Wirestock/iStock Editorial via Getty Images

When I last wrote about LVMH Moët Hennessy – Louis Vuitton, Société Européenne (OTCPK:LVMUY) (“LVMH”), the disconnect between its fundamentals and its price stood out. Its price was down by 28% year-to-date (YTD) at the time of writing. Cut to a month later, and many of these price losses have been wiped out, with a rise of more than 21% since then. This raises the next question – is there any more upside left to LVMH? Or is it a good time to sell when it’s at a high? Based on the company’s latest performance update and a comparison of market multiples with its peers, it’s likely to rise more.

Strong growth continues

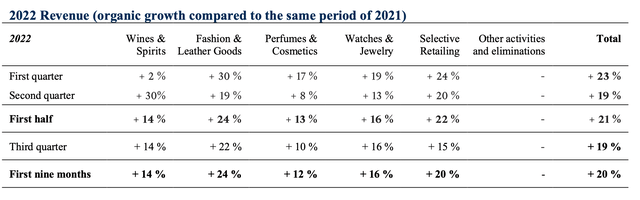

While the group’s growth in 2022 so far hasn’t been quite as elevated as the 44% revenue increase seen in 2021, the fact is that last year’s numbers were much higher because of the low base of the pandemic year of 2020. Compared to 2019, growth in 2021 was 20% on a reported basis, even considering the Tiffany & Co acquisition, which resulted in a jump of 167% in its Watches & Jewelry segment. By contrast, in the first nine months of 2022, it has seen a 28% growth in reported numbers. The details have notable positives as well.

One, its growth has been driven by its U.S., European, and Japanese markets, which together account for 56% of its total sales. This is a positive particularly because the U.S. until recently was in a technical recession. While luxury products tend to be more resilient in slowdowns, an analysis of the past recessions in 2008 and 2020 shows that they are indeed affected even if for a relatively short time (see LVMH: Prepare To Buy, October 10, 2022, linked above).

Another positive is some return of Chinese demand. Without disclosing the actual numbers, in its latest release the company says:

“Asia (including China) saw a lower level of growth over the first nine months of 2022, though growth in the latest quarter accelerated there due to the partial easing of health restrictions.”

This is noteworthy, since growth is set to decelerate in the U.S. and Europe in 2023, where LVMH gets half its revenues. An expected acceleration to 5% growth in Asia-ex Japan as per the IMF, presumably led by China, however, could counteract this softening to a great extent, considering that the biggest chunk of 32% of its revenue is derived from the region.

Real demand sustained across segments

Two, organic growth for the first nine months of the year, which accounts for exchange rate changes and any structural changes because of say, acquisitions, is at a robust 20%. In the third quarter of 2022 (Q3 2022) it came in at 19% year-on-year (YoY), largely in line with the growth levels seen so far this year, showing sustained demand. Interestingly, organic growth this year is even higher than the 14% level seen in 2021 compared to 2019, which indicates the extent of genuine demand rise.

Three, this growth consistency in organic terms is largely visible across all of its segments. Notably, the Fashion & Leather Goods business, which is its biggest category, accounting for almost half its revenues, also grew at the fastest pace of 24% YoY among all segments, for the nine months ending September 30, 2022. In Q3 2022, it grew by 22%. Selective Retailing is its only business to have seen a notable slowing down in growth to 15% in Q3 2022 from 22% in the first half of the year. While LVMH says Sephora, within this segment “enjoyed excellent performance,” Duty Free Shoppers [DFS] has suffered because of “persistent lack of travel, owing to ongoing health restrictions in Asia,” which is probably what slowed the segment’s growth. However, with the lifting of COVID-19 restrictions in China now, the segment should see an upturn.

In a nutshell, LVMH’s real growth is faster than it was in 2021 and the growth is visible across segments, which makes it less vulnerable to fluctuations in any one segment. If growth in the U.S. and Europe slows down next year, it’s likely that its Asia growth will be supportive. In any case, luxury stocks, despite representing consumer discretionary demand tend to hold up well during uncertain times for economies and the stock markets. LVMUY, for instance, rose consistently after the stock market crash of 2020 and well into 2021, reaching near all-time highs.

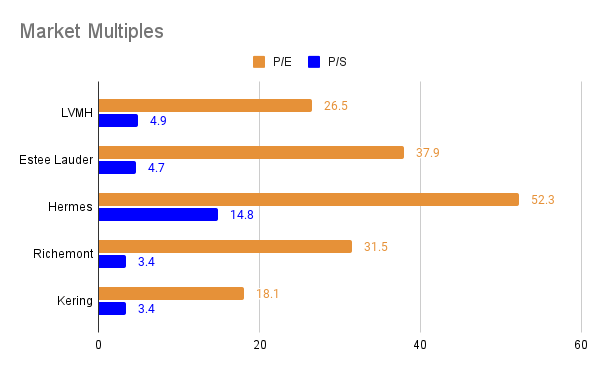

Rising earnings ratios

Further, its market multiples indicate that it can keep rising even now. Over the past month, its price-to-earnings (P/E) ratio has risen from 21.8x to 26.5x. This is a fair bit of jump in a relatively short time and isn’t subdued by any stretch. But here are two points to consider. First, it’s not terribly high compared to the S&P 500 (SP500) index’s P/E at 20.8x, which includes a number of stocks that are far more vulnerable to macroeconomic fluctuations than LVMUY is. Second, its peers’ P/E ratios have also risen over this time. Hermes (OTCPK:HESAY), Estee Lauder (EL) and Richemont (OTCPK:CFRUY) are all trading at higher multiples than LVMH. The only exception is Gucci owner Kering, which is at 18.1x. There’s little to suggest so far that any of these companies are slowing down either. Richemont, for instance, which recently released its half-year figures, has seen good progress. Similarly, Hermes is going strong as well.

Source: Seeking Alpha

LVMUY’s price-to-sales (P/S) figures however are more elevated compared to peers. Only Hermes has a higher P/S of 13.8x. Excluding it, LVMH has the highest figure of 4.9x, giving little room for an increase based on this multiple. Averaging out the potential price change indicated by both P/E and P/S indicates that there’s at least another 10-15% upside to it for now.

Looking ahead

If the company’s numbers continue to be strong, the increase could be more. However, there are risks to consider as well. We don’t know what’s going to happen in China next with the COVID-19 situation. So far, it’s clear that LVMH’s sales are still being impacted by the restrictions there. Further, if growth in China doesn’t pick up as hoped and next year is a poor one for its Western markets, sales could be impacted more. Also, the U.S. dollar’s fast rise has stalled for now, so a bump up from overseas earnings because of the exchange rate effect can slow down now.

For now, though, LVMH continues to look like a strong buy. I also take comfort in its medium-term to long-term performance. It has generated returns of 150% over the past 5 years and 362% over the past 10 years. I maintain a Buy on LVMH.

Be the first to comment