jetcityimage

Snap-on, Inc (NYSE:SNA) is a leading global manufacturer of hand and power tools and related products and services for professional users performing critical tasks. The company operates in four reportable business segments; the Commercial & Industrial Group (“C&I”); the Snap-on Tools Group (“Tools”); the Repair Systems & Information Group (“RSI”); and Financial Services.

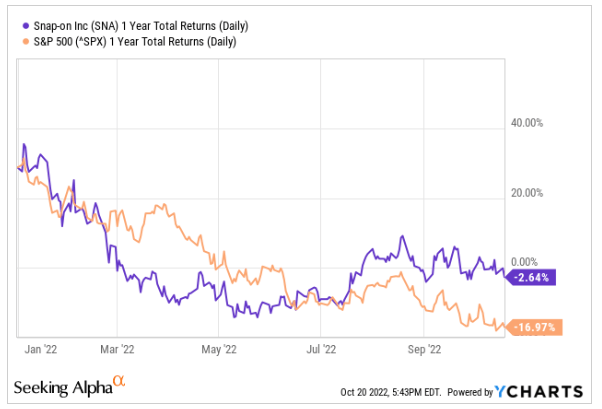

Over the past year, the stock has been one of the few places in the market to find shelter, with a 1-YR decline of 2.6% versus a nearly 17% decline in the broader S&P 500.

YCharts – 1YR Total Returns Of SNA Compared To S&P 500

Following their recent earnings release, SNA shed 5% and shares are now down 5% YTD. For prospective investors, the stock offers market-beating stability, in addition to continuous dividend payments that are growing at an attractive compound growth rate. The company’s outlook is also positive and will remain supported by steadily increasing demand for vehicle maintenance and repairs. Though upside exists, it may not be enough to satisfy those seeking deep-end market bargains. For those seeking shelter at a reasonable cost, however, SNA remains a quality portfolio holding.

SNA Q3FY22 Earnings Recap

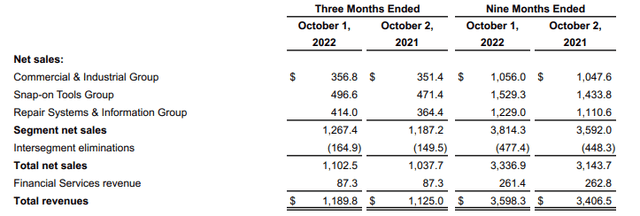

For the quarter ended October 1, 2022, SNA reported total consolidated net sales excluding financial services revenue of +$1.1B. This was 6.2% greater than the same period last year and +$30M better than expected. Unfavorable foreign currency translation (“forex”) weighed on total consolidated sales by +$39.1M. Organic sales, on the other hand, which refer to sales from continuing operations, excluding forex effects, were up 10.4%.

While gross profit (“GP”) was up 2.3%, margins were down by 190 basis points (“bps”) due to higher material and other costs, offset primarily by higher overall sales volume and favorable pricing actions resulting from the company’s rapid continuous improvement (“RCI”) initiatives, which are a structured set of tools and processes intended to eliminate waste and improve operations across their multiple businesses and geographies.

Savings from their RCI initiatives were also realized in total operating expenses, which, as a percentage of net sales, was down 280bps during the quarter. This fed into overall operating earnings before financial services that came in 11% higher than last year with 90bps improvement in total operating margins.

When including financial services, which posted results that were effectively unchanged from the prior year, total operating earnings were higher by 6.6%, with just 20bps of improvement in total margins.

Within the individual segments, total revenues were earned proportionately across the three non-financial services groups, with Tools representing the largest share of non-financial segment revenues at 39%.

Q3FY22 Form 10-Q – Total Net Sales Disaggregation By Segment

Leading the way higher in the current period was the RSI group, whose segment revenues were up double digits, including 17.2% of organic sales growth, attributable primarily to double-digit increases in activity with OEM dealerships and in sales of undercar equipment.

In addition to driving revenue growth in the current period, RSI also contributed favorably to operating margins, seeing an improvement of 10bps from last year versus declines of 20bps and 60bps in Tools and C&I, respectively.

Overall, the three non-financial segments all reported revenue growth that was weighed down by forex effects, particularly in the C&I group, who incurred a 6.4% hit as compared to 2.1% and 3.6% in Tools and RSI, respectively. Additionally, GP margins were weaker in the three segments, but this was offset by strength in overall expense control.

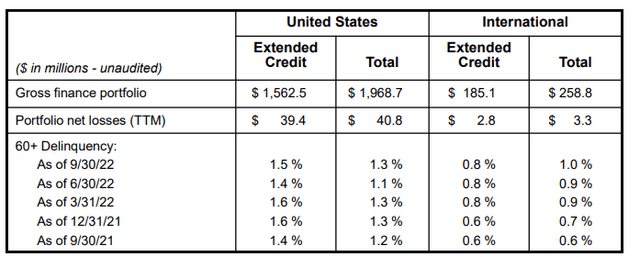

In the Financial Services segment, revenues were essentially unchanged but operating earnings were down 5.9% due to greater provisions on credit losses. Average yields on finance and contract receivables, however, remained consistent. And this was paired with an 11.5% increase in originations.

Q3FY22 Earnings Presentation – Summary Of Financial Service’s Segment Metrics

Total cash flows during the quarter remained positive but were down from last year due primarily to working capital investments, particularly in inventory, which is now up +$151M from 2021 year-end levels. Turnover, however, remains consistent at 2.6x versus 2.8x at the beginning of the year.

Overall, SNA generated +$81M in free cash flow during the quarter and about +$264M YTD, leaving them in a quarter end cash position of approximately +$760M, with more than +$800M available under their revolving credit facilities.

Post-Earnings Insights

SNA continues to be a leader in high quality tool and diagnostic equipment for the professional vehicle repair sector. In the current quarter, overall sales were supported not only by favorable pricing actions but by higher volumes, which is indicative of the quality of their high-service strategies that are built around its large franchise base.

It is also suggestive of the continuing demand for vehicle maintenance and repairs, especially on a steadily increasing population of older vehicles, whose average age is around 12 years. As both used and new cars increasingly become out of reach for many buyers, more will likely opt-in to holding on to their vehicles for as long as they can. This should serve as a tailwind for SNA’s C&I and Tools group.

Reinforcing this view were the positive trends noted on the conference call. These trends include higher repair spending and some of the highest technician counts seen in decades due partly to above-average wage growth in the sector, resulting from increased demand for critical repair skills on modern vehicles with more complex technological components.

Continuing demand strength enabled SNA to post their 9th straight quarter of YOY expansion. But this was partially offset by negative forex effects that affected all segments, particularly C&I, which benefited from double-digit gains in the segment’s Asia Pacific operations and specialty tools business but was weighed down by over 6% from forex.

And despite pricing strength, gross margins still came in lower due to increased material and other costs, though this was offset by adequate operating expense control, most notably in the RSI segment, who reported a 400bps improvement in operating margins from last year.

Results were also weighed down by their Financial Services segment, who reported essentially no change in YOY revenues but contributed nearly 6% in declining operating earnings. While the segment accounts for less than 10% of total consolidated revenues, it’s a high margin business that accounts for over 20% of total operating earnings. So, any margin weakness in this segment would disproportionately affect the consolidated figures.

One can point to the increase in credit provisions as one concern, but the increase was essentially a normalization from the historically lower provision rate experienced last year. And when compared to the rates from 2017-2019, current year provisions are still lower. Credit conditions, therefore, still appear stable despite the uncertain macroeconomic environment.

Besides the forex effects, which is unlikely to last over the long-term, SNA does not appear to be at risk of any potential slowdown in economic conditions. The industry tends to exhibit greater resistance to recession due to the essential nature of vehicle repairs and maintenance. This should provide SNA with a continuing source of positive cash flows that will add to their existing liquidity profile, which is already strong due to their limited debt load.

At 12x forward earnings, SNA trades at a discount to the broader S&P 500, which is currently trading at about 16x. The multiple is also slightly lower than their five-year average of 14x. While there is some upside embedded in the stock, it may not be enough in the near-medium term for investors seeking deep market bargains.

Shares do come with a reliable dividend payout with a strong track record of double-digit growth rates. But the current yield isn’t attractive enough compared to other risk-free alternatives. While not the most compelling for new investors, existing shareholders will likely benefit from continued stability and a modest rebound in the current share price upon any reversal in current market sentiment.

Be the first to comment