sanfel

Shares of The Travelers Companies (NYSE:TRV) rallied 4% on Wednesday as investors digested its third quarter earnings release. Results were strong, and catastrophe losses were not as bad as feared. While weaker investment income weighed on results, we should be nearing the bottom here, and with over $13 in earnings power, shares in this strong operator are reasonable at just 13.1x earnings.

In the company’s third quarter, Travelers earned $2.20, beating consensus by $0.60. This was down $0.60 from last year due to weaker investment returns and a modest uptick in catastrophe losses due to Hurricane Ian. The difference between core earnings and GAAP EPS of $1.89 was due to $72 million of realized investment losses, given higher interest rates; I agree with management that core results are better to focus on to gauge the underlying performance of the business.

The company had a core ROE of 7.9%, which was below the company’s mid-teens target, though Q3 is seasonally the most challenging as this is when it typically faces the worst catastrophe losses as it is hurricane season. While it budgets for some cat losses in premiums it charges throughout the year, most losses occur just in one quarter. This year catastrophe losses were $512 million, up $11 million from last year. This was about a $1.65 headwind to quarterly earnings.

Despite the catastrophe losses, it still turned an underwriting profit with a combined ratio of 98.2% better than last year’s 98.6% (100% represents breakeven). These results were better than feared after Progressive (PGR), usually the gold standard in underwriting, reported large cat losses from Ian. Excluding catastrophes, Travelers had a combined ratio of 92.5%.

Net earned premiums rose by 10.2% to $8.6 billion from last year, and there was strength across the board as Travelers retains customers and has been able to push meaningfully on prices. Business insurance is its biggest unit, accounting for about half of all premiums. Premiums here rose 9%, and the combined ratio was 96.3%, a 1.2% improvement. The majority of its client are mid-sized companies, and it focuses more on casualty and property, which helps to reduce its exposure to catastrophes like Ian.

Bond and specialty insurance premiums rose 8%. This unit primarily provides management liability insurance, a niche but higher margin space, given there are fewer players. As a consequence, it generates the strongest underwriting margin with a normalized combined ratio of 78.4% from 83.4% last year. TRV is retaining 89% of its customers even with a 9% pricing increase, echoing what American Financial (AFG) has been reporting. Given its niche nature, this unit is the smallest part of the business at 10% of total premiums.

Finally, personal insurance premiums grew 13% from last year. It is about 40% of the business with a roughly equal split between auto and homeowner policies. This unit had a combined ratio of 107.2% due to 8.4% of catastrophe losses as flooding from Ian caused significant auto losses for the industry. TRV has been able to retain over 80% of its customers even with auto rates up 8% and homeowners up 14%. These higher premiums should help improve underwriting profits going forward.

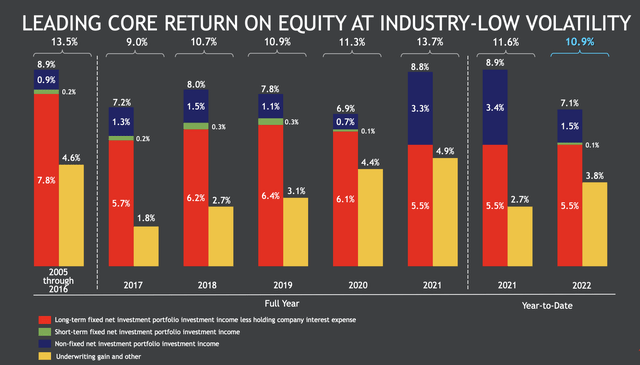

Overall, the underwriting arm of the Travelers did solidly, and it continues to grow premiums while exhibiting meaningful pricing power. As you can see below, historically Travelers has generated profits through a combination of underwriting profits, fixed income returns, and alternative investment returns. So far this year, underwriting is doing well. The primary drag versus last year is on the investment side, namely alternatives.

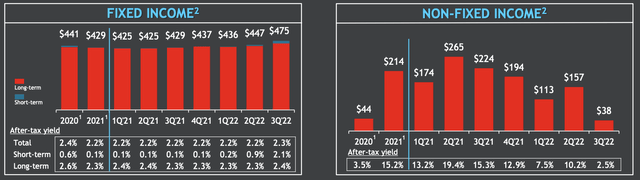

In Q3, investment income fell from $645 million last year to $505 million this year. The majority of Travelers’s assets are in bonds, which provide predictable quarterly income, and then it also invests in alternatives like private equity. As you can see below, fixed income returns are slowly rising given higher yields while non-fixed income returns have fallen sharply.

Its fixed maturity investment portfolio has seen earnings slowly rise as the company benefits from higher interest rates. The portfolio has a weighted average duration of 4.8 years. As bonds continue to mature, it can invest in higher yields today, boosting income. This unit should see steadily rising income over at least the next three quarters. It is also a conservative portfolio with an average rating of AA, and 98.7% is investment grade. Over half of its portfolio is in treasuries and municipal debt. This means the portfolio has limited credit risk and should not suffer meaningful losses even in a recession. A 50bp increase in investment yields, which should occur over the next 12-18 months at current yields will boost EPS by about $1.20.

Its non-fixed income portfolio tends to be more correlated with the equity market. While private equity prices do not change daily, if public companies are worth less, so too are private ones in all likelihood. PE returns are also generally reported on a one-quarter lag, so the weak $38 million income result was partly reflective of the market sell-off we saw in Q2. Now, the 15.2% return the portfolio generated in 2021 is not sustainable-that was a boom year. By the same token, the 2.5% return this quarter is also lower than normal given the equity sell-off. Its true earnings power is somewhere in the middle. Given continued volatility, Q4 non-fixed income returns may still be low, but they should recover over time.

TRV also maintains a robust balance sheet. Debt to capital is just 21.8%, and it has no long-term debt maturing until 2026. The holding company has liquidity of $1.45 billion. As a result, it bought back $501 million in stock last quarter. This year it has repurchased just under 3% of its shares. Accordingly, adjusted book value (excluding unrealized gains and losses) is $111.90, up 7%. Year to date, core earnings are up 3% to $9.02, putting the company on track to earn about $12 in 2022.

With higher premiums likely to aid underwriting margins next year, greater returns from fixed income as it invests at higher yields and some recovery in non-fixed income returns, TRV is well positioned to earn $13 next year. That gives shares a 13.1x multiple. That is a reasonable multiple for a premier franchise with consistently profitable underwriting and a strong balance sheet. Plus, insurance is generally less correlated with economic activity, making the sector attractive given all of the macroeconomic uncertainty. I would own TRV up to 15x earnings or about $195, offering 15% upside.

Be the first to comment