BCFC

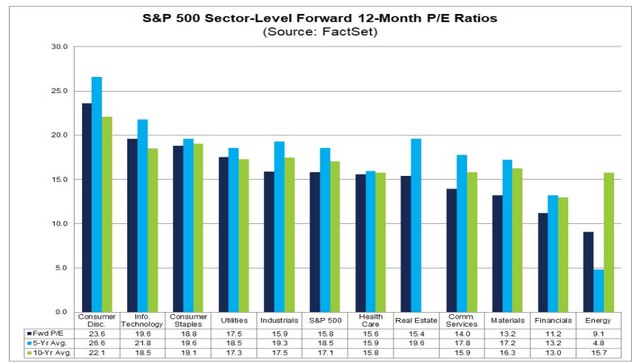

The Consumer Staples sector is now the third most expensive area in the stock market with a forward earnings multiple of 18.8, but that’s below both its average 5-year and 10-year next 12-month valuation ratios, according to John Butters at FactSet.

While blue-chip staples stocks appear expensive, one underperforming high yielder looks cheap ahead of its Q4 earnings report Thursday morning.

S&P 500 Sector Valuations: High-Priced Staples

According to Bank of America Global Research, Walgreens (NASDAQ:WBA), following the completion of the Rite Aid stores acquisition, is the largest global pharmacy, with nearly 10,000 stores in the U.S. alone. The company also operates an international pharmacy business, primarily composed of the Boots pharmacies in the United Kingdom.

The Illinois-based $27.9 billion market cap Food & Staples Retailing industry company within the Consumer Staples sector trades at a low 4.9 trailing 12-month GAAP price-to-earnings ratio and pays a high 6.3% dividend yield, according to The Wall Street Journal. The firm reports quarterly results later this week.

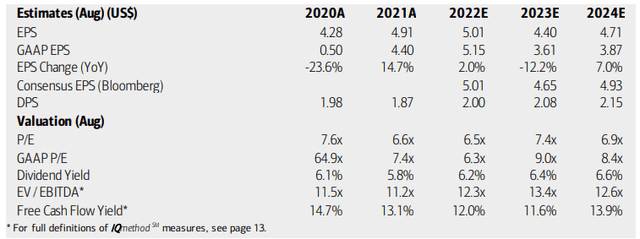

On valuation, analysts at BofA see 2022 earnings having fallen 2% while next year’s EPS should see an even larger annual decline. Both the Bloomberg consensus forecast and BofA’s outlook call for a slight per-share profit growth rate in 2024, though. While earnings growth is quite soft in the years ahead, WBA’s dividend is seen as growing through 2024 as free cash flow actually remains healthy.

Given sluggish profit growth trends, investors have punished the stock with a low valuation. Both its operating and GAAP P/E ratios are in the single digits. Its EV/EBITDA ratio, however, is elevated.

Overall, I see the value case here as compelling given strong and steady free cash flow. Earnings could be pressured by reimbursements and increasing global competition. There’s also uncertainty concerning its Walgreens Health business operations.

WBA: Earnings, Dividend, Valuation Forecasts

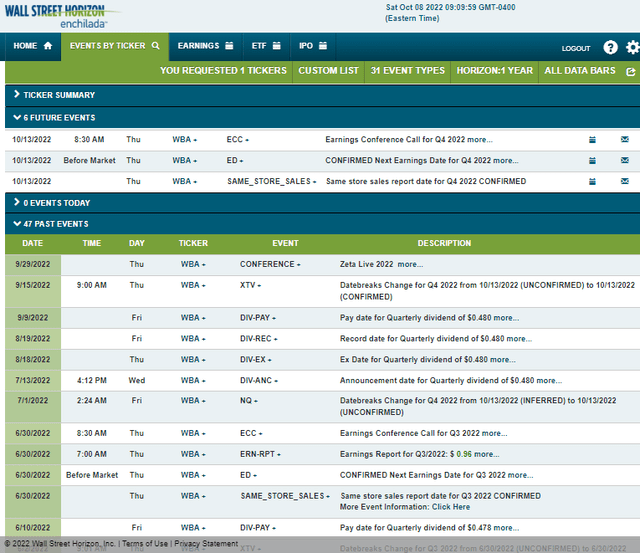

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2022 earnings date of Thursday, Oct. 13 BMO with a conference call immediately following the morning numbers crossing the wires. You can listen live here.

Corporate Event Calendar

The Options Angle

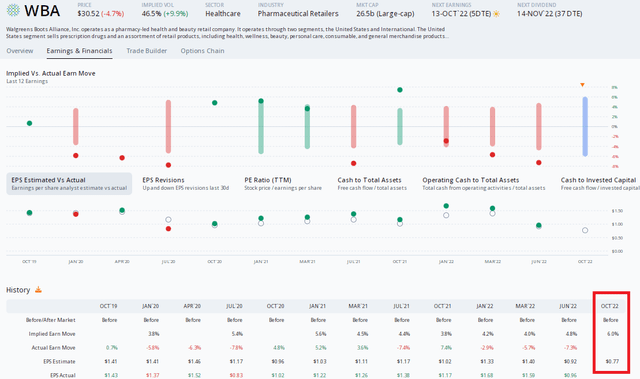

Digging into the earnings report, data from Option Research & Technology Services (ORATS) show a consensus EPS figure of $0.77. If $0.77 verifies, that would be a more than 30% per-share profit decline from the same period a year ago.

On the positive side, though, is a strong EPS beat rate history for Walgreens. The firm has bested analysts’ estimates in each of the past eight reports. Unfortunately for the bulls, the stock has traded lower in the wake of the past three quarterly reports.

Options traders have priced in a 6% post-earnings date stock price move using the nearest-expiring at-the-money straddle. That is the biggest percentage in the last three years, per ORATS. Since the last report, there have been three analyst rating changes – one to the positive side and a pair of downgrades. So, the options are a bit expensive on this cheap stock, what does the chart say?

Walgreens Earnings: A Historically Big Stock Price Move Priced In

The Technical Take

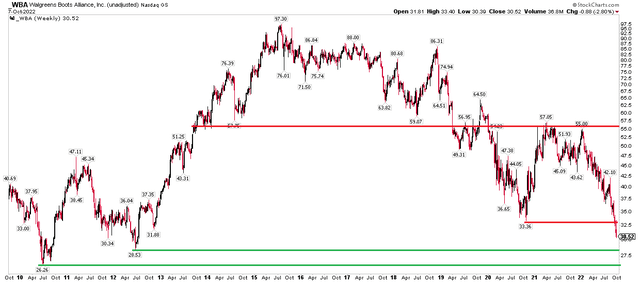

WBA has been an absolute and relative loser for years. After peaking near 4100 in 2015, shares have fallen nearly 70% to Friday’s lowest close since 2012. Near decade-lows, I see support approaching in the $26 to $29 range.

There could be resistance on future upswings to the late 2020 low near $33, though. And long-term resistance is seen in the mid-$50s.

Overall, I expect shares to pull back a bit more, but then the stock should attract technical buyers.

WBA: Shares Approaching Support

The Bottom Line

I like WBA here. The stock looks like a good value with a high yield, while the chart shows the possibility of buyers about to step in. Going long a call spread could be a way to play its somewhat pricey options. If we get a negative stock price reaction to earnings this week, both technical traders and long-term investors can buy shares at a favorable risk/reward price and value level.

Be the first to comment