CagdasAygun/E+ via Getty Images

The Vanguard Ultra-Short Bond ETF (BATS:VUSB) provides investors with exposure to short-term investment-grade fixed income securities. However, its returns to date have been disappointing. The main attraction, its distribution yield, has also been disappointingly low, less than treasury bill yields. I would avoid this fund.

Fund Overview

The Vanguard Ultra-Short Bond ETF provides exposure to short duration bonds with average expiry less than 2 years. The fund has close to $3 billion in assets.

Strategy

The VUSB ETF invests in a diversified portfolio of fixed income securities with average maturity under 2 years. Investments may include asset-backed bonds, government bonds, and investment-grade (“IG”) corporate securities. Although the fund has minimal duration risk due to the short duration of its portfolio, it does carry credit risk, and the fund should not be viewed as a substitute for money market funds.

Portfolio Holdings

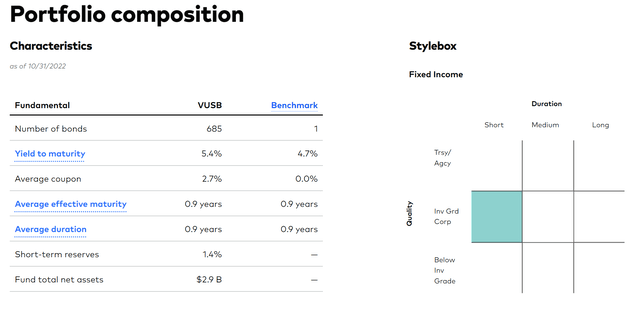

The VUSB ETF holds 685 positions with average yield to maturity of 5.4% and average duration of 0.9 years (Figure 1).

Figure 1 – VUSB ETF portfolio composition (vanguard.com)

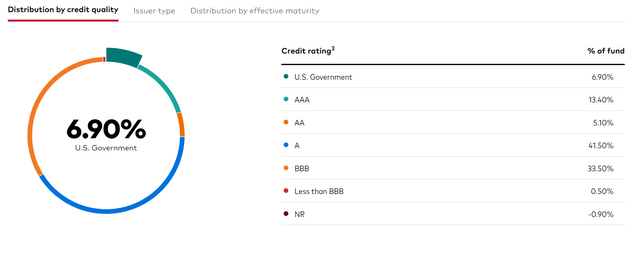

VUSB’s portfolio is predominantly rated investment-grade (93%) and treasuries (7%) (Figure 2).

Figure 2 – VUSB ETF distribution by credit rating (vanguard.com)

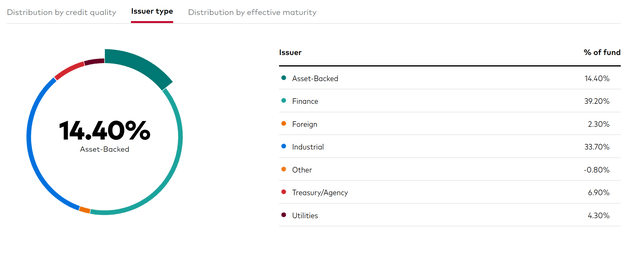

Grouped by issuer type, the portfolio is 39% issued by financial companies, 34% issued by industrials, and 14% issued by asset-backed structured finance (Figure 3).

Figure 3 – VUSB distribution by issuer type (vanguard.com)

Returns

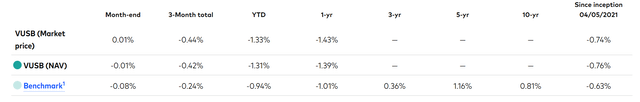

VUSB was incepted on April 4, 2021, so it has limited operating history. However, returns to date have been disappointing, with 1Yr returns of -1.4% and since inception average annual total returns of -0.7% to October 31, 2022 (Figure 4).

Figure 4 – VUSB ETF returns (vanguard.com)

Distribution & Yield

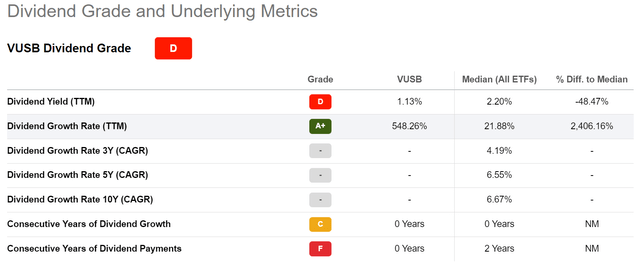

Although VUSB has a 30-Day SEC yield of 4.58%, this is based on the portfolio holdings’ yield to maturity for the prior 30 days. Actual distribution yield for the ETF has only been 1.1% on a trailing 12 month basis (Figure 5). VUSB’s distribution is variable and paid monthly.

Figure 5 – VUSB trailing distribution yield (Seeking Alpha)

Fees

VUSB charges a 0.10% expense ratio.

Struggle To Understand Attractiveness Of VUSB

Presumably, the attraction of short-term fixed income funds like the VUSB is its low effective duration and potential for yield. However, with a trailing yield of only 1.1%, I struggle to understand why investors should own VUSB.

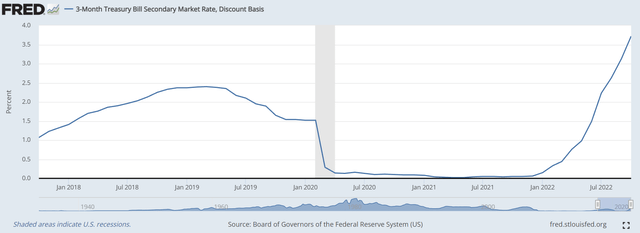

For example, with the Fed’s aggressive interest rate hikes so far in 2022, even 3 month treasury bills are yielding 3.7% (Figure 6). Treasury bills have no credit risk, unlike the portfolio held by VUSB.

Figure 6 – Treasury bills are yielding over 3% (St. Louis Fed)

Alternatively, investors can take a look at the US Treasury 3 Month Bill ETF (TBIL) that I recently reviewed. TBIL owns a basket of treasury bills, and pays a distribution yield that approximates treasury bill yields.

Conclusion

The VUSB provides exposure to short-term investment-grade fixed income securities. However, its returns to date have been disappointing. It also has not paid out a distribution close to the yield to maturity of its underlying portfolio, reducing its appeal. I would avoid this fund.

Be the first to comment