Black_Kira/iStock via Getty Images

Background and Rating

QuantumScape (NYSE:QS) has seen a 20% bump in share price since my last article on QuantumScape regarding its deal with Fluence Energy (FLNC). This will help ramp up QuantumScape’s milestone timeline and hopefully lead them to commercialization in the coming years. In general for many investors, paying over six billion for a company that won’t have any revenue until 2024 seems like a poor investment. QuantumScape benefits from the transition of legacy energy sources such as oil fuels, to more green solutions such as lithium-metal batteries and the proliferation of solar and turbines.

Fundamental Technological Advantages

Due to the sheer size of the market cap and money invested QuantumScape has been able to ramp up its facilities and fund its Giga factory. However much of this wouldn’t have been possible without the funding and approval of Volkswagen (OTCPK:VWAGY). Recently Volkswagen announced a new partnership with QuantumScape to help power the new Porsche 911. As Volkswagen continued to tie themselves to QuantumScape the success of the two will soon be wrapped up together. This will lead to more institutions toward the stock long term.

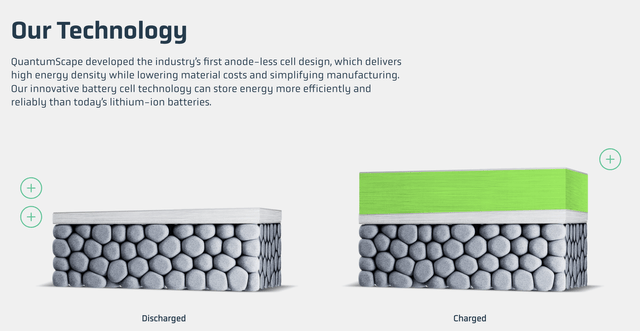

QuantumScape.com

One of the critical parts of QuantumScape’s technology is its anode-less lithium metal battery. QuantumScape’s essential competitive advantage is that its battery utilizes fewer raw materials than competitors. There are battery conglomerates such as Solid Power (SLDP) and SES AI (SES) with impressive battery technology, but the problem arises with commercializing this technology. I believe that QuantumScape is in a similar position as Tesla (TSLA) in 2019. Money is flooding into the space yet share price appreciation hasn’t taken hold of the stock. QuantumScape will soon show analysts, when production comes online in 2024, the power of their batteries.

QuantumScape.com

There are various factors and reasons that QuantumScape outperforms its competitors. Firstly the company has faster charging times than all the other battery makers, including large EV giants like Lucid Motors (LCID) and Rivian (RIVN). QuantumScape is also a lithium-metal only battery company, whereas Lucid Motors and Rivian are strictly Lithium-Ion Wall Street has yet to see this phenomenon, and there are lithium-ion batteries companies valued very similarly to lithium metal competitors. These batteries will be used in electric vehicles and consumer electronics because they are simply more efficient than lithium-ion batteries. As Biden makes more Cold War-era precedent executive moves to strengthen the battery industry, analysts will see the significant disconnect in these valuations.

Increased Production Possibilities Due to Superior Energy Density

One of the critical parts of QuantumScape’s success has been its commitment to making a dense battery that also doesn’t consume more raw materials than it needs to. These batteries save supply chains billions of dollars in material and logistics costs. This will help usher in further commercialization of the batteries themselves and electric vehicles because the battery portion has already been contracted out to a third party. That is the future of these OEM contacts, and I genuinely believe that QuantumScape is in a great position to benefit from these tailwinds.

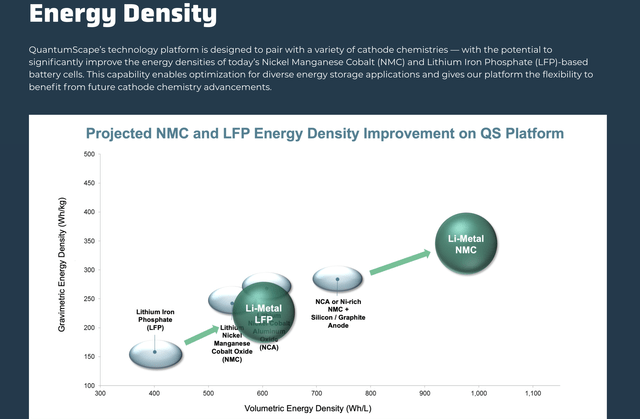

QuantumScape.com

The energy density is one of the essential parts of the battery. QuantumScape found a way to incorporate manganese Cobalt oxides instead of iron phosphate in their lithium metal. the difference between Li Metal LFP and Li Metal NMC is roughly 400 Wh/L difference in volumetric energy. While this may not seem significant, this is an over 50% increase in density between the two battery chemistry types. QuantumScape’s innovations have led the company to cement itself as the clear leader in the battery space. Many competitors have come along trying to replace QuantumScape’s batteries. QuantumScape’s battery has been third-party tested, and it’s clear they have innovative technology that can disrupt the EV industry. Other larger competitors haven’t had intense third-party testing like the small independent lithium metal battery makers.

QuantumScape.com

The years and amount of R&D committed rival extensive technology institutions. Ford (F) and Toyota (TM) have invested a similar amount of money in R&D and have also spent a year of R&D on this project. I believe QuantumScape has the advantage because of its time spent developing lithium-ion batteries and other lithium metal technologies. The patent applications for commercialization will be a massive benefit for the company. QuantumScape’s goal is to fulfill its agreements with Porsche (OTCPK:POAHY) for the new Porsche 911.

Risks are Apparent However, the Benefits Outweigh the Negatives

The risks are clear as QuantumScape is a six billion dollar electric vehicle battery company with no revenue. However, the company has significant commercialization and party agreements with Volkswagen. There is still money to be made in this space, considering the sheer size of the European conglomerate. It also should show investors that they are better than Volkswagen battery teams, and that’s why they decided to make such a significant investment into QuantumScape. In sector terms, QuantumScape continues to underperform price-wise but outperforms business development-wise.

Valuation Needs to be Re-rated at These Levels

While valuation is always a concern with a battery company with no revenue, QuantumScape continues to get signed contracts with OEMs. The newest contract with Porsche to power the new electric 911 is just the newest OEM partner for QuantumScape. Due to Volkswagen being the parent company of various brands, QuantumScape has room to create batteries for different vehicles. With cells performing well under his rounds of cycling tests, Porsche looks well-positioned to have successful commercialization of the first lithium-metal battery EV.

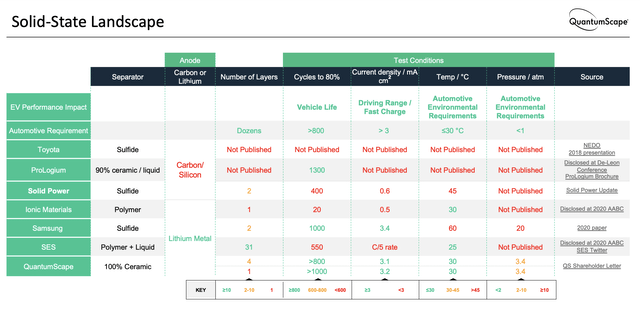

Source: (QuantumScape.com)

There are many competitors to QuantumScape; however, none have shown the dedication to scaling that QuantumScape has. An even smaller number of these companies are doing lithium metal, and an even smaller number are below the automotive requirements. This is just one statistic in which QuantumScape showed its crucial advantage over other players within the battery space.

Conclusion and Rating

QuantumScape has many unique factors that differentiate the company from its competition. The advantage it has over competitors technologically will support shares in the future. With the current depreciation of shares and the major milestone completions, QuantumScape is fundamentally improving. Even though these will not be seen with the company’s financials, it should be clear to the somewhat technologically savvy investor. I keep my Strong Buy rating and will continue to cover QuantumScape moving forward.

Be the first to comment