bjdlzx

(Note: This article was in the newsletter on September 3, 2022.)

Crescent Point Energy (NYSE:CPG) management had a little noticed statement in the latest quarterly report that cannot be emphasized enough. Management was disposing of noncore assets and so was adjusting the production guidance. Even though now is clearly the time to sell assets (especially those smaller holdings that appeal to a limited market) many companies do not “clean house” until the next market bottom.

“Cleaning house” during a time of weak commodity prices usually results in very poor sales prices that can cost investors a whole lot of money. Just ask EQT (EQT) shareholders who are now benefiting from the purchase of Chevron (CVX) properties back in 2020 when commodity prices were nothing close to where they are now (and no one was even thinking about the current environment as a possibility). There is an excellent possibility that the sale in 2020 cost Chevron shareholders billions (instead of trying to sell it currently or spin it off to shareholders as a separate company).

Similarly, Crescent Point Energy purchased assets from Shell (SHEL) Canada back in the beginning of fiscal year 2021. Selling at the wrong time in the market cycle can cost shareholders a whole lot of money even in a large company. The reason is that back in 2021, the parties negotiated a price back in fiscal year 2021 that likely involved far lower future prices than what actually happened.

A company like Crescent Point (or even EQT) whose management knows where they are in the business cycle knows that as the cycle progresses, prices will strengthen during a recovery. Therefore, the coming profits should raise the return on equity because money coming back sooner is worth a whole lot more than money coming back later.

Properties that come on the market now will undoubtedly concede that future commodity prices will be lower if they want to sell their properties. But that concession is buffeted by the sky-high prices in the current market to result in a far better deal for the seller than was the case back at the beginning of fiscal year 2021.

In the commodity business, the product is not differentiated. So, finding competitive moats is a real challenge. Many do not realize that superior execution can be a long-lasting competitive advantage even if it is not a moat in the traditional sense. The market tends to not value superior market execution because it is not tangible and therefore seen as less reliable. But competitive moats also have risks as well. Personally, I have always gone with superior management because managements like Chevron and Shell that leak a few billion here and there will someday leak a lot more at the expense of shareholder performance.

Extra money here and there is often how a company reports above average profits when the product itself is not differentiated so “everyone” receives the same selling price. Therefore hard-driving detail-oriented management is absolutely essential to make sure none of those potential profit pennies escape getting to reported profits. Crescent Point Energy management appears to have that kind of management.

There may be impairment charges during the next cyclical downturn. But Crescent Point Energy management appears to know when to sell noncore properties. It is a lesson that many managements never learn to the detriment of shareholders.

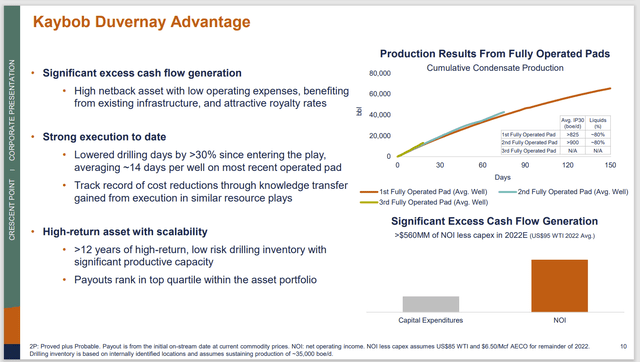

Crescent Point Energy Condensate Exposure From The Kaybob Duvernay Leases (Crescent Point Energy September 2022, Corporate Presentation)

Not only were the properties from Shell purchased at the right time in the market cycle, but also the company purchased leases that produce a premium product (condensate). The Canadian heavy oil and thermal industry mixes condensate with their production so that it can properly flow through pipelines to refineries. Canada is nearly always in the position of importing condensate because it does not produce enough.

One of the very nice things about premium price products (to WTI) is that they often outperform even in down markets. Should the premium disappear because demand temporarily exceeds supply in a down market, there is still plenty of room for decent cash flow at a time when cash flow is extremely important. Details are important in this industry. This is an example where management is making sure some extra pennies will be on the “bottom line” of the income statement for years to come.

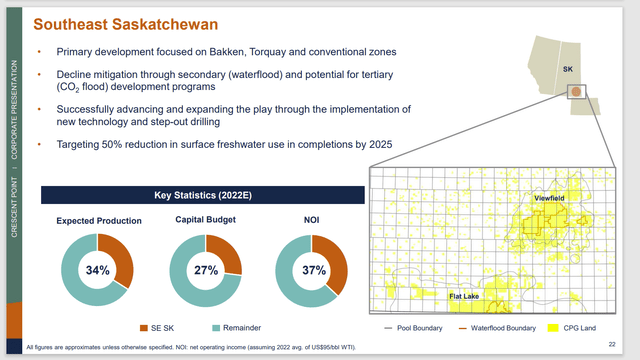

Crescent Point Energy Summary Of Southeast Saskatchewan Operations (Crescent Point Energy September 2022, Investor Presentation)

One of the other indications of superior management is finding a relatively low-cost secondary recovery project that results in some good margins. Southeast Saskatchewan has a generally thinner layer of Bakken interval oil (and other zones as well) that is shallower. The overall result is the ability to have a very competitive secondary recovery operation that has the usual low decline. This makes the average corporate decline rate lower because it offsets the typically high decline rate of the unconventional business that is so prevalent in the industry.

The Future

This management has gone from turning around a real financial mess to running a low debt company with some superior profit potential assets. The low purchase price of the assets from Shell should lower average corporate depreciation for years to come.

Depreciation itself represents the recovery of a sunk cost. Low depreciation translates into lower finding and development costs because usually the lease purchase cost was low. That kind of bargain eventually influences return on equity.

Rarely do companies include a location cost in the reported breakeven calculations for wells. Canada already has a big location cost because property purchases generally run lower than is the case for major United States basins like the Permian. Yet the profitability of Canadian wells is often as good or better than is the case in the United States.

The industry further benefits from paying for costs with the weaker Canadian dollar while receiving income that is often based upon United States dollar benchmarks.

Crescent Point Energy is listed on the NYSE as well as in Canada. That exposure combined with some business in North Dakota means that this company is in a position to achieve a higher valuation than many of its peers. Traditionally many Canadian companies trade at a discount to United States companies because Canadian stock markets do not reach nearly as many customers as in the United States. This company appears to be in the process of dealing with that.

Good management will usually surprise to the upside from time to time. Mr. Market rarely values anything that is not tangible. That often means that good management is usually a bargain for a number of reasons (only some of which are discussed here). The oil and gas recovery now has some age on it. But companies like this one can usually be purchased by a wide variety of investors even though the rally has been underway for a while. Superior returns from management like this makes CPG a worthy investment consideration.

Be the first to comment