Supersmario/iStock via Getty Images

Overview

Diebold Nixdorf (NYSE:DBD) has likely withstood many a storm over its 146-year history. The banking and retail specialist has carved out a niche marketing payment hardware and transaction equipment across 2 segments.

Banking provides bespoke solutions for financial institutions – with a product line boasting ATMs, money counters, cash dispensers, smart terminals, and ground-breaking kiosk technologies.

The retail segment showcases modular, integrated point-of-sale and self-service terminals. As retailers continue outsourcing stages of the transaction process to the end customer, these more complex, integrated payment machines have become increasingly popular.

Care-free, seamless, efficient transactional systems have been the company’s way of life accordingly.

Tradingview

Year-to-date price action – (DBD)

The year has not been pretty for the payment terminals specialist formed from the 2016 merger of Diebold and Wincor Nixdorf. To date, the firm has shed -72.47% of its market cap since the pandemic-induced consumer durables boom slowly eased.

Other problems have plagued the company, the biggest being a gargantuan mountain of debt ($2.42B) maturing just as interest rates spike. This would be immaterial if the firm did not have a market cap of $226M, faltering sales and net incomes heaped in red ink.

A combination of dwindling consumer interest in consumer durables, coupled with paralyzing debt loads may see the company keel over. Wider supply chain woes and unfortunate FX headwinds have also taken their toll on the Ohio-based corporation.

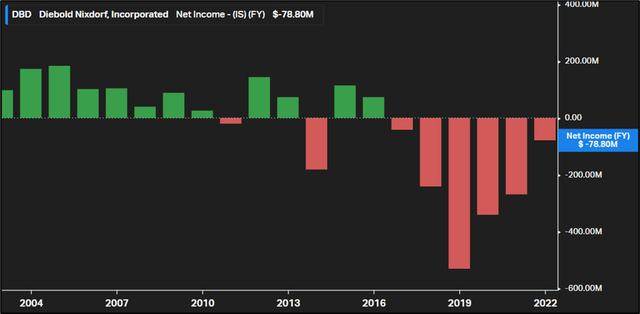

Koyfin

Since the 2016 merger deal between Diebold & Wincor Nixdorf, the firm has been bleeding money. It was perhaps only the Fed induced post pandemic liquidity boom which provided it with a cash lifeline.

Simplified Income Statement

Sales growth has faltered, with the terminals enterprise posting only $3.9B sales in FY 2021, down from $4.4B 2 years earlier. In tandem, sales, general & administrative expense has lowered but research and development, which weighs about ~$120M per year, has not moderated simultaneously.

Most of the damage inflicted on the income statement emanates from its Everest-like debt load. Net interest expense has spiraled, amounting to $190M in FY 2021. As yields move to the upside on the back of aggressive monetary tightening, corporate default and restructuring abound.

In fact, the debt load has been so crippling that the firm has hired Evercore and Sullivan & Cromwell to devise some form of restructuring plan in last ditch attempts to save the enterprise from default.

Right now, the company’s credit spread over US government bonds sits at an eye-watering 4175 basis points.

Simplified Balance Sheet

There are not many accolades that can be hurled at the balance sheet either. Cash and marketable securities, despite volatility, have declined. Inventory has increased from $466M in FY 2019 to $544M in FY 2021 as sales have tapered.

Receivables have only marginally decreased, exposing the company to considerable cost and risk as it endeavors to convert economic output to cash. Circa $700M in goodwill, the excess paid above the net value of corporate assets minus liabilities looms like a stormy cloud on the horizon.

Tested annually for impairment, any pending write-down would be catastrophic for the value of equity.

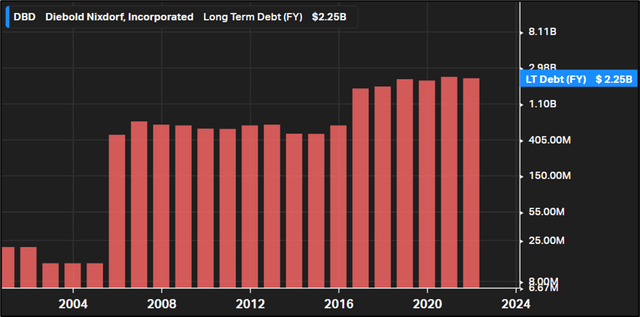

Koyfin

A sea of debt has plagued the company for the past 15 years, with problems accentuating as the SARS-Cov2 pandemic wreaked havoc on consumer spending. Only abundant liquidity pushed by the Federal Reserve has provided the firm any respite.

Naturally, accounts payable has ticked up while the company looks to hoard cash any way possible. Long-term debt has been the real standout feature on the balance sheet, indicating pending financial doom, particularly as refinancing options freeze over.

Key shareholders remain large institutions, with players such as Blackrock Fund Advisors (13.16%), The Vanguard Group (6.59%), and Beach Point Capital Management LP (5.02%) divvying out sizable stakes of company ownership. Consequently, big institutional investors look like they will bear the brunt of any cash crunch.

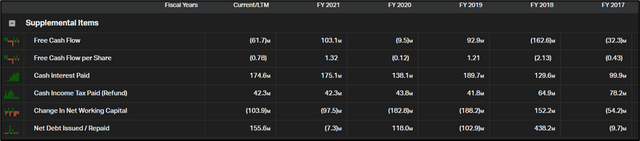

Simplified Cash Flow Statement

A glimpse at the cash flow statement provides little indication that the company will be able to overcome its liquidity woes. During the period of relatively abundant and cheap liquidity witnessed since the Great Financial Crisis, little action has been taken to address a looming credit bust.

While net debt repaid has seen down payments made, they have been increasingly sporadic.

Koyfin

Since 2017, few inroads have been made into addressing the company’s debt pile

Some restructuring charges and asset write-downs are starting to leak into cash flow from operations, perhaps signaling volatility to come. Amazingly, stock-based compensation continues to figure and even though it has reduced by about 50%, it provides little indication of robust performance-based compensation measures, specifically given the recent track record.

Risk

Risks aplenty for Diebold Nixdorf – the cash-strapped money machine manufacturer has found itself in a tornado of illiquidity, right now when interest rates are starting to peak.

Operating, liquidity & credit risk all showcase on the firm’s risk register, with credit risk representing an outsized allocation. During periods of cheap liquidity, a looming default may be countered by an asset fire-sale, debt restructuring or recourse to more cash.

But now is hardly the time. Spiraling price pressures have forced the hand of sovereign banks the world over. Subsequent restrictive monetary policy has seeped into the global economy, putting a stranglehold on interest expense induced by debt mountains.

The global economy appears to have started tanking. Despite a tight labor market, consumer durables spending has eased and consumer prudence, and earnings guidance rapidly seems to be shifting.

Perhaps a vestige of the Great Financial Crisis, cheap liquidity propelled risk capital to the moon and provided rock-bottom borrowing costs. Yet it may be this very phenomenon coupled with lavish M&A activity, poorly constructed deal-making and a tanking of global consumption which spells doom for the organization.

Key Takeaways

- Diebold Nixdorf serves the banking and retail segments providing ATMs, money counters, cash dispensers, smart terminals, and ground-breaking kiosk technologies.

- The company is part of the information technology sector in technology, hardware, storage, and peripherals industry.

- It was born out of the 2016 merger of Diebold and Wincor Nixdorf.

- Since then, a tidal wave of debt and goodwill has wreaked havoc on the payments hardware player.

- As capital becomes increasingly more expensive to raise and the global economy drags on consumer sentiment, the likelihood that the firm rolls its debt or pays it off through boosts in consumption are unlikely.

- As such, bankruptcy protection, restructuring and full-blown equity destruction are the most likely out.

Be the first to comment