insta_photos

A skeptic’s thesis

Etsy (NASDAQ:ETSY) has a business that’s easy to love. A technology company that operates in the consumer discretionary sector, items from Etsy have a feel good element to it. Most of the items it sells are niche, made to order goods done by small businesses and work perfect as gifts. But as a stock there is uncertainty on what the shareholders can expect in the short to medium term once you realize that the primary goal for a business is to increase value for its shareholders.

In essence, there are one of two things you can consider when buying a stock –

-

You give more focus to a company’s growth characteristics and less to value

- You give more focus to a company’s value characteristics and less to growth

In my write-up, I will attempt to show that, in my assessment, neither the value nor growth story is appealing for Etsy, and I have a high conviction of this.

Deep Dive

Etsy operates an online marketplace selling goods which is hard to find anywhere else. Connecting buyers and sellers through its unique market, it generates revenues through listing fees, commissions on sold items, advertising services, payments and shipping. I have been a big customer of Etsy for a long time and I was very excited initially when it became a public company. One of my go-to holiday gifts is this personalized Passport holder and I have every one of its recipients ask me where I got it made so that they can use the idea on someone else. This showed me that the Etsy bug was contagious and recently I was given the below gift which was definitely amusing and made me laugh.

Etsy Products Page

And this lovable sentiment of Etsy is shared by many people. The company has reported millions of new buyers since the pandemic and has also shown significant growth in repeat buyers. But does a lovable business translate to a good stock? I myself have made this mistake before. Confusing what you like with what should be added to your portfolio is an incorrect way to invest and could drag down your portfolio. So let’s pull back the curtain on this and look at the metrics that really matter (And not just the number of buyers, number of repeat buyers and other metrics that the company selectively uses to show “significant” growth)

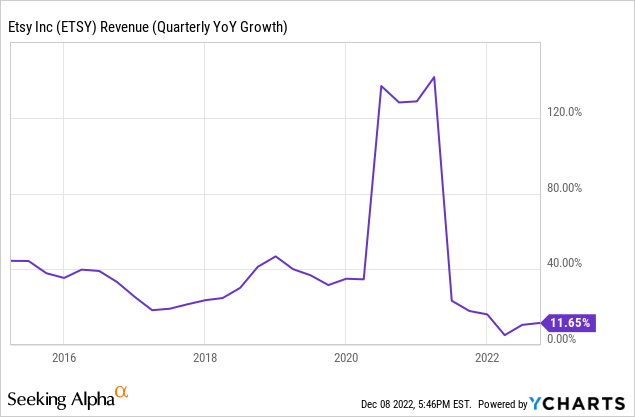

Stalled Growth

Business had grown impressively past few years but the last few quarters have been disastrous. Bulls repeatedly quote beating expectations (a well known trick to set low expectations and then beat it) but when viewed holistically and impartially, it’s quite clear that the growth has come down significantly. Last few quarters showed the slowest recorded growth in the company’s history. The upcoming quarter is not expected to get any better either. At the mid-point of company’s revenue guidance of $740M it would only show QoQ growth of 3% and may bring the full year growth to single digits (Historically, helped by holiday sales, Q4 has been company’s best quarter and previously showed 16% revenue growth)

There are many reasons to believe this may continue well into the future.

- The e-commerce industry is intensely competitive with low barriers to entry (The only perceived moat is network effect for Etsy which may not prove wide enough in the face of rapid scaling by its competitors)

- Attempts to increase profitability or grow its business by allowing non-handmade items, increasing fees and efforts to emulate Amazon have been met with backlash. Continued efforts in the future in this regard may be met with much less success.

- Many indicators are pointing towards a recession next year and consumer discretionary is one of the first sectors to get affected in the face of recession. Slowing growth from Etsy may already be a leading indicator (Flat growth for next year would be a best case scenario in that instance)

- With a good portion of its sales denominated in non-US currencies it remains sensitive to exchange rate fluctuations

Etsy’s negative shareholders’ equity

Viewed as a red flag for investors and in simple terms it means what a company owes is more than what it owns. For a company that showed promising growth and positive cash flows how did it get here? For this we have to look at some of the steps taken by the company in the recent years. Over the past four years Etsy has spent more than $2B in acquisitions and its most expensive acquisition to date ‘Depop’ came at $1.6B; a huge premium. The firm took a big impairment of $1B in its latest quarter related to this. These missteps have resulted in a big hole in its balance sheet.

- Looking at its growth for recent quarters it’s not clear how much the acquisitions have helped them grow their topline

- If it wants to pursue growth by looking outside again there is not a lot of maneuvering room left

Profitability, Valuation and other catalysts

In my opinion this is ample evidence for Etsy to be classified as ex-growth. Can we rule out other aspects that could propel its stock price in the near future?

- Although once profitable, its acquisition mis-steps have severely dented its profitability in the latest quarter. Etsy showed a net loss of $960M which resulted in a diluted EPS of -$7.62 (Reflects the impairment of its goodwill related to its acquisitions)

- Looking past this quarter, Etsy could show profitability once again but this could be nowhere near enough to justify the current stock price let alone propel it upwards.

- Just because a stock is down 50% does not mean its valuation got any better and Etsy is proof of that. At more than 6x Sales, it is far outside the average sales multiple for consumer Discretionary sector (≈1)

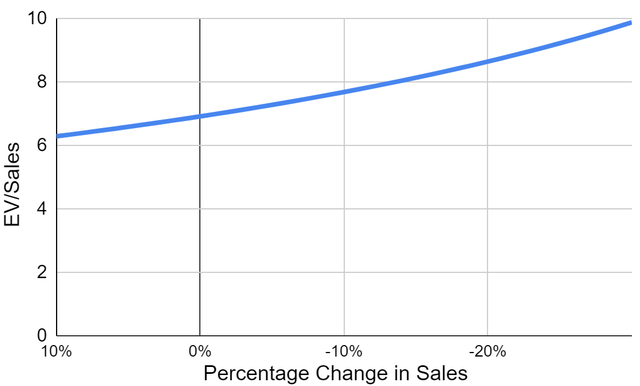

- Its EV to Sales ratio (≈7) is also far outside the sector median (≈1) and this too looks unlikely to come down organically anytime soon (Macro conditions could lead to a flat/flattish sales growth)

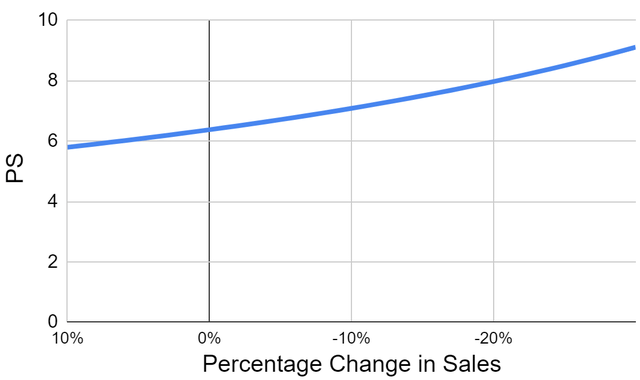

- Since consumer discretionary is the most vulnerable in an economic downturn we want to look at forward metrics in a range of scenarios and as expected the valuation gets progressively worse

PS under changing Sales Growth (Author Computed)

EV/Sales under different sales growth (Author Computed)

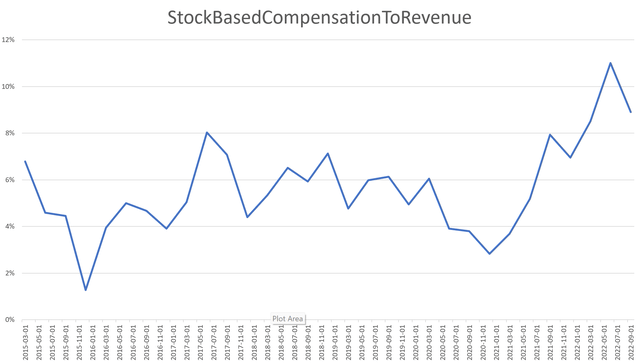

- Etsy has been trying to make use of some of its cash through stock buybacks. But its share based compensation has been going up as well. So far they have been able to offset this through their buyback program. But going forward it could be a tough position to be in. Any attempts to conserve cash in a downturn by suspending buybacks would prove highly dilutive.

Stock Based Compensation to Revenue (Author Collected)

Lastly from Seeking Alpha’s quant ratings Etsy is rated as a Hold scoring 3/5. Poor individual scores on valuation, growth and profitability are the main factors dragging down its quant score.

Risks to this thesis

The very factors that are contributing to the slowdown in growth would be the very thing that could help Etsy’s business. While there are competitors that are attempting to do what Etsy has done so far, it may run into the same challenges and Etsy has the wherewithal to survive these challenges.

- Etsy’s brand is recognizable and lovable. If its competitors do not have the capital to compete with Etsy while undergoing an economic slowdown, Etsy may end up cornering the market in the niche hand made segment

- With no threats of competition, Etsy’s attempts to increase its revenues through higher commissions, ad sales, transaction fees etc. may be met with little resistance which would be beneficial to its topline

Action

From my view a position in Etsy is not appealing in the short to medium term. Etsy is not only subject to company specific risks but also highly correlated with the index, trading with a Beta of 1.8. This suggests that any move in the index would be reflected even more severely in Etsy’s stock price. In my view the risks to the bearish thesis are mainly on a longer time frame (> 5 years), and given it would take quite a bit to move the needle investors should be able to find better returns elsewhere with far lower risks and volatility associated with it.

Currently, I do not hold any position but I am planning to initiate a short position through the use of far OTM puts. If this stock sees a significant upward move before the next earnings, I may even initiate a direct short position on the eve of next earnings announcement.

Be the first to comment