tang90246/iStock via Getty Images

It has been quite some time since I published my last article about DexCom (NASDAQ:DXCM) – about three years ago. Back then I was rather bearish about the stock and while I rated the stock as a “Sell”, DexCom gained about 115% in the meantime and clearly outperformed the S&P 500 (SPY), which gained about 30%.

Therefore, I must admit I was wrong about DexCom in the last three years and the market’s assessment of DexCom was completely different than my assessment as the stock increased more than 300% since my last article (before it lost more than half of its value again). I have been wrong about the stock performance in the last three years, but this does not mean I have to be wrong again in the next three years. In my opinion, DexCom remains in a bubble and bubbles can last for quite some time.

In the following article, I will acknowledge once again that DexCom is a great business and a company that can continue to grow with a high pace. However, the valuation is still not justified, and the stock remains a “Sell” in my opinion.

Growth Slowing Down

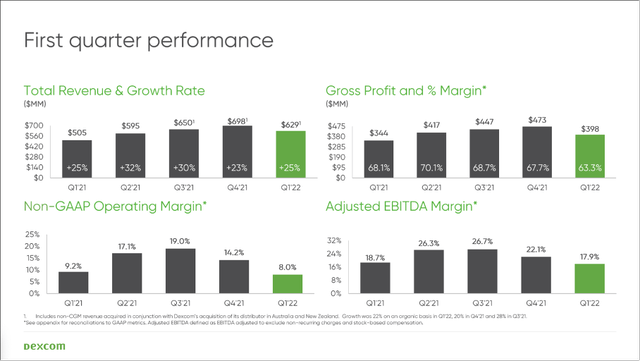

Let’s start by looking at the last quarterly results (first quarter of fiscal 2022). DexCom could increase revenue from $505 million in the same quarter last year to $628.8 million this quarter – resulting in 24.5% YoY growth (22% growth on an organic basis). While revenue was growing, operating income declined 10.0% from $45.9 million in Q1/21 to only $41.3 million in Q1/22. However, diluted net income per share increased from $0.56 in the same quarter last year to $0.93 this quarter – mostly due to $61.2 million income tax benefits, which led to a much higher net income. When looking at earnings per share, we must keep in mind the stock split (4:1 split) and the per share data reported several weeks again is not accurate anymore.

DexCom is still generating 72% of its revenue in the United States and 28% of revenue are from international operations (and while revenue in the United States increased only 18% YoY, international revenue increased 43% YoY).

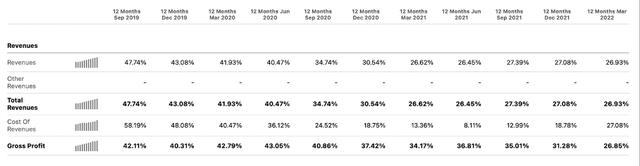

While DexCom is still reporting high growth rates for revenue (and for earnings per share), we can’t deny that growth rates for revenue were slowing down in the last few years and quarters.

DexCom: Quarterly revenue and gross profit (Seeking Alpha)

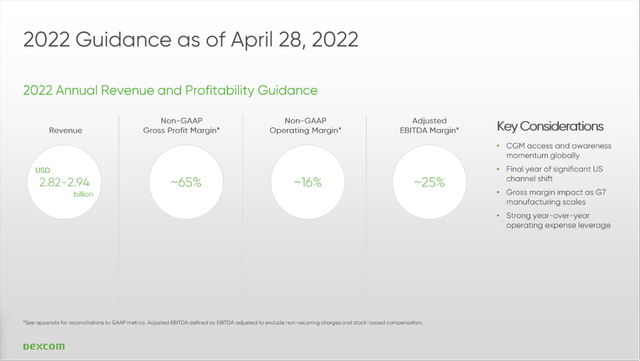

And when looking at the company’s guidance for fiscal 2022 we still see growth rates many other businesses ever won’t achieve. However, we can also see growth slowing down further. When taking the midpoint of revenue guidance ($2.88 billion), top line will grow about 17.5% and that is clearly lower than in the previous quarters.

Market Growing

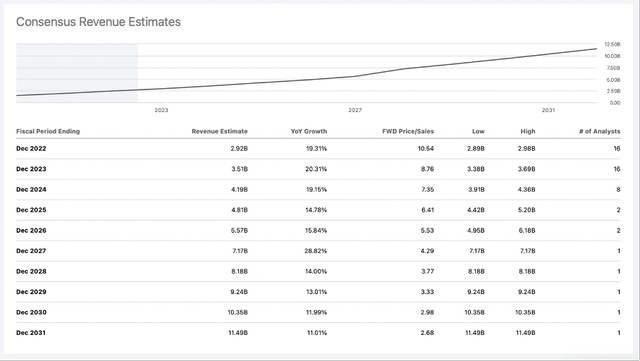

And while growth is slowing down, we should not fail to appreciate the still extremely high growth rates DexCom is reporting. In the last few quarters, DexCom was clearly growing above 20%. But rather important are the growth rates in the next few years. And different studies are estimating the CGM (continuous glucose monitoring) market to grow with a high pace till the end of the current decade. A study by Grand View Research is estimating a CAGR of 10.1% till 2028 and Fortune Business Insights is estimating the same CAGR till 2029. And when assuming these estimates are correct one must ask how analysts are estimating DexCom to grow its revenue with a CAGR of 16.71% for the next ten years (until fiscal 2031).

DexCom: Consensus Revenue Estimates (Seeking Alpha)

I am not saying these growth rates are not achievable, but DexCom must take market shares from its two main competitors – Medtronic (MDT) and Abbott Laboratories (ABT) – in that scenario and considering the increasing competition from these two companies it might be difficult.

Competition

Abbott Laboratories for example is a serious competitor for DexCom. Not only are the company’s FreeStyle Libre sales growing with a fast pace – 37% growth in fiscal 2021 and 26% growth in the first quarter of fiscal 2022 – but it generated about $3.7 billion sales in fiscal 2021 and was ahead of DexCom (which generated only about $2.45 billion in sales). And like DexCom is developing its CGM further, Abbott Laboratories is also improving its FreeStyle Libre – for example by being able to measure ketone levels as well.

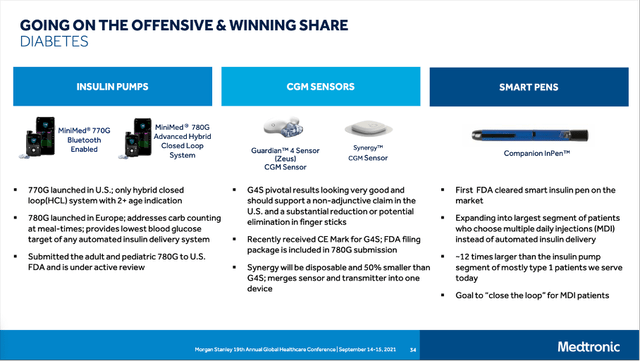

The second competitor is Medtronic and in comparison to Abbott Laboratories and DexCom, the company is also offering insulin pumps and the company’s goal is to connect its insulin pump MiniMed 780G Advanced Hybrid Closed Loop System with the CGM to a “closed loop system” which should be able to anticipate insulin needs and be able to adjust and automatically correct the entire time. I don’t think the closed loop system will be able to copy the human pancreas – in my opinion this is almost impossible to achieve – but Medtronic might come closer and have an edge over DexCom.

Medtronic Morgan Stanley 19th Annual Global Healthcare Conference

CGM Really Necessary?

And aside from the market probably not growing as fast as analysts are estimating for DexCom and competitors making it harder to gain market share, there might be another problem I already addressed in my previous article: Analysts might just be too optimistic about the number of people using CGM systems in the years to come. The number of people using CGM systems will be limited at least by two factors. First, CGM systems are rather expensive and if DexCom wants to continue growing with a high pace it must also address low-to-mid income countries (and population classes). However, these people might not be able to afford the expensive DexCom system and rather buy Abbott Laboratories’ product (if they buy any CGM system at all). Second, while the number of diabetics worldwide is gigantic, most of them are type 2 diabetics and they don’t need a CGM system in most cases. And if they might purchase a CGM system they might have to pay for themselves and probably choose the FreeStyle Libre as it is more affordable.

In my last article I wrote:

Of course, it is absolutely unrealistic to assume every diabetic is a potential customer. We have to differentiate between type 1 diabetics and type 2 diabetics and while type 2 diabetics might use a CGM system, the main target group are type 1 diabetics which make up about 5% of the total number. Additionally, many diabetics live in countries that can’t afford to spend $3,000-4,000 “just” to measure the blood sugar level. For these people, insulin or maybe an insulin pump is far more important. And finally, to buy and use DexCom’s system you must care about your disease and really be motivated to control it – and although insurance companies might pay, not every diabetic might care enough to spend money on a CGM system.

And when considering these aspects, it seems likely that DexCom must lower prices to continue growing and stay competitive with Abbott Laboratories. We also should not be surprised if the market for CGM systems is rather small as most type 2 diabetics might never use it.

Recession

Another issue we need to consider and discuss is the potential upcoming recession. Healthcare companies (and medical device companies like Dexcom) can be seen as rather recession-proof and we can assume that the company won’t be affected by a recession and won’t see declining revenue. However, growth rates could slow down during a recession – especially for a high-growth company.

When analyzing other companies, I often looked at the performance during past recessions and while we have data from the Great Financial Crisis, we can only state that DexCom obviously wasn’t affected at all (revenue never declined). This is not surprising when considering that DexCom was a very young company back then and it was much easier to grow.

In an upcoming recession, I would assume that growth rates will slow down, but I don’t expect to see declining revenue for DexCom in the next few years. Earnings per share and free cash flow however might turn negative again as it might be more difficult to be profitable during a recession as DexCom was hardly profitable in the last decade.

Acquisition and Margins

We must be cautious if DexCom can really grow its top line with such a high pace. However, we are rather focused on the bottom line (earnings per share) and especially free cash flow. And DexCom can improve the bottom line not just by growing revenue, but also by reducing the number of outstanding shares (rather unlikely) as well as improving margins (which seems like a realistic possibility).

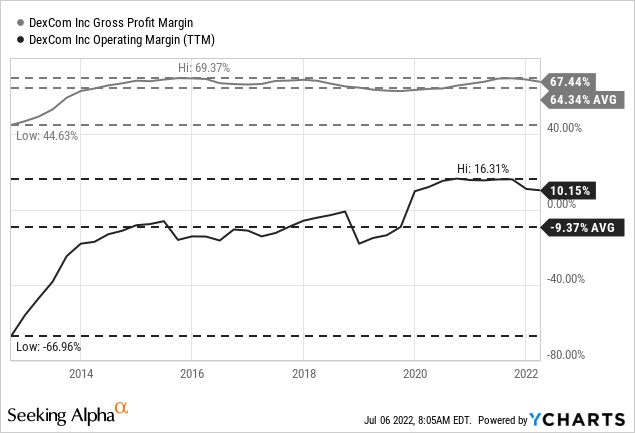

While the gross margin was rather stable in the last few years and fluctuating between 65% and 70%, the operating margin improved over time and since 2019 DexCom is able to generate a positive operating income. Right now, DexCom has an operating margin around 10%. However, when looking at competitors Abbott Laboratories and Medtronic, it seems possible for DexCom to reach an operating margin of 20% like those two companies.

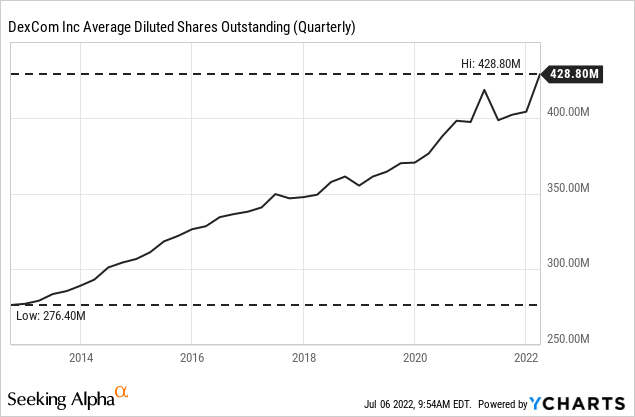

And when looking at the balance sheet, there seems to be another way for DexCom to grow in the years to come. I mentioned the possibility of share buybacks, but that seems rather unlikely for two different reasons. First, the company increased the number of outstanding shares in the past (55% in the last ten years) and second, considering $1,966 million in long-term senior convertible notes, we should not be optimistic about the number of outstanding shares declining.

However, when looking at the balance sheet we can also see $716 million in cash and cash equivalents as well as short-term marketable securities of $1,972 million (on March 31, 2022). Out of $5,057 million in total assets, DexCom has 53% of total assets as extremely liquid assets. And DexCom certainly can grow by using this cash or short-term marketable securities for acquisitions that might contribute to growth in the years to come.

Intrinsic Value Calculation

So far we discussed several aspects that are positive for DexCom as well as many negative aspects that should make us question if DexCom can continue to grow with an extremely high pace for several years to come.

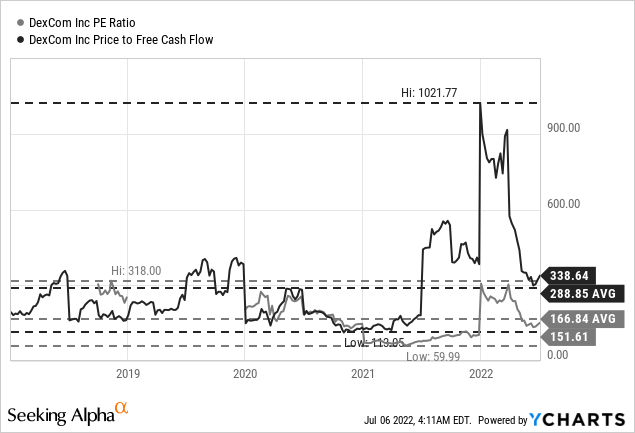

The biggest remaining problem for DexCom is the valuation, which can’t be justified in my opinion. Right now, DexCom is trading for 151 times earnings and for 339 times free cash flow. And we certainly can have many different opinions what valuation multiples are justified for a business, but triple digit valuation multiples are very seldom justified for any company.

When arguing that the current earnings per share are not reflective of the business, we can use the highest EPS DexCom ever reported ($1.39). However, that would still lead to a valuation multiple of 56 and when taking the highest free cash flow ever (which was $277 million), it would still lead to a P/FCF ratio of 110.

I think we can already conclude that DexCom is still overvalued, but to take into account the growth potential we should also calculate an intrinsic value by using a discount cash flow calculation. And even when taking the free cash flow of $277 million as basis and assume my usual 6% growth till perpetuity, DexCom must grow more than 25% annually for the next ten years to be fairly valued right now (assuming 10% discount rate and 389 million outstanding shares). And assuming 25% growth for the next 10 years is too optimistic in my opinion and therefore the current stock price can’t be justified. Even when assuming improving margins and DexCom not diluting its share count in the years to come, I think these growth rates are unrealistic.

Of course, one can argue that DexCom might be able to grow with a higher pace than 6% in ten years from now. And while that might be true, I never use a higher growth rate till perpetuity as we never know what might happen in 10 or 20 years from now and 6% growth is quite high already (and only justified for companies with a wide economic moat).

Conclusion

Although growth rates will slow down for DexCom in the years to come, I remain confident that the company can grow with a rather high pace (growth rates in the teens) for several more years. But we must keep in mind that increasing competition and the potential recession will slow down growth rates over time and we should not get carried away by unrealistic high growth assumptions for years or decades to come.

And even if DexCom should be able to grow with the high pace analysts are estimating, the stock is still overvalued and remains a “Sell” in my opinion. I would however be rather cautious about shorting the stock as we never know what might happen and where sentiment is pushing the market.

Be the first to comment