Just_Super

Introduction

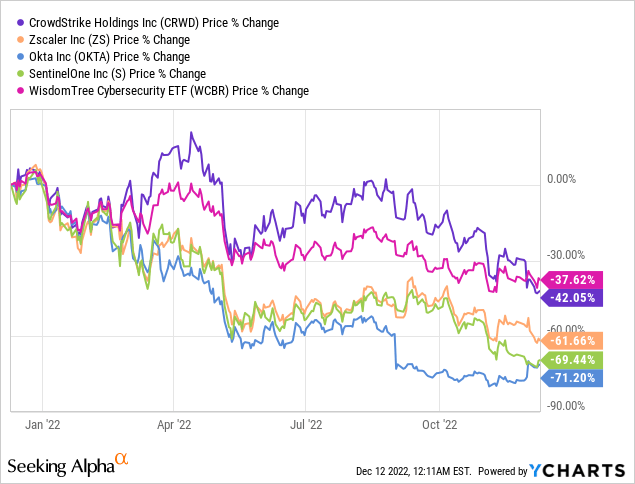

In the digital era, cybersecurity software is critical infrastructure for all businesses regardless of which sector or industry they operate in. And this secular growth trend is set to go on for several years to come. We have gained exposure to cybersecurity in TQI’s Moonshot Growth portfolio via a basket of stocks that contains CrowdStrike Holdings, Inc. (NASDAQ:CRWD), Zscaler (ZS), Okta (OKTA), and SentinelOne (S). While these rapidly-growing companies have some overlap, I think each one of them has differentiated strengths, and there’s good reason to own all of them.

In the last couple of weeks, we got Q3 reports from CrowdStrike, Zscaler, Okta, and SentinelOne, and the market reactions from these cybersecurity reports have been mixed, with Okta and SentinelOne being in the green after their respective reports, whilst CrowdStrike and Zscaler have seen big declines.

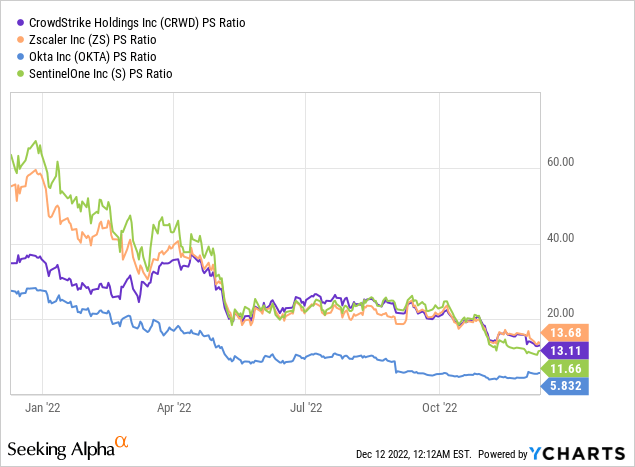

Over the last year, cybersecurity stocks have been declining along with the broader tech sector amid a violent valuation reset. Some of these names are now trading at or below pre-pandemic multiples. Yes, the interest environment has changed, but CrowdStrike and Zscaler are now trading at ~25-30x forward P/FCF multiple. These are FCF-generative businesses trading at terminal (mature-stage) multiples, whilst still growing at 40-50% per year.

With cybersecurity growth trends set to last well beyond this decade, free cash flow machines like CrowdStrike and Zscaler are looking very, very attractive. In this note, we will focus only on CrowdStrike, but if you’re interested in my earnings analysis for the other stocks mentioned above, please refer to this note:

Without further ado, let’s jump straight into CrowdStrike’s Q3 numbers.

Reviewing CrowdStrike’s Q3 Earnings Report

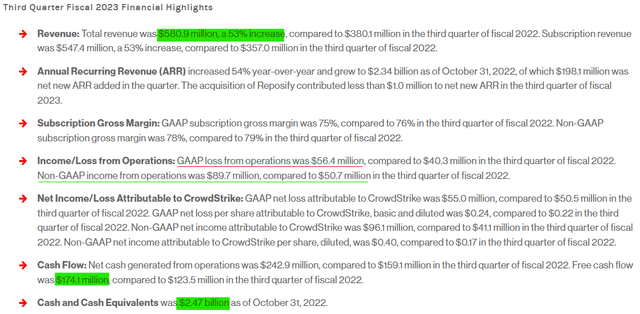

In Q3, CrowdStrike’s revenue of ~$581M (up 53% y/y) came in slightly ahead of guidance, resulting in record free cash flow generation of ~$174M. As revenues scale up, CrowdStrike is delivering operating leverage, with free cash flow margins reaching 30% in Q3. And management expects 2023 (FY2024) FCF margins to also come in above 30%.

CrowdStrike Q3 2022 Press Release

By the end of Q3, CrowdStrike’s cash balance reached ~$2.5B (net cash ~$1.7B), and with robust FCF generation, this balance sheet is only going to get stronger in the upcoming years. That said, CrowdStrike is still not GAAP profitable, and that is down to its aggressive SBC structure. While SBC as a % revenue will continue to moderate over coming years as CrowdStrike grows, it is quite high at ~24%. With headcount growth of 40%+ this year, SBC is set to remain high next year too. And this is not an environment where such heavy SBC spending is looked upon favorably! High SBC is a problem, but it is far from being a dealbreaker.

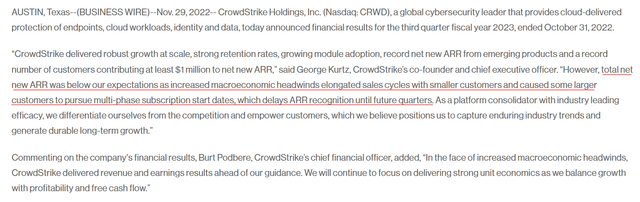

After being insulated from the macroeconomic environment so far, cybersecurity firms are finally starting to see signs of weakness. In Q3, CrowdStrike’s net new ARR came in short of expectations, and the management team attributed this miss to macroeconomic headwinds causing elongated sales cycles with SMBs and phased deployments among large customers. The positive thing here is that win rates are actually higher, and revenue is only delayed (these deals are not lost). While CrowdStrike is struggling to close deals with new customers, it continues to get more out of its existing customer base, as evidenced by Net Retention Rates [NRR] of more than 120.

CrowdStrike Q3 2022 Press Release

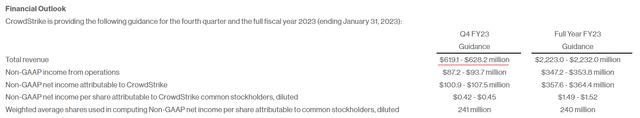

For Q4, CrowdStrike is projected to record revenues of $619-628M, and this guide fell short of consensus analyst estimates of $634M. Yes, the guide for non-GAAP EPS of $0.42-0.45 came in well ahead of estimates. However, the market reaction to CrowdStrike’s ER shows that investors are clearly upset about revenue guidance and management commentary.

CrowdStrike Q3 2022 Press Release

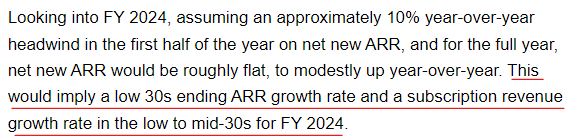

That’s not all; management had more bad news for us. From the earnings call transcript, I learned that CrowdStrike’s management is expecting these macro headwinds to last through the first half of next year. As a result, CrowdStrike’s ARR is set to slow down to the low 30s in 2023 (FY2024).

CrowdStrike Investor Relations Website

And I think this projected growth deceleration is the major driver of the ~15-20% plunge we saw in the stock after the release of CrowdStrike’s report. Now, CrowdStrike’s management has a history of under-promising and over-delivering, and so, we may well end up with 35%+ growth next year. Unfortunately, significant growth deceleration in this environment is not going to go unpunished. That said, cybersecurity trends are going to remain strong for years to come, and CrowdStrike is performing exceptionally well (even in this tough macro environment).

Here’s My Updated Valuation For CRWD Stock

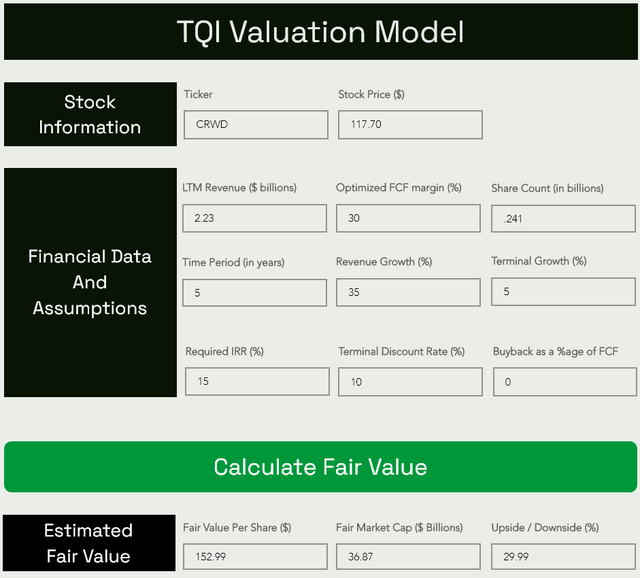

TQI Valuation Model (Author’s Website: TQIG.org)

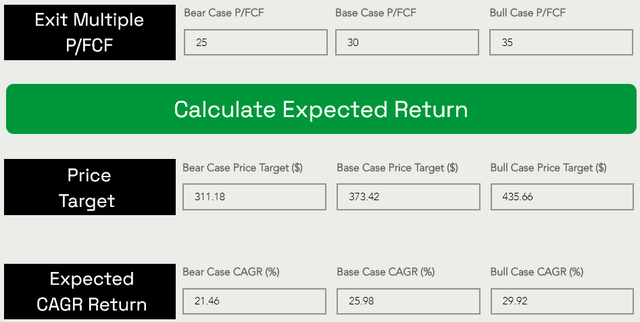

TQI Valuation Model (Author’s Website: TQIG.org)

No big changes here:

- Old FV Estimate: $154.7, New FV Estimate: $152.99

- Old Base Case PT (5-yr): $380.91, New Base Case PT (5-yr): $373.42

After recent declines in the stock, CrowdStrike now looks undervalued, and the risk/reward is highly favorable for bulls. That said, the deal could yet get better in the near to medium term.

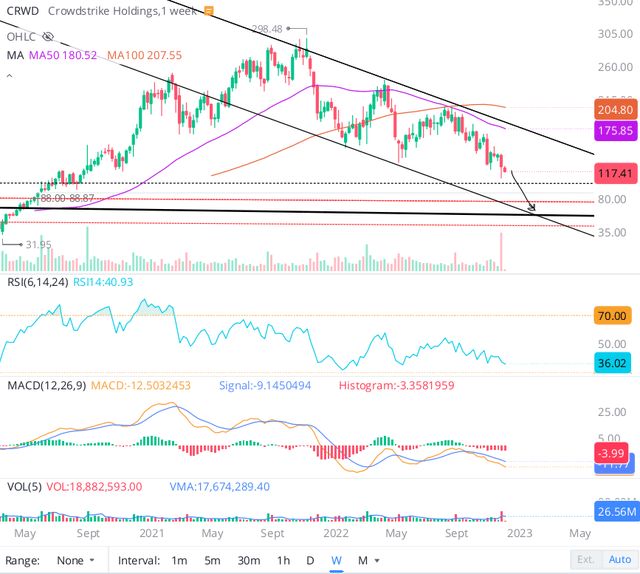

A Look At CrowdStrike’s Technical Chart

WeBull Desktop

Technically, I can see CrowdStrike testing the $100 psychological level in the next couple of months, and if that fails, I expect CRWD to drop down to the $80-85 range. That’s a level where I would consider CrowdStrike to be a GARP/Value stock. As of today, I like the idea of buying more shares in CrowdStrike (at ~30x 2023 P/FCF) as a long-term growth investment (with a preference for slow accumulation).

Key Takeaway: I rate CrowdStrike a buy at $115.

Thanks for reading, and happy investing. Please share your thoughts, questions, or concerns in the comments section below.

Be the first to comment