Vladimir Mironov/iStock via Getty Images

When times are tough in the market, it can be difficult to remain confident in your assessment of a company when that company’s share price is moving against you. However, if the numbers still make sense, then your conclusion should probably still be accurate. And at the end of the day, that kind of scenario only requires a great deal of patience until the market comes to realize what kind of value the firm in question offers. One example of a company that has experienced a lot of downside recently because of general pessimism in the market, but that ultimately does have upside potential based on where shares are trading today, is Seaboard Corporation (NYSE:SEB).

This firm, which focuses largely on the production of hogs and pork processing in the US, also engages in trading and grain processing activities in Africa and South America. It also provides cargo shipping services in various markets, as well as sugar and alcohol production throughout Argentina, and electric power generation in the Dominican Republic. With a diverse set of operations under its belt, the company has done well to generate growing sales and robust cash flows in the current environment. But even so, the market has met these returns with downside pressure. Given how shares are priced, however, I do still think the company offers investors nice upside, leading me to keep my rating on the company as a ‘buy’ right now.

Focus on the fundamentals

The last time I wrote about Seaboard was in an article in the middle of April of this year. At that time, I was covering how the company performed during the final quarter of its 2021 fiscal year. Even though the company had suffered from a profitability perspective during that year, overall sales were impressive. I remained confident at that time that the fundamental picture of the enterprise was robust and I believed that shares were attractively priced. This, all combined, led me to rate the firm a ‘buy’, reflecting my belief that it would likely outperform the broader market for the foreseeable future. Since then, the market has fallen by 18.7%. Over that same window of time, Seaboard has generated a similar return, declining by 18.6% in all. While this is technically an outperformance compared to the broader market, it’s not enough to be material. Instead of performing as I would expect a ‘buy’ prospect to perform, it performed along the lines of what I would anticipate from a ‘hold’ rated company.

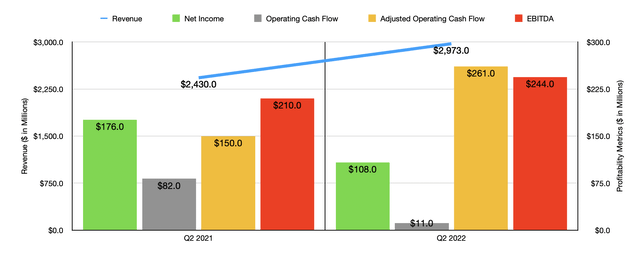

Interestingly, this market-matching downside came at a time when most of the fundamentals of the company remained strong. To see what I mean, we need only look at the most recent data covering the second quarter of the company’s 2022 fiscal year. During that quarter, revenue came in at $2.97 billion. That’s 22.3% higher than the $2.43 billion generated the same quarter just one year earlier. This increase in revenue came even as the revenue associated with the firm’s Pork segment dropped from $693 million to $661 million. The big driver, then, was the CT&M segment, short for Commodity Trading and Milling. Revenue there jumped from $1.38 billion in the second quarter of 2021 to $1.71 billion the same time this year. This increase, management said, largely reflected higher sales prices and, to a lesser extent, higher volumes of certain commodities to third-party customers that helped to offset lower volumes to affiliates. Another nice increase came from the Marine segment, with revenue jumping from $319 million to $523 million thanks to higher freight rates caused by strong demand and higher cargo volumes.

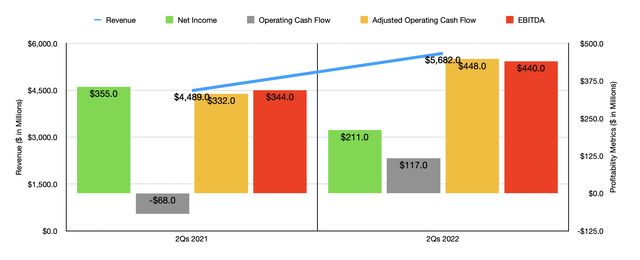

Although revenue rose nicely, profitability was a bit mixed. That income fell from $176 million in the second quarter of 2021 to $108 million the same time this year. Operating cash flow fared even worse, falling from $82 million to $11 million. But if we adjust for changes in working capital, it would have risen from $150 million to $261 million, while EBITDA for the company expanded from $210 million to $244 million. As you can see in the chart above, the second quarter alone was not the only strong time for the company this year. Revenue and the company’s cash flow metrics remained strong throughout the entire first half of 2022 relative to the same time last year. The only real weak spot involved net income, which fell from $355 million last year to $211 million this year.

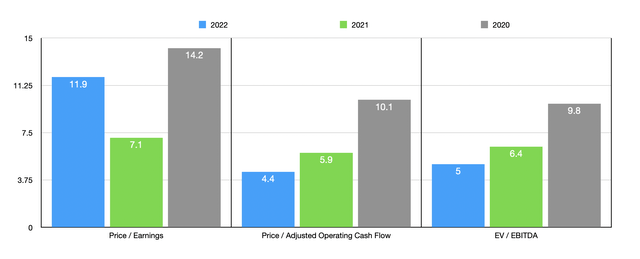

Unfortunately, we don’t really know what to expect for the rest of the current fiscal year. But if we were to annualize results experienced during the first half of the year, we should anticipate net income of $338.8 million. Adjusted operating cash flow should be higher at $923 million, while EBITDA should come in at roughly $813.5 million. Based on these figures, the company is trading at a forward price to earnings multiple of 11.9, at a forward price to adjusted operating cash flow multiple of 4.4, and at a forward EV to EBITDA multiple of 5. If, instead, we were to rely on data from the 2021 fiscal year, these multiples would be 7.1, 5.9, and 6.4, respectively. Of course, these are uncertain conditions in the economy and we don’t know what the future holds. But even if the financial performance of the company were to revert back to what we saw in 2020, these multiples, as the chart above illustrates, would still be fairly attractive. as part of my analysis, I also decided to compare the company to five similar firms, with the appropriate comparison being the 2021 data for each business. On a price-to-earnings basis, these companies ranged from a low of 24.3 to a high of 521.3. Using the price to operating cash flow approach, the range was between 8.1 and 84.8, while the EV to EBITDA approach resulted in a range of between 12.6 and 74.5. In all three cases, Seaboard was the cheapest of the group.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Seaboard Corporation | 7.1 | 5.9 | 6.4 |

| Lancaster Colony Corp. (LANC) | 36.3 | 36.4 | 21.2 |

| Hostess Brands (TWNK) | 24.3 | 13.9 | 14.7 |

| The Simply Good Foods Co. (SMPL) | 207.9 | 36.9 | 37.5 |

| Post Holdings (POST) | 85.8 | 8.1 | 12.6 |

| Cal-Maine Foods (CALM) | 521.3 | 84.8 | 74.5 |

Takeaway

What data we have today seems to me to be rather bullish when it comes to Seaboard. Yes, the company is bound to see some volatility should the economy worsen from here. But in the long run, we need to be focused on what the numbers say. Given how cheap shares are, the firm offers plenty of protection from additional downside. and once the market shows signs of coming back to health, the upside potential for this particular opportunity could be significant. Because of this, I have decided to keep my ‘buy’ rating on the business for now.

Be the first to comment