John Phillips/Getty Images Entertainment

Note: For US investors who wish to trade Everyman Media Group, they must do so directly on the London Stock Exchange – there is no US ticker for Everyman

Taking a contrarian stance in the market isn’t easy. It requires patience and resolve. Patience in allowing your thesis to play out and understanding that it may take a while to do this. Resolve through being comfortable with disagreement. After all, contrarian investing in its essence is thinking in unconventional ways. Sir John Templeton phrased these struggles well:

To buy when others are despondently selling and to sell when others are avidly buying requires the greatest fortitude

However, there are numerous contrarian ‘traps’ across the market. Many individuals, unsuccessfully, try to act against the herd. Whether this be through catching a fast-falling knife, or attempting to short against a momentum rally. On the long side, a lot of the time the market has good reason to be cautious.

Therefore when taking these stances on certain equities, I believe there needs to be a significant margin of safety from a risk/reward standpoint to take a position. To me, little-known UK Micro-cap Everyman Cinemas provides exactly that – the best risk/reward profile I have personally come across in my albeit short investing journey.

It makes sense to devalue the cinema industry, right?

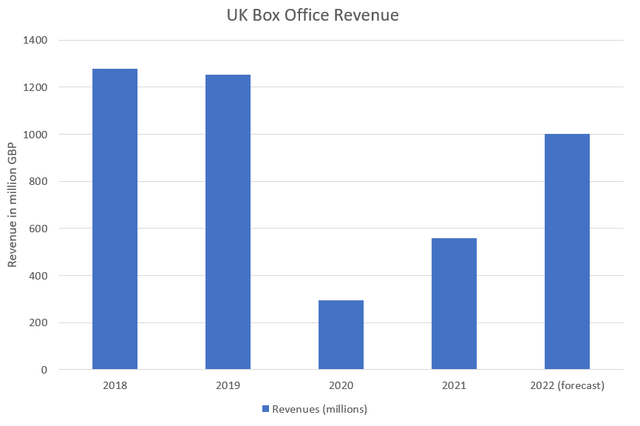

At the top level, there is little reason to invest in a cinema chain. The cinema industry is the last place that comes to mind when we think of suitable investments right now. Not only has the industry suffered from extended closures with minuscule government support (particularly in the UK), it is also facing the worst inflationary (and subsequently consumer) pressures since 1981. It’s therefore unsurprising that the box office figures have been so unimpressive:

The market knows this and that’s exactly why it’s significantly devalued the entire industry – understandable considering the backdrop, right? Well, where I draw issue is that this is being done to the industry in its entirety.

Over the last few months, more data and subsequently opinions have started to surface regarding a shift in the cinema landscape. When you hear me say this what likely comes to mind is streaming pressures – no it isn’t that. But it does somewhat evolve from that.

The industry is going through a period where it needs to adapt. The days of huge multiplexes and debt-heavy balance sheets are numbered. Cineworld was a casualty of this. Companies with healthier balance sheets and a leaner structure are likely to thrive. But more importantly, cinemas that are wholeheartedly focused on creating the best customer experiences will succeed.

Cinemas can no longer purely rely on the strength of the film slate to depict their own success – consumers need a reason to get off Netflix (or the numerous other streaming platforms) and go back to the big screen.

Right now, the films themselves aren’t providing that. The slate is going to get stronger in 2023 but box office is still expected to be below 2019 levels. That’s exactly why cinemas need to do more – Everyman is doing that:

- Luxurious focus (sofas in screens)

- Unique and intimate interior

- Curated menu options.

Essentially taking a 360 view of cinema and making an effort to make customers the star of the show – a focus they have had since inception (the year 2000).

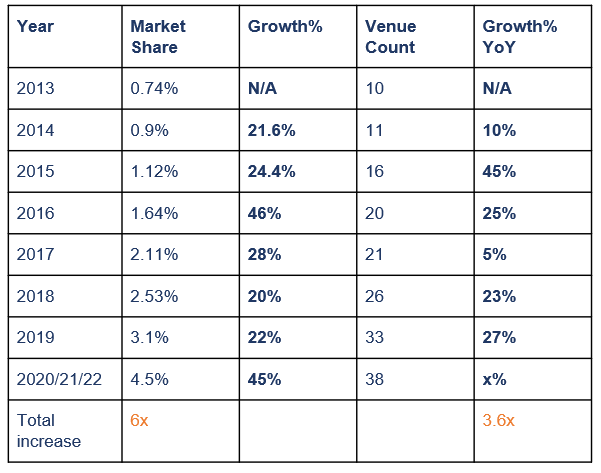

This has now started to really pay off for Everyman, if you don’t trust me, I am sure you will trust the hard figures. Take a look at the company’s market share growth:

Compiled by author from company accounts

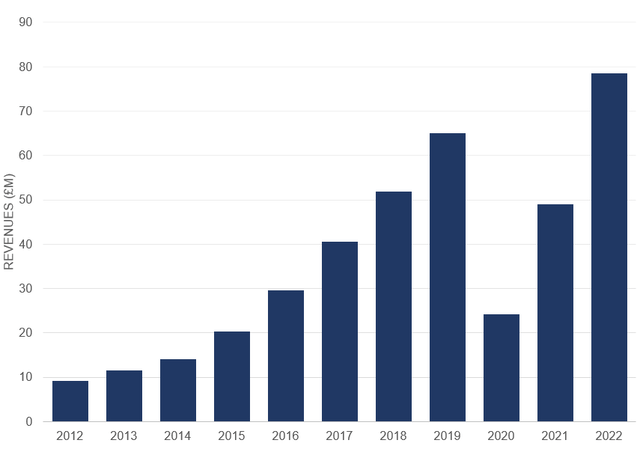

How this is impacting the top line you say?

Compiled by author from company accounts

That FY22 revenue figure was reaffirmed recently by management, they expect to at least meet those expectations. I have been banging the table for a while now about Everyman’s superior product and how they are well placed for the current cinema landscape shift we are starting to see. It’s great to see mainstream outlets start to cover this shift, The FT recently ran a piece about the decline of multiplex venues, it includes a quote from the Everyman CEO.

Cinema recovery riding on slate of winter blockbusters

The trend and belief that Everyman was built on has now started to accelerate. Everyman is in the right place, at the right time.

Valuation update

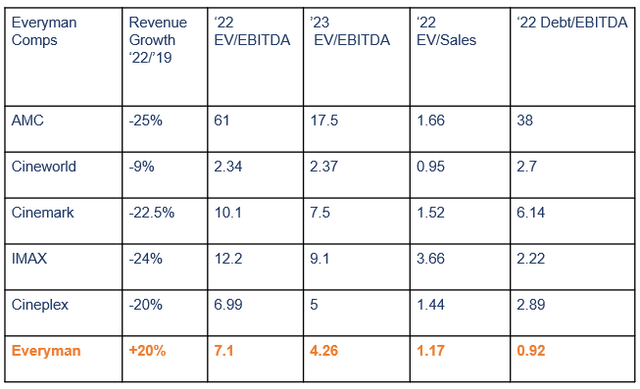

The market, astonishingly, has priced Everyman at similar levels the most other listed cinema chains, despite the fact the company is growing at a fast clip, gaining market share and expanding its footprint.

Below I have tabled key metrics. Key considerations for metrics and justifications:

Compiled by author from company reports

- Enterprise Value – I have excluded leases from the EV figure to draw fair comparison between US (GAAP) and UK/Canadian peers (IFRS)

- EBITDA – I have used EBITDA due to Everyman’s large depreciation charge from rolling out new venues – you can’t punish the business for expanding by valuing it on a P/E basis.

The table clearly shows Everyman as a stark outlier when it comes to top-line growth this year compared to 2019. Despite this Everyman trades at similar/cheaper prices to peers based on ’22 EBITDA. Also note that this is comparing Everyman to other pessimistic valuations, market sentiment towards the industry hasn’t been much worse than over the last few years. Everyman is the only chain whose ’22 EBITDA more than covers its total debt. So the summarise; Everyman is growing revenue faster, trading at a cheap price with a more manageable debt pile. You can see what I am alluding to here – the market price simply isn’t a reflection of Everyman’s performance and prospects.

Just sofas in cinemas?

Many may think that Everyman is an easy-to-replicate experience. This is primarily down to the fact they can’t patent their offering and it may seem like their differentiation is pretty basic. But actually achieving this at scale is really difficult. It took Everyman eight years from its first Hampstead venue to get to a total of eight screens. For a small competitor starting up, obtaining capital to roll out venues isn’t easy. And maintaining standards across the whole country requires a lot of resource and skill.

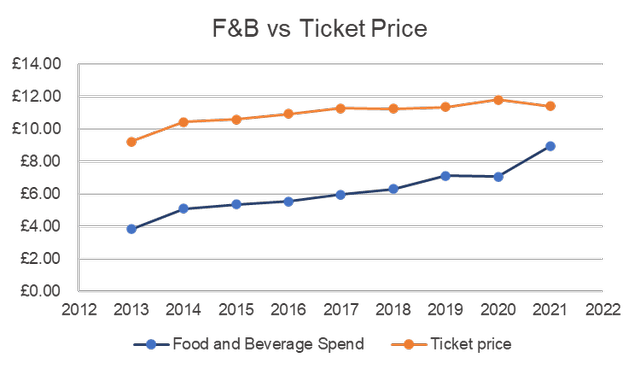

Then comes Everyman’s curated menu options, which have developed and evolved over a long period of time. Below is Everyman’s Food and Beverage (F&B) spend per head vs Box Office spend per head over time.

Compiled by author from company reports

It’s important to note this dramatic rise in F&B hasn’t happened through substantial increases in prices, rather through customers opting to spend more and buy more items. A lot of this is a reflection of Everyman’s success in understanding what customers want and delivering on that.

Now considering Everyman’s success, it should be expected that others will look to compete in their arena. However, this is difficult. Let’s take a large peers, such as Cineworld (OTCPK:CNNWQ) or Odeon (AMC). How exactly do you replicate Everyman? Do you start picking up small venues in towns across the country? (that takes time and expertise to do so successfully). You are an operator of 10’s – 100’s of 20-odd screen multiplexes with a high fixed cost base and a large debt load (fuelled Cineworld’s demise). Therefore it’s very hard for you to pivot into a new focus, particularly in the current economic environment. Your whole business is built on the viability of multiplexes as a destination for consumers, a business that is now slowly becoming less viable in its current capacity.

Sente Corporation with author edits

Then you have smaller competitors like Curzon Cinemas and Picturehouse. Curzon Cinemas is seeing success and reported profitability in 2021 according to Companies House filings. But the operator is primarily focused on London and isn’t expanding like Everyman (Everyman is the only national cinema chain that grew attendance in the UK vs 2019). Remember, Everyman only has 4.5% market share. All these chains and other niche operators can be successful – there is a large growth runway for town-centric players. But I do think Everyman is best positioned due to its national scale, capital base and healthy balance sheet.

Conclusion

So to summarise, let’s answer the two big questions; Why Everyman? and Why now?

Why Everyman?

Everyman has a superior, well-developed unique offering that is building momentum in the cinema market. The company has curated this over a long period of time. The UK industry (and somewhat US) has now hit an inflection point where smaller more intimate venues are on the rise and Everyman sees this opportunity as it is rolling out venues across the UK. There is one more coming in December with a further four (plus potentially an additional two) coming in 2023. That’s just the start with so many untapped regions (such as Kent) and a relatively small market share, the growth potential for Everyman over the coming years is huge.

Why now?

This is a matter of both market price and, strangely, sector tailwinds. Everyman’s current market price couldn’t be further detached from the operational progress of the business. If Everyman was trading above pre-Covid prices, it would be harder to reason for a high conviction buy. However the fact shares trade down 59% with the current financial performance. The market has got it wrong in my opinion, Everyman has been placed in the same basket as other chains when performance couldn’t be more different.

I continue to take up opportunities to buy more Everyman. This is because I believe once the market starts to take notice of the changing narrative in the cinema sector and Everyman’s operating performance, this share will be trading a lot higher.

Be the first to comment