Sean Gallup

Thesis Summary

Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) is one of the most robust companies, but it has fallen alongside other Wall Street darlings. The general market has suffered a multiple contraction, due to the reduced liquidity in this tightening cycle. Though this has been priced in, Google and other companies now face an earnings recession. The American economy is now forecast to enter a recession in 2023 with a 100% likelihood (according to Bloomberg) which means lower demand.

When all is said and done, investors will be left with a generational buying opportunity, and we must be aware that the market is a forward-looking mechanism, so stocks will likely bottom well before the economy does.

Google’s Multiple Contraction

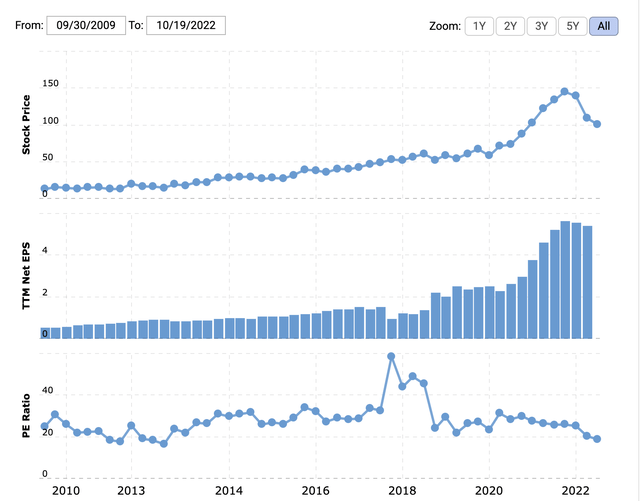

When looking at Google’s stock price decline, there are two key factors coming into play. First off, like most other stocks on the Nasdaq, Google has suffered significant multiple contractions.

At its peak in June 2021, GOOGL shares were trading at a PE of over 30. This has now declined to under 20. There are various factors coming into play here. As I will address below, expectations are an issue, but it’s clear to anyone following the market that this has been a market-wide phenomenon.

Equities have been repriced to the downside over the last 6 months due to notable increases in Treasury yields, which act as the benchmark rate for the economy. In simple terms, the discount rate has increased, making cash flow less valuable and equities less attractive in terms of risk/reward.

Google’s Earnings Recession

However, it’s not just a matter of liquidity drying up in the market. The US economy is probably going to enter a recession in 2023, affecting earnings and earnings expectations. This change is even more noticeable in tech companies like Google, which actually saw their earnings boosted to an extent by the covid pandemic.

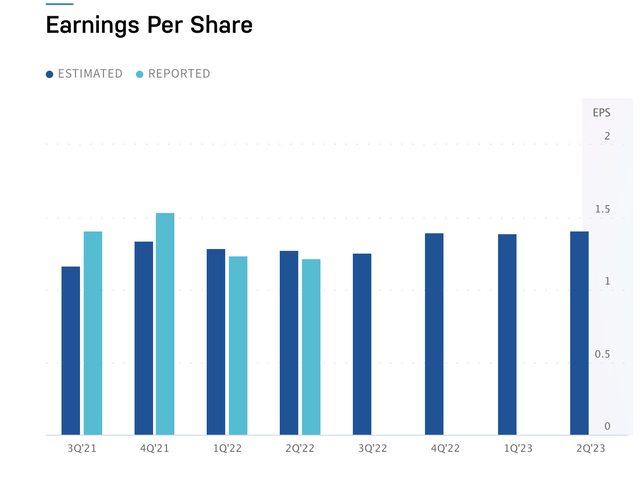

As we can see above, GOOGL was beating earnings solidly in 2021, but this soon changed in 2022. Analysts were expecting a slowdown, but the fall in revenues was more pronounced than they had anticipated, with Alphabet missing earnings in Q1 and Q2.

The question now is, what happens moving forward? Lower earnings are baked in already, but there’s a margin for further disappointment or perhaps a surprise. As I write this, Tesla (TSLA) is down over 6% after announcing earnings, but we also saw Netflix (NFLX) rally 13% following an earnings beat.

Which way will Google go, and what will investors be paying attention to coming into this earning season?

What to Look For in Q3

A recession is likely imminent, and while there are a lot of nuances to this statement, it is mostly true that advertising and marketing are the first expenses a business cuts. Revenues are inevitably going to slow down, the question is; what expenses is Alphabet going to cut to improve the bottom line?

CEO Pichai recently addressed allegations that the company was “nickel and dining employees.

Fun didn’t always – we shouldn’t always equate fun with money. I think you can walk into a hard-working startup and people may be having fun and it shouldn’t always equate to money.

Source: Sundar Pichai

I think the upcoming earnings call will be an important event for investors to get a sense of just how much Google can squeeze profitability.

Another big topic of conversation, no doubt, will be the performance of YouTube. The video streaming platform had been one of the fastest growing segments, but we already saw signs of weakness in the last quarter, in which revenue rose 5%, netting Google $7.3 billion. I expect YouTube numbers to be disappointing again. While Search engine advertising should hold well in a recession, video and social media forms of ads will be the first to go.

Though this won’t have so much bearing on the immediate share price, investors should also get some insights into Waymo. The self-driving division of Alphabet has now launched self-driving ride-sharing in Los Angeles, which marks the third city where Google has rolled out this service. Without a doubt, driverless technology will be one of the most significant markets of the future, and Google is currently competing head-to-head with Tesla on this front.

Lastly, it’ll be interesting to see what management has to say about the regulatory threat, which seems to have ramped up over the last few months. Texas has just sued Google over its collection of Biometric data. More significantly, though, Google is facing a $4 billion antitrust lawsuit from the EU for its 2018 Android system operations. The second-highest court in Europe upheld the EU ruling last week.

Now that every penny counts for Google, I expect the company and investors to take the regulatory threat much more seriously.

Takeaway

In conclusion, I expect some more pain ahead for Google in the coming months, but this is still by far my highest conviction pick. In fact, I believe 2023 will offer investors a generational buying opportunity. I advise holding on to your position and dollar-cost averaging on the way down. Google, and the broader market, will bottom way before the economy does. It happened in 2009 and 2020, and I believe it will happen again in 2023.

Be the first to comment