imaginima

The energy bull market is probably obvious to everyone, but going long oil is not the only way to play this market. Devon Energy (NYSE:DVN) owns and operates more than 5,100 wells, and has been doing this since 1971.

With 1600 employees, Devon is like a smaller version of the Mega Cap Oil companies, so it’s a good alternative to companies like Exxon Mobil (XOM) and others in my view. They have grown through acquisition as well as organically, so their business is now at a point where they can kick back and watch the oil flow.

Fundamentals

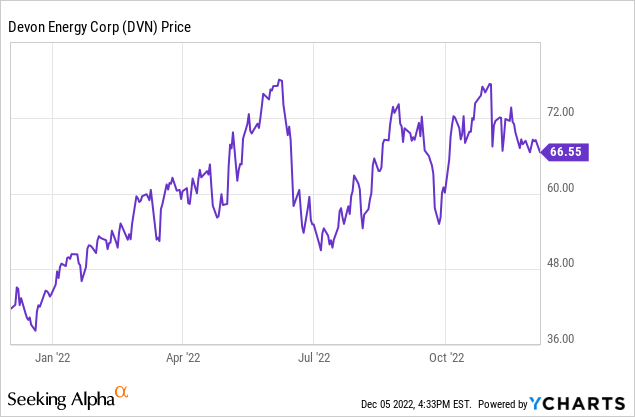

With a P/E ratio of 7.7 what’s not to like? I think the dividend rate of $5.50 and yield of 7.89% make Devon a great conservative buy. Take a look at the chart:

The market cap is reasonable compared to its peers and those in other industries as well. For example, Exxon Mobil Corporation which is 10x the size in market cap, has less yield, and a lower dividend rate. Buying Devon isn’t about high growth, it’s about conservation of capital, and a play on the energy markets.

Getting oil out of the ground is actually a complex logistics business, and companies like Devon have made it look easy (it’s not).

Oil consumers look West

Russia is sitting on record energy profits, and their economy was not really impacted by sanctions (in fact, it was arguably boosted). According to the New York Times (Some refer to this as the ‘newspaper of record’) – in an article called: Russia’s Oil Revenue Soars Despite Sanctions, Study Finds – rising oil prices more than offset a decline in export volumes during the first 100 days of the assault on Ukraine:

Russia earned what is very likely a record 93 billion euros in revenue from exports of oil, gas and coal in the first 100 days of the country’s invasion of Ukraine, according to data analyzed by the Center for Research on Energy and Clean Air, a research organization based in Helsinki, Finland. About two-thirds of those earnings, the equivalent of about $97 billion, came from oil, and most of the remainder from natural gas. “The current rate of revenue is unprecedented, because prices are unprecedented, and export volumes are close to their highest levels on record,” said Lauri Myllyvirta, an analyst who led the center’s research.

So because of this, many are looking to US companies for energy, and as we have seen just switching to EV is not a solution. We have seen images of the California EV owners powering their EVs with gas powered generators. This is not a situation of taking sides in a war, it’s an issue of national security. Companies would not want to depend on Russia, and then have the sanctions switch off that pipeline. This is the situation Germany got itself in, and now Germany is facing an energy shortage, during a cold winter.

Multiple factors to go long

So far, we haven’t said anything that isn’t already widely known. However, it is our contention that Devon is a good bet to go long a company with experience, that is lean, and in a good political and economic environment – for the long term. Analysts also like Devon, if you snoop around you’ll find many buy ratings on the stock.

Global Environment – USD Energy Inflation

USD inflation is on fire, yet why is the USD Index at an all-time high? The reason in my opinion is because this last bout of inflation was caused by sanctions on the largest energy producer in the world (Russia) not because of Fed policy. When Russia was removed from the world system, the US was the next best choice for energy. This supports the US Dollar and companies like Devon as well. Why? Because if you need energy from the USA, or parts for your production, you will first convert your Euros or Mexican Pesos to USD first, in FX that’s called “Real Money Flows” – and that has caused the USD to skyrocket. It has also given a boost to US energy companies like Devon.

China needs Oil, and with a huge trade balance with the United States, they are another potential consumer (they already are a big one).

Overall, Devon is a good buy and hold at this point. If you aren’t exposed to energy, I think Devon is a better buy than its peers and is nimble enough to rise to the surface as does the rest of the oil in the ground.

Be the first to comment