Kruck20

Real Estate Earnings Recap

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on November 10th.

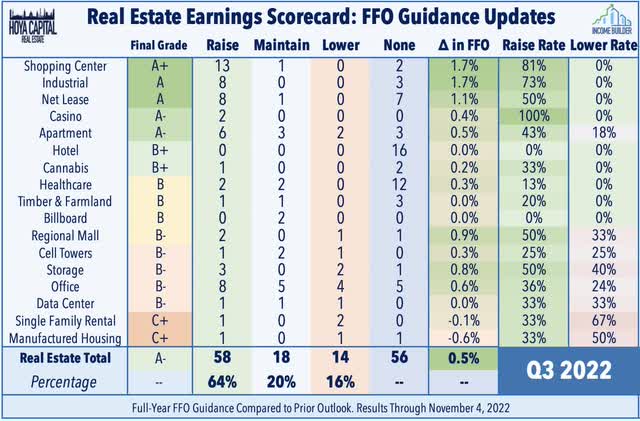

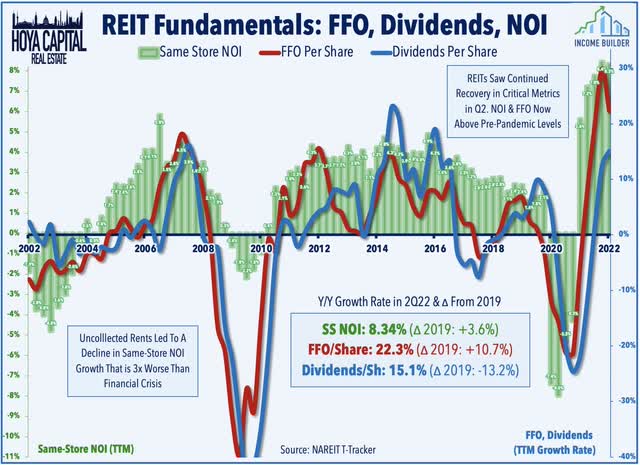

Over 200 U.S. REITs and homebuilders have reported third-quarter earnings results over the past three weeks, providing critical information on the state of the real estate industry in a period defined by moderating global economic growth and persistently elevated levels of inflation – albeit with some better-news on the inflation front on the final day of earnings season. REIT earnings season was surprisingly strong across nearly all property sectors. Among the 90 REITs that have provided full-year Funds From Operations (“FFO”) guidance, 58 REITs (64%) raised their outlook while just 14 REITs (16%) have lowered or withdrawn their outlook. Strong results from REITs come amid an otherwise disappointing earnings season for the broader equity market as, per FactSet, just 48% of S&P 500 companies boosted their outlook.

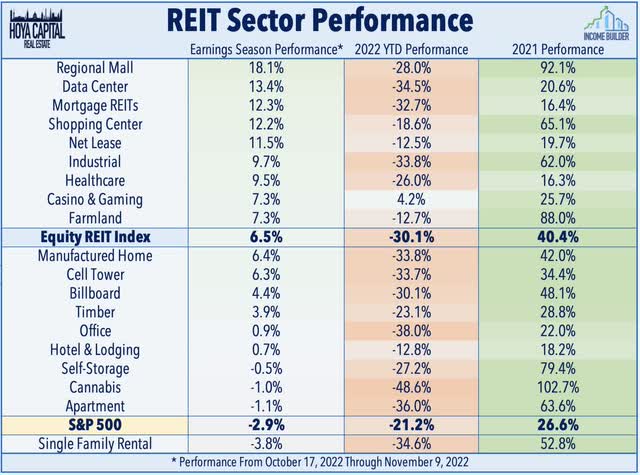

The fundamental earnings outperformance reflects the fact that most REIT sectors are still earlier in their post-pandemic recovery relative to the broader market, having just recovered to 2019 FFO levels in early 2022 while total dividend payments are still about 10% below pre-pandemic levels. Earnings results from Shopping Center, Industrial, and Net Lease REITs were most impressive – accounting for exactly half of the 58 guidance hikes. Residential and technology REIT results were more hit-and-miss – accounting for half of the 14 downward guidance revisions. Notably, during REIT season running from October 17 through yesterday’s close on November 9, the Equity REIT Index outperformed the broader S&P 500 by nearly 10 percentage points while the Mortgage REIT Index outperformed by over 15 percentage points.

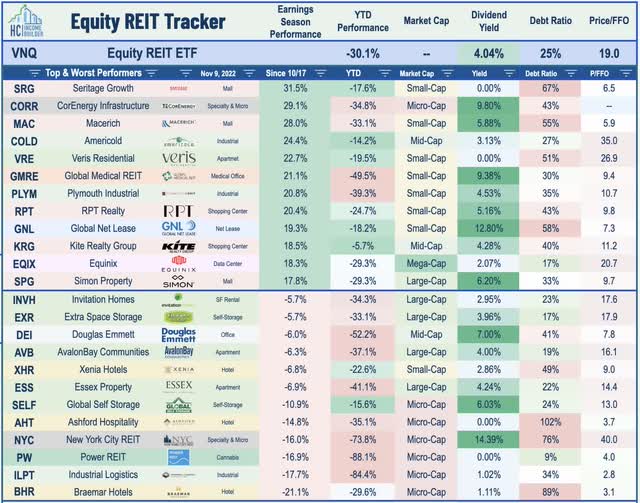

Notable individual upside performers during earnings season included mall REITs Seritage Growth (SRG), Macerich (MAC), and Simon Property (SPG); industrial REITs Americold (COLD) and Plymouth (PLYM); shopping center REIT Kite Realty (KRG); data center REIT Equinix (EQIX), and healthcare REIT Global Medical (GMRE) – the former three being among our holdings in the Income Builder REIT portfolios. Veris Residential (VRE) was also a notable upside performer following an unsolicited takeover bid from Kushner Companies – the only major M&A news of an otherwise quiet earnings season that saw most REITs hunker down by scaling back on external growth plans. Dividend hikes were a theme this earnings season with another two dozen REITs hiking their payouts, bringing the full-year total across the REIT sector to over 120 – matching last year’s record pace.

Retail REIT Earnings Recap

Shopping Center: (Final Grade: A+) Results from shopping center REITs were highly impressive with 12 of the 13 REITs that provide guidance raising their full-year FFO outlook, indicating that fundamentals are now as strong – if not stronger – than before the pandemic with occupancy rates climbing to the highest level since early 2015 while rental rates have continued to accelerate despite the broader economic slowdown. Kite Realty (KRG) – which remains one of our three “Best Ideas in Real Estate” – has surged nearly 20% this earnings season after reporting very strong results and raising its full-year outlook and its dividend. Driven by record leasing volume, KRG raised its full-year FFO growth outlook to 25.3% – up 330 basis points from last quarter. Regency Centers (REG) also reported impressive results, raising its full-year FFO and NOI outlook while raising its dividend by 4%. Kimco Realty (KIM) was also an upside standout, boosting its full-year FFO growth target to 14.5% – up 220 basis points from last quarter – driven by an acceleration in blended leasing spreads to 7.5 while also hiking its dividend by another 4.5%.

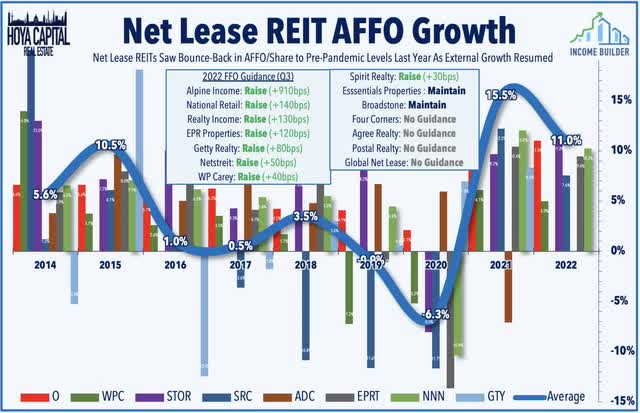

Net Lease: (Final Grade: A) Net lease REITs delivered a similarly strong earnings season with 8 of the 10 REITs that provide guidance raising their full-year outlook. W.P. Carey (WPC) – which we own in the REIT Focused Income Portfolio – rallied after raising its full-year FFO outlook driven by record-high rent growth driven by CPI adjustments. WPC now expects FFO growth of 5.0% this year – up 40 basis points from its prior outlook – and is one of seven net lease REITs to raise its full-year outlook this quarter despite the headwind from higher rates. National Retail (NNN) has been an upside standout after it raised its full-year FFO growth outlook to 9.4% – up 120 basis points from its prior outlook. Of note, while NNN continued to plow ahead with acquisitions, it noted some upward “velocity” in cap rate since the last Fed rate hike remaking that cap rates have risen about 25-40 basis points “in the last month or so.” Spirit Realty (SRC) rounded-out net lease REIT earnings season this week with a strong report and raising its full-year outlook. Spirit raised its full-year FFO growth outlook by 30 basis points to 7.6%. Of note, Spirit commented that it’s seeing cap rates that are 150 basis points higher than a year ago – but seeing more “spread widening” among industrial assets than on retail assets.

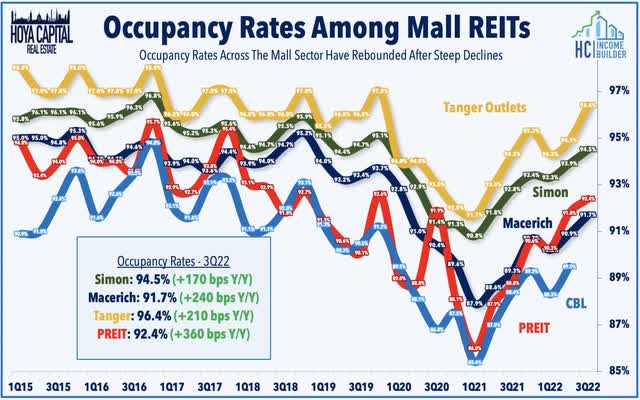

Malls: (Final Grade: B-) Results from mall REITs have shown that downward pressure on rents and occupancy rates may finally be subsidizing. Simon Property (SPG) hiked its full-year guidance along with its quarterly dividend. Driven by an uptick in occupancy rates and a stabilization in rents, SPG now sees its FFO/share roughly matching that of the prior year driven by comparable leasing spreads are “wildly positive. Tanger Outlets (SKT) also reported better-than-expected results and raised its full-year outlook, driven by its strongest quarter for rental rate spreads in a half-decade at 5.7% – its third straight quarter of positive spreads following a streak of eight straight quarters of negative growth. Macerich has rallied after reporting similar strength in occupancy rates and rental rate spreads, which offset a downward revision to its full-year FFO target. Encouragingly, MAC reported positive spreads of 3.3% – up from -6.6% in the prior quarter – its best quarter of leasing since the pandemic began.

Residential REIT Earnings Recap

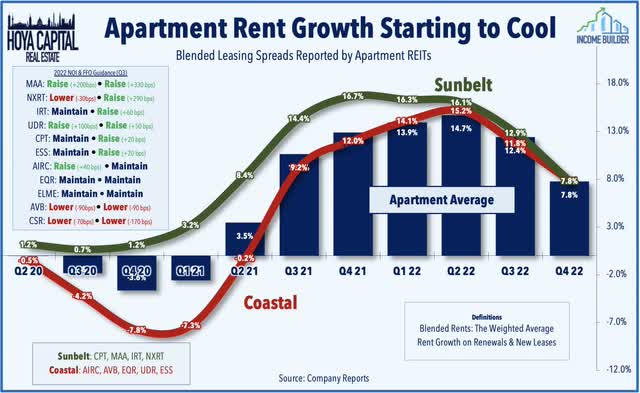

Apartment: (Final Grade: A-) Results were more hit-and-miss in the residential sectors following a strong start to earnings season with 6 of the 11 REITs that provide guidance raising their full-year FFO outlook. The three Sunbelt-heavy REITs – Mid-America (MAA), Camden (CPT), and NexPoint Residential (NXRT) all raised their full-year earnings outlook this quarter – and now expects FFO growth of nearly 25% this year – while performance among the Coastal-heavy REITs Equity Residential (EQR), Essex (ESS) and UDR, Inc. (UDR) was less impressive with average FFO growth expected to be around 16% this year. Perhaps the most notable trend is the rather sharp sequential slowdown in rent growth – especially in new lease rates. New Lease rates peaked in Q2 at 17.5% and slowed to 12.7% in Q3 and just 5.1% in October, but renewal rates have held firmer which should keep blended spreads in the mid-to-high single-digits into early 2023. Apartment Income (AIRC) was a notable upside standout among the coastal REITs, reporting 14.0% blended spreads in Q3 and 12.9% in October while recording an impressive 640 basis point decline in turnover rates.

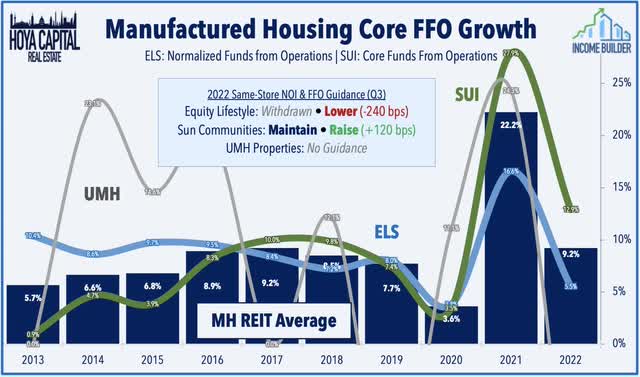

Manufactured Housing: (Final Grade: C+) Sun Communities (SUI) – one of our three “Best Ideas in Real Estate” – has been an upside standout this earnings season after reporting better-than-expected results and raising its full-year outlook driven by strength in its RV and marina division and expectations of accelerating rent growth in its core manufactured housing communities for the 2023 renewal season. SUI now expects its full-year FFO to rise 12.9% this year – up 120 basis points from last quarter – which is particularly impressive in light of the earnings miss from its MH peer, Equity LifeStyle (ELS) – which revised its FFO growth lower by 240 basis points. ELS and SUI each reported a relatively muted impact from Hurricane Ian representing less than 1% of its annual revenues. Both MH REITs expect to send out record-high rent increases for the 2023 renewal season in the range of 6-8%, consistent with our expectation that MH REITs will leverage the record-setting cost-of-living adjustment (COLA), which should result in a roughly 9% rise in benefits to a significant percentage of MH REIT residents.

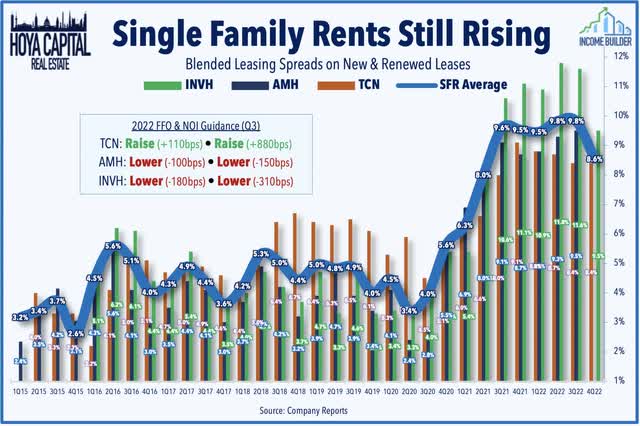

Single-Family Rental: (Final Grade: C+) Results from Invitation Homes (INVH) and American Homes (AMH) – two of the nation’s largest single-family housing owners – were uncharacteristically soft with both REITs lowering their full-year FFO and NOI outlook, citing a hit from higher-than-expected property taxes and higher bad debt expense from renters who have fallen behind on their rent. INVH reported impressive leasing spreads of nearly 12% in Q3 and roughly 9.5% in October, but its rent collection rate dipped to 97% in Q3 – down 200 basis points from last quarter and below its pre-COVID average of 99%. Tricon Residential (TCN) salvaged an otherwise downbeat earnings season for SFR REITs by significantly boosting its full-year FFO outlook by 880 basis points to 17.5% driven in part by performance fee earned from the sale of its U.S. multi-family portfolio. Providing further color, TCN commented, “the fundamentals of our SFR business are rock solid.. underscoring the resilience of the single-family rental business in a much higher rate environment where it’s never been more compelling to rent versus own a home.”

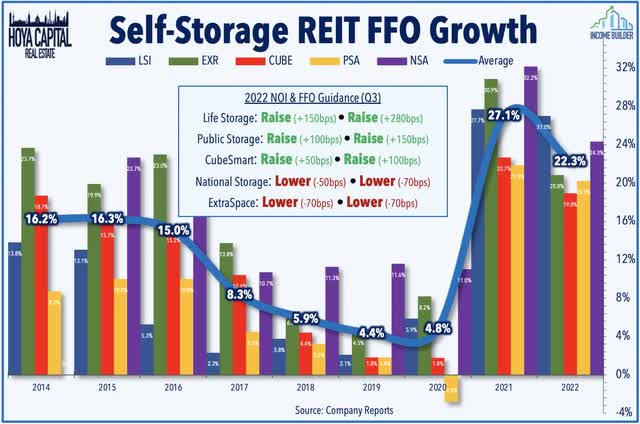

Storage: (Final Grade: B-) “Hit and miss” was certainly the theme of storage REIT reports with a trio of strong reports offset by a pair of downbeat outlooks. CubeSmart (CUBE) started earnings season with a “beat and raise” report, hiking its full-year FFO growth target to 19.0% – up 100 basis points from last quarter. Public Storage (PSA) also raised its FFO growth target to 20.5% this year – up 150 basis points from its prior outlook while Life Storage (LSI) boosted its full-year FFO growth target by 280 basis points to 27.0%, commenting that “fundamentals are very strong with occupancy remaining elevated from pre-pandemic seasonal levels.” Snapping an incredible six-quarter streak of essentially “perfect” beat-and-raise results across the sector, results from Extra Space (EXR) and National Storage (NSA) were less impressive with each lowering their FFO and NOI growth outlook by roughly 50 basis points, citing a combination of expense pressures and slowing demand from the breakneck pace from late 2020 into early 2022.

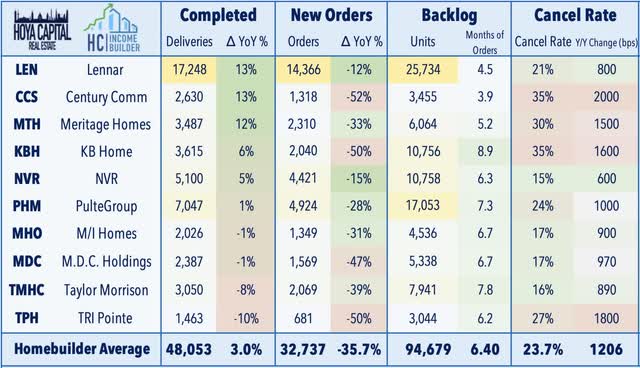

Homebuilders: (Final Grade: C) Rates, rates, rates. Results from the ten homebuilders that have reported results over the past month have shown that while the existing pipeline of previous orders has kept homebuilding revenues and EPS near record-high levels, the surge in mortgage rates has led to a sharp drop-off in new orders – lower by over 35% year-over-year in Q3 – and a surge in cancellation rates, which jumped to nearly 25% during the quarter. Positively, builders still have more than six months’ worth of backlog to work through at the current sales pace – which should help to buffer the immediate downside pressure on revenues and earnings metrics. Upside standouts in earnings season have included M.D.C. Holdings (MDC) – which maintained its sector-leading dividend of over 6% and KB Home (KBH) which reported a solid improvement in margins and has the accumulated largest backlog relative to its current sales with nearly three-quarters of existing orders.

Technology and Logistics Earnings Recap

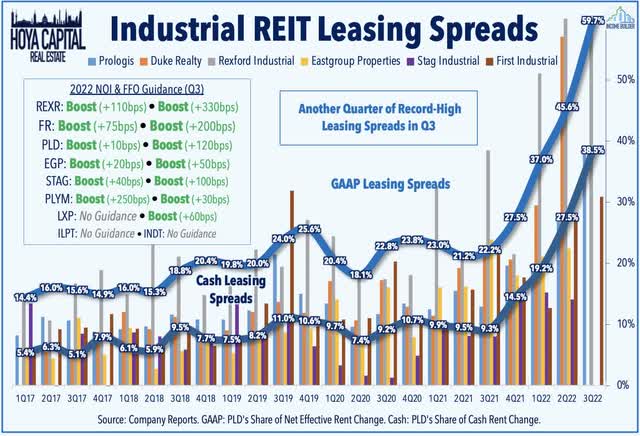

Industrial: (Final Grade: A) No signs of slowdown here. Powered by another quarter of head-spinning cash rental rate spreads of over 30%, all seven of the industrial REITs that provide guidance raised their full-year FFO growth target. Sector stalwart Prologis (PLD) reported a record-high effective leasing spread of 59.7% and record-high cash same-store NOI growth at 9.3%. First Industrial (FR) also reported record-high cash leasing spreads of 30.9%, driving a boost to its NOI outlook by 75 basis points to 9.5% and its FFO growth outlook by 200 basis points to 13.2 while Rexford (REXR) reported incredible cash rental rate spreads of 62.9% in Q3. STAG Industrial (STAG) also delivered impressive results with rent growth on new leases of nearly 20%. Even the lagging Americold snapped a streak of icy-cold performance with a solid upward boost to its outlook. Small-cap Industrial Logistics (ILPT), however, has continued to lag following its ill-timed acquisition of Monmouth and commented that its dividend resumption is “not going to happen until late-2023 at the earliest.”

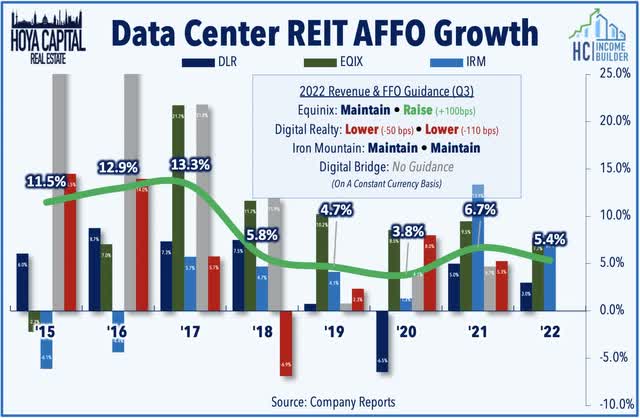

Data Center: (Final Grade: B-) Equinix (EQIX) – which we own in the REIT Dividend Growth Portfolio – has been an upside standout after reporting strong results and raising its full-year 2022 outlook driven by a sixth consecutive quarter of record leasing activity and strong pricing trends. Of note, EQIX reported same-store revenue growth of 7% in Q3, continuing an acceleration in rent growth since early 2021. EQIX now sees full-year FFO growth of 7.7% (10.5% on a constant-currency basis) – up 100 basis points from last quarter. Digital Realty (DLR) reported mixed results – highlighted on the upside by a record-level of leasing volume – but offset by softer pricing trends. During the quarter, DLR signed total bookings expected to generate $176M of annualized GAAP rental revenue – its strongest quarter of bookings on record. Rental rates on renewal leases signed during the quarter rolled down 0.5% on a cash basis – down from the 3.3% average in the first half of 2022. Foreign currency headwinds prompted a downward revision to its full-year FFO growth target, which is now expected to rise 3.0% this year – down from 4.1%.

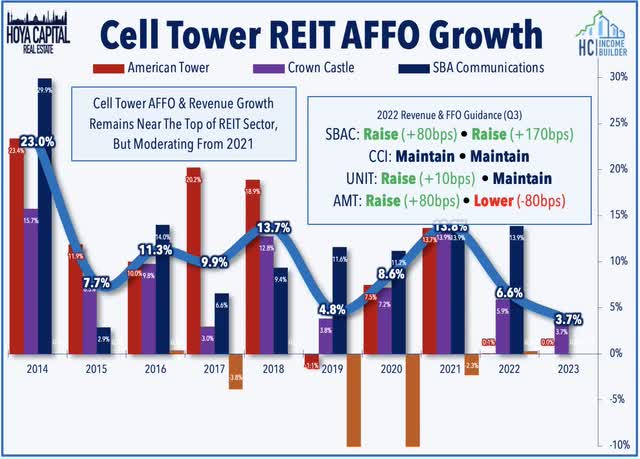

Cell Tower: (Final Grade: B-) Results from the two largest Cell Tower REITs were similarly lukewarm. Results from Crown Castle (CCI) were the stronger of the two, highlighted by strong organic “same-tower” growth metrics and another 6.5% dividend hike. CCI maintained its full-year outlook calling for FFO growth in 2022 of roughly 6% while also providing 2023 guidance which calls for growth of 3.7%. American Tower (AMT) revised down its full-year FFO target, citing negative FX effects and a drag from deferred rent payments from Vodafone India – which is undergoing a government-backed restructuring. AMT did raise its full-year revenue growth target by 80 basis points, however, driven by strong “organic” rent growth in the U.S. and in its Latin America and Africa markets. Of note, AMT expects 2023 to be a “challenging year” given the headwind from rising interest rates which will “certainly will take us off of our target AFFO growth” but noted that property-level fundamentals should continue to “accelerate” into 2024.

Office, Healthcare, Hotel, and Casino Recap

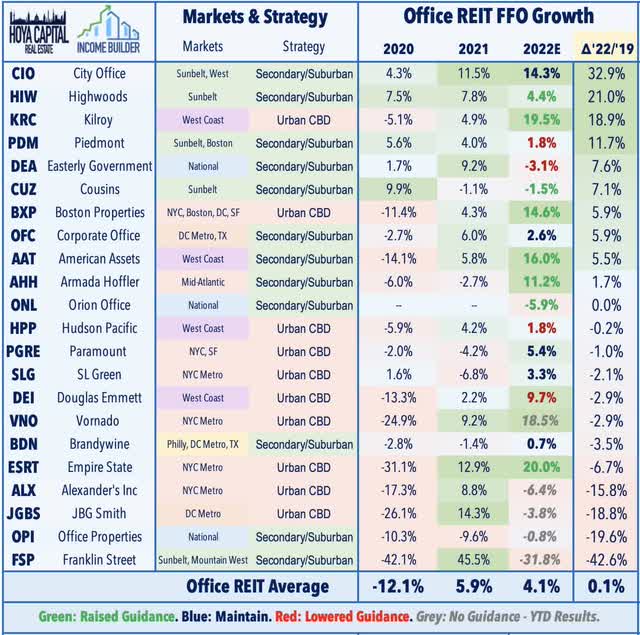

Office: (Final Grade: B-) Sunnier in the Sunbelt: Sunbelt-focused Highwoods (HIW) was an upside standout, raising its full-year FFO growth target to 4.4% – up 180 basis points from its prior outlook while noting that it leased 518k SF of space in Q3 – its highest volume of new leases since 2014 with rents that were 20% above its prior five-quarter average. Cousins (CUZ) and Brandywine (BDN) also reported notable strength in their Sunbelt markets. Results from coastal-focused REITs have been shakier – with the exception of the lab space segment which has seen continued robust leasing demand. NYC-focused SL Green (SLG) reported that rental rates were about 10% lower on renewed leases this year. Boston Properties (BXP) slightly raised its full-year FFO outlook, but noted that it expects its FFO to be about 4% lower in 2023 at the midpoint of its range. Lab space demand powered a solid quarter from Kilroy (KRC) which boosted its full-year FFO growth target to nearly 20%.

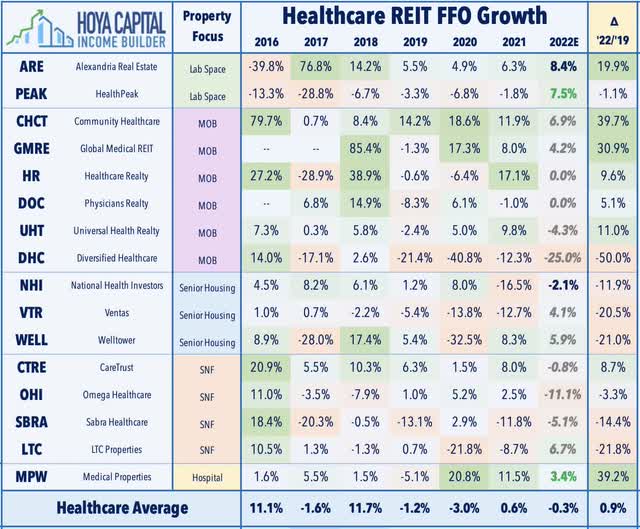

Healthcare: (Final Grade: B) Speaking of lab-space, Alexandria Real Estate (ARE) reported another very strong quarter highlighted by impressive cash NOI growth of over 20% driven by renewal rent spreads of roughly 25%. Hospital owner Medical Properties Trust (MPW) – perhaps the most closely-watched report this earnings season – reported raised its full-year FFO growth target, citing improvement in operating performance at its hospital facilities and forecasted escalations in its CPI-linked leases. Welltower (WELL) has also been an upside standout after reporting better-than-expected results highlighted by total portfolio same-store NOI growth of 7.2% and provided an upbeat fourth-quarter outlook. Sabra Health Care (SBRA) has been a laggard after reporting disappointing results and ongoing operating issues, announcing that it will transition operators in 24 of its properties previously leased to North American Health Care to two of its existing tenants, Ensign and Avamere.

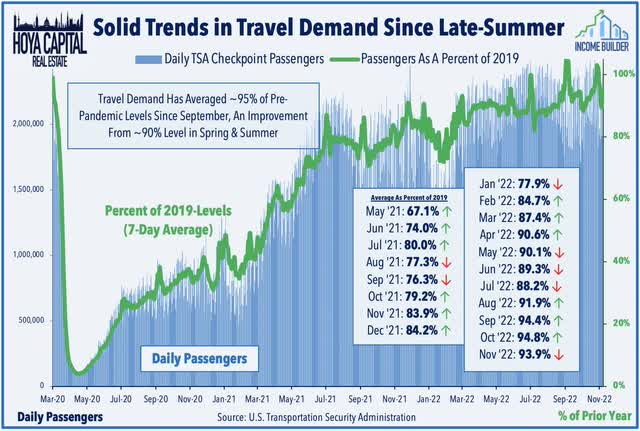

Hotel: (Final Grade: B+) Hotel REIT results indicated that hotel demand has been surprisingly solid in recent weeks and months despite signs of slowing across other segments of the economy as an uptick in business travel has offset a moderation in leisure demand. Pebblebrook Hotel (PEB) reported that its RevPAR in the third quarter was 1% above comparable pre-pandemic levels with the strongest month coming in September, which was about 5% above 2019-levels. Hersha Hospitality (HT) reported that its comparable RevPAR growth exceeded 2019-levels for the first time since the pandemic in September while commenting that its “seeing this trend accelerate into October, which is on pace to record RevPAR growth of approximately 8% as compared to 2019.” DiamondRock (DRH) reported that its Revenue Per Available Room (“RevPAR”) in Q3 was 8.7% above comparable 2019-levels while September was 9.8% above pre-pandemic levels. Also of note, Apple Hospitality (APLE) hiked its monthly dividend by 14% to $0.08/share.

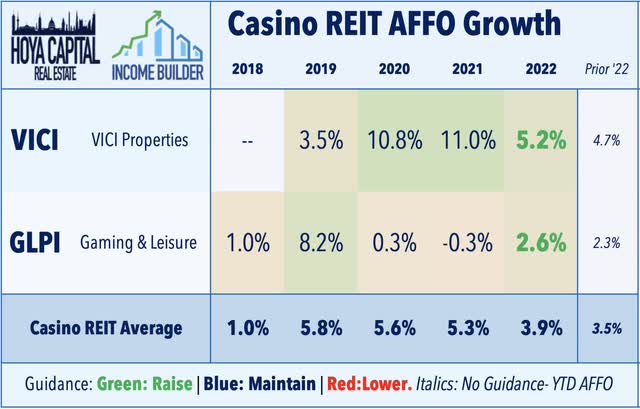

Casino: (Final Grade: A-) Casino REIT results were a bit better than expected with VICI Properties (VICI) and Gaming and Leisure Properties (GLPI) each raising their full-year outlook. Of note, with REITs now owning a significant share of casino real estate properties in the U.S., VICI reiterated that it is looking at non-gaming asset classes for future growth opportunities, hiring a new Chief Investment Officer last quarter to “focus on non-gaming.” Casino REITs have been among the best-performing property sectors this year, benefiting from an upward “re-rating” from investors as the sector has matured following the VICI acquisition of MGM Growth Properties and resulting in an investment grade credit status and inclusion in the S&P 500.

Mortgage REITs Earnings Recap

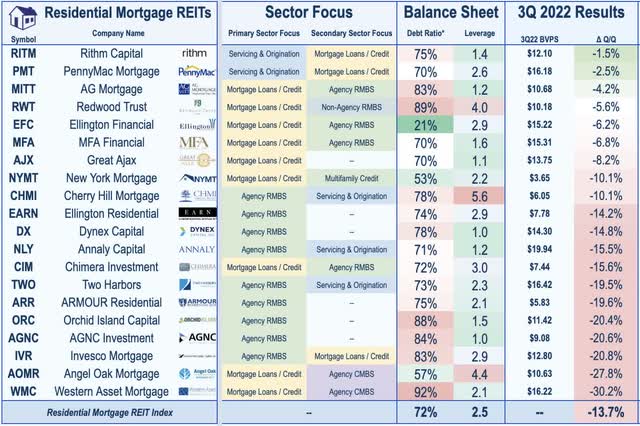

Residential mREITs: (Final Grade: B) Consensus expectations called for Book Value Per Share (“BVPS”) declines of up to 20% in Q3 during a historically brutal quarter for fixed income securities – particularly MBS securities – but mREITs rebounded sharply during earnings season as results were not as catastrophic as many feared with average book value declines of roughly 14%. BV declines were more muted for credit-focused mREITs compared to pure-play agency-focused mREITs with particularly solid results from PennyMac (PMT) and Rithm Capital (RITM). Among the agency-focused mREITs, BVPS declines ranged from 10%-30%, but EPS metrics were generally “less ugly” than BV metrics with most agency mREITs still able to cover their dividends, including a strong report from Annaly (NLY), which noted that its Earnings Available for Distribution (“EAD”) of $1.06/share still comfortably covers its dividend yield of nearly 20%.

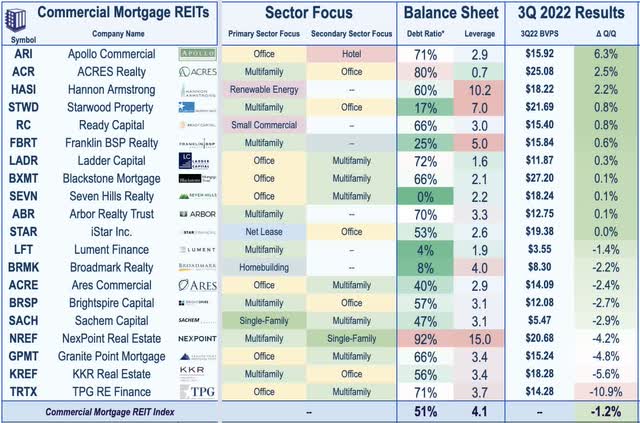

Commercial mREITs: (Final Grade: A-) On the commercial mREIT side, the movement in BVPS has been far more muted – and even positive from the REITs that focus primarily on floating rate lending. Apollo Commercial (ARI) soared after reporting better-than-expected results including a 6% rise in its BVPS to $16.12. Blackstone Mortgage (BXMT) – which owns a similar book of floating-rate loans – reported a 1% rise in its BVPS while noting that its average loan rates increased 100 basis points in Q3 alone while Starwood (STWD) also reported a modest BVPS increase during the quarter. Also of note, Arbor Realty (ABR) rallied after reporting strong Q3 results and raising its dividend for the fourth time this year. Downside laggards this quarter included KKR Real Estate (KREF) and TPG Real Estate (TRTX) which each reported BVPS declines of over 5% while Broadmark (BRMK) dipped after reporting disappointing results with an increase in loans under default.

Specialty REIT Sectors Earnings Recap

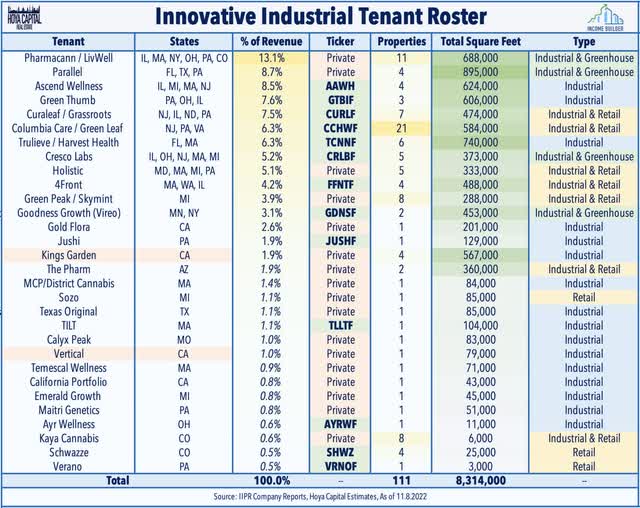

Cannabis: Innovative Industrial (IIPR) – a perennial outperform that has been slammed this year on concerns over tenant health – rallied last week after reporting better-than-expected results and noting that rent collection issues remain limited to two troubled tenants – Kings Garden and Vertical. IIPR noted that it has collected 97% of its rent so far this year with the Kings Garden defaults in July responsible for the majority of that 3% of uncollected rent. Encouragingly, IIPR reported that it signed a Letter of Intent for a long-term lease at one of the properties that was formerly leased to Kings Garden in “just over a month of marketing the property.” NewLake Capital (OTCQX:NLCP) reported that it collected 100% of contractual rent. Also of note, in midterm elections, voters approved adult-use cannabis in Missouri and Maryland, while rejecting similar measures in Arkansas, North Dakota, and South Dakota.

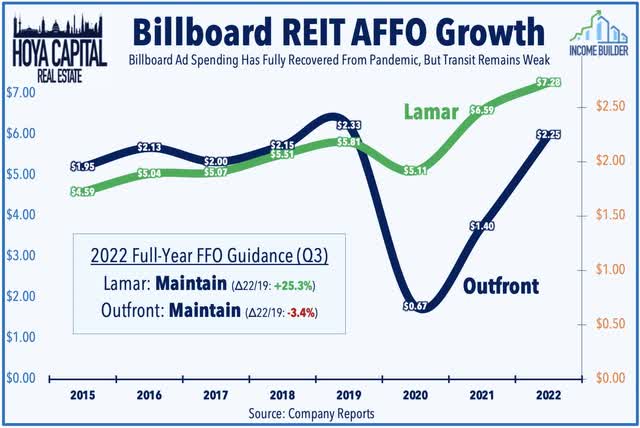

Billboard: Lamar Advertising (LAMR) reported results that were roughly in line with estimates while noting that it’s “tracking to the top of our previously provided guidance range for full-year diluted AFFO per share.” LAMR cited strong political ad spending as a key driver of revenue growth in Q3 and into early Q4, contributing 210 basis points of the total sales growth of 7.6% in October. LAMR did note relative weakness in demand from national brands with its national/programmatic segment growing just 0.3% in Q3 while its local business grew 6.4%. Outfront (OUT) dipped hard last week after reporting that its billboard business continues to outperform its transit business – primarily through its major deal with the New York MTA, which continues to operate at “essentially breakeven” levels.

Earnings Recap: REITs Still Have Momentum

Despite the strong slate of earnings reports across most property sectors, performance trends continue to be dominated by macroeconomic factors which continue to create near-term dislocations which create value opportunities for long-term investors that are keyed in on fundamentals. Critically, the fundamentals across the REIT sector remain quite impressive across most property sectors with nearly two-thirds of REITs raising their full-year outlook, reflecting a high degree of confidence among REIT executives that the growth momentum will be sustained beyond the initial post-pandemic recovery despite the broader global economic slowdown. The thesis for maintaining an overweight allocation to U.S. real estate equities in a balanced portfolio remains compelling given their domestic focus, early-cycle fundamentals, and their historical outperformance later in the Fed rate hike cycle.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment