wildpixel

Article Thesis

Lower-than-expected inflation numbers on Thursday fueled a massive rally in the broad market and especially the tech-heavy Nasdaq that contains many long-duration equities, where sensitivity to interest rates is especially high. The lower inflation reading makes a Fed pivot more likely, but investors shouldn’t assume that interest rates will be falling soon. Instead, it is very likely that interest rates will continue to climb, although likely at a somewhat slower pace. After all, inflation is still very elevated in absolute terms.

What Happened?

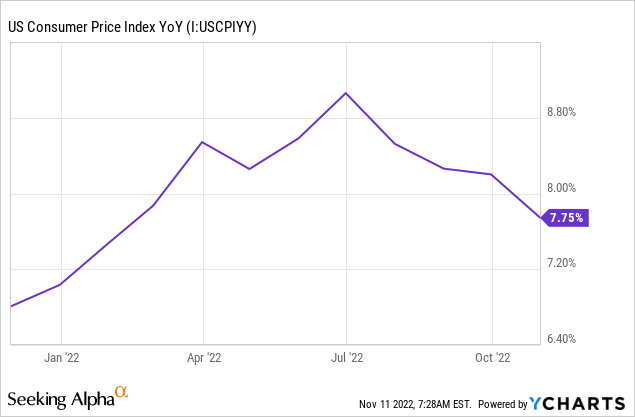

On Thursday, the latest inflation numbers were released, for October 2022:

A 7.7% year-over-year increase is still pretty high, around 4x as much as what the Fed is generally targeting. But unlike during previous months, the reading was slightly lower than expected, beating estimates of an 8.0% increase. Likewise, month-over-month inflation was lower than expected as well, coming in at 0.4%. If month-over-month inflation were to stay at that level going forward, annual inflation would be around 5%, which would still be too high, but significantly lower than the trailing 12-month reading. In other words, it looks like inflation is decelerating, although inflation has not yet come down to the target level of around 2% per year, or 0.17% per month.

In previous months, inflation has repeatedly been higher than expected, which usually resulted in violent sell-offs, as the market suddenly priced in a higher chance of a large interest rate increase. This time, the reverse came true — the market suddenly saw a higher chance of a smaller interest rate increase in the upcoming report (50 base points instead of the 75 base point hikes we have seen in recent meetings), which made the broad market rally.

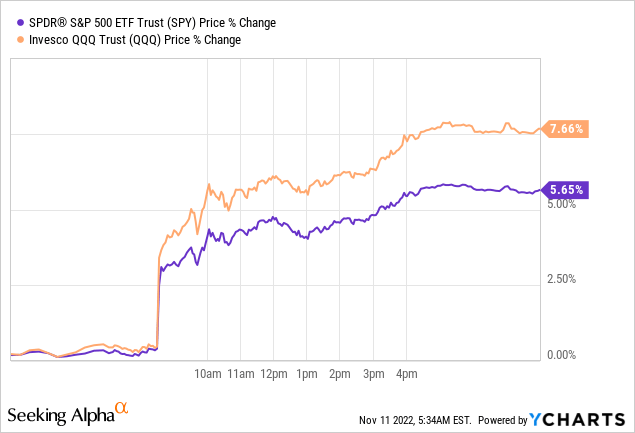

The S&P 500 index (SPY) soared by 5.7%, its best day in more than two years, while the Nasdaq index (NASDAQ:QQQ) jumped by an even better 7.7%, which was the first-ever 700 base point move in its existence, and one of the best days in relative terms.

At the same time, bond yields declined meaningfully, as the bond market also started to price in a higher chance that future interest rate hikes would be smaller. The 10-year Treasury yield, for example, dropped from 4.15% to 3.82% on Thursday, which is a relative decline of 8%. Likewise, 2-year yields also saw a big decline of 30 basis points on the day.

Lower yields on US government bonds, combined with a different outlook when it comes to future interest rate increases, also had an impact on forex rates. When investors get lower returns by investing in Treasuries and other USD-denominated fixed-rate assets, that means that these assets become somewhat less attractive to foreign investors. As a result, the US Dollar weakened against other currencies, as the Dollar Index (DXY) dropped by 2.3% on the day, although it is still up a lot over the last year.

What Is The Outlook?

Let’s first evaluate what it means when interest rates rise less than expected, or what it means if they actually decline. That naturally impacts the returns from Treasuries, both when it comes to their price performance and when it comes to the income yields they offer. But importantly, interest rates also impact equities. First, due to the fact that income investors can decide between investing in income stocks and treasuries. When interest rates change, their decision might change, thus income stocks are impacted. In a zero-rate environment, a 3%-yielding equity is more compelling than in an environment where treasuries offer a 4% yield, all else equal.

Interest rates also impact the interest expenses of companies, although oftentimes with a time lag, as many companies primarily utilize fixed-rate debt. Still, over time, interest rate movements impact the net profits that companies generate, all else equal.

Last but not least, interest rates are important when it comes to the valuation of stocks. One very common way to find the fair value for an equity is the discounted cash flow method. Future free cash flows of an equity are estimated or modelled. Then, due to the time value of money concept, those cash flows are discounted towards the present — after all, $1 billion in free cash flow 10 years from now is worth less than $1 billion in free cash next year. The discount rate generally is calculated via several factors, one of them being the beta (relative volatility) of an equity, but the risk-free rate (treasury yield) also is a part of that equation. Higher interest rates result in a higher discount rate, and lower interest rates result in a lower discount rate. A higher discount rate reduces the fair value of equities, all else equal. That explains why equities have been falling this year, as interest rates have risen. Of course, there are some other factors at play, such as worries about a recession, but the interest rate issue is important for sure. With the lower-than-expected October CPI reading resulting in a higher likelihood that interest rates rise less going forward, market expectations for future interest rates have changed. This results in a lower expected discount rate for equities, which results in a higher fair value for stocks, all else equal. It thus makes sense that the market rose on the CPI news.

Not all equities are impacted equally by changes in the discount rate. So-called long-duration assets, where the majority of all future cash flows are generated in the distant future, are more heavily impacted by interest rate changes. That’s why long-duration assets, such as those held by ARK Innovation (ARKK), which was up 10% on the day, rose more than the broad market. The tech-heavy Nasdaq also contains many long-duration assets, which is why it rose more than the broad market, too.

Of course, before investors chase equities right now, they should consider a couple of items. First, the CPI beat for October may not necessarily be the first in a line of downward beats. Instead, it is possible that inflation reverses higher again. That’s far from guaranteed, and not necessarily likely, but it’s possible.

In spring, inflation had experienced a downward move as well, before running to even higher highs. The downward move has now been in place for a couple of months, which means that it is more likely that this is a prolonged trend, but investors should still not believe that it is guaranteed that inflation will be heading lower without pause.

On top of that, even when inflation continues to head lower going forward, it will potentially take a long time before the 2% target is reached. The Fed may not be happy with the time it takes until that happens, thus Fed members may decide to raise rates more than the market anticipates right now in order to bring down inflation faster.

Also, investors should not chase equities without looking at the macroeconomic outlook. The rate increases so far this year make it likely that there will be an economic downturn next year, which could mean that profits for publicly traded companies come under pressure. Buying into equities solely because inflation has come down from the 40-year high while ignoring that a recession might impact companies’ profits could be a risky move.

Right now, there’s a lot of enthusiasm about a Fed pivot, and many investors are happy to buy equities. But we have seen such rallies a couple of times over the last couple of months, and they were oftentimes not sustained. Instead, they were repeatedly faded, as recession worries or Fed statements about there being no pivot hurt sentiment again. This could happen again. The Fed’s next meeting will be roughly one month from now, on December 13-14. Markets could react heavily to statements of Fed members then, and the interest rate increase that will be announced is also highly important. Maybe, the Fed surprises with a lower-than-expected increase (25 base points), but the opposite could also come true. In the near term, I expect that markets will remain volatile, that macro news will continue to have big short-term impacts on equity prices, but I do not believe that it’s a great time to call for a clear upwards trend in equities yet. There are still uncertainties about the Fed’s path, inflation is still pretty high, and ignoring the recession risk also seems like a bad idea.

Takeaway

The CPI reading was surprisingly low versus expectations, but still pretty high in absolute terms. The markets saw this as a reason to rally, but chasing equities now seems risky. Past “Fed pivot hope” rallies have failed repeatedly, and the macroeconomic picture remains cloudy. Investors should be careful not to be too euphoric.

Be the first to comment