gorodenkoff

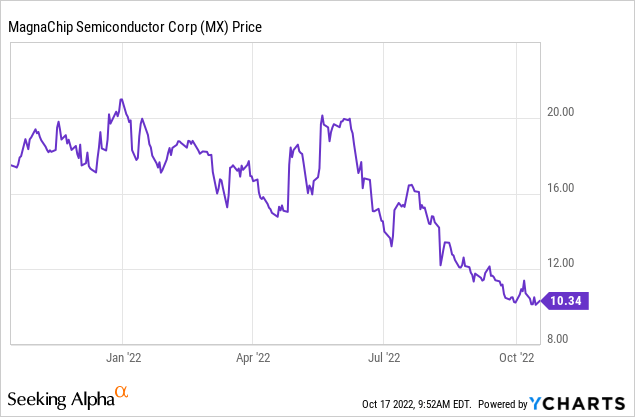

Magnachip Semiconductor Corporation (NYSE:MX) has performed extremely poorly over the past year. It is now a $454 million market cap semiconductor company with a $50 million buyback program. I think some big holders have indicated they want out (note the price action), and MX will probably negotiate a price where to take them out.

I have egg on my face, as I’ve been bullish from a signed deal (that got blocked) to rumors of another deal (that didn’t come to fruition). I’ve been holding and even adding on the way down. If you hold on to losers while your thesis changes to justify this, that’s called “thesis drift,” and that’s justifiably viewed as bad practice. I feel conflicted, but Magnachip seems highly undervalued at $10.12 per share.

Admittedly, business is far from perfect. From the last earnings call:

First, in the second half, we are facing further supply constraints of 28 nanometer 12-inch wafers. Lower wafer allocation from our foundries impacted our new design-in assignments for second half of 2022 from our large panel customer in Korea.

This supply constraint resulted in a 44% year-over-year in OLED revenue decline to $24.6 million.

This decline obscured the performance of power solutions which booked solid growth year-over-year:

Now, let’s turn to the Power solutions business. It was another solid quarter for our Power solutions business driven by strong demand for our premium power products, as well as BatteryFET products. Our Power solutions business revenue in Q2 was $63 million, up 11.1% year-over-year and down 2.9% sequentially. The year-over-year growth was driven by continued strong demand across the board for almost all of our products but particularly for our premium products such as our Super Junction MOSFET, Power IC and IGBT in key end markets like communication, consumer, industrial and computing, all driven by trend in electrification of everything.

But ultimately, the company guided towards a weak third quarter:

Our results will be challenged by some of the things I just mentioned and further OLED wafer shortages as well as cost challenges, including labor, due to inflationary pressures. While actual results may vary, for Q3, Magnachip currently expects revenue to be in the range of $70 million to $75 million, including about $9 million of Transitional Foundry Services, gross profit margin to be in the range of 26.5% to 28.5%.

Longer term, management expects things to look better because its OLED division should deal with the supply problems, and both Power and OLED should be growth segments. Especially with power, this is easy to believe, as the products are used in renewable energy generation and everything that’s getting electrified. Electrification is an important piece in the ongoing energy transition, and that’s a tailwind to MX.

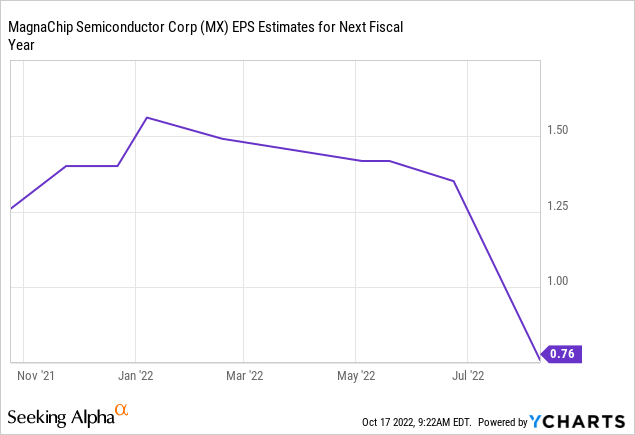

Analysts have adjusted their EPS estimates for next year in a big way. The estimates have halved. This looks a bit negative to me unless OLED doesn’t come back. At the end of the day, I don’t think the stock is expensive if the estimates are correct.

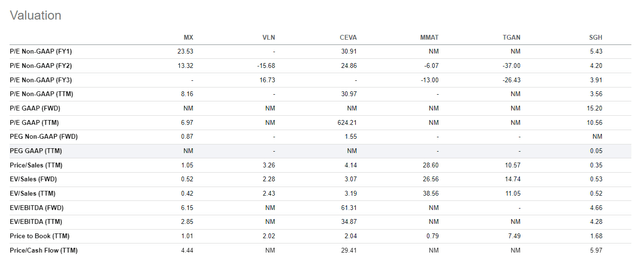

I pulled up the peer group from Seeking Alpha, and it includes Maxeon Solar Technologies (MAXN), Valens Semiconductor (VLN), CEVA, Inc. (CEVA), and Transphorm (TGAN):

valuations MX peers (Seeking Alpha)

The sales metrics are most interesting among the above. Magnachip trades at the lower end of the ranges here. The EV/Sales metric takes into account the huge amount of cash.

Finally, though deals have been falling apart for different reasons, there’s still a push to unlock some shareholder value here:

Yes, as we mentioned, we have reactivated Strategic Review Committee and they’re responsible for reviewing, considering, exploring and evaluating all the strategic alternatives. And that is to mainly to maximize shareholder value. And one of their mandates also includes reviewing the company’s capital allocation plan and also looking at other active strategic and transitional activities. So I think that is very good to look at all the alternatives, as well as reviewing the company’s capital allocation plan.

The easiest thing would be just to dividend out $6 per share or increase the monster buyback program even further. That would help a lot, and it only requires the willingness of the company’s own board. A very low hurdle, I would suppose. The company has shown a willingness in the past to sell segments of the company, which is a positive sign. The company could dividend out $6 (and I would argue it could dividend out more). Afterward, it would only trade at an 8x forward earnings multiple (based on analysts’ estimates that I find conservative).

I initially wrapped this article up, saying it is a clear hold. My editor pointed out that I labeled it a buy and called it undervalued. I think I should add some context. For me, Magnachip is a top-6 position in size (and I’ve been holding it from a much higher price).

I tend to prefer situations where there’s some catalyst on the horizon. Ironically, it is likely that lack of catalysts that have driven all of the merger arbitrageurs away and left this small-cap Korean semi left for dead in a brutal bear market. The price here is so low that I prefer holding to moving on, given my existing position. Suppose I didn’t own it already and went through the disappointing process of two deals falling apart. In that case, I could see myself buying purely because of valuation even without the presence of a clear catalyst.

Be the first to comment