courtneyk

Earnings of PacWest Bancorp (NASDAQ:PACW) will likely plunge this year on the back of higher provisioning and operating expenses. Further, a sharp drop in non-interest income will likely drag earnings. On the other hand, the recent remarkable loan additions and moderate margin expansion will boost the top line, thereby supporting earnings this year. Overall, I’m expecting PacWest Bancorp to report earnings of $4.30 per share for 2022, down 16% year-over-year. Compared to my last report on the company, I’ve reduced my earnings estimate because I’ve revised downwards the non-interest income estimate and pushed upwards the non-interest expense estimate. The December 2022 target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on PacWest Bancorp.

Loan Growth to Decelerate Due to Interest Rates

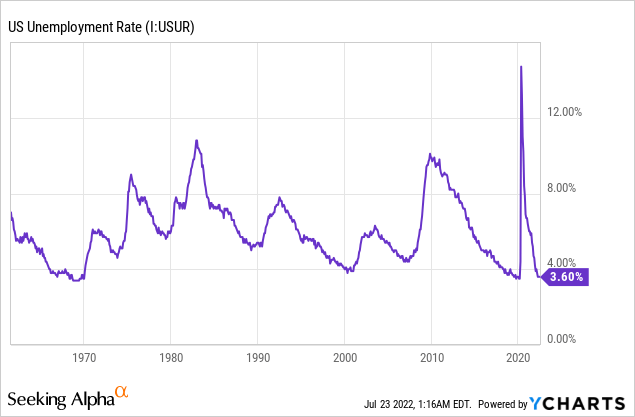

The loan book grew by a remarkable 8.9% in the second quarter of 2022, which surpassed my expectations. Loan growth will likely slowdown in the second half of the year mostly because of heightened interest rates that will discourage borrowing. However, growth will likely remain above zero thanks to strong job markets. PacWest Bancorp is a nationwide lender based in California; therefore, the national unemployment rate is a good gauge of future credit demand. As can be seen below, the country’s unemployment rate is near multidecade lows, which bodes well for loan growth.

Considering these factors, I’m expecting the loan portfolio to grow by 3% in the second half of 2022, leading to full-year loan growth of 19%. In my last report on PacWest Bancorp, I estimated loan growth of 11% for the year. I’ve revised upwards my estimate mostly because of the second quarter’s performance.

Meanwhile, other balance sheet items will likely grow in line with loans during the second half of 2022. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Financial Position | |||||||||

| Net Loans | 16,833 | 17,825 | 18,708 | 18,735 | 22,741 | 27,108 | |||

| Growth of Net Loans | 10.0% | 5.9% | 5.0% | 0.1% | 21.4% | 19.2% | |||

| Other Earning Assets | 4,245 | 4,544 | 4,303 | 8,263 | 14,656 | 11,608 | |||

| Deposits | 18,866 | 18,871 | 19,233 | 24,941 | 34,998 | 34,995 | |||

| Borrowings and Sub-Debt | 930 | 1,825 | 2,217 | 471 | 863 | 2,530 | |||

| Common equity | 4,978 | 4,826 | 4,955 | 3,595 | 4,000 | 4,187 | |||

| Book Value Per Share ($) | 40.5 | 38.6 | 41.2 | 30.8 | 34.2 | 35.6 | |||

| Tangible BVPS ($) | 19.1 | 17.7 | 19.7 | 21.3 | 21.8 | 23.3 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Loan and Deposit Mixes Make the Margin Moderately Rate Sensitive

According to details given in the earnings presentation, around 44% of the loan portfolio is based on variable rates, thus it will re-price soon after every rate hike. Further, fixed and hybrid-rate loans maturing or repricing within a year made up 5% of total loans at the end of June 2022. Therefore, around half the loan portfolio will benefit from rate hikes within a year.

A similar portion of the deposit book has flexible rates. Interest checking, money market, and savings accounts made up 52% of total deposits at the end of June 2022. Nevertheless, the liability side is slightly less rate-sensitive than the asset side as banks have more power to price deposits than usual. This is because currently there is excess liquidity in the banking industry.

The net interest margin’s sensitivity to rate changes is moderate-to-low. According to the results of the management’s interest-rate sensitivity analysis given in the presentation, a 200-basis points hike in interest rates can boost the net interest income by 3.18% only.

Considering these factors, I’m expecting the margin to grow by 8 basis points in the second half of 2022 from 3.56% in the second quarter of the year.

Updating Non-Interest Income and Expenses Estimates Following 2Q Surprises

PacWest Bancorp missed my earnings estimate in the second quarter of 2022 partly because it reported lower-than-expected non-interest income. The company’s non-interest income declined by 54% year-over-year during the second quarter. The drop was not just attributable to gains on sales of assets, but also to core non-interest income (warrant income to be precise). The management mentioned in the presentation that it expects non-interest income to continue to remain at the second quarter’s level for the remainder of the year. As a result, I’ve decided to revise downwards my non-interest income estimate to $124 million, from my previous estimate of $159 million.

Another reason why PacWest Bancorp missed my earnings estimate during the second quarter was that it reported higher-than-expected non-interest expenses. Going forward, I’m expecting operating expenses to remain elevated due to inflationary pressures on salary expenses. However, the slowdown in loan growth will ease the pressure on operating expenses. The management also expects non-interest expenses to dip in the second half of the year, as mentioned in the earnings presentation.

In light of the second quarter’s results, management’s guidance, and my outlook on inflation and loan growth, I’m expecting the expense run rate to drop to $182 million – $183 million in the third and fourth quarters from $184 million in the second quarter of 2022. For the full year, I’m expecting PacWest to report non-interest expenses of $716 million, up 12% year-over-year. I have revised upwards my non-interest expense estimate by 5% from my previous estimate of $682 million given in my last report on the company.

Earnings to Dip by 16%

The anticipated dip in non-interest income and higher operating expenses will likely contribute to an earnings decline this year. Further, the provisioning for expected loan losses will likely be higher through the second part of the year because of high interest rates that will hurt the portfolio’s credit quality.

On the other hand, substantial loan growth and some margin expansion will likely support the bottom line. Overall, I’m expecting PacWest Bancorp to report earnings of $4.3 per share for 2022, down 16% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Income Statement | |||||||||

| Net interest income | 980 | 1,041 | 1,015 | 1,015 | 1,104 | 1,316 | |||

| Provision for loan losses | 58 | 45 | 22 | 339 | (162) | 37 | |||

| Non-interest income | 129 | 149 | 143 | 146 | 194 | 124 | |||

| Non-interest expense | 496 | 511 | 502 | 1,984 | 637 | 716 | |||

| Net income – Common Sh. | 358 | 465 | 469 | (1,239) | 597 | 506 | |||

| EPS – Diluted ($) | 2.91 | 3.72 | 3.90 | -10.61 | 5.10 | 4.30 | |||

| Adjusted EPS – Diluted ($) | 2.91 | 3.72 | 4.06 | 2.12 | 5.10 | 4.30 | |||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

In my last report on PacWest Bancorp, I estimated earnings of $4.43 per share for 2022. I’ve tweaked downwards my earnings estimate mostly because I’ve revised downwards my non-interest income estimate and revised upwards my non-interest expense estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation. The new Omicron subvariant also bears monitoring.

PacWest Trading at a Large Discount to its Target Price

PacWest Bancorp is offering a dividend yield of 3.7% at the current quarterly dividend rate of $0.25 per share. The earnings and dividend estimates suggest a payout ratio of 23% for 2022, which is below the five-year average of 40%. Nevertheless, I’m not assuming an increase in the dividend level to remain on the safe side.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value PacWest Bancorp. The stock has traded at an average P/TB ratio of 1.63x in the past, as shown below.

| FY19 | FY20 | FY21 | Average | |||

| T. Book Value per Share ($) | 19.7 | 21.3 | 21.8 | |||

| Average Market Price ($) | 37.8 | 22.6 | 41.5 | |||

| Historical P/TB | 1.92x | 1.06x | 1.91x | 1.63x | ||

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $23.3 gives a target price of $38.0 for the end of 2022. This price target implies a 41.6% upside from the July 22 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.23x | 1.43x | 1.63x | 1.83x | 2.03x |

| TBVPS – Dec 2022 ($) | 23.3 | 23.3 | 23.3 | 23.3 | 23.3 |

| Target Price ($) | 28.7 | 33.3 | 38.0 | 42.7 | 47.3 |

| Market Price ($) | 26.9 | 26.9 | 26.9 | 26.9 | 26.9 |

| Upside/(Downside) | 6.8% | 24.2% | 41.6% | 58.9% | 76.3% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 9.4x in the past, as shown below.

| FY19 | FY20 | FY21 | Average | |||

| Earnings per Share ($) | 4.06 | 2.12 | 5.10 | |||

| Average Market Price ($) | 37.8 | 22.6 | 41.5 | |||

| Historical P/E | 9.3x | 10.7x | 8.2x | 9.4x | ||

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.30 gives a target price of $40.4 for the end of 2022. This price target implies a 50.3% upside from the July 22 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 7.4x | 8.4x | 9.4x | 10.4x | 11.4x |

| EPS 2022 ($) | 4.30 | 4.30 | 4.30 | 4.30 | 4.30 |

| Target Price ($) | 31.8 | 36.1 | 40.4 | 44.7 | 49.0 |

| Market Price ($) | 26.9 | 26.9 | 26.9 | 26.9 | 26.9 |

| Upside/(Downside) | 18.3% | 34.3% | 50.3% | 66.3% | 82.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $39.2, which implies a 45.9% upside from the current market price. Adding the forward dividend yield gives a total expected return of 49.7%.

Compared to my last report, I’ve significantly reduced my target price as I’m taking the average multiple for the last three years only while, previously, I was taking the average multiple for the last five years. I’ve decided to reduce the timeframe because it seems increasingly unlikely that PacWest will be able to return to the higher multiples of 2017 and 2018 given the current economic environment.

Despite the cut in the target price, PacWest is trading at a large discount to the updated year-end target price. In my opinion, the market has overreacted to the prospects of an earnings decline. The considerable discount on the target price appears unjustified. Therefore, I’m maintaining a buy rating on PacWest Bancorp.

Be the first to comment