Ibrahim Akcengiz

Investment Thesis

Wereldhave (OTCPK:WRDEF) is enjoying strong operational performance and higher interest rates are still not affecting the bottom line. The prospects for 2023 are also good, given the upcoming delivery of three transformation projects and the change of headquarters office location.

The shares of Belgian subsidiary Wereldhave Belgium have lagged the parent company year-to-date, hence I think they are a better buy over the short term. Key risk for the Wereldhave Belgium is a dilutive stock-financed acquisition given the very attractive levels the shares trade at.

The next leg higher for Wereldhave shares should come with the booking of residential gains, which is expected to start later in 2022 and accelerate into 2023.

Company Overview

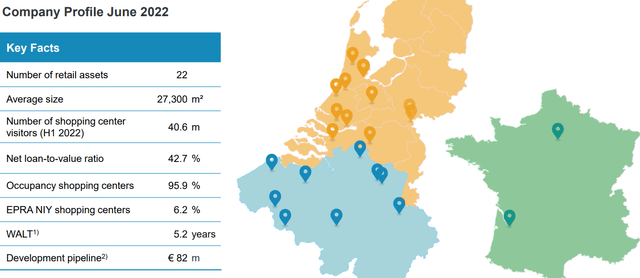

Wereldhave operates 11 shopping centers in the Netherlands, ten centers and offices in Belgium (through a 64.5% stake in Wereldhave Belgium), and 2 centers in France:

Wereldhave H1 2022 Results Presentation

Operational Overview

The improving retail/office landscape is starting to bear fruit for Wereldhave, with occupancy up 0.7% quarter-over-quarter to 94.7%. Direct result came in at 0.42 EUR/share for the quarter with the company sticking to the 1.55-1.65 EUR/share annual guidance.

Property valuations were the main focus point of the report given rising rates. Although German 10-year yields are up north of 1% year-to-date real estate investors can breathe a sigh of relief. Yields appear to have topped for the year at about 1.76% and have reversed a third of the move higher, now trading around the 1% level. That said, the ECB has signaled a meeting-by-meeting approach going forward, implying significant yields volatility over the coming months.

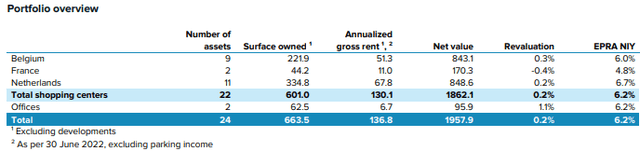

As far as Wereldhave is concerned, valuations were up marginally in Belgium and the Netherlands and down slightly in France, with the bulk of the rent indexation resulting in higher net initial yields, up 0.2% to 6.2% Q/Q:

Portfolio Valuation Overview (Wereldhave H1 2022 Results Release)

Finally, some useful details about the last two French assets were unveiled at the conference call by CEO Matthijs Storm:

Sell the last two assets in France. And I think it’s worth mentioning, because I think you will have questions about this, when will that happen? We have two centers left in France. We have Meriadeck in Bordeaux. That asset, we are building an extension in food and beverage, which is fully pre-let and will complete around April next year. That is still on track and on time. We’ve always said we will start marketing that asset once it is completed.

Côté Seine and Argenteuil in Paris, we’ve decided to enhance the value a bit more in that center. And we’re working on some projects. We’ve decided to push that sale a little bit further in time. So we think we will sell Côté Seine in the second half of next year or even the year after, which from a balance sheet perspective and a liquidity perspective is still totally fine. We think that’s the best way to generate as much shareholder value as possible.

Source: Wereldhave H1 2022 Conference Call Transcript

Market-implied Net Initial Yield Valuation

To calculate the market-implied net initial yield, I will take the EPRA Net Disposal Value (NDV) which stood at 21.81 EUR/share in H1 2022:

Market-implied net initial yield = Valuation net initial yield / Division factor where:

Division factor = Price/NDV Ratio * ( 1 – Loan-to-value ratio) + Loan-to-value ratio

with the H1 2022 parameters, namely:

1. EPRA NDV = 21.81 EUR

2. Loan-to-value = 42.7%

3. Valuation net initial yield = 6.2%

4. Closing price at the time of writing = 15.07 EUR

You get a P/NDV Ratio of 15.07 / 21.81 = 0.69, a division factor of 0.82 (0.69 * (1-0.427) + 0.427 ) and a market-implied net initial yield of roughly 7.5%.

I estimate Wereldhave Belgium currently offers a market-implied yield of circa 8% while largest peers Klepierre (OTCPK:KLPEF) and Unibail-Rodamco-Westfield (OTCPK:UNBLF) are in the 6.3-6.4% range.

Deutsche EuroShop Takeover

The big news in the last few months was certainly the takeover of Germany-focused shopping center operator Deutsche EuroShop AG by Oaktree and CURA.

Using the above methodology for market-implied yield, I estimate the cap rate used for the transaction offer price of 22.5 EUR/share (21.5 EUR per share plus 1 EUR in dividend) for Deutsche EuroShop to be around 6.8%.

On the one hand, this transaction highlights that valuations net initial yields of Wereldhave assets in France and Belgium are still unrealistically low. On the other hand, the discount applied by the market appears to be too great.

In essence, if someone wanted to acquire Wereldhave a fair offer would be around 18.5 EUR/share, or some 22.7% higher than the current price. Likewise, Wereldhave Belgium offers 28.5% upside to the target level of about 64 EUR/share. It is worth noting that the upside is before the booking of residential gains, which would be left to the acquiring party.

To be fair, Germany has the lowest country risk in all of Europe. This is offset by the fact that Deustche EuroShop has one center in Hungary and one in Poland, which would command a higher country risk premium. In terms of peer comparison however I think Deutsche EuroShop is a decent peer, although they are active in larger cities and center size is much greater than the Wereldhave average of 27,300 square meters.

Finally, the capital structure is very similar to Wereldhave Belgium with net debt around 32%.

Investor Takeaway

I think Wereldhave offers decent medium-term potential but the valuation of the Belgian subsidiary needs to catch up to the parent’s. Add to that general lackluster stock market performance plus higher interest rates and the case for using upticks in the share price to sell options premium grows more appealing. This is offset by the good upside relative to the recent Deutsche EuroShop transaction and the residential gains to be booked over the coming years.

Personally, I will continue to evaluate selling covered calls but I think the general stock market conditions call for naked long exposure, especially in the more cyclical sectors.

Thank you for reading.

Be the first to comment