miromiro/iStock Editorial via Getty Images

Earnings of Bankwell Financial Group, Inc. (NASDAQ:BWFG) will most likely continue to trend upwards thanks to heightened loan growth. Robust pipelines, digital innovation, and a strong regional economy will likely drive loan growth. Meanwhile, the margin will likely remain stable during the last three quarters of 2022 as the balance sheet is slightly liability sensitive. Further, the provisioning will likely remain at a normal level. Overall, I’m expecting Bankwell Financial to report earnings of $4.07 per share for 2022, up 21% year-over-year. The year-end target price suggests a high upside from the current market price. Therefore, I’m adopting a buy rating on Bankwell Financial Group.

Internal and External Factors to Maintain the Loan Growth Momentum

Like 2021, loan growth remained remarkably strong during the first quarter of 2022. The portfolio surged by 4.8% during the quarter, or 19.1% annualized. The management mentioned in the earnings release that the loan pipeline at the end of the quarter remained as vibrant as it had been for the last several quarters. Therefore, loan growth will most probably remain robust through the mid of 2022.

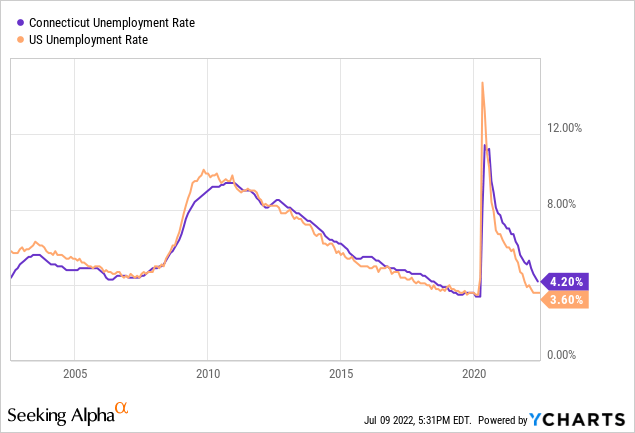

Further, Bankwell Financial has invested in a new online banking platform during the second half of 2021, which should bear fruit this year. Further, the robust job market in Bankwell Financial Group’s operating regions bodes well for loan growth. The company operates in the state of Connecticut, where the unemployment rate is worse than the national average but still very good from a historical perspective. As shown below, the unemployment rate is near multi-decade lows.

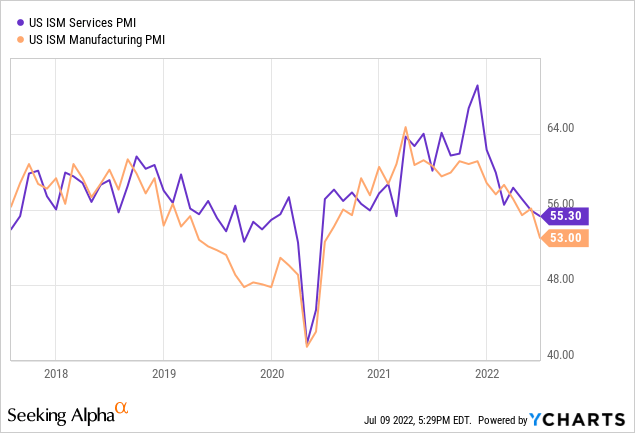

Around 90% of the total loan portfolio is made up of commercial and industrial loans (“C&I”) and commercial real estate loans (“CRE”). Therefore, the purchasing managers’ index is also a good gauge of loan demand. As shown below, the PMI index has continued to remain comfortably in the expansionary territory (above 50), which bodes well for loan growth.

However, loan growth will most probably decelerate in the latter part of 2022 because heightened interest rates will take a toll on credit demand. Overall, I’m expecting the loan portfolio to increase by 14.5% by the end of 2022 from the end of 2021.

Further, I’m expecting deposit growth to match loan growth in the last three quarters of 2022. Meanwhile, securities growth will lag loan growth in the last three quarters because the growth in deposits and borrowings will mostly go towards funding the heightened loan growth. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | |

| Financial Position | |||||

| Net Loans | 1,587 | 1,589 | 1,602 | 1,875 | 2,147 |

| Growth of Net Loans | 4.3% | 0.1% | 0.8% | 17.1% | 14.5% |

| Other Earning Assets | 119 | 101 | 111 | 161 | 144 |

| Deposits | 1,502 | 1,492 | 1,827 | 2,124 | 2,367 |

| Borrowings and Sub-Debt | 185 | 175 | 200 | 84 | 90 |

| Common equity | 174 | 182 | 177 | 202 | 229 |

| Book Value Per Share ($) | 22.4 | 23.4 | 22.8 | 26.0 | 29.7 |

| Tangible BVPS ($) | 22.1 | 23.1 | 22.5 | 25.7 | 29.3 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Loan Growth to Counter Liability Sensitivity

Bankwell Financial Group’s balance sheet is liability-sensitive as more liabilities than assets are subject to repricing this year. Interest-bearing-transactional deposits, namely negotiated order of withdrawal (“NOW”), money market, and saving accounts made up a hefty 60% of total deposits at the end of March 2022. These deposits will re-price soon after every rate hike. The management’s interest-rate sensitivity analysis given in the 10-Q filing shows that a 200-basis point increase in interest rates can REDUCE the net interest income by 3.0% over twelve months.

On the plus side, strong loan growth will likely drive margin expansion. The management mentioned in the earnings presentation that it was originating loans at higher yields than the existing portfolio’s average yield. The yield on new loans will continue to improve in the year ahead as rates rise. Therefore, the loan additions will lift the margin. Moreover, loan growth will likely crowd out the growth of lower-yielding assets. This improvement in the asset mix will also boost the margin.

Overall, I’m expecting the net interest margin to remain unchanged in the last three quarters of 2022 from 3.30% in the first quarter of the year. Combining the loan growth and margin estimates, I’m expecting the net interest income to grow by 20% year-over-year in 2022. The management mentioned in the earnings release that it is targeting net interest income growth of 12% to 14%. In my opinion, the management can easily beat this target thanks to the loan growth.

Provision Normalization Likely

I’m not expecting the threats of a recession or heightened interest rates to boost Bankwell Financial Group’s provision expense in the near term. Bankwell is not subject to the Current Expected Credit Losses (“CECL”) accounting standard. The bank calculates its allowance level in accordance with the incurred loss model. As a result, I believe Bankwell Financial will not have to bolster its reserves ahead of a possible recession, unlike other banks. Moreover, the interest rate outlook will not require additional provisioning until rates start affecting credit performance, which I believe will not happen until the last quarter of 2022.

On the other hand, provisioning will likely increase for the existing portfolio and new loan additions. This is because the current allowance level just barely covers the portfolio’s credit risk. Nonperforming loans made up 0.79% of total loans at the end of March 2022, as mentioned in the earnings presentation. In comparison, allowances made up 0.86% of total loans. As the coverage is a bit tight, I believe Bankwell Financial will have to build its reserves to get to a more comfortable level.

Overall, I’m expecting the provision expense to be at a normal level this year. I’m expecting the net provision expense to make up 0.12% of total loans in 2022. In comparison, the net provision expense averaged 0.11% of total loans from 2017 to 2019.

Earnings Set to Grow by 21%

The anticipated loan growth will likely be the chief driver of an increase in earnings this year. On the other hand, provision normalization will likely limit earnings growth. Meanwhile, the margin will likely remain mostly stable for the remainder of the year. Overall, I’m expecting Bankwell Financial to report earnings of $4.07 per share for 2022, up 21% year-over-year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | |||||

| Income Statement | |||||||||

| Net interest income | 56 | 54 | 55 | 68 | 82 | ||||

| Provision for loan losses | 3 | 0 | 8 | (0) | 2 | ||||

| Non-interest income | 4 | 5 | 3 | 6 | 4 | ||||

| Non-interest expense | 36 | 36 | 43 | 40 | 43 | ||||

| Net income – Common Sh. | 17 | 18 | 6 | 26 | 31 | ||||

| EPS – Diluted ($) | 2.21 | 2.31 | 0.75 | 3.36 | 4.07 | ||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a recession can increase the provisioning for loan losses beyond my expectation.

Adopting a Buy Rating Due to a High Total Expected Return

Bankwell Financial is offering a dividend yield of 2.5% at the current quarterly dividend rate of $0.20 per share. The current dividend and earnings estimate suggest a payout ratio of 19.6% for 2022, which is in line with the average of 20% from 2017 to 2019. Further, Bankwell Financial usually increases its dividend only once per year. Therefore, another dividend hike is out of the question for this year.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Bankwell Financial. The stock has traded at an average P/TB ratio of 1.14x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 22.1 | 23.1 | 22.5 | 25.7 | ||

| Average Market Price ($) | 31.5 | 28.6 | 18.2 | 27.8 | ||

| Historical P/TB | 1.43x | 1.24x | 0.81x | 1.08x | 1.14x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $29.3 gives a target price of $33.4 for the end of 2022. This price target implies a 6.1% upside from the July 8 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.94x | 1.04x | 1.14x | 1.24x | 1.34x |

| TBVPS – Dec 2022 ($) | 29.3 | 29.3 | 29.3 | 29.3 | 29.3 |

| Target Price ($) | 27.6 | 30.5 | 33.4 | 36.3 | 39.3 |

| Market Price ($) | 31.5 | 31.5 | 31.5 | 31.5 | 31.5 |

| Upside/(Downside) | (12.6)% | (3.3)% | 6.1% | 15.4% | 24.7% |

| Source: Author’s Estimates |

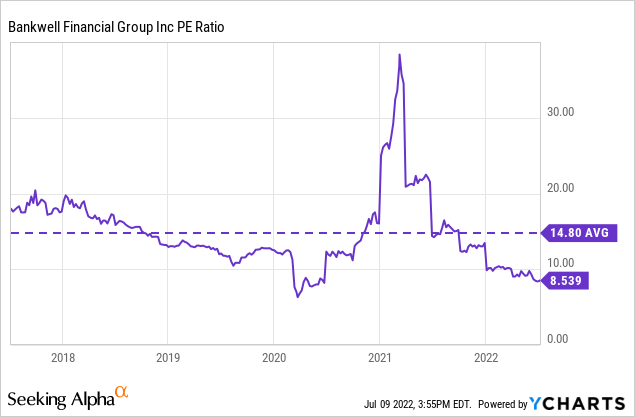

As can be seen below, the historical P/E multiple has some anomalies.

Excluding these outliers, Bankwell Financial has traded at an average P/E multiple of 11.6x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | T. Average | ||

| Earnings per Share ($) | 2.21 | 2.31 | 0.75 | 3.36 | ||

| Average Market Price ($) | 31.5 | 28.6 | 18.2 | 27.8 | ||

| Historical P/E | 14.2x | 12.4x | 24.2x | 8.3x | 11.6x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the trimmed average P/E multiple with the forecast earnings per share of $4.07 gives a target price of $47.4 for the end of 2022. This price target implies a 50.3% upside from the July 8 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.6x | 10.6x | 11.6x | 12.6x | 13.6x |

| EPS 2022 ($) | 4.07 | 4.07 | 4.07 | 4.07 | 4.07 |

| Target Price ($) | 39.2 | 43.3 | 47.4 | 51.4 | 55.5 |

| Market Price ($) | 31.5 | 31.5 | 31.5 | 31.5 | 31.5 |

| Upside/(Downside) | 24.4% | 37.4% | 50.3% | 63.2% | 76.1% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $40.4, which implies a 28.2% upside from the current market price. Adding the forward dividend yield gives a total expected return of 30.7%. Hence, I’m adopting a buy rating on Bankwell Financial Group.

Be the first to comment