D-Keine

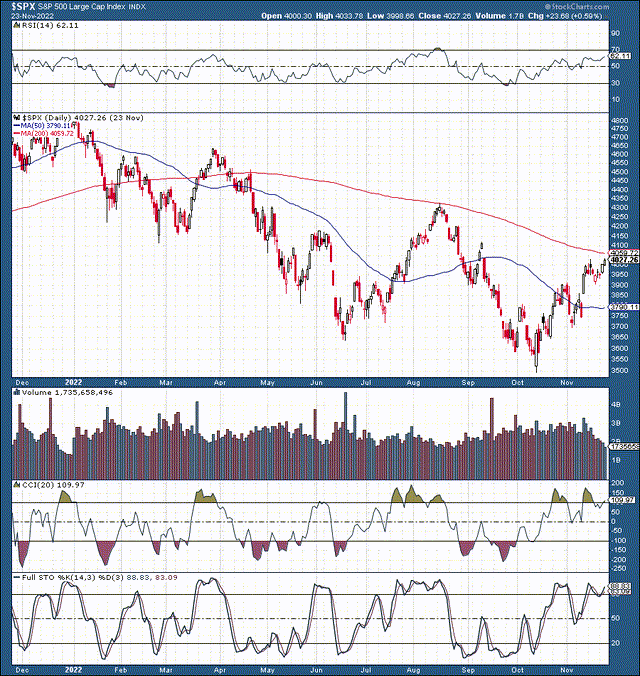

The S&P 500/SPX (SP500) has staged a significant 15% rally off the low at 3,500. Many quality stocks have appreciated by 30-50% or more. To put things in perspective, the SPX is currently about 15% below its ATH of around 4,800. Moreover, much of the recent gains in many popular stocks can be attributed to short covering and FOMO, for the most part. The underlying economic atmosphere remains highly challenging and may worsen shortly.

Higher interest rates, more monetary tightening, inflation, a general economic slowdown, a softer labor market, and other elements could weigh heavily on consumer spending, negatively impacting corporate profits into 2023. Therefore, the bear market is not over, the recent countertrend rally should end soon, and the SPX should go on to make new lows before this bear market is concludes. My bottom buy-in range for the SPX remains 3,200-2,800, 20-30% below current levels.

Just Another Bear Market Rally

We’re still in a clear downtrend in a bear market that crashed to SPX by 27%, but that may not be enough. We’ve seen several significant countertrend rallies since the downturn started. These rallies can last months, and the previous bear market rally took the SPX up by 19% from its low. Therefore, there is a chance that the current rally can continue to about 4,200. However, despite the potential for near-term upside, gains will likely be limited and short-lived. Intermediate-term risk is still to the downside, and the next leg of the bear market could take the SPX notably lower.

The bear market probably didn’t reach the bottom at 3,500 in mid-October. There was not enough panic selling, no apparent signs of capitulation, and volume wasn’t high. We saw a textbook technical reversal off a critical support level. The market was oversold, and it was time for a rebound. The rally got exacerbated due to better-than-expected inflation numbers and other factors. Nevertheless, this rally may end soon, with the SPX approaching the 200-day MA.

Upcoming Data: Bad News Isn’t Good News Anymore

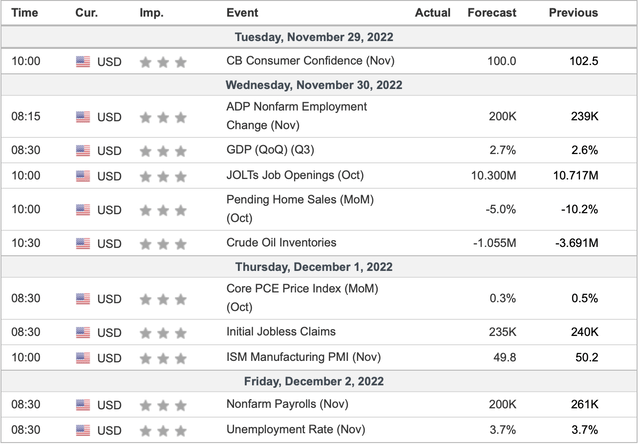

We have some critical market-moving data coming out this week. Consumer confidence, Q3 GDP, PCE inflation, the ISM, and the all-important nonfarm payrolls are a great deal to digest in one week, especially since the Fed’s FOMC meeting is coming up in about two weeks. Better than anticipated data could increase the probability of another 75Bps increase. While worsening economic data may increase the chances for a 50Bps hike, it would illustrate that the economy is weakening.

Therefore, a delicate balance must be sustained between the Fed, economic data, and market expectations. A hotter-than-expected PCE would be particularly damaging. Likewise, a jobs report that’s too hot or cold could adversely affect the stock market.

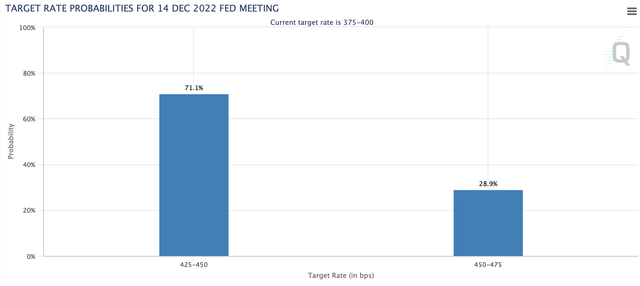

The Fed Will Keep Raising

There’s about a 70% probability that we will see a 50 Bps increase instead of another 75 Bps move. The Fed has raised by 75 Bps five times in a row now, and after the subsequent increase, the funds rate will be at around 4.5%. When was the last time you saw the cost of borrowing increase by so much so quickly? It takes time for interest rates to impact the real economy. As higher borrowing costs permeate all levels of the U.S. economy, growth should slow significantly, leading to higher unemployment, worsening consumer spending, and ultimately lower growth and less corporate profits. Therefore, we are still waiting to see the full effects of the Fed’s tightening, which should lead to more pain for the stock market in the months ahead.

Valuations: Still Far From Cheap Here

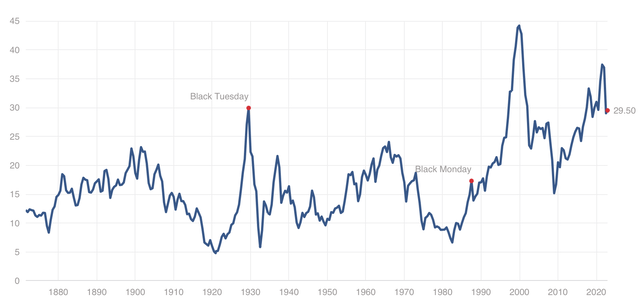

Shiller P/E Ratio

I use the Shiller P/E ratio over other valuation metrics because the P/E ratio is based on average inflation-adjusted earnings from the previous ten years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio). The CAPE ratio allows us to gauge the over or under-valuation of stocks better than many other valuation metrics. Provided the current dynamic, stocks are still expensive by historical standards. Also, considering that many companies are going through earnings declines, we should see the downtrend in the CAPE ratio continue in the mid-term.

It’s not likely that the CAPE will return to its historical mean at around 17, but we could see the CAPE come down to 23 or possibly even the 20 level. Incidentally, a drop to the 20-23 level in the CAPE is akin to the SPX dropping to the 3,200-2,800 from here. Therefore, stocks likely have more downside ahead, and we should see excellent buying opportunities in the months ahead.

Ignore The Hype & Protect Your Portfolio

Despite the recent run-up, the upside potential in the current rally may be limited. The long-term trend is still lower, and if economic indicators fail to please investors next week, stock prices could begin their next drop lower. As the challenging economic atmosphere progresses, higher interest rates should pressure consumer spending, decreasing corporate profits in the near term. Valuations are still relatively high, and we should continue seeing multiple compression as earnings and sentiment decline in the coming months.

Therefore, if the current rally falters soon, I will reduce risk exposure in the tech sector and other higher alpha areas. Moreover, I will introduce more covered calls and more aggressive forms of hedging. I will employ the collar play strategy to protect against potential downside in core stock holdings. Furthermore, I will increase my cash position significantly when the market turns south for the next downturn.

The current trend may take the SPX up to about 4,200, but the upcoming leg of the bear market should be significant and could push prices much lower. I suspect the final down leg may materialize in Q1 2023 and be the last flush-out capitulation style selloff we’ve been waiting for to put the final nail in this bear market. My S&P 500 bear market bottom and long-term buy-in range remain at 3,200-2,800.

Be the first to comment