Darren415

This article was first released to Systematic Income subscribers and free trials on Nov. 12.

Welcome to another installment of our CEF Market Weekly Review where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the second week of November. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

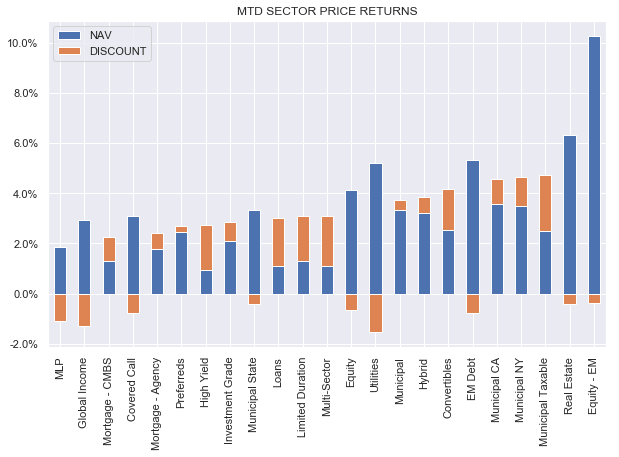

CEFs had a strong week with all sectors finishing in the green. Higher-beta and longer-duration sectors like REITs and Taxable Munis outperformed. MLPs are underperforming in November so far on the back of a downside surprise in inflation.

Systematic Income

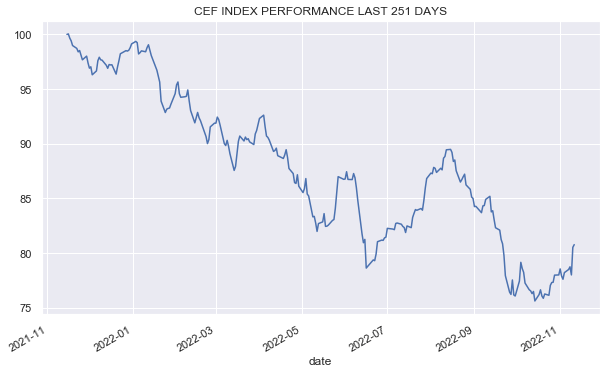

The CEF market has recovered somewhat after reaching a 25% drop.

Systematic Income

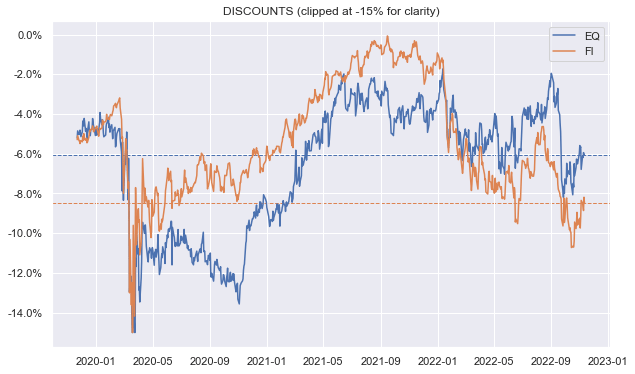

Discounts continue to tighten as fixed-income sector valuations continue to look more appealing than their equity counterparts.

Systematic Income

There have been a number of previous bear market rallies so only time will tell whether this one sticks or not. Even if inflation has peaked, a number of concerns remain for the market: first, how long the Fed will keep hiking at a slower pace, how long it will keep the terminal rate in place and the likelihood that the Fed will err on overtightening to ensure inflation does not remain sticky at current high levels.

Market Themes

An important question that came up on the service is whether we can expect CEF prices to make a full recovery. It’s always good to break down the return drivers of CEFs to get an intuition of whether this is likely. For fixed-rate credit CEFs, the drivers of returns are Treasury yields, credit spreads and discounts. For loan CEFs, it is credit spreads and discounts. For equity CEFs, it’s equity prices and discounts.

On top of this there are also, as always, realized losses such as defaults, trading losses and others. Deleveraging across many funds may or may not be a realized loss now since asset prices are low (i.e., the deleveraging likely happened at higher prices). However, if asset prices revert back, past deleveraging will have resulted in realized losses.

If we take fixed-rate credit CEFs, the sum of Treasury yields and credit spreads (using HY corporate bonds as the usual proxy here) was around 4% at the end of 2022 and it is now around 9%. It’s extremely unlikely we see this 9% number move back to 4%. It would likely require 1) inflation to move back to 1-2%, 2) Fed policy rate move to 0-2%, 3) credit spreads move back to their historic lows of around 3%.

The first two are certainly possible in a tough recession however if that’s the case it would preclude credit spreads moving back to their lows. And if credit spreads move back to their 3% lows (indicating a very robust economic environment) it seems unlikely that inflation would all of a sudden jump back to 1-2%.

In other words, it’s very hard to envision a scenario where both Treasury yields and credit spreads move back to their lows. That’s why the 2021-end combination of low Treasury yields and low credit spreads was so odd.

To see loan CEFs retrace their losses is somewhat more likely however the main issue with the sector now is that high short-term rates are putting a lot of pressure on loan borrowers so their quality is decreasing and if the quality is decreasing it’s hard to envision credit spreads move back lower either. A large drop in short-term rates will ease the pressure on interest coverage, however, it would also very likely be in the context of a severe downturn.

Equity CEFs could easily retrace their losses if stock prices come back – the relationship there is fairly clear. Covered call funds are unlikely to retrace their losses since they sell the upside to generate their yields. Also, many equity CEFs hold fixed-income securities which will weigh on their NAVs.

Finally, discounts are procyclical – i.e., they tend to follow NAVs. If NAVs move lower discounts widen out as well and vice-versa. This means we are very unlikely to see discounts tighten sharply while NAVs remain depressed. And because many CEF distributions have been cut, discounts are likely to remain wider than where they were at the start of the year even if NAVs come back.

All in all – it’s very unlikely we see a broad retracement in CEF prices in the near term. It’s going to be the usual “down the elevator, up the escalator” as the old adage goes. The most important driver of positive returns is likely going to be coupons rather than massive capital gains.

The saving grace of the current environment is that yields are very attractive – much more attractive than they were at the end of 2021. That’s why our Income Portfolios partially deallocated from CEFs and have been adding them back this year.

Market Commentary

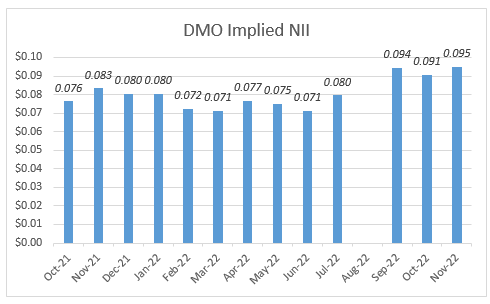

We are still waiting for Western Asset CEFs to declare distributions. These funds declare only quarterly and at a fairly random date. Western Asset Mortgage Opportunity Fund (DMO) and Western Asset Diversified Income Fund (WDI), being in the High Income Portfolio, are in particular focus. DMO has been releasing monthly Section 19 statements. Using these, net income has risen 14-30% depending on where you start over the past year. This will keep going since a lot of the rise has not yet fed through actual income. This doesn’t mean we’re going to see big dividend hikes later this month but it’s good to see the numbers working as expected. Both funds remain attractive.

Systematic Income

CEFs Virtus Convertible & Income Fund (NCV) and Virtus Convertible & Income Fund II (NCZ) bought back nearly all of their preferreds. In the near term, this means that the funds won’t have issues paying dividends as they won’t face any more regulatory constraints. They can easily replace the preferreds with repo, allowing them to maintain their full allocation rather than deleverage. The repo would also be cheaper than the preferreds.

This also highlights the possibility that some PIMCO CEFs will also hold a tender offer to buy back their preferreds. It would make a ton of sense as these preferreds are very expensive, having interest multipliers of 1.6-2x of short-term rates. This includes funds like PCN, PHK, PTY, PFL and PFN. These funds do benefit from relatively low management fees (vs. PDI, PDO etc) so it’s not necessarily that they should be avoided. We will be looking at this question in more detail in a PIMCO CEF monthly update.

Two Invesco CMBS CEFs Invesco High Income 2023 Target Term Fund (IHIT) and Invesco High Income 2024 Target Term Fund (IHTA) released shareholder reports. Net income held steady – a result of a partial allocation to floating-rate securities. NAV net income of the two funds are 7.3% and 6.4% respectively and is slightly higher on a price basis. Actual portfolio yield should be higher by 1-2%. It remains very odd that IHTA, which holds longer-maturity assets and is a higher-beta fund, has a lower net income yield. Most likely this is an artifact of its fixed-coupon profile and its actual portfolio yield is a bit higher than that of IHIT. The two funds have been pretty resilient – they are at roughly 2% discounts. Their year-to-date total price return is about half of HY or Multi-Sector CEFs and about 5% better than that of loan CEFs. A big part of the reason for this is that the funds have a term structure with expected termination dates in 2023 and 2024. Term CEFs tend to see discounts anchored much better than perpetual CEFs.

At around a 2% discount their term feature is much less compelling, especially as Invesco, unlike Nuveen, does not have a track record on term CEFs. They could easily extend the termination date with a shareholder vote. Closer to a high single-digit discount, which we saw briefly in the last couple of months, these funds become much more compelling. They are also attractive because of the relative value opportunities between them – occasionally they trade out of sync with each other which offers an opportunity for rotation. IHTA remains in a couple of our Income Portfolios.

Be the first to comment