lcva2

Summary

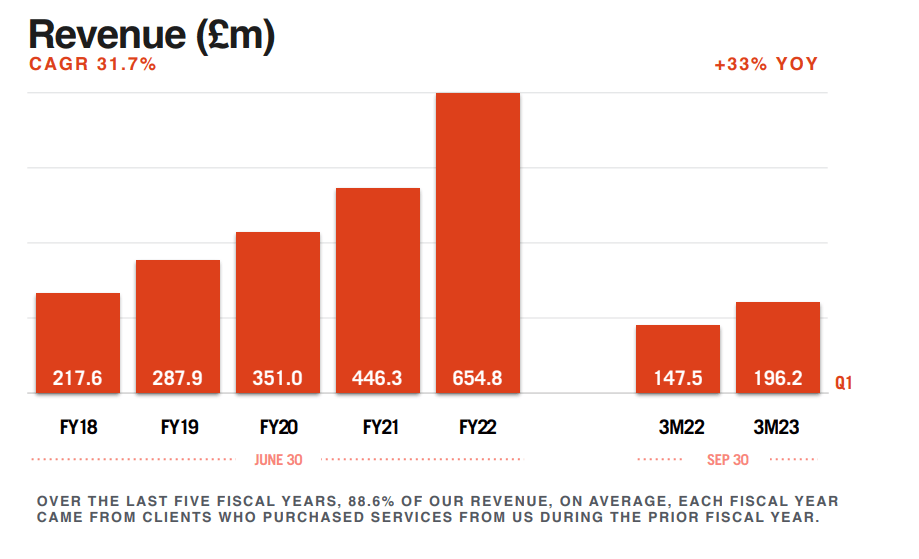

Endava (NYSE:DAVA) is one of my top holdings, and the jump after the November earnings is not surprising after continued strong performance. In fact, revenues remain growing over 30% on a YoY basis, even as profit margins also continue improving. This strength even in a bear market is an indicator of the company’s ability to drive sticky contracts and recurring revenue-based services from customers, in combination with organic growth of the customer base.

If you would like to understand more about the qualitative points of the company, feel free to read my prior two articles from June 2022 and June 2021. This article will instead highlight the recent earnings and my expectations for the future.

Revenues Continue to Grow Exponentially

Last quarter saw YoY revenue growth above 30%, with ~7% of that being attributed to foreign exchange benefits. This also continues the long-term trend of the annual revenue growth rate remaining above 30%. Despite some headwinds that can be seen in other areas of the tech market, Endava’s market/secular growth remains, and I will point out the key data points that indicate why.

Endava Presentation

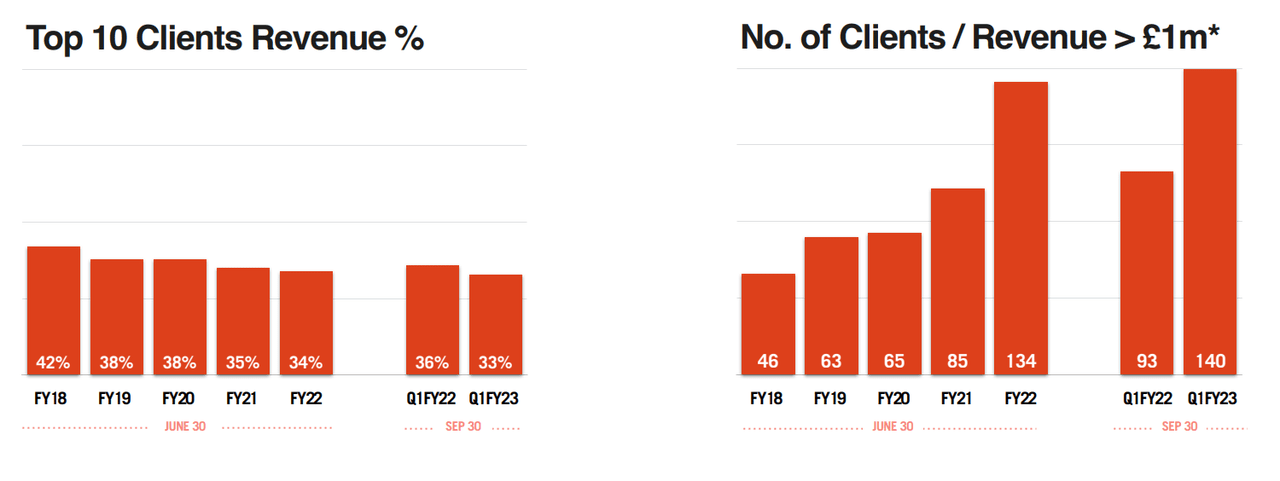

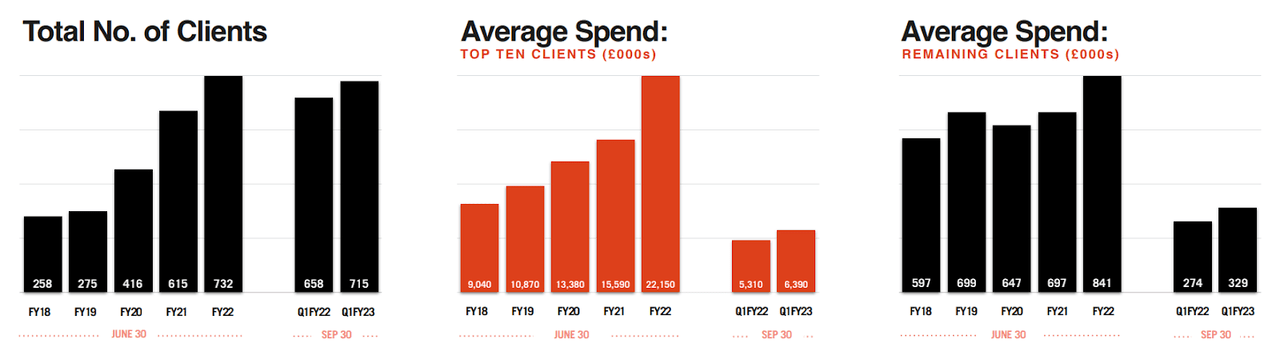

Revenues are able to surge so efficiently based on both organic and inorganic principles. Most importantly, Endava has a healthy customer base that is growing rapidly. They are healthy because the data shows that the top ten clients, or a significant 30%+ of total revenues, are spending more and more money on average each quarter. At the same time, the total number of smaller clients are increasing and average spend is increasing as well. Acquisitions have also been a fruitful way to drive growth, and Endava recently announced a purchase that will bolster growth for the end of the fiscal year.

Also of note, the reliance on the top 10 largest customers is decreasing regularly even as their average spend increases, and this reduces the risk of individual partnerships moving forward. As such, meeting revenue goals and expectations is more likely to occur and transparency is increased. However, this data is extremely positive and any negative client growth or decreased average spend may become reasons for a sell-off into the future. For now though, there is little data to suggest that average spend will fall, and the available market will continue to allow for client growth.

Endava Presentation Endava Presentation

As management put it in the earnings webcast:

[W]e’re seeing a mixture of responses to the macro uncertainties. Some clients are trimming or delaying, the others are accelerating in terms of what they’re doing and growing their spend with us. There are some sector themes to this. So, some sectors such as payments, including the horizontal that’s cross sector that I described during the opening remarks, banking, capital markets, insurance, mobility that includes especially automotive and travel, we’re seeing strong growth in those areas, still no sign of pullback.

And actually, those are areas where as a company, we have particularly high exposure. Across all those that I’ve just mentioned, is about 70% of our business. We’re seeing some weakness become more apparent, particularly in TMT across all geographies, but the area that is most visible to us is around West Coast Tech, that is seeing a sharper pullback and that’s probably the one change that we got from when we guided last time. It’s not a huge part of our business. So, it has not had a huge impact. So, the rest of it is just maintaining the prudent caution that we had in our guide last time.

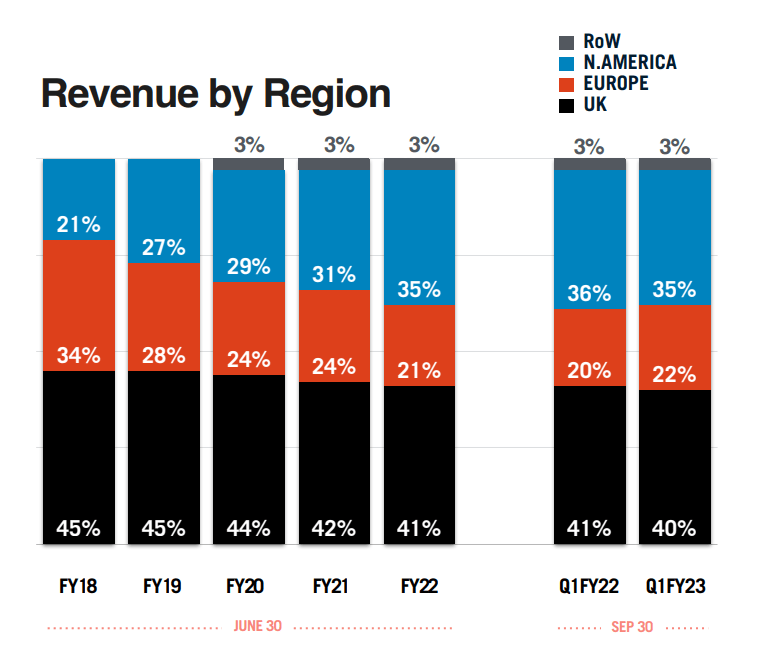

While organic growth can be relied on across most revenue segments, another critical factor that allows for investors to expect continued above average revenue growth is from the effects of the strong dollar. Endava’s primary operations are based near-shore, meaning that profits from US and Pound-based currencies can be reinvested cheaply in emerging markets in Eastern Europe, South America, and other lower-cost regions. For FY 2022, over 35% of revenues are based on the USD and this portion is growing every year.

This corresponds to a 15-20% YoY weakening of the pound during the same time, or a 8% boost to revenues on a constant currency basis last quarter. This effect causes revenues to increase YoY, and it is unknown how long these forex benefits will last. Just be aware that if the USD weakens as a potential recession appears, the reverse can be true and revenues will see a decline. Thankfully, the company is well diversified across a wide range of currencies, and this will mitigate volatile forex markets in the coming years.

Endava Presentation

Profitability

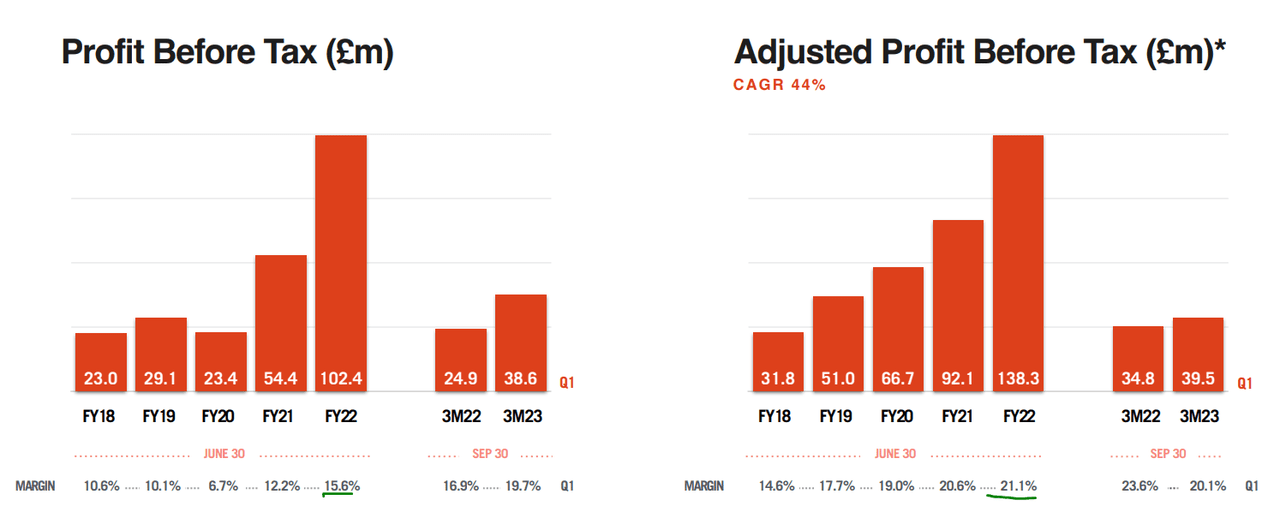

While Endava has significant revenue growth momentum for investors to rely on, profitability also remains a quality indicator for the bullish thesis. This quarter, a record high 38 million pounds of pre-tax profit was earned at 19.7% margin. This continues the upward trend in profitability of the past five years, with Endava now having an adjusted pre-tax CAGR of 44% per year from 2018 to 2022. This profitability is likely to continue as higher value services are rendered with the top customers, especially recurring revenues. In prior articles, I highlight how these high growth and profit margins compare with peers such as EPAM (EPAM), and this trend is set to continue.

There were also some key points to consider from the earnings webcast. Profitability was at a record high mainly due to pricing increases and low SG&A. However, to remain competitive, wages are increasing in 2022 in order to retain talent. However, management does not expect the current 20%+ PBT margin will fall to their prior mid-term goal of 17%, as they focus on remaining at the 20% level. The ability to be nimble on their feet in terms of pricing and costs will likely allow for the continuation of their growth and profit trends well into the future.

Endava Presentation

Valuation and Outlook

Despite continued forward growth, Endava remains at a record low valuation. This earnings may be the signal that the market needs in order to buck the downward trend in valuation over the past year. We can also consider that the company is still undervalued despite the 15% jump in price today, as both revenues and earnings grew at a higher percentage.

With TTM revenues now at $888 million and the market cap at $4.6 billion, the current P/S ratio is 5.0x. This contrasts with peer EPAM, who is growing slower and offers lower profit margins, trading at a 4.35x P/S. Considering the growth prospects of Endava are better, and the stability of the investment is on equal terms with EPAM, I believe that the current valuation remains favorable for investors.

Conclusion

Thanks to the performance of this quarter, I feel comfortable with my longterm investment in Endava and I will continue to add on a recurring basis for years to come, barring major issues. This is because the company is able to perform well in the face of multiple headwinds across the market. The ability to organically grow both clients and average spend this late into 2022 is a great sign, even if the market continues to stumble.

Considering the share price jumped 15% today on the good report, I assume most investors continue to hold the same positive outlook that I have. I even expect to make DAVA one of the largest holdings in my portfolio.

Thanks for reading.

Be the first to comment