% after one year of membership and then at 98% for the following renewals.

Now, in my past article, I tried to show that for Amazon, the value of each membership is not only the recurrent revenue that comes from membership fees, but also the $700 that each member spends in addition to the $700 that a non-Prime user spends yearly on Amazon. I showed some calculations from here to reach a member’s present lifetime value for Amazon is $1,317.14. This means that just with 759k new members, Amazon will lock in a value close to $1 billion, which is enough to match the current investment. However, we may assume that current Prime members are already paying for other investments and that Amazon needs to increase its membership to cover the Lord of the Rings series. So we can look at the value of a new Prime member, which I assumed to be non-US residents, since Amazon has in the U.S. around 160 million members and I thus think the market is almost saturated. I calculated the new Prime member value for Amazon to be around is $930. If this is true, Amazon needs just a little more than 1 million new subscribers to match its initial investment for the rights and the first two seasons because the value of 1 million non-U.S. subscribers is $930 million for Amazon.

For those interested in a deeper analysis of this model, in addition to my first article on the value of the series for Amazon, I suggest reading the article where I shared my research on The Influence Of Costco On Amazon Prime.

Here I try to show the link between Costco’s (COST) business model and Amazon and how Jeff Bezos acknowledge this more than once.

New available data

Now, let’s dive into the new data that the earnings report and the earnings call gave us.

Viewership

First of all, we know that the week it was released the series streamed 1.253B minutes. Actually, we know that since the week considered goes from Aug. 29th to Sept. 4th, we know that these impressive amount of streaming minutes happened in just two days, from Sept 2nd to Sept 4th. Brian Olsavsky, Amazon Senior Vice President & Chief Financial Officer, said in the last earnings call that The Rings of Power attracted more than 25 million global viewers on its first day. In the quarterly report, Amazon declared that the show was close to 100 million viewers.

As the Los Angeles Times reported:

According to Parrot Analytics, which measures the audience demand for television and film by tracking a number of factors, such as social media engagement and downloads (including pirated versions), “The Rings of Power” averaged 30.5 times more demand than the average TV show in the U.S. during the first 30 days after its launch. This puts the series at the high end of what Parrot Analytics classifies as “outstanding,” a level reached by just the top 2.7% of all U.S. shows.

Business Insider has questioned the silence of Amazon about the viewership numbers on its “Rings of Power” finale, stating that it seems suspicious. Though it may be, we have to consider that Amazon is not so boastful about its numbers as other companies as it doesn’t want to disclose data that could make us understand thoroughly the single aspects of an investment or a business division. Secondly, I think Amazon will wait in any case a bit more before releasing the number of total viewership because there are many people who waited for the series to be fully released before watching. I personally know many who chose to do so because they like to watch a series without having to wait for further episodes to be released. Since Netflix (NFLX) has gotten many users accustomed to this way of series consumption, I bet that, especially in the U.S., the people who are watching The Rings of Power in October are still significant. Nielsen still has to release the data of October, so we have to wait a bit to see if this assumption is correct.

In any case, during the Q3 2022 earnings call, Brian Olsavsky said that

In the first two months since its launch, Rings of Power has driven more Prime sign-ups globally than any other Amazon Original.

He also pointed out that this release had a rather big impact on operating income:

Another impact to operating income was the step-up in Prime Video content and marketing costs in Q3, primarily driven by the global premiere of the Rings of Power and the launch of the NFL Thursday Night Football package in the United States.

So let’s get to the numbers published by Amazon to see if we can understand how many new members Amazon obtained in the quarter.

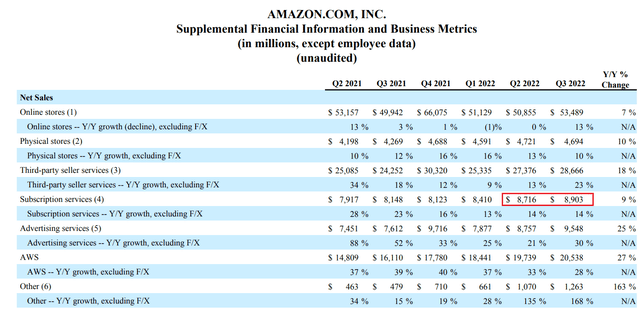

We have to look at subscription services revenues, a huge portion of which is from Prime membership fees. In the red box, I highlighted the change in revenue from Q2 to Q3 which is equal to an increase of $187 million.

Now, let’s consider that most of Amazon new members come from outside the U.S. where the average membership fee is lower than the $139 paid in the U.S. In my previous article I assumed the average fee worldwide was around $80, but since Amazon hiked prices in many countries, I would rather consider the new average fee to be around $90.

If we divide the increase in revenue by the average fee, we reach this number: 2.07 million new members.

Let’s also consider that Amazon saw an effect from FX which has crushed big tech earnings so far. By the way, this is one of the reasons I am not that worried about some of the results because I still see a business that is growing organically by double digits. Just imagine what may happen to the stock if next year the USD weakens and Amazon’s international results see a boost from favorable FX. Anyways, the FX headwind this time shrunk the international new membership revenue from what would have been a 12% growth on a constant currency basis to a -5%. A 17 percentage point impact is quite big. This means that actually international members may have risen by more than 2 million. In fact, if we take out FX, the $187 million increase in subscription revenue may be around $225 million. This would make me believe that new subscriptions came in at 2.5 million.

My estimate was that Amazon needed around 1 million new subscribers to match the value obtained with the investment made. As far as I see, Amazon reached a far better result on this metric. Of course, not all of the new subscribers signed up because of the series, but during the earnings call Mr. Olsavsky did hint that the series was a major driver of new subscriptions.

Conclusion

Just a reminder: this article is not about the quality of the series, nor does it aim at stating whether it is better than others or not. It aims only at checking some assumptions made in the summer to see if Amazon’s huge bet is paying off or not. From what I see, Amazon has already obtained more than needed. Since I think the first season had the aim to introduce viewers back into Middle-Earth and introduce them to many key characters. Action was somewhat lacking. But I think the slow pace of the series is something that shows how Amazon works and thinks. When the company bets big on something it doesn’t aim at immediate profits, but at building a solid branch or division or franchise that has durability and future scale. I think we are just at the early innings of a game that Amazon will play to the end and that has the possibility to go on for at least a decade.

Personally, not only going over the numbers of the series, but looking at the whole report didn’t scare me at all, but, to tell the truth, made me set an order at market open to scoop up some Amazon shares at a discounted price. However, I will need a further article to go over the whole report. For now, it is enough to say that, as far as I see, Amazon is on pace towards good returns from The Rings of Power.

Be the first to comment