bjdlzx

(Note: This article was in the newsletter on September 2, 2022, and has been updated as needed.)

Through the years, it has become apparent that good results come from superior management. But time and again investors underestimate the risks of inferior or risk-taking managements only to find the profits disappear before they get them. Crescent Energy (NYSE:CRGY) is run by a combination of two very well-known names in the oil and gas business (John Goff, Chairman and KKR). Yet that kind of reputation is evidently not as convincing as a reserve report (combined with a cash flow statement lacking in adequate cash flow) or an exciting, expensive, and risky offshore project by a company not equipped for such a project.

When investors invest in projects that are less than suboptimal or managements that are not top-notch and hard driving, the result is often as bad as one would expect. Yet one success that proves to be an exception is enough to lure investors into this strategy time and again for that one “home-run” to tell the family and grandchildren about forever.

A company like KKR (Kohlberg, Kravis, Roberts) does not get involved for a puny return like 30% (even if that sometimes happens) because it does not cover the risks they normally take. Big investors like them want to usually at least triple their money every five years. That is a 25% compounded rate of return.

Investors normally have an average long-term return of 8%. Many studies show that the return is mostly dividends (and it has been that way since I was in graduate school decades ago). Therefore, when a public opportunity to invest alongside some very accomplished professional investors appears, one would think that the market would at least consider the opportunity. If the interest in the articles on this company is any indication, the answer is a resounding no because there is no financial leverage and no giant reserve report (showing something crazy like $200 per share).

Now, sometimes these public companies have all the risk and leverage that KKR is well known for. Therefore, investor due diligence is an absolute and thorough requirement. But this time around, the two entities in control of the company have made clear that oil and gas is unusually cheap compared to historical values. They wanted to partner up in the current form to take advantage of some of those bargain deals.

The unusual aspect appears to be that many of the acquisitions done are done in a way to keep leverage low while providing a very fast payback “just in case”. Many of these entities used leverage back in the boom times of 2014 and before. But that strategy came to a crashing halt during 2015-2020 when many leveraged companies struggled and eventually failed.

New And Improved Strategy

Since a lot of people that had no business getting into oil and gas in the first place were burned badly trying to make a fast buck, that money appears to be gone “for good” for the time being. That allows for a far more rational recovery than was the case in the aborted 2018 recovery. Sooner or later that money will be back in time for more losses to bring about the next cyclical downturn. That has been a classical sign of a coming downturn for as long as I can remember.

In the meantime:

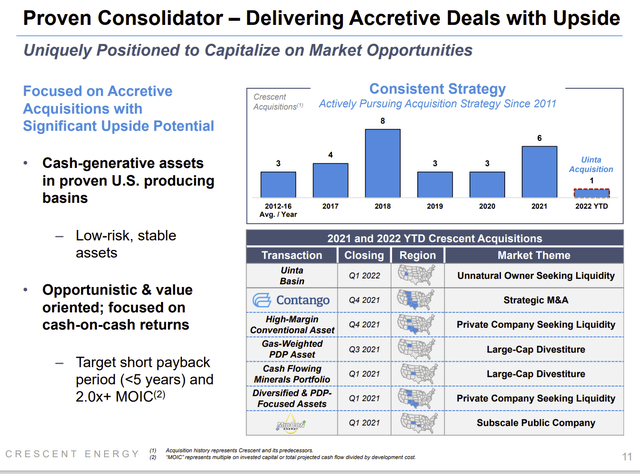

Crescent Energy Details Of Recent Deals (Crescent Energy Second Quarter 2022, Earnings Conference Call Slides)

Obviously, there were a fair amount of “stressed” deals when oil and natural gas prices were lower. Right now, there are a lot of deals on the market where the seller has unrealistic expectations about future prices to come up with a rosy selling price that is just not acceptable. The key is there are a lot of sellers in a suboptimal position (for many reasons) that want out, and there are not many buyers willing to do the work that makes these purchases profitable.

In cases like that, there are likely to be small acquisitions that may be viable because small holdings are not really marketable. Usually, only a big neighbor is interested (and just as usually they do not pay much either).

A couple of things reduce the risk of this strategy. First, the payback period mentioned above is short. Secondly, management has repeatedly stated that they intend to keep the leverage ratio at 1 or less. Last, this is unstated, but anyone following KKR knows they keep a watchful eye on cash flow at all times. KKR happens to love lots of cash flow (and growing cash flow at that). Nothing reduces financial risk when evaluating an investment like “lots of” and “growing” cash flow. Investors can just bet (as sure as tomorrow arrives) that KKR will fix any cash flow issues “yesterday”.

There is yet another feature here that has not really been stated but is available should there be an unexpected cyclical business downturn that “hangs on for a while”. That feature is the acquisition of oil properties in Utah and the Eagle Ford that have changed the oil percentage of production.

Those oil properties give the company the ability to focus upon oil drilling during times of weak commodity prices should the need occur. This market often expects that oil leases will do better than natural gas leases in a downturn (whether or not that turns out to be the case).

Needless to say, the flexibility to increase the natural gas production is also now available should that turn out to be the successful strategy. That was unlikely to be the case because the production purchased is considered relatively higher cost production. However, the current pricing environment combined with a management projection of the pricing outlook may change the thinking. Management can always hedge to assure a reasonable outcome before allowing the production to vary with market pricing.

Betting On Management

However, many investors, including institutional investors, do not bet unless there are tangible things to see like reserve reports and an operating history. Yet, the operating history of KKR in the industry is pretty well known and definitely at least reasonable. In my mind, it is far better than reasonable.

Good management often surprises to the upside. In this case, investors need to realize that this management often succeeds in meeting or exceeding its unstated goal of roughly tripling the investment value in 5 years. The financial and operating risks are unusually low in the current environment, in my opinion.

The main officers also have a significant amount of company stock. KKR and John Goff have long believed that stock should be the majority of the compensation. Building a company successfully then rewards those officers.

So, investors have the chance that is usually only available to large institutions, to invest alongside those institutions using some of the top management talent in the business.

The reason that is happened is the company is structured to allow sellers to delay paying taxes. So, when those sellers decide to convert their interests to the publicly traded shares, there needed to be a way for the seller to raise cash. As the company increases in size, this process will become less material.

There are also sellers who saw the benefit of combining their holdings with a larger entity for a better chance at long-term appreciation. Those larger holders of stock likely will not be selling any time soon.

My own strategy is to find the best management I can find and diversify my holdings by making a basket rather than loading up on one stock. This company fits my requirements. I intend to hold probably until KKR sells the company (it is known for doing that as well).

Be the first to comment