Morsa Images

Curis, Inc. (NASDAQ:CRIS) is a small biotech company that is working on developing drugs to treat cancer. It has gotten hammered in 2022, plunging from a 52-week high of $7.63, to a low of $0.68. As I write it’s trading at $0.7148. Its market cap has also plunged to $67.69 million.

The only thing approved for Curis is Erivedge®, a tiny molecule drug that is orally administered. It’s approved for use in advanced basal cell carcinoma or BCC and medulloblastomas. This is the only source of revenue for the company, which it receives from a licensing agreement with Genentech and Roche. The revenue from the drug is small and isn’t material in the long-term performance of the company.

In this article we’ll look at the status of the pipeline of Curis, its expenditures and balance sheet, along with my thoughts on how to view the company as a potential holding.

Latest numbers

The $2.4 million in revenue in the second quarter came primarily from royalty revenue from Erivedge®.Curis reported a $15.9 million net loss for the second quarter 2022, or $0.17 per share, against the $10.8 million, or $0.12 net loss in the same reporting period a year ago.

For the first six months of 2022, the company reported a net loss of $32 million or $0.35 per share, up from the net loss of $20.8 million, or $0.23 per share year-over-year.

Second quarter operating expenses were $17.5 million, compared to $12.9 million in the second quarter of 2021. For the first half of 2022 operating expenses were $34.6 million, up from the $23.9 million in the first half of 2021.

R&D expenses climbed from $8.8 million last year in the second quarter to $12.3 million in the second quarter of 2022. Most of that increase was attributed to a boost in spending on consulting services. Cost for employees was up $2.5 million as well. Overall R&D spending in the first half of 2022 was $23.8 million, up from the $15.5 million in R&D spending in the first half of 2021.General and Administrative Expenses increased from $4.1 million last year in the second quarter to $5.1 million in Q2 of 2022. The total for the first half was $10.8 million against the $8.2 million in General and Administrative Expenses in the same period of 2021.The company had $107.2 million in cash, cash equivalents and investments at the end of the reporting period, which management said should allow it to “maintain its planned operations into 2024.”

Curis’s pipeline

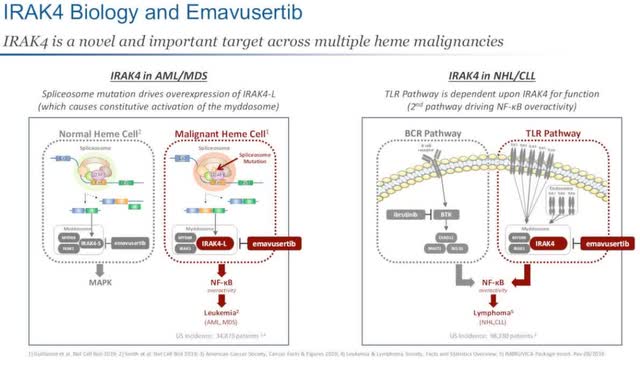

The most advanced candidates in Curis’s pipeline are associated with Emavusertib, which is being developed to treat IRAK4-driven leukemia (AML/MDS) and IRAK4-driven lymphoma (NHL/CLL). As the image shows below, IRAK4 in AML/MDS includes a spliceosome mutation which drives an overexpression of IRAK4, causing constitutive activation of the myddosome. In regard to IRAK4 in NHL/CLL, the TLR pathway depends upon IRAK4 for function, with the 2nd pathway driving NK-kB overactivity.

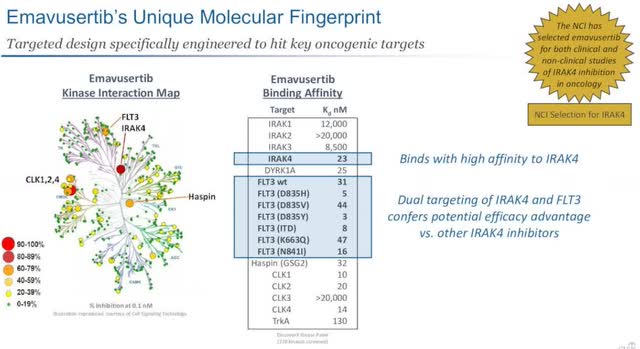

Emavusertib is designed to target hit key oncogenic targets, as shown below. Curis believes by targeting IRAK4 along with FLT3 it potentially provides a greater advantage when compared to results from other IRAK4 inhibitors.

If this is eventually determined to be true, it would give Curis a moat and competitive advantage against current inhibitors as they stand today.

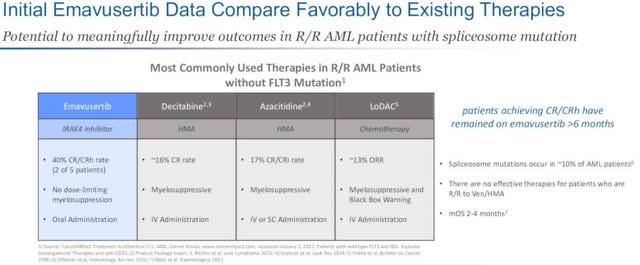

Preclinical data confirms anti-cancer activity, pointing to the potential for Emavusertib’s effectiveness across heme malignancies. Data also show it compares favorably when compared against existing therapies like Decitabine (HMA), Azacitidine (HMA), and LoDAC (chemotherapy).

Concerning the use of Emavusertib in lymphoma (NHL/CLL), the company considers it to be an “ideal candidate to combine with BTKi to maximize downregulation of NF-kB. “According to the company, two pathways drive NF-kB: the BCR Pathway, which is addressed by blocking BTK, and the TLR Pathway, which is addressed by blocking IRAK4. While not conclusive yet, initial data suggest by blocking both pathways it could possibly overcome resistance to ibrutinib.

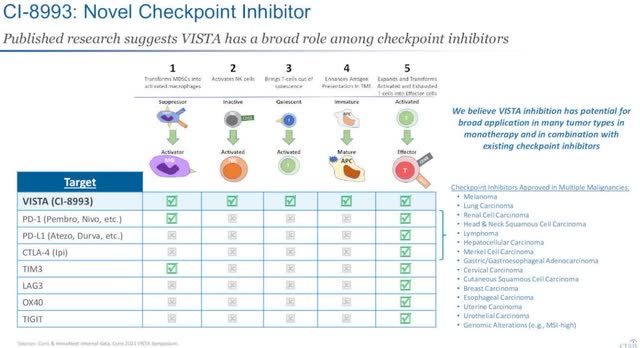

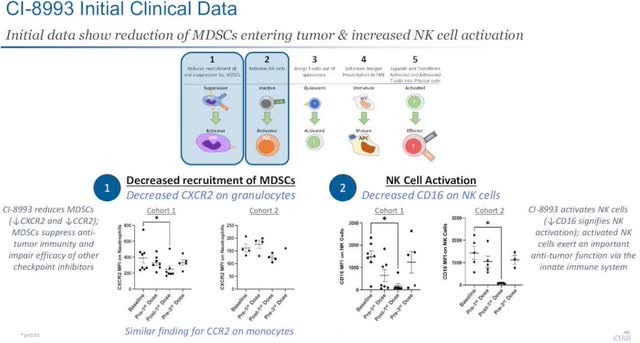

The other program Curis most recently updated its progress on was VISTA (CI-8993). This deals with a novel immune checkpoint with a unique role in T-cell activation. It is currently at the clinical safety stage of development, and so far shows immune effects are manageable. There is also some early data showing there are anti-cancer mechanisms being activated.

Management believes VISTA inhibition has the “potential for broad application in many tumor types in monotherapy and in combination with existing checkpoint inhibitors.

Initial data show there is a reduction of MDSCs entering tumor and increased NK cell activation, as shown below.

As for the potential, there are approximately 317,000 patients for AML/MDS, and 1.8 million patients for NHL/CLL.

There are several other drugs in the pipeline, but I would want to see current updates before commenting on them.

Update on partial clinical hold

In April 2022, the FDA put partial holds on the TakeAim Leukemia and TakeAim Lymphoma studies in response to the death of a patient that had acute myeloid leukemia. The patient had experienced rhabdomyolysis, which had been identified as a “dose-limiting toxicity of the candidate.”

On August 18, 2022, Curis said in a press release that the FDA lifted the hold when the company offered a “strategy for rhabdomyolysis identification and management, and on the enrollment of at least nine additional patients at the 200 mg dose level of Emavusertib in combination with ibrutinib.”

Management said it should have a preliminary data update some time in 2023.

Conclusion

As with any early-stage Biotech company, Curis has a long way to go before it is likely to have its treatments approved of by the FDA. That said, some of the drug treatments in its pipeline look promising.

Even so, anything can happen along the proposed path to approval, and for that reason I see Curis as a having the potential to be an asymmetric play if it is able to have a couple of drugs in its pipeline approved. But where the company is today, it should only be considered a speculative play. I wouldn’t put any more money in the company than you are able to afford losing. Investors don’t have to put a lot of money in a company like Curis to potentially reap some significant rewards.

While the company is now adding patients to its trials and moving closer to being approved, it is now at the tough stage where it’ll be under closer scrutiny by the FDA. Yet if it’s able to move forward, it could be a big winner for patient shareholders.

Be the first to comment