Banphote Kamolsanei

With our 4th installment concerning MPLX’s (NYSE:MPLX): A Special Investment, management offered enough information, in our view, surrounding cash flow to make a defendable determination. Going forward, the business appears to be dropping from the sky lucrative amounts of cash (investor gold that is) for distributing reasonable sizes toward all three forms of return of capital: stock repurchases, special distributions and distributions.

Stepping Out into the Rain of Gold

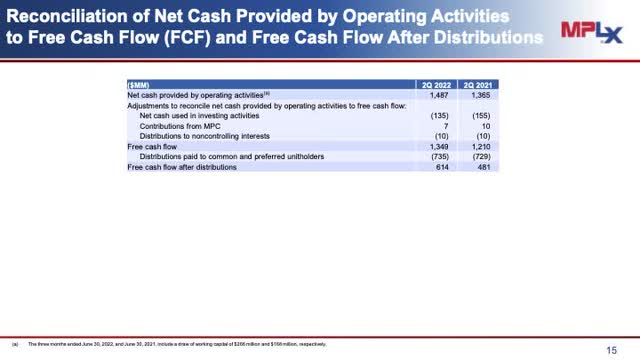

Let’s step out from under the porch into the action. Our analysis includes a set of slides from the past three conferences showing extra cash flow after the primary distribution. Before we begin, a reminder, the surplus cash shown in the slides includes all expenses except for special payments and stock repurchases. The first slide from the 2nd quarter shows that the company generated an additional $614 million.

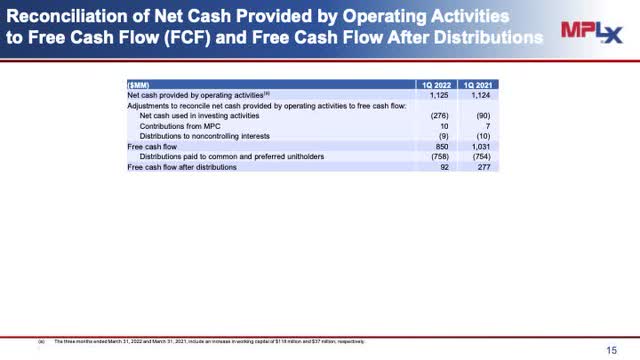

The second slide from the 1st quarter shows that the businesses generated $92 million in extra cash.

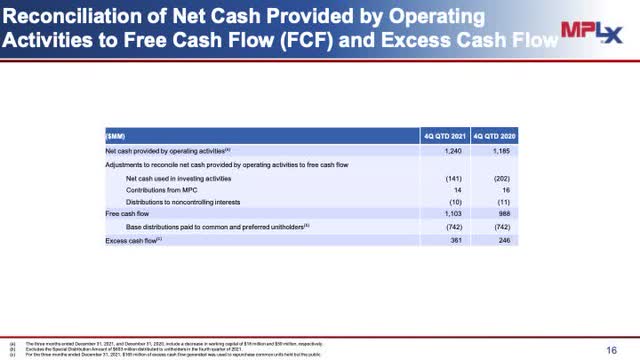

The last slide from the 4th quarter report shows excess cash at $341 million.

The next table displays cash after stock repurchases.

| Cash Flows | 4th Q | 1st Q | 2nd Q | Total |

| Excess Cash | $341 M | $92 M | $614 M | $1050 M |

| Repurchases | $165 M | $100 M | $35 M | $200 M |

| Differences | $174 M | -$8 M | $579 | $745 M |

Our 3rd quarter estimate assumes that the business performs the same in the 3rd quarter compared with the 2nd. A note at the bottom of the 2nd quarter FCF slide notifies investors that approximately $265 million in lower working capital aided the very positive cash results. During the call, management noted that most of the working capital savings will disappear in the 3rd quarter. The 3rd quarter cash flows might equal $614 – 2*$265 or $85 million. The total for the last 4 quarters equals $830 million.

In the prepared remarks, management noted, “And with the strength and stability of the business, we will evaluate an increase to our base distribution later in the year.” And “We announced an incremental $1 billion unit repurchased authorization” making a total of $1.2 billion available for repurchasing.

Estimating Excess Cash Expenditures

With three spots for expenditures, estimating how much for each requires some history, both recent and longer term. Last year, the company raised the basic distribution by $0.017 at a cost of approximately $70 million per year (Remember: the company does purchase stock, making the cost changes in the distribution non-linear.). Next, in the 3rd quarter of 2021 report, MPLX announced a $600 million special distribution (Slide 3). Finally, the announcement of adding $1 billion for stock repurchases with $200 million left in its plan, suggests that the company plans to spend more than $200 in this quarter for repurchases, perhaps $300 million. Adding up the three extra expenditures from last year equals $1 billion, slightly more than the $800 plus million in extra cash for the last four quarters. We suspect that stock repurchases might be $300 minus and that any special distribution will be less than $500 million. But, it seems to us that nice distribution expansion might be expected in November.

Risk & Investment

MPLX will increase its distribution in our view. A $0.015 per quarter or more adder increases the basic to $2.90 on a yearly basis. A special distribution less than $0.50 seems likely also. At stock prices near $30, MPLX is a steal. It appears to us that MPLX is still special with rains of gold falling down.

Risks always exist in investing. The world economy could once again shutdown. Infrastructures could be damaged. But for us, this is a special steal. We are stepping out from under the porch to enjoy the rain.

Be the first to comment