tsingha25/iStock via Getty Images

Credicorp (NYSE:BAP) is the leading financial services company in Peru with a presence in universal banking (Banco de Credito del Peru-BCP and Banco de Credito de Bolivia), microfinance (Mibanco and Encumbra), insurance and pensions (Grupo Pacifico and Prima AFP), as well as investment banking and wealth management (Credicorp Capital, Wealth Management at BCP and Atlantic Security Bank). The company’s recent quarterly earnings beat was mostly down to a solid net interest income performance, driving net interest margin (NIM) expansion while also managing the cost of risk lower. As a result, BAP saw its return on equity (ROE) hit an industry-leading 19.6% for the quarter, well above 16.9% in Q2 2022.

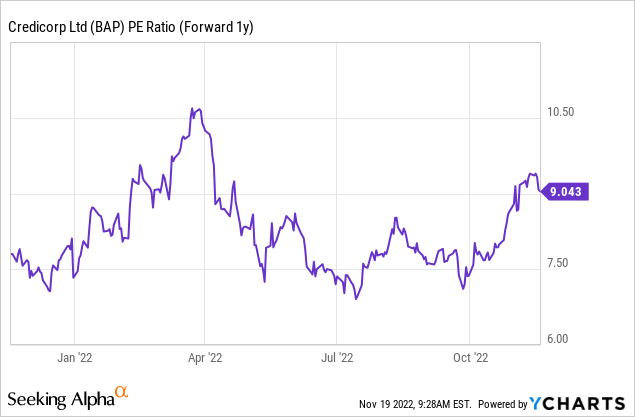

With the company continuing to benefit from higher interest rates (note the Q3 portfolio has yet to reflect the rate impact fully), the NIM expansion story still has legs, in my view. The stock currently offers good value at an undemanding ~9x fwd P/E despite the underlying earnings momentum and the prospect of an economic recovery in Peru over the next year.

NIM Expansion Headlines A Strong Quarterly Result

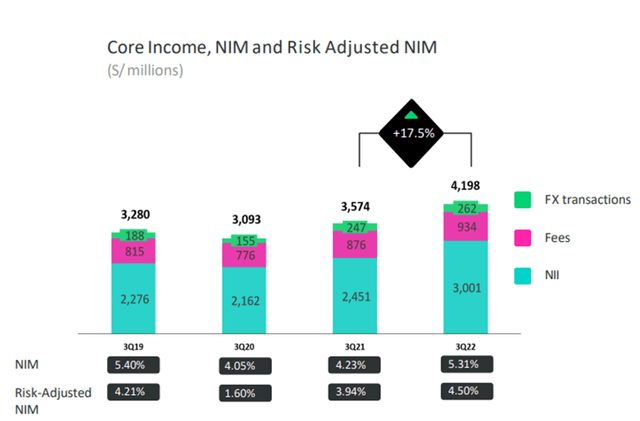

BAP’s latest quarterly beat was strong across the board, but the key takeaway was the significant +40bps NIM expansion QoQ at 5.3% (vs. 4.9% in 2Q22). To recap, net interest income rose +10% QoQ (+22% YoY), benefiting from the rising rate tailwind and active yield management, and driving the higher NIM. Total average loan growth also impressed at +2% QoQ (+4% YoY), as corporate and consumer loan growth reached +8% QoQ and +5% QoQ, respectively.

Credicorp

There were fewer positives from the cost management side, with operating expenses up +4% QoQ (+9% YoY), mainly from higher staff costs (+12% YoY). Still, outperformance on net interest income and other non-interest income (+33% YoY) led to a 42.8% efficiency ratio (i.e., non-interest expenses as a % of revenue) – a significant improvement from 44.6% last quarter. Elsewhere, the Grupo Pacifico insurance unit also impressed, with significantly improved underwriting results in the life business supporting an industry-leading 30% segment ROE. On a YTD basis, BAP now boasts a group-level 17.7% ROE (19.6% in Q3 2022).

Higher Provisions But Asset Quality Remains Under Control

The only real blemish on the quarterly results, in my view, was the +27% QoQ increase in net loan loss provisions (albeit from a low base). Of note, the accelerated new NPL formation is a concern, given it is running well above the trailing twelve-month average. A large portion of the charge-offs was from the small/medium business (SME) loan book, although this was down to a one-off regulatory change allowing BAP to write off SMEs that had Reactiva loans (i.e., a government loan guarantee scheme in Peru). Thus, I wouldn’t read too closely into the headline numbers or the lower coverage ratio this time around. Plus, the result still implies a solid 1.2% total cost of risk (1.4% ex-Reactiva), which is well below the 1.5-1.6% pre-COVID levels.

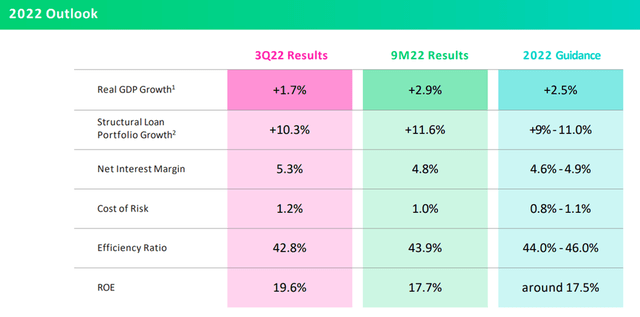

Reiterated ROE Guidance Could Prove Conservative

On the Q3 call post-results, management stood firm on its full-year ROE guidance of ~17.5% despite an improved fundamental outlook underpinned by better loan growth and stronger NIM expansion. To recap, the company has pegged its structural loan growth guidance at 9-11% and net interest margins within the 4.6-4.9% range. Insurance will continue to be the standout performer, but with the mid-term ROE guidance of 18-20% well below the 30% ROE in Q3 (but above pre-COVID levels), there remains ample upside here on better efficiency and further retail growth. The cost of risk guidance also seemed a tad conservative at 1.5-1.6% by end-2023 (in line with pre-COVID levels).

Credicorp

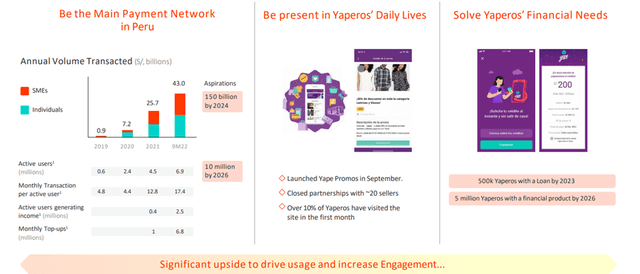

The key upside driver long-term remains digital, in my view, with the BCP digital client base already at 34% (i.e., clients with >70% of transactions completed through digital channels within the last six months). Growth here will likely prove accretive to earnings, given the cost-to-income ratio of digital clients runs ~13%pts lower than non-digital clients. From here, all eyes will be on its main app, Yape, which has reached 6.9m active users (up from 6m in Q2) and remains on track to reach 10m active users by 2026.

Credicorp

Discounted Play On The Peruvian Rate Cycle

There was little to fault in BAP’s latest quarterly results, with the company delivering NIM expansion and insurance growth while driving the overall cost of risk lower. Given the prospect of higher interest rates in the coming quarters, this earnings momentum should continue for some time yet. With management also opting to stay conservative on the NIM guidance for the full year (unchanged at 4.6-4.9%), the strong underlying momentum points to another bear-and-raise quarter ahead. The mid-term ROE target stays at 18% as well, but the near-term loan repricing impact and more efficiency gains could drive upward revisions down the line. The stock has deservedly rallied YTD, but at ~9x fwd P/E, there remains ample upside from a potential valuation re-rating and from rate/macro tailwinds ahead.

Be the first to comment