Lari Bat/iStock via Getty Images

DBD Backtracks To Moderation

Diebold Nixdorf (NYSE:DBD) has changed its stance and has become more defensive compared to a quarter ago. It has revised down its FY2022 revenue guidance due to the Russia-Ukraine conflict, unfavorable foreign exchange movement, and supply chain disruptions. It now focuses on simplifying its business model by streamlining its operations and digitizing processes, which would result in significant cost savings over the next 12 to 18 months.

The continued flow of deals in supplying the DN Series machines and EV charging facilities can boost its operating margin in the medium to long term. Plus, it will continue to increase the production of ATMs and double self-checkout in the near term. The balance remains at risk due to the negative shareholders’ equity, while cash flows can weaken further. Although the stock is marginally undervalued versus its peers, investors might want to avoid or sell the stock, especially when the US equity market is in a bear phase.

Strategic Importance: Operational Streamlining And EV Charging Business

DBD plans to simplify its model by streamlining its operations and digitizing processes, which will drive efficiencies. It will reduce redundancies, streamline the organizational structure, and standardize practices across its subsidiaries. The crucial part of the company’s strategy involves making an adjustment to the supply chain, which has been a significant roadblock to revenue generation and a source of cost hikes. A streamlining of the processes produced 19% more systems in Q1 2022, which would increase the production of ATMs by 17% and double the number of self-checkout in Q2 compared to a year ago.

As I explained in my previous article, DBD has been shifting away from its legacy devices with the introduction of DN Series recyclers. In North America, 87% of the new orders came from DN Series in Q1. To offset the long supply chain lead time, the company is investing in the Ohio manufacturing facility to meet most of the demand for North American recyclers. Due to the increased volatility in its supply chain and logistics, the revenue conversion on the $1.2 billion product backlog can accelerate in the near term. Overall, the management has set a target of ~$150 million in cost savings over the next 12 to 18 months. In June, it partnered with Al Qurtas Islamic Bank to deploy DN Series ATMs in Iraq. In May, FOREX, a currency exchange service provider in Europe, outsourced its entire ATM channel management to the company.

DBD’s electric vehicle (or EV) charging stations diversification process recently signed a contract with a European electric charging station manufacturer for more than 10,000 chargers. The contract also includes servicing more than 7,000 chargers in the US. The deal can extend up to 30,000 charging stations by 2022. Investors may note that Europe provides a robust charging market for EVs facilities because of higher usage of rental and fleet cars and more electric vehicles being used for public transportation.

The FY2022 Outlook Has Changed

The supply chain issue has disrupted the company’s earlier guidance and forced it to lower estimates for FY2022. Now, it has revised its FY2022 revenue guidance down by 7% to $3.8 billion (at the guidance mid-point) compared to the previous estimate. The current guidance suggests a 3% lower revenue than FY2021. The two critical factors that would result in the expected revenue loss are the ongoing conflict in Russia and Ukraine and the effects of an unfavorable foreign exchange movement. On the other hand, the favorable drivers in 2022 would be the improved backlog-to-revenue conversion and pricing growth.

However, the revenue under-realization and supply chain disruptions would reduce the profit margin. These factors have prompted the adjusted EBITDA margin guidance to lower by 26.6% (at the guidance mid-point) in FY2022. Despite the drawbacks, improved pricing and the cost-saving exercises will mitigate some headwinds. So, the company’s long-term adjusted EBITDA outlook has been less affected. In 2024, the management targets revenue growth of 2%-4% and expects the adjusted EBITDA margin to exceed 13%. The free cash flow conversion is expected to exceed 50% in 2024.

Analyzing The Drivers And Margins

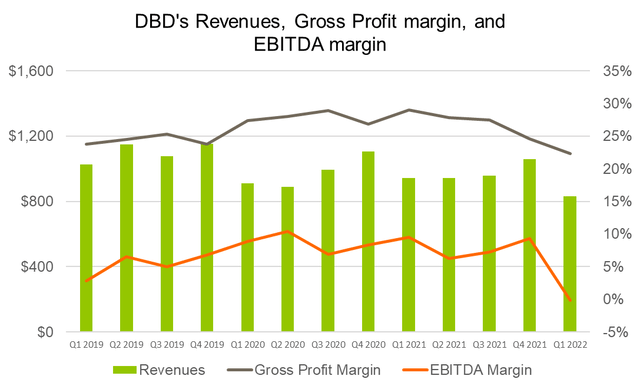

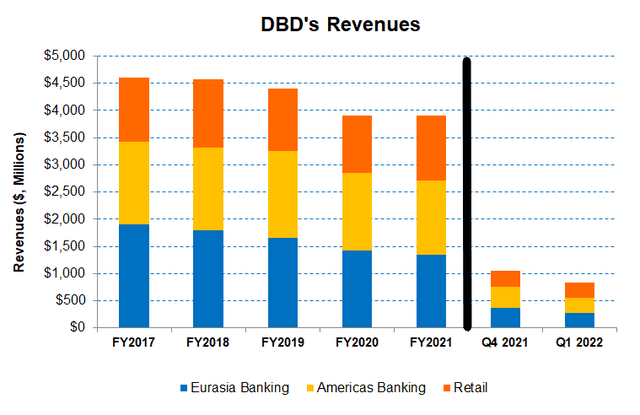

In Q1 2022, the Americas Banking segment revenues decreased by 26% compared to Q4 2021. Both product and service revenues decreased due to the continued supply chain challenges. The cost inflation impaired its ability to convert backlog to revenues. Lower product sales also contributed to a reduction in attached services and software. As a result, the company exited some low-margin service contracts in Q1.

Quarter-over-quarter, revenues from the Eurasia Banking segment also declined by 26% in Q1. The Retail segment revenue, in comparison, saw a more modest revenue drop (10% down quarter-over-quarter in Q1 2022).

The EBITDA margin nearly evaporated in Q1 compared to a healthy 9.3% margin a quarter ago. Most of the backlog conversion occurred before the price increase, leading to the margin fall during Q1. During Q1, the company recorded $38.4 million in impairment charges related to ERP implementation in North America and $16.8 million for assets in Russia and Ukraine.

Negative Cash Flows And Shareholders’ Equity

In Q1 2022, DBD’s cash flow from operations (or CFO) steeped more into the negative territory than a year ago. Not only did the year-over-year revenues decline, an adverse payable disbursement timing and an increase in inventory due to longer lead times resulted in the deterioration of cash flow. As a result, its free cash flow (or FCF) turned significantly negative in Q1. During the year, I expect inventory and accounts payable to normalize.

DBD’s shareholders’ equity is negative. On top of that, it had a net debt of $2.02 billion as of March 31, 2022. Its liquidity was $437 million (cash plus available revolving credit facility) as of that date.

DBD lowered its free cash flow guidance for FY2022 from $140 million to break even in its latest update. This would also be a significant reduction compared to the FY2021 FCF.

Linear Regression Based Forecast

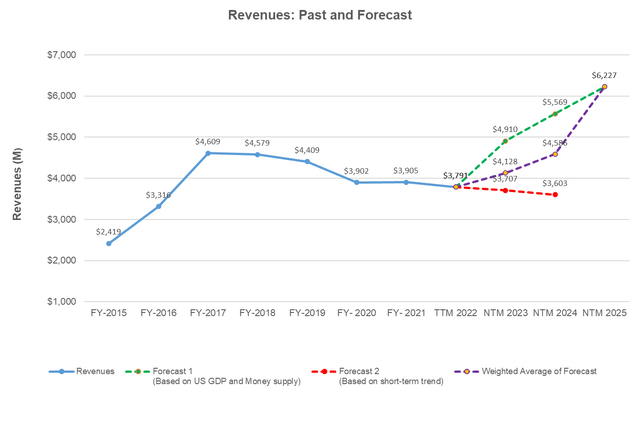

Author Created, Seeking Alpha, and FRED Economic Research

Based on the historical relationship between the US GDP, money supply, and DBD’s reported revenues for the past seven years and the previous eight-quarters, I expect revenues to increase steadily over the next two years.

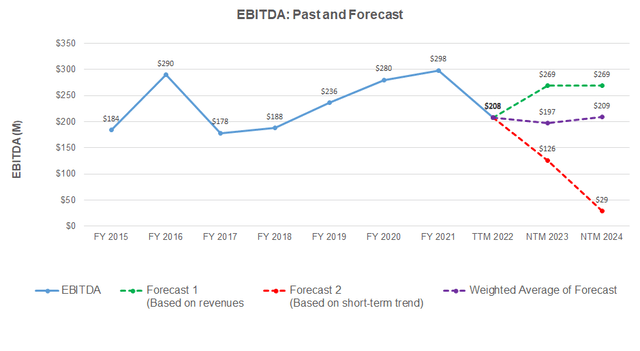

Author Created and Seeking Alpha

The model suggests its EBITDA will increase steadily over the next 12 months (or NTM 2023) and NTM 2024.

Relative Valuation And Target Price

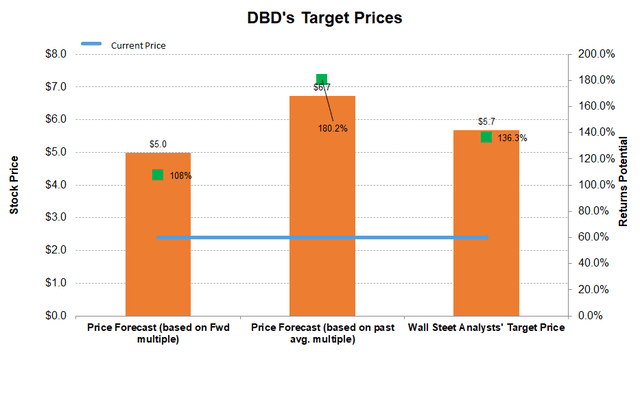

Author Created and Seeking Alpha

Returns potential using the price forecast based on the forward EV/Revenue multiple (0.61x) is lower (108% upside) than the return potential using the past average (180% upside). The Wall Street analysts’ estimates (136% upside) fall between the two above. I think the stock has upside potential in the short term.

The stock is slightly undervalued at the current level. The stock’s EV/EBITDA multiple is marginally lower than its peers’ (NCR, ORCL, and FISV) average of 11.5x. I estimated the relative valuation based on DBD’s forward EV-to-EBITDA multiple contractions versus the current EV/EBITDA and compared it to peers.

Risk Factors

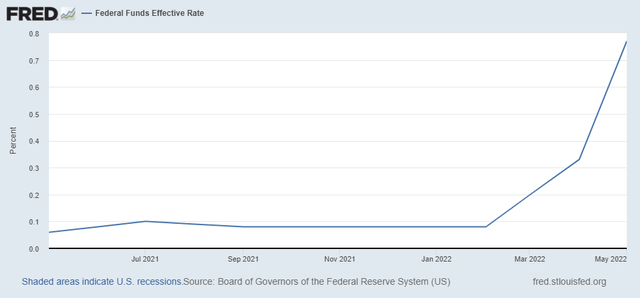

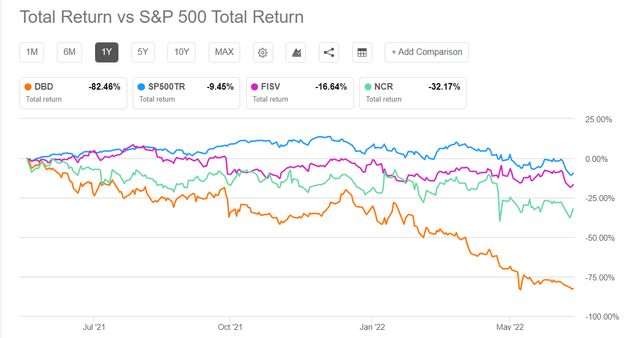

The possibility of a recession, in one form or the other, can significantly lower its profitability. As the US interest rate and inflation move up after several years of easy credit, companies like DBD with potential financial risks would see investors abandoning the stock. As a result, DBD’s stock price has plummeted 29% in the past month and 74% year-to-date.

What’s The Take On DBD?

DBD focuses on simplifying its business model by streamlining its operations and digitizing processes. Its short-term revenue generation can accelerate from the revenue conversion of substantial product backlog following the increased volatility in its supply chain and logistics. The increased use of DN Series machines due to higher demand for automation and self-service will boost its operating margin. The management targets moderate revenue growth and a much healthier EBITDA margin in the medium-to-long term.

However, it can face revenue loss and supply chain disruptions in 2022. Cash flows turned significantly negative in Q1. As a result of these adverse developments and the recession fear in the economy, the stock underperformed the S&P 500 (SPY) in the past year. Plus, negative shareholders’ equity placed it at financial risk over the past few years. So, despite the potential returns, investors might not want to buy the stock in the current scenario.

Be the first to comment