Khanchit Khirisutchalual

Elevator Pitch

I assign a Buy investment rating to Blue Owl Capital Inc.’s (NYSE:OWL) stock.

OWL boasts a good mix of both defensive and growth characteristics, and its shares are valued by the market at a discount to its listed asset management peers. This makes Blue Owl Capital a Buy in my view.

Company Background

Blue Owl Capital describes itself as “an alternative asset manager” and “a leading provider of private capital solutions” in the company’s Q2 2022 earnings presentation slides.

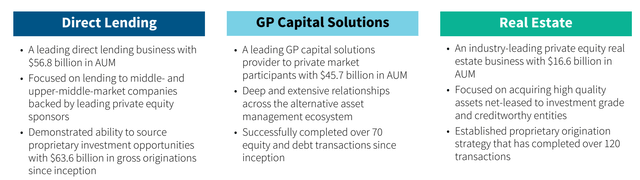

As of the end of the first half of 2022, OWL boasted an AUM (Assets Under Management) of $119.1 billion as indicated in its second quarter results press release. Specifically, the company’s Direct Lending, GP (General Partner) Capital Solutions, Real Estate investment strategies made up 48%, 38%, and 14% of Blue Owl Capital’s AUM, respectively.

A Brief Overview Of Blue Owl Capital’s Different Investment Strategies

OWL’s Q2 2022 Results Presentation

Defensiveness

In the current market environment, investors are seeking out potential investment candidates with limited earnings downside risks, and Blue Owl Capital clearly fits the bill.

In the first half of 2022, OWL generated distributable earnings and fee-related earnings of $336.1 million and $368.4 million, respectively. In other words, Blue Owl Capital’s distributable earnings are fully covered by fee-related earnings. As such, the company isn’t reliant on carried interest or carry, which is dependent on investment performance and tends to fluctuate significantly from period to period, to support its earnings. This is by no means the norm for alternative asset managers. According to OWL’s internal research detailed in its May 2022 Investor Day presentation slides, listed alternative asset managers on average have about half of their respective distributable earnings derived from fee-related earnings.

Furthermore, Blue Owl Capital earned 92% of its Q2 2022 fee-related management fees from permanent capital vehicles, which is way higher than its peers. OWL highlighted in its May 2022 Investor Day presentation that listed alternative asset managers on average have permanent capital vehicles contributing 39% of their fee-related management fees. This implies that Blue Owl Capital has a much lower risk of suffering from a big drop in earnings for any specific time period due to a spike in redemptions.

In a nutshell, it is reasonable to conclude that Blue Owl Capital’s earnings are very defensive.

Growth

It isn’t just about defensiveness when it comes to assessing Blue Owl Capital as a potential investment candidate. Most of OWL’s peers are very much reliant on new fund raising as a mean of growing future fee-related earnings. In contrast, Blue Owl Capital has other growth drivers.

The first key growth driver for OWL is the potential listing of its private Business Development Companies or BDCs.

In the company’s Investor Day presentation, Blue Owl Capital guided that its yearly management fees could potentially increase by between $185 million and $230 million following the IPOs of OWL’s private BDCs. In comparison, OWL’s annualized management fees amounted to $1,172.8 million (calculated by annualizing the Q2 2022 figure). This implies that the listing of the private BDCs might provide a management fee uplift of +15%-20% for Blue Owl Capital.

OWL’s management comments at its recent Q2 2022 earnings briefing suggest that it is more of “when” rather than “if” with respect to the planned listing of its private BDCs. At the company’s most recent quarterly investor call, Blue Owl Capital stressed that “we’re just looking for a good market environment” when questioned about the potential timing of the private BDC IPOs.

Blue Owl Capital’s second key growth driver is the deployment of its existing funds to grow fee-paying AUM.

OWL noted in its Q2 2022 financial results presentation that it has “AUM not yet paying fees” of “$8.8 billion” as of end-1H 2022, which can translate into annual FRE (Fee-Related Earnings) management fees of over $105 million.”

The company’s fee-paying AUM growth has been excellent, so it is just a matter of time before Blue Owl Capital sees a meaningful increase in management fees. OWL’s fee-paying AUM was $77.5 billion as of end-Q2 2022, which was equivalent to YoY and QoQ growth rates of +81% and +18%, respectively.

The third growth driver for OWL is margin improvement.

Blue Owl Capital revealed at its second quarter results call that it achieved a fee-related earnings margin of 62% in the recent quarter. There is room for OWL to further expand its margins on the back of positive leverage as it grows in size. Notably, Blue Owl Capital had previously highlighted in a November 2021 investor call that “we continue to target a range of 65% to 70%” with respect to “our FRE (Fee-Related Earnings) margin.”

Valuations

The market currently values OWL at a consensus forward next twelve months’ normalized P/E ratio of 15.0 times according to valuation data obtained from S&P Capital IQ.

In comparison, Blue Owl Capital’s peers, Blackstone (BX), Ares Management Corporation (ARES), StepStone Group (STEP), and Hamilton Lane (HLNE), are all trading at higher consensus forward next twelve months’ normalized P/E multiples in the 18-19 times range.

Bottom Line

Blue Owl Capital deserves a Buy rating. OWL trades at a discount to its peers, and I don’t think this is justified considering the stock’s mix of defensive and growth attributes.

Be the first to comment