MikeMareen/iStock via Getty Images

I’m looking to start a position in clean energy yieldco Brookfield Renewable (NYSE:BEP, NYSE:BEPC). This would be an expansion of my climate economy portfolio which already holds yieldcos Clearway Energy (CWEN.A) and Atlantica Yield (AY). The intention isn’t duplication but exposure to Brookfield’s unique asset base which includes Westinghouse.

Nuclear energy will be a critical source of zero-carbon baseload power for countries looking to fully decarbonize their power grids. It can be aggregated with renewables to fully optimize the electricity production mix. The long-term trend will be the displacement of coal, petroleum liquids, and natural gas in economies around the world now looking towards ambitious net-zero targets. Europe is also looking at nuclear to form a long-term solution to the energy crisis sparked by Russia’s invasion of its neighbour Ukraine.

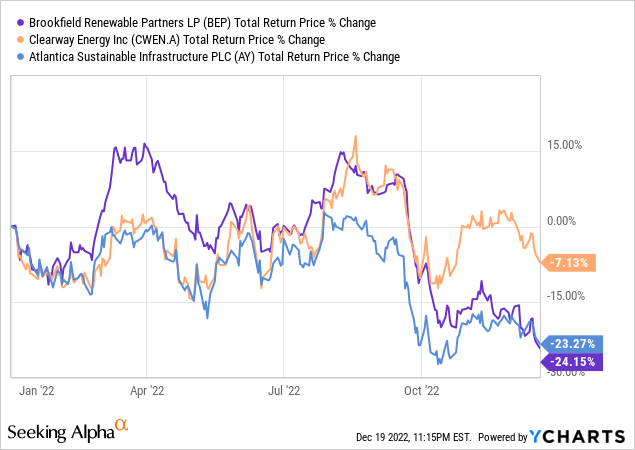

The stock is down around 24% on a total return basis year-to-date which ranks worse than Clearway and Atlantica. These both also have a 4.85% and 6.74% dividend yield respectively. Brookfield last paid out a quarterly cash dividend of $0.32 which is around a 4.9% yield on BEP, the Bermuda-based partnership units. The company also offers BEPC which offers exposure to the same income-producing asset base but in a more tax-advantaged structure.

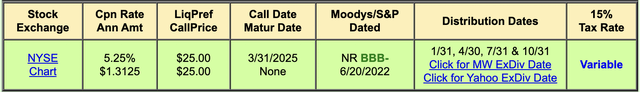

Shareholders might also be interested in the Class A Preferred Limited Partnership Units (NYSE:BEP.PA). Trading at $18.70, these have mirrored the year-to-date pullback of the commons to trade below their $25 redemption price. This is around a 25% discount on their intrinsic value.

Further, as they pay out a $1.3125 annual coupon, holders would be paid a 7% cash dividend yield to wait for the units to close the gap with their redemption value. Assuming the company redeems the units at its March 2025 call date, the potential return for holders over the next two years and three months would be 50%. This is a near-guaranteed return profile as the preferreds are higher on the capital structure than the commons and it’s hard to think of a near-term scenario that the company suspends its payout.

Going Nuclear With Westinghouse

Brookfield has been aggressively expansionary in recent months. The most transformative of this has been the joint $8 billion acquisition of Westinghouse with strategic partner, Cameco (CCJ). Westinghouse has played a crucial role in the development of the US nuclear power industry and has designed and built more than half of the nuclear reactors currently in operation in the US. The company wants to seize the initiative on the revival of interest in nuclear power which stalled in the decades after the Chornobyl disaster. Poland, the United Kingdom, and a number of economies in Asia and the Middle East are all looking to build nuclear power plants. Indeed, Poland recently awarded Westinghouse a contract to build three AP1000 reactors. This will be the first nuclear power facility in the country with another three pressurized water reactors expected to follow.

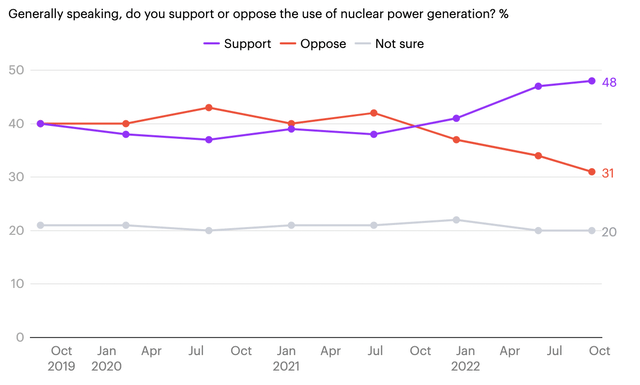

The Russian invasion of Ukraine has drastically improved the public perception of nuclear energy with a recent UK survey showing the public is increasingly supportive of its use. This sentiment change is mirrored in most developed countries with energy security and a long-term decoupling from Russia in view.

The death of nuclear power seemed certain following the 2011 Fukushima disaster and Japan’s subsequent shutdown of all its nuclear plants. Germany would also follow and pass legislation to halt the use of nuclear power. The trend is now changing. California’s long-beleaguered Diablo Canyon Power Plant, owned by utility PG&E Corporation (PCG), was recently awarded $1.1 billion to extend its life beyond its scheduled 2025 shutdown date. More plants set for closure in the US are set to be extended with the Bipartisan Infrastructure Law passed last year set to award billions in credits to extend the lives of US reactors.

This comes as the Southern Company (SO) progresses towards a 2023 start date to power up Georgia’s Vogtle Power Plant Units 3 and 4. This will be the first new nuclear units built in the US since the early 90s and will use Westinghouse AP1000 technology. France has approved draft legislation to speed up the construction of new nuclear facilities. Japan is reopening at least seven closed power plants by the summer of 2023 with public sentiment being supportive of plans to construct new plants. South Korea’s new president Yoon Suk Yeol has laid out plans for the country to extend the life of existing plants and build new nuclear power plants. China is adding two AP1000 technology-based reactors to its Lianjiang nuclear power plant in Zhanjiang. The UK is considering a new Westinghouse-powered nuclear power plant on its Welsh coast.

Decarbonization Is A Secular Trend

At no other time in the contemporary history of nuclear energy since France’s Messmer Plan has the outlook for nuclear looked so great. The world now faces a buildout of its own nuclear fleet under not dissimilar circumstances faced by the former Prime Minister of France Pierre Messmer. Russia’s weaponization of energy just like the 1973 Arab oil embargo is set to catalyze a striking global buildout of nuclear energy.

Critically, it would be hard to see countries truly achieve ambitious net zero targets without the zero-carbon baseload power that nuclear energy provides. This has become clear with the long-term trend pointing to a nuclear renaissance to drive the creation of a thriving global nuclear and renewable-powered planet where the climate change threat is truly defeated. Britain’s ex-Prime Minister in his outgoing speech encouraged this successor to go nuclear and go large.

Brookfield’s Westinghouse acquisition will come to represent a watershed moment for its future performance and forms a core reason for a potential position. Apart from uranium miners, direct nuclear power companies are somewhat rare on the public markets. Brookfield would join SMR companies NuScale (SMR) and X-Energy (AAC) as being one of the only ways for an investor to gain exposure to the coming global nuclear energy boom.

Westinghouse represents an attractive risk-adjusted return proposition for Brookfield as its operations are underpinned by highly visible cash flows. Around 85% of its revenue comes from long-term inflation-linked contracted or highly recurring services all with a 100% customer retention rate. According to Brookfield’s management during their fiscal 2023 third quarter earnings call, around 50 GW of plant extension have been announced so far with more than 60 GW of newbuild reactors expected over the next two decades across more than 20 countries. They expect Westinghouse to be a significant contributor to their target to grow their dividend payout by 5% to 9% for the foreseeable future. I’m bullish on nuclear, hence I’m bullish on Brookfield and will look at establishing a position in the new year.

Be the first to comment