David Hecker/Getty Images News

On Wednesday, November 16, 2022, liquefied natural gas infrastructure provider Golar LNG Limited (NASDAQ:GLNG) announced its third-quarter 2022 earnings results. These results were disappointing on the surface as the company missed analysts’ revenue estimates, although it did significantly improve its net income. In fact, the company’s net income actually came in positive compared to the loss that it reported in the year-ago quarter. We also saw signs that the demand for liquefied natural gas continues to increase and Golar LNG began construction on a third floating platform for its fleet. This will ultimately result in fairly strong growth over the coming years as the story continues to play out. There is actually very little to complain about here as the year-over-year revenue decline was entirely expected and is part of the company’s conversion to a new and more stable business model.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Golar LNG’s third-quarter 2022 earnings report:

- Golar LNG reported total operating revenues of $68.626 million in the third quarter of 2022. This represents an 8.05% decline over the $74.636 million that the company reported in the prior-year quarter.

- The company reported an adjusted EBITDA of $85.209 million in the reporting period. This compares quite favorably to the $52.336 million that the company reported in the year-ago quarter.

- Golar LNG ordered $300 million worth of long-lead items to secure delivery of a third floating liquefaction plant in 2025.

- The company sold eight million shares of Cool Company and 6.3 million shares in New Fortress Energy (NFE) following the end of the quarter, which gave it $430 million in cash.

- Golar LNG reported a net income of $141.121 million during the third quarter of 2022. This compares very favorably to the $90.956 million net loss that the company had in the fourth quarter of 2021.

The first thing that anyone reviewing these highlights is likely to notice is that Golar LNG’s revenue declined year-over-year. At first glance, this would seem to run contrary to my earlier comment that the demand for liquefied natural gas is incredibly strong. However, this decline in revenue was largely expected. As I mentioned in my last article on Golar LNG, the company completed divesting its entire tanker fleet during the third quarter. This resulted in a drastic revenue decline from the fleet as the company did not own these ships so they could not generate any revenue. In the third quarter of 2021, the divested tanker fleet generated $13.861 million in operating revenues for the company. That figure was $981,000 in the third quarter of 2021. As I have pointed out in a few previous articles, the floating liquefaction plants that the company still owns tend to enjoy much more stable revenue since they are all under twenty-year contracts. We can see this in the latest results. In the third quarter of 2021, Golar LNG’s floating liquefaction plants had total operating revenue of $54.480 million and this figure was only a slightly higher $54.893 million in the third quarter of 2022.

Although revenues are important for any business, they are not the most important thing. As investors, we are most concerned with the amount of money that the company actually generates after it covers its expenses. Fortunately, Golar LNG did incredibly well here because its floating liquefaction plants have always had much higher margins than the tanker fleet. We can see this by looking at the company’s adjusted EBITDA, which is a proxy for its pre-tax cash flow. This figure was $85.848 million in the third quarter of 2022 compared to $47.992 million in the year-ago quarter. An eagle-eyed reader might note that the business unit’s adjusted EBITDA is higher than its operating revenue, which may not make sense. However, there is a reason why the revenue figure is specifically called “operating revenues.” The contract that Golar LNG has with BP (BP) for the FLNG Hilli has a component that is linked to crude oil prices. Specifically, when crude oil prices are high, the company receives much more revenue than it does when oil prices are low. Golar LNG uses derivative contracts to hedge its exposure to this in order to ensure that its revenue does not vary too much over time. During the third quarter, the company realized a $57.047 million gain on these hedges. This was a realized gain and it does represent money coming into the company but it is not considered to be operating revenue as it did not come from the company’s core business operations. This realized gain is also the reason why the company’s net income is higher than its operating revenue in the most recent quarter.

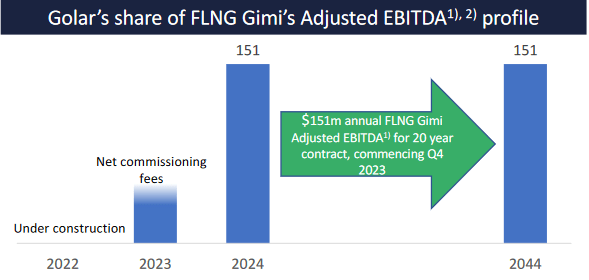

Golar LNG is positioned for a significant revenue increase in the near term. This comes from the fact that the FLNG Gimi is going to begin work on its contract during the second half of 2023. Golar LNG currently only has one floating liquefaction plant that is generating any revenue. The FLNG Gimi has a similar contract to the FLNG Hilli(the currently operational unit) so we can assume that it will roughly double Golar LNG’s revenue once it starts operating. This should have a similar effect on the company’s cash flows. Golar LNG has stated that the FLNG Gimi should result in an adjusted EBITDA of $151 million annually over the 2024 to 2044 period:

Golar LNG

Any investor should be able to appreciate this increase in the company’s cash flow, particularly considering that Golar LNG still has a considerable amount of debt to address. It is also important to note that Golar LNG will likely be hedging the commodity price exposure of the FLNG Gimi as well. This could very easily result in the adjusted EBITDA produced by this vessel being considerably higher than this estimate, much as we saw from the FLNG Hilli during the most recent quarter. Overall, we can clearly see how the company will likely see very strong growth next year.

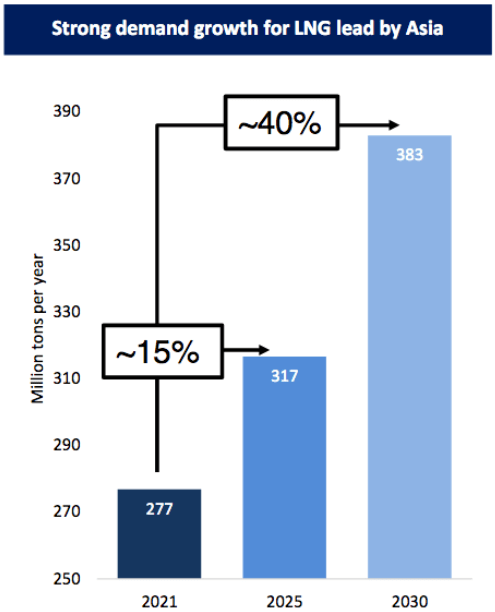

In various previous articles, I mentioned how the demand for liquefied natural gas is expected to surge significantly over the coming years. This is being driven by a few factors, including the pervasive fear of climate change. This fear has led countries around the world to attempt to replace fossil-fuel power plants with renewables but renewables do not have enough reliability to support a modern grid on their own. As a result, utilities are being forced to supplement renewables with natural gas turbines, which generally burn cleaner than any other source of fossil fuels. In addition to this situation, Europe is struggling to maintain its own supplies of natural gas, which would ordinarily be supplied by Russia. The continent has thus been turning to liquefied natural gas as an alternative.

Despite the rising demand from Europe, however, the majority of liquefied natural gas demand growth is expected to come from Asia. In fact, the continent is expected to increase its imports of the substance by 40% by 2030:

Golar LNG

This growing demand has not gone unnoticed by Golar LNG. In fact, the company reported in its earnings report that it has been seeing numerous customers beginning to inquire about securing a floating liquefaction plant like the FLNG Hilli or FLNG Gimi. This has prompted the company to prepare to construct a third unit for its fleet. During the third quarter, it ordered some parts that it would need for this task including centrifugal compressors, gas turbines, cold boxes, and heat recovery steam generators. These items can take a significant amount of time to secure, which is why Golar LNG ordered them despite the construction of a unit not beginning for several years. The company spent $300 million on this delivery so we should certainly hope that the company does manage to secure a contract for a third floating liquefaction plant, although the firm could probably sell the parts if it cannot. When we consider that global demand for liquefied natural gas is likely to grow more rapidly than the supply for the rest of this decade, it seems unlikely that the company will not be able to secure such a contract. The current plan is for the company to ultimately complete the construction of this unit sometime during 2025 so we can expect it to drive a significant earnings and cash flow increase as we enter 2026. Admittedly though, this scenario does depend on the company securing a contract, but this seems likely.

In various past articles on Golar LNG, I discussed that one of the company’s major problems is debt. Fortunately, it has been making progress in addressing this problem. As of September 30, 2022, the company had contractual debt of $993.094 million, which is roughly in line with the amount that it had at the end of the second quarter. However, this is a significant improvement over the $2.100733 billion that it had as of September 30, 2021. This represents a 53% decline over the past year, which is nice to see. We can expect this to keep improving as time goes on. Following the end of the third quarter, Golar LNG sold shares of Cool Company and New Fortress Energy that netted $430 million in cash, bringing the company’s cash balance up to $1.04 billion. This is actually more than its contractual debt. In addition, as already mentioned, Golar LNG should see significant cash flow growth during the second half of 2023 which will give it a lot more money to use for purposes like debt reduction and improving its balance sheet. Overall, the company seems to be reasonably financially strong.

In conclusion, this was a much stronger quarter for Golar LNG than might be assumed due to the revenue miss and year-over-year decline. The company substantially improved its profitability, which provides us with some evidence that its new business model is paying off. The company also is well positioned to deliver growth in the second half of next year once its new floating liquefaction plant begins work on its contract. This growth will likely be followed up in 2025 when a third plant is completed, although this is not certain at the moment. When we combine this potential with an improving balance sheet, Golar LNG looks reasonably solid.

Be the first to comment