Alistair Berg/DigitalVision via Getty Images

Thesis

Delaware Investments Dividend and Income Fund (NYSE:DDF) is a closed end fund that contains a mix of dividend generating equities and fixed income securities. The fund has a high level of current income as its primary objective and sports a 7.54% current dividend yield. As per its annual report “The Fund seeks to achieve its objectives by investing, under normal circumstances, at least 65% of its total assets in income-generating equity securities. Which may include up to 25% in real estate investment trusts (REITs) and real estate industry operating companies including dividend-paying common stocks, convertible securities, preferred stocks, and other equity-related securities“. The fund is thus a hybrid CEF that contains a mix of equities and fixed income that are leveraged up to generate income.

On a long term basis, the fund has performed well, with the 5- and 10-year trailing total returns sitting at 9.49% and 11.31%, respectively. DDF’s management navigated very poorly the Covid pandemic shock, with the fund experiencing a massive -40% drawdown and never quite recovering in performance. The Covid pandemic has caused the fund’s 3-year trailing total returns to be a mere 0.33%.

The fund usually trades at a discount to net asset value but is currently trading flat to NAV. As the yield curve rises we feel that funds such as DDF which have dividend yielding equities and fixed income in their portfolio will be under pressure (DDF also does not have a notable allocation to energy which has outperformed this year). There will be further pressure on DDF as the fund reverts to a discount to NAV. The predicted price weakness in the fund will be offset by its dividend yield in 2022, hence we rate it a Hold.

Analytics

AUM: $80mm

Sharpe Ratio: 0.46 (5-year)

Standard Deviation: 17.33 (5-year)

Beta: 1.7

Discount to NAV: -0.85%

Leverage Ratio: 27%

Yield: 7.54%

Holdings

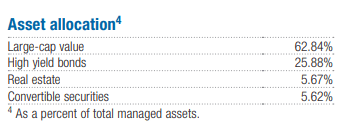

The fund contains a mix of dividend generating securities and high yield bonds:

Asset Allocation (Fund Fact Sheet)

On the large capitalization stock portfolio the top common stocks held by the fund are:

Top Equity Holdings (Fun)

As from its website for example Broadcom is “an American designer, developer, manufacturer and global supplier of a wide range of semiconductor and infrastructure software products. Broadcom’s product offerings serve the data center, networking, software, broadband, wireless, and storage and industrial markets“. The stock has a 2.74% dividend yield.

All top holdings have yields in the 2%-3% range and they represent large capitalization stocks. None of the top stocks have outsized dividend yields.

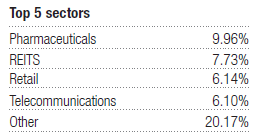

Pharmaceuticals and REITS are the top sectors in this portfolio:

Top 5 Sectors (Fund)

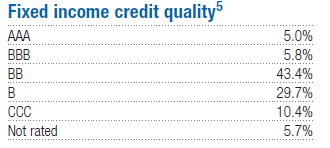

On the high yield side that composes approximately 25% of the portfolio the allocation is on the conservative side, with the fund being overweight BB names:

Fixed Income Rating Matrix (Fund Fact Sheet)

As one goes down the rating spectrum the default risk increases, but the fund is concentrated in BB names with a healthy allocation to single-B credits as well and a fairly small CCC bucket.

Performance

On a year-to-date basis the fund is down more than the S&P 500 due to its duration profile (dividend yielding securities tend to lose value when the yield curve moves up):

YTD Price Return (Seeking Alpha)

On a 5-year basis the fund has severely underperformed the S&P 500 mainly due to the value destruction that occurred during the Covid pandemic:

5-Year Total Return (Seeking Alpha)

Given the fund has almost 30% leverage the move down in asset prices during Covid was magnified and we are guessing that the management team’s actions in unwinding certain positions at the lows resulted in the value destruction we can observe in the subsequent performance.

On a long term basis (10-year timeframe) the fund is indeed a buy-and-hold vehicle that actually had outperformed the S&P 500 before the Covid pandemic:

10-Year Total Return (Seeking Alpha)

A retail investor needs to understand that leverage is the specific aspect that differentiates a CEF from other products and the management team actions and usage of leverage makes a significant difference in alpha generation or value destruction. Losses were magnified during the Covid pandemic and it looks like the actions taken then around portfolio composition have resulted in a significant lag in performance since.

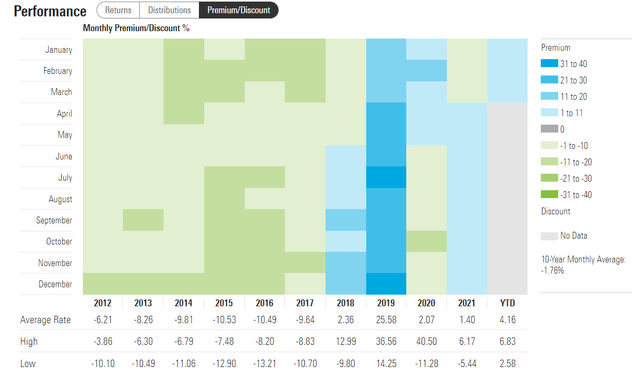

Discount/Premium to NAV

The fund has historically traded at a substantial discount to NAV:

We can observe how up to 2018 the average discount rate was around -10% to NAV for the fund. The fund moved to a premium in 2019 and again in 2021 on the back of the zero rates environment triggered by the Fed actions. Currently the fund is fairly flat to its net asset value and we would expect a reversion to historic norms as rates go higher.

Distributions

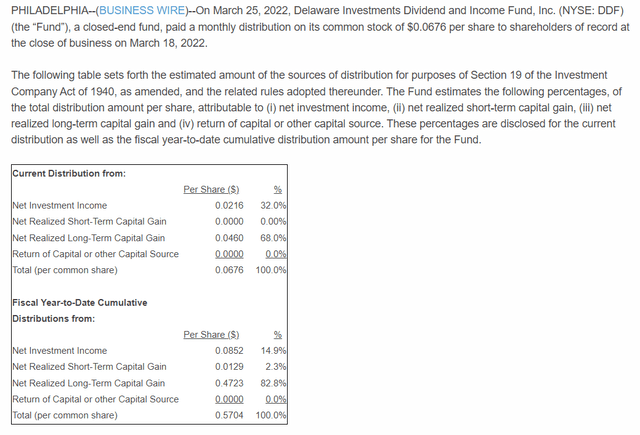

The fund has a well covered distribution yield:

We can see from the latest 19.a filing that the fund does not overdistribute but covers its dividend yield from the fund’s investment income and the long term capital gains realized on the equities portfolio.

Conclusion

DDF is a hybrid CEF that contains a mix of equities and high yield bonds. The fund has a fairly small AUM at $80mm but its market bid/ask spread do not portray any liquidity issues. DDF has a well covered 7.54% dividend yield but has not yet reverted to a substantial discount to NAV as historically observed for the name. We expect a reversion to historic norms where the fund will trade again at a discount to net asset value. The fund’s portfolio will be under pressure as the Fed raises rates, weakness which will be offset by the fund’s dividend yield. We thus rate DDF as a Hold.

Be the first to comment