Scott Olson

VIZIO Holding Corp. (NYSE:VZIO) has been getting hammered on TV sales recently, and it share price has been punished as a result, falling from approximately $29 per share in early May 2021 to its 52-week low of $6.47 on July 5, 2022, before clawing its way back to about $13.50 per share.

Since then it has dropped back down to trade in a range of about the mid-$8s to around $11.50 as a ceiling.

It appears most investors are continuing to look at VZIO as primarily a seller of physical TVs, rather than a company that has been leveraging its TVs into other revenue streams, including targeted ads, data licensing, subscriptions, and SmartCast active accounts, among other offerings.

In this article we’ll take a look at some of the company’s recent numbers and how the company is attempting to expand beyond devices in the minds of consumers and investors.

Some of the numbers

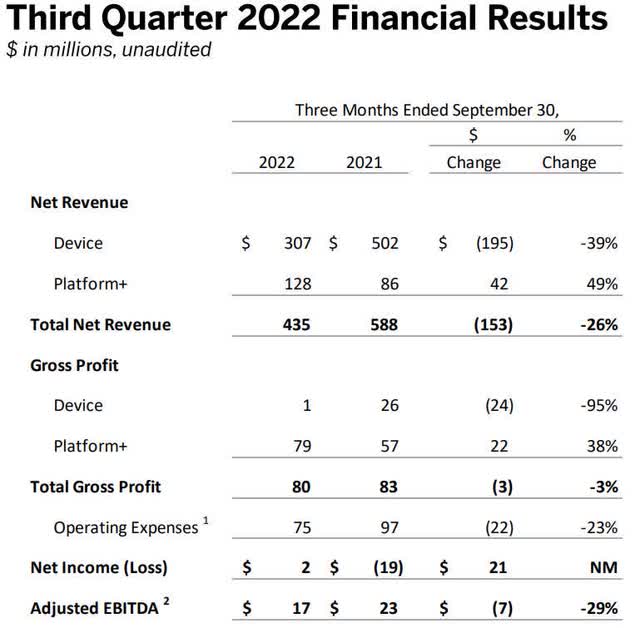

Revenue in the third quarter of 2022 was $435 million, down $153 million or 26 percent from the $502 million in revenue generated in the third quarter of 2021.

Based upon segments, Device revenue was $307 million, down $195 million or 39 percent from the $502 million in revenue generated last year in the same reporting period. Platform+ revenue was $128 million, up 49 percent compared to $86 million in the third quarter of 2021.

Gross profit in the reporting period was $1 million for Device, down $24 million or 95 percent year-over-year. Gross profit for Platform+ in the third quarter was $79 million, up $22 million or 38 percent from the third quarter of 2021.

Total gross profit in the third quarter was $80 million, down $3 million from the $83 million in gross profit generated in the third quarter of 2021.

Net income in the reporting period was $2 million, up $21 million from the negative $(19) million in the same quarter of 2021.

Adjusted EBITDA was $17 million in the third quarter, down $7 million from adjusted EBITDA 0f $23 million last year in the same reporting period.

Cash and cash equivalents at the end of the third quarter were $265.9 million, with the company holding no debt.

Platform+

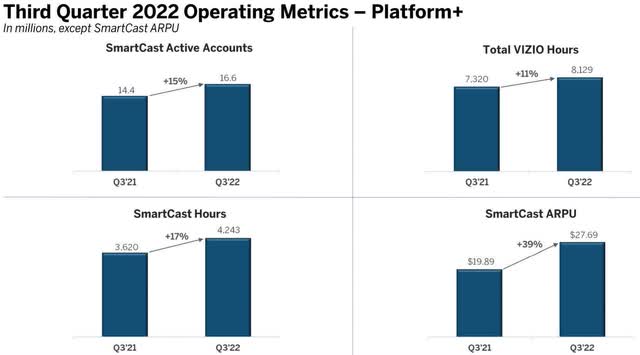

ARPU from SmartCast jumped to a record $27.69, an increase of 39 percent year-over-year. The number of active accounts on SmartCast grew to more than 16.6 million while streaming over 4.2 billion hours.

Time spent streaming on SmartCast grew by 17 percent in the quarter, as measured against an 11 percent increase in overall video hours streamed.

Active accounts for StarCash were up $500,000 in the reporting period from the prior quarter, and up by $2.2 million year-over-year to a total of $16.6 million.

As far as advertising goes, the company said it has over $200 million in upfront advertising commitments at the end of the third quarter. The number of direct client relationships in the quarter was up 65 percent with an additional 158 new advertising partners added in the third quarter.

Advertising revenue in the third quarter was $97 million, up 47 percent from the $66 million in advertising revenue generated in the third quarter of 2021.

Non-advertising revenue from data licensing and higher content distribution was $31 million in the third quarter, up 55 percent from the $20 million in non-advertising revenue in the third quarter of 2021.

As you can see from the numbers and business model of VZIO, the strategy is to get more Smart TVs into the homes, and from there monetize the big screen through a variety of revenue streams.

While I generally like the model, I don’t think the company wants to have to compete solely on price to gain market share with the TVs. That will be a headwind going forward, although the increasing amount of revenue from Platform+ is starting to offset some of the low-margin sales from Devices.

The current fourth quarter is going to be an important one to watch because management stated it has more product available for shipment when compared to last year, so with its pricing strategy and available inventory, it needs to grab some more market share in the fourth quarter.

What’s been hindering TV sales

Even though there are some things outside the control of Vizio that have held back sales some, I want to focus here on the demand side of the issue, showing why I think lower TV sales are also part of lower consumer demand.

The first thing to consider is that people were shut in at home during the pandemic, where they spent a lot of time on in-home entertainment. But when the country started opening up again, consumers starting prioritizing spending on travel, experiences and events, which meant having to cut back on time spent at home and deciding not to buy new TVs.

With the strong impulse to get out of the home and see and experience the world again, it’s my thesis that this is a key part of the reason TV sales have been down, as people aren’t going to spend a lot in other areas until their desire for travel and experiences is assuaged, or they run out of disposable income.

Many people can’t afford to have it both ways, so for now they’re opting to spend their capital and time on traveling, rather than sitting home and watching TV. Obviously, this is a general point I’m making with a number of outliers, but the point is they’re not looking to spend on new TVs at the expense of not being able to travel; they’ll just continue to use their old TVs until they’re done spending on going to events and other experiences.

I think this is a significant reason VZIO has to compete on price, as it lowers prices to the point where some consumers who wouldn’t have bought TVs otherwise, decide to go ahead because it isn’t likely to conflict with their current lifestyle.

The good news with lower margin is, by getting a TV into the homes of consumers the company can then offer its Platform+ products and services to TV owners, which has been growing consistently. VZIO is looking for hardware margins to be in the low single digits in the quarters ahead.

What the company needs to prove in the near term is it can hold and/or grab market share in an increasingly competitive environment. As mentioned above, the one thing different this year over last year is it has plenty of supply in the channel to meet consumer demand.

Conclusion

With the existing tough TV market, VZIO has been transitioning more to a company using its Smart TVs as a means of offering a variety of products and services that have solid margins and accelerating growth.

For that reason, sacrificing TV margins in order to get more into the home is a good long-term strategy, as long as it in fact works and it continues to grab market share. After all, its Platform+ grows based upon the number of screens it can provide its products and services to.

That doesn’t mean it can’t cross sell to its existing TV customer base, only that new customers represent a more lucrative market because they’re starting from a baseline of no services in the beginning of hardware ownership.

What the company must do is increase its revenue and earnings from its Platform+ business in order to offset what is basically becoming a low-margin hardware business that generates little, if any earnings.

So, in the quarters ahead investors need to see Platform+ becoming an increasing percentage of revenues, as that will determine the profitability and viability of the company over the long term.

Be the first to comment