Delmaine Donson/E+ via Getty Images

Introduction

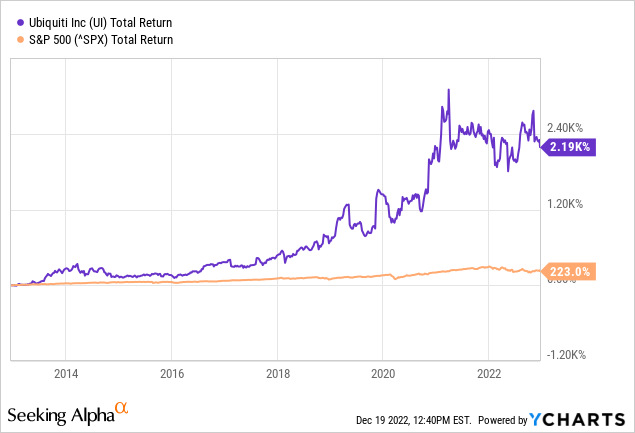

Ubiquiti’s (NYSE:UI) stock returns are unprecedented. Over the past decade, the stock rose an average of 37% per year. The S&P500 rose an average of only 12.4% per year during this period. Few shares are available for trading because CEO Robert Pera owns as much as 75% of the company’s stock. Ubiquiti is known for its UniFi Enterprise WiFi, a system of great value. Both Ubiquiti’s sales and profits have grown strongly in recent years. The company is growing strongly, repurchasing shares and distributes a good dividend. Still, the stock is expensively valued. Therefore, the stock is a hold.

Shortage Of Components Affected Results

Results for the first quarter of fiscal 2023 were mixed, with revenues up 8.5% and non-GAAP earnings per share down 27%. Revenue growth was primarily due to growth in the Enterprise Technology platform (23% YoY). Revenues from the Service Provider Technology platform declined year over year by 36%. Revenues were impacted by the inability to meet demand due to component shortages. Gross margin decreased to 34.4% from 45.6% in the same period last year. Gross margins were also impacted by the component shortage as component prices were more expensive and because of changes in product mix and higher shipping costs. Non-GAAP earnings per share declined due to lower gross margins.

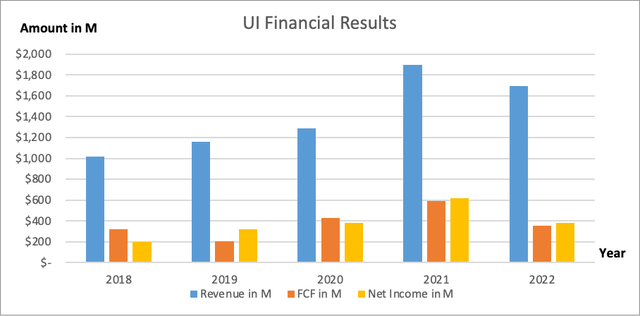

The past four years have been strong. Ubiquiti saw annual revenue growth of 14%, net income growth of 18%, and free cash flow growth of 3%. Because of higher costs, free cash flow for fiscal 2022 was lower than free cash flow for fiscal 2021. The company is growing steadily, and its products are in demand because the products are of great value.

Ubiquiti financial results (SEC and author’s own graphical representation)

Repurchasing A Huge Amount Of Shares

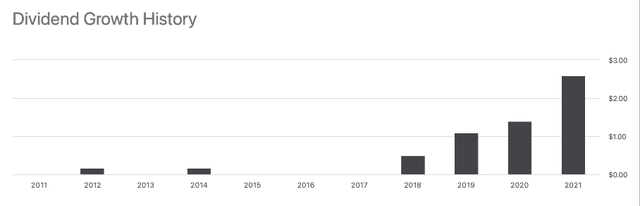

Ubiquiti has been paying a dividend structurally since 2018. The dividend rate is $2.40 and the dividend yield is currently 0.9%. The stock price has risen strong, resulting in a low dividend yield. The low dividend yield is difficult to compare with interest rates, as interest rates are expected to rise to 5%.

Ubiquiti’s dividend growth history (Seeking Alpha Ubiquiti ticker page)

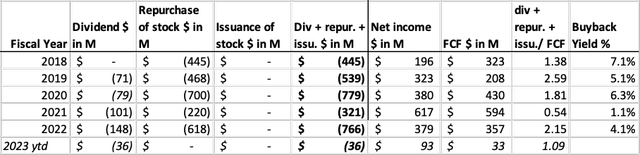

The dividend per share is growing steadily due to rising profits and due to share repurchases. Ubiquiti distributes more cash to shareholders than its free cash flow. In fiscal 2022, the company distributes 115% more to shareholders than fiscal 2022 free cash flow. As a result, cash on the balance sheet decreased significantly and net debt increased.

Net debt was $258M in fiscal 2019, while it is now $653M. The company can easily carry the net debt with free cash flow of $357M in fiscal 2022, but this does not mean that it is.

A sustainable amount to return to shareholders in the form of dividends or share buybacks is an amount that is equal to free cash flow. In fiscal year 2022, the free cash flow was $357M. Dividend payout ratio (free cash flow) is 41%. That means $209M is available for share repurchases. A sustainable repurchase yield is then 1.2%. The lower buyback yield could hinder further share price appreciation.

Ubiquiti cash flow highlights (SEC and author’s own calculation)

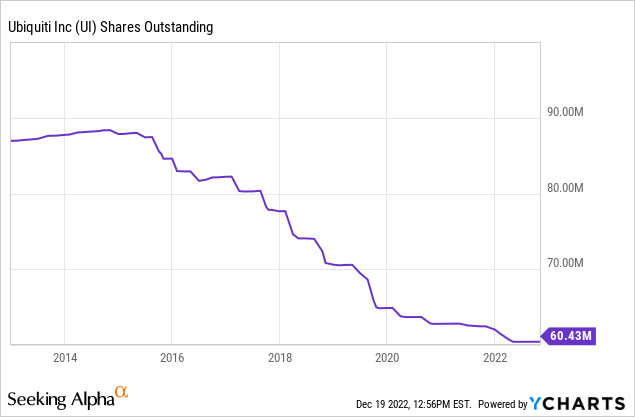

Share buybacks reduce the supply of shares and increase demand when the shares are purchased on the open market. The company managed to reduce the number of shares outstanding from about 85 million shares at the beginning of 2016 to currently about 60 million shares. Shares outstanding are reduced by an average of 4.9% annually. Earnings per share should increase because fewer shares are available. Each shareholder owns more of the business after the company repurchased shares.

Valuation Looks Expensive

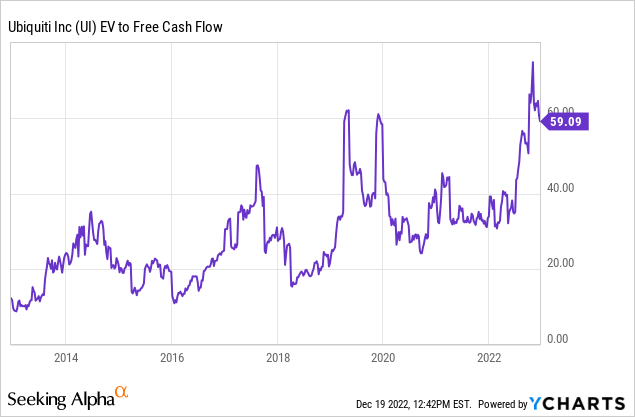

Ubiquiti buys back shares with their free cash flow and cash from the balance sheet. This makes the ratio of EV to free cash flow an appropriate choice for charting stock valuations.

The ratio of EV to free cash flow is at a record high of 59 and is generally also a very high number. The sharp rise in share price has led to extremely high valuations.

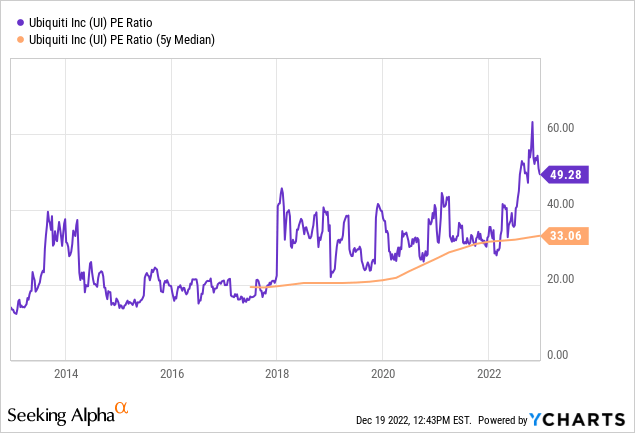

Share buybacks increase earnings per share, and the PE ratio is lower after the company repurchased shares (provided the stock does not rise). The stock has been rising strongly and the PE ratio is also coming off an all-time high at 49. This is a very high number compared to that of the S&P500 of 21. The high PE ratio is justified if earnings per share increases in the future. Only one analyst on the Seeking Alpha Ubiquiti ticker page expects earnings per share for fiscal 2024 to increase 47%, making the forward PE ratio 31. This is still an expensive stock valuation. Despite the company’s strong growth, the stock’s valuation allows no further growth in share price. The stock is a hold.

Conclusion

Ubiquiti has risen sharply over the past decade, averaging 37% a year. CEO Robert Pera owns as much as 75% of the company’s stock; few shares are available for trading. Revenue and earnings have risen sharply in recent years, and the first quarter fiscal 2023 came with 9% year-over-year revenue growth. Ubiquiti saw gross margin decline due to a component shortage. The shortage led to higher component prices, and shipping costs and product mix changes also led to lower gross margin. These are temporary headwinds as Covid is heating up again in China. The company is buying back shares and distributing dividends at a much higher rate than free cash flow. Net debt rose sharply as the company returned a lot of cash to shareholders, but it is still manageable. In the long run, large share buybacks are not sustainable. The company’s valuation is also expensive compared to the S&P500 and its historical stock valuation. The company is doing great, but the valuation holds me back. The stock is a hold.

Be the first to comment