FreezeFrameStudio/iStock via Getty Images

This was originally published for subscribers of Reading The Markets on the morning of July 9.

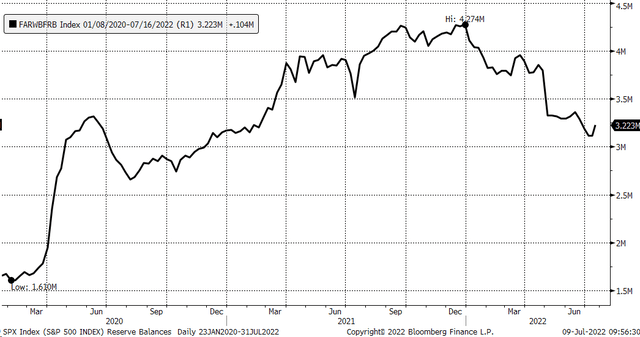

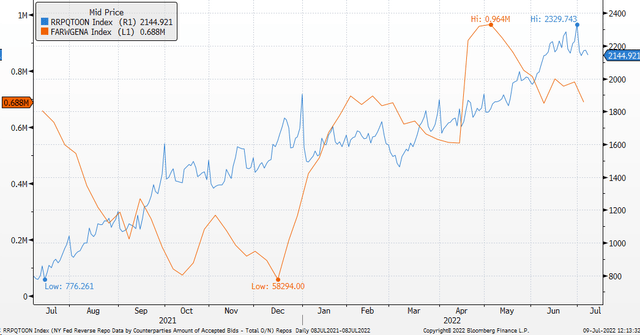

Reserve balances have been playing an essential role in the S&P 500 (SP500) and the broader equity market. Changes in reserve balances appear to have impacts on the changes in the S&P 500 over time. However, there seems to be a lag of about 15 to 20 days, meaning changes in reserve balances are reflected in the S&P 500 about 15 to 20 days later. It makes watching the reserve balances crucial in helping assess the market’s direction.

While reserve balances do not tell us how much the market is likely to rise or fall, they can give us a sense of direction and potential range. More recently, when reserve balances have hit new highs, stock prices have new highs, and when reserve balances have hit new lows, stock prices have hit new lows.

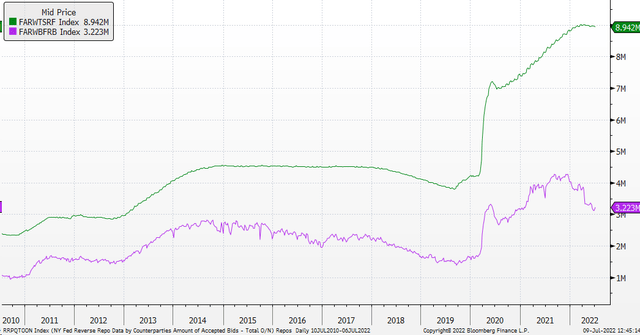

For the week ending July 8, reserve balances rose to $3.223 trillion from $3.119 trillion.

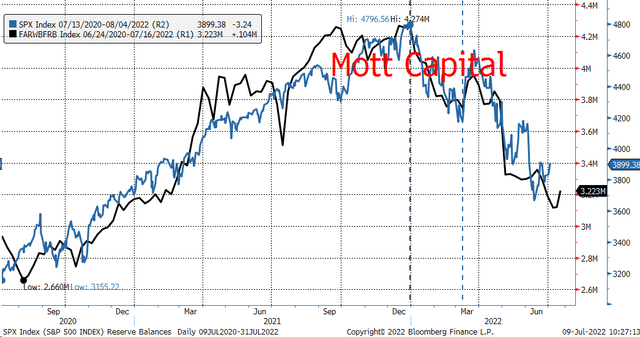

When overlaying the S&P 500 chart with the reserve balances, we can see how nicely the direction of the S&P 500 relates to changes in reserve balances over the past two years.

At this point, we can see in the chart that reserve balances suggest another decline in the S&P 500 over the next two weeks is coming. That data indicates the index could retrace too or make a new closing low during those two weeks. After that decline, there should be another decent rally. Whether that rally turns into something longer-lasting at this point is early to tell.

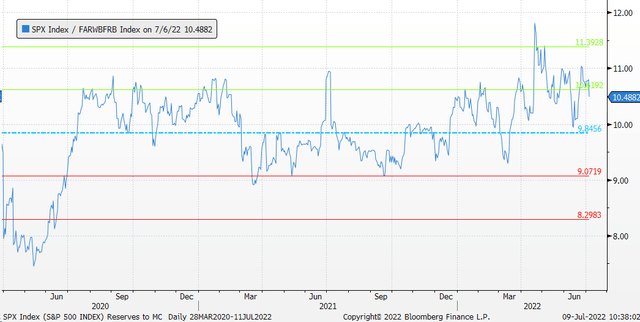

The Ratio

Since the Fed started QE in March 2020, the market cap of the S&P 500 has traded for around 9.8 times the size of reserve balances. The tradable range has been between 9 and 10.5 times the size of the balances.

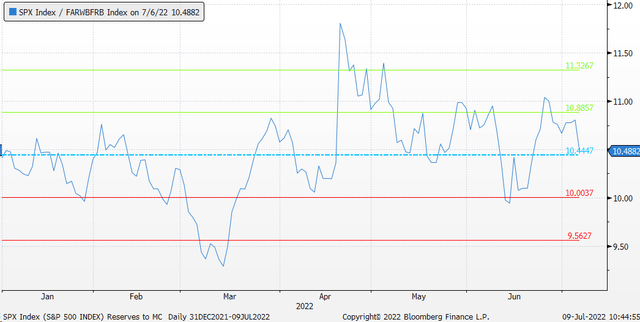

Since December and the unwind of QE, that range shifted slightly higher to around 10.4. This is where the current ratio stands. Except for March, the lower end of the range has been about 10. A decline in the reserve balances to $3.1 trillion, using an average of 10.4, could reduce the market cap of the S&P 500 to around $32.5 trillion from its current value on July 9 of $34.3 trillion, or 5.2%. That would bring the S&P 500 to approximately 3,680. A decline to the lower end of the range of 10.0 would bring the S&P 500 market cap down to $31.19 trillion, or about 9%. That would take the S&P 500 to around 3,535.

Of course, the further the S&P 500 falls during the next two weeks, the bigger the rebound. Remember that this week’s data shows us that reserve balances increased, which suggests that a sharp rebound will follow any decline in the S&P 500 because of that 15- to 20-day lag.

The Biggest Impact On This Week’s Changes

The most significant daily change we can watch to help determine the potential path of reserve balances is the daily reverse repurchase agreements. Reverse repos declined over the past weeks. There had been a big push in the overnight repos heading into the second quarter-end, and now that quarter-end has passed, overnight repo totals have declined. This decline in repos over the past week helped push reserve balances higher.

Meanwhile, the Treasury General Account also fell this past week, which helped to put more reserves on the bank’s balance sheets.

These are the two most significant contributors at this point to changes in reserve balances. But reverse repos are the only piece of the equation we can track throughout the week on a daily basis.

What About QT?

Quantitative tightening did have a modest impact on the overall balance sheet this week, but it was only $20 billion, which is too small to see any real effect. It is just too early to judge how QT will be felt in the market over time, but as total assets held by banks begins to fall due to QT, one would expect reserve balances to fall, which is what happened during the prior cycle.

For now, watching the daily repo activity to monitor a day-by-day account for how reserve balances may change and the potential impacts it may have on the equity market in time.

Be the first to comment