CorEnergy: Original To Current Market Cap Timeline nico_blue/iStock via Getty Images

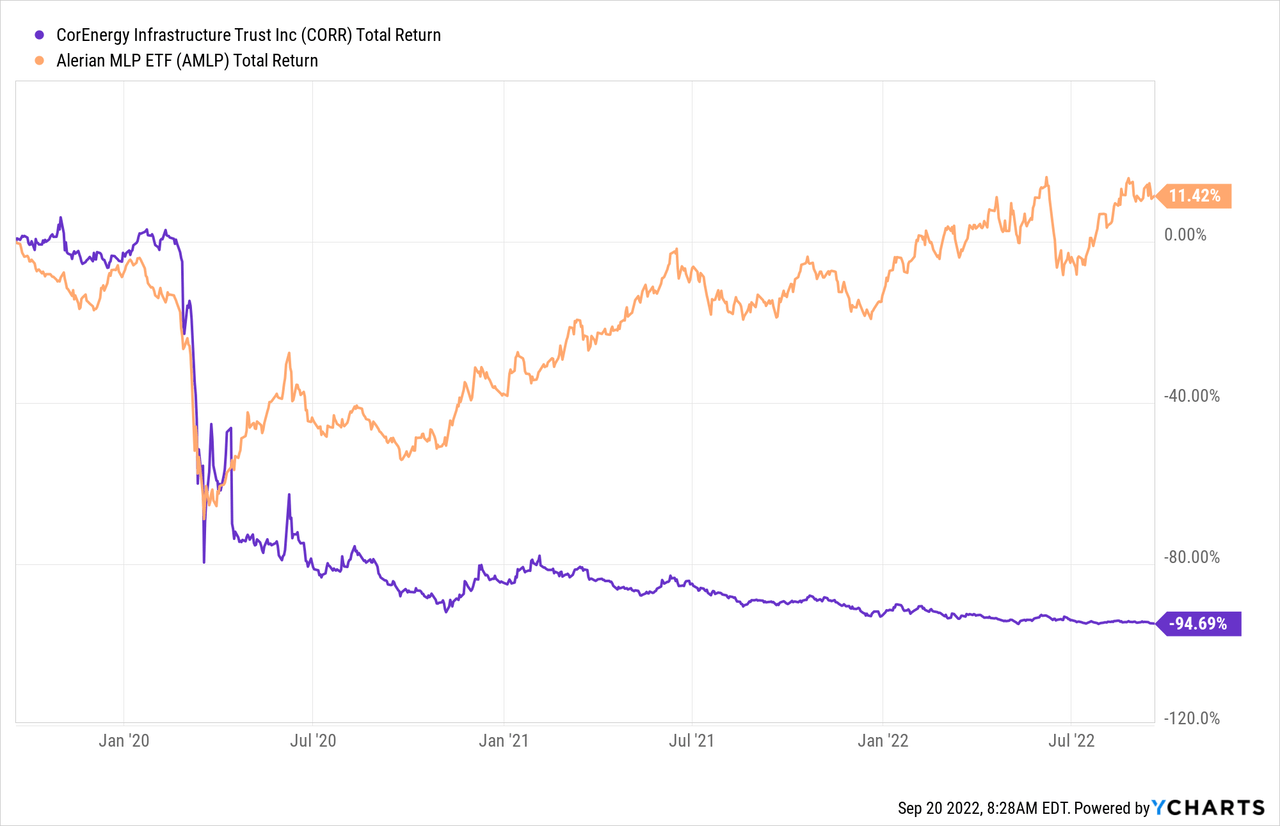

Sometimes you don’t need more than a chart. CorEnergy Infrastructure Trust Inc. (NYSE:CORR) has delivered an exceptionally poor performance relative to the Alerian MLP ETF (AMLP).

What else is left to say here you might ask. Well for one, investors are still long this equity and its preferred shares (NYSE:CORR.PA), and interestingly enough there is a trade to be made here.

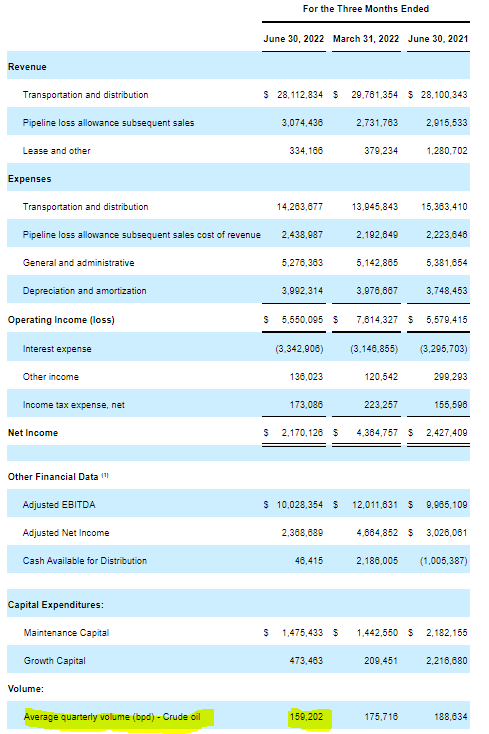

Q2-2022

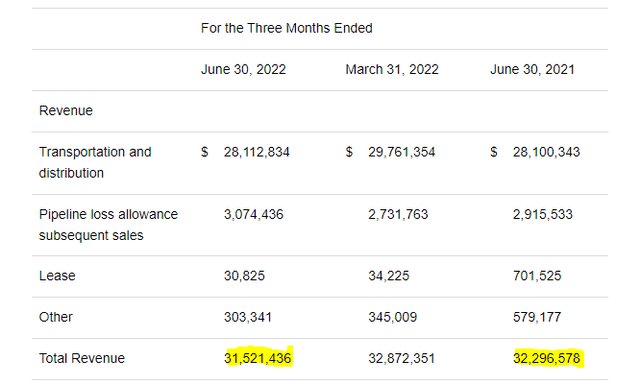

CORR’s big acquisition closed in early 2021 (10-Q) and this was the first quarter where we got a year over year number that was fully comparable. We saw a year over year decline in revenues

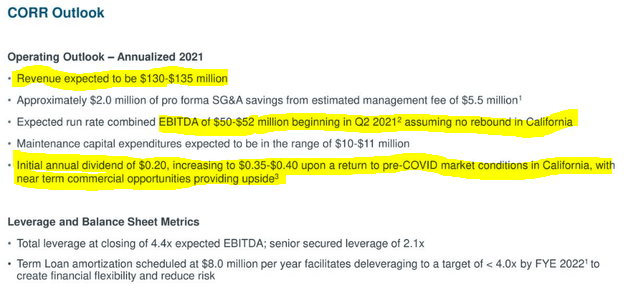

This is a rather grim outcome from what was projected right around the time the acquisition was announced. Back then the projected run rate was supposed to exceed $130 million and EBITDA was supposed to be at $51 million (midpoint).

CORR Presentation

Those numbers were projected at a time of far lower oil prices and were supposed to be a launchpad for 2022. CORR also instituted 10% price hikes in August 2021 and despite this all we are at a revenue run-rate far below that. So what’s going on here?

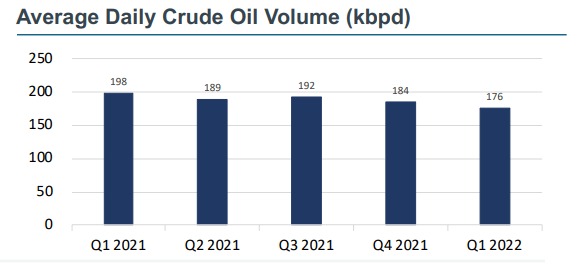

In a nutshell, this is a volume story. Volumes on the Crimson pipelines are headed in one direction and one direction only.

CORR Presentation

Note that this does not include the Q2-2022 numbers as this is the latest presentation we could find. The Q2-2022 numbers are below though and you can see the trend continues.

CORR 10-Q

CORR of course spoke about this in their earnings release.

The Company also announced that its joint venture with Crimson Midstream experienced an unexpected volume decline in the second quarter, primarily due to supply disruptions in the global oil market resulting in the California refineries altering their historical crude oil sourcing patterns. However, the volume loss has reversed beginning in July due to operational issues in the crude oil supply chain unrelated to the Crimson assets. As a result, volumes are expected to remain near first quarter 2022 volumes as long as the third-party operational issues persist.

The level of volume volatility in 2022 is unusual compared to historical patterns. Based upon the impact of current market conditions on our customers, and therefore on volumes shipped on Crimson’s pipelines in any given month, swings in revenue may occur quarter to quarter, until the global oil markets return to a more normal state.

Despite the low second quarter volume and uncertainty of the duration of other supply chain issues, the Company maintains its revised adjusted EBITDA guidance of $42 to $44 million. The Company expects to benefit from potential increase in crude oil volume available to be shipped upon the conversion of the Phillips 66 Rodeo refinery to renewable diesel, scheduled for first quarter 2024.

Source: CORR Press Release

There was also the mention of yet another 10% hike this year.

The Company also announced that Crimson subsidiaries recently submitted applications for 10% rate increases to the California Public Utilities Commission. These rate increases mitigate the adverse earnings impact of long term decline in oil production in California. The rate increase will become effective in the third quarter; as always, rate increases are subject to potential refund if the cost of service impact of lower volume is successfully challenged.

Source: CORR Press Release

This is a fascinating case study to us where a regulated asset is passing on huge hikes as the volume drops off. It will be interesting to see if this hike is approved at the current request rate and whether CORR can continue to offset declines in this manner.

Outlook

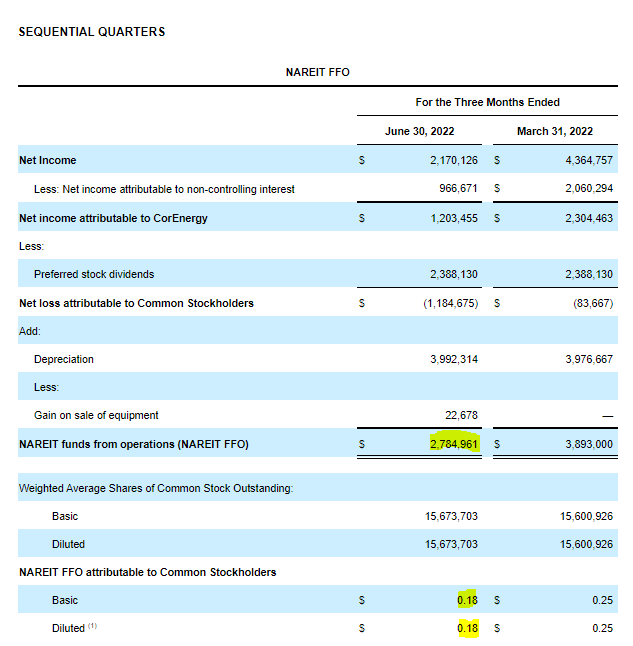

At first glance, the NAREIT defined funds from operations (FFO) appears rather sturdy in relation to the dividend of $0.05 per quarter.

CORR 10-Q

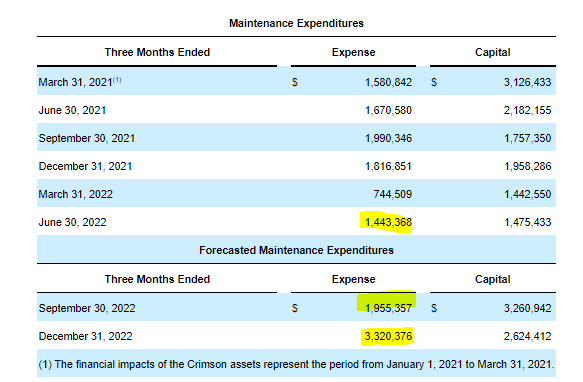

It is important to note though that the FFO does not include maintenance capex and those were half of the FFO in Q2-2022. They will also increase dramatically in Q3-2022 & Q4-2022.

CORR 10-Q

One more point here is that even the FFO after subtracting maintenance capex is not a free cash flow measure as CORR has mandatory debt payments of $2 million a quarter. So as we move further into the year coverage gets really tight.

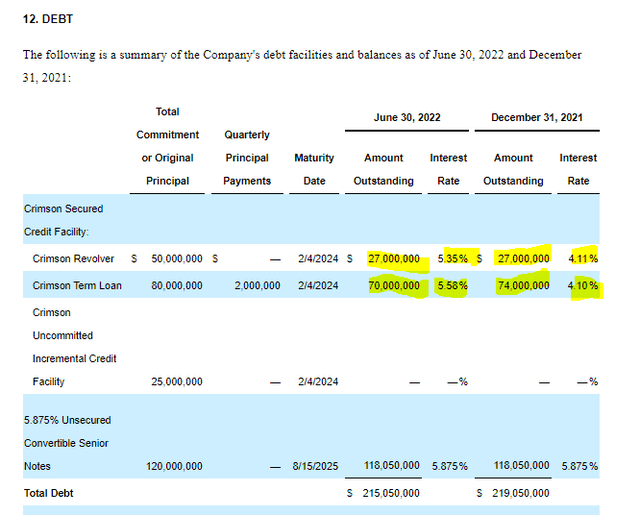

CORR also faces huge interest rate hikes on its floating debt which is just a shade under $100 million.

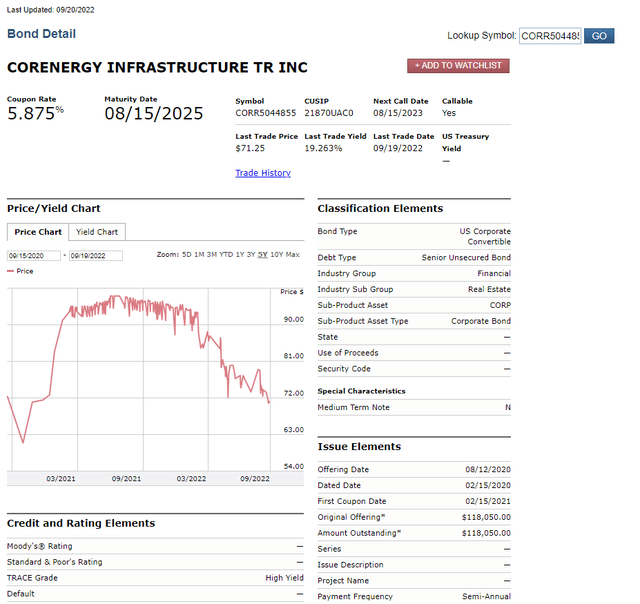

Based on Fed Fund Futures, this looks incredibly ominous as we step into 2023. Interest costs will easily double from the December 2021 base rate. This facility also has a maturity in 2024 and refinancing this looks next to impossible in our view. Well don’t take our word for it, look at where the bonds that are next in line are trading. 19.263% yield to maturity is even higher than what the figure was at the worst of COVID-19. The price was lower but the yield to maturity back then only reached 17%.

At this point there are two major sources of cash outflows for the company. The first is the rising interest costs and the second is the preferred distribution of about $10 million a year. The two currently run at about $24 million out of the $41 million EBITDA. Removing the latter and paying off the debt is likely the best option to solve both problems and ensure the viability of the firm.

Verdict

Of course preferred distributions can only be cut when common distributions are moved to zero. We get that. But in this case, it is totally warranted and likely the only thing that keeps the firm on a good footing going into 2024. For those bullish on the firm the 19.263% yielding bonds make 100 times more sense than the preferred shares 10%. Sell the common shares, sell the preferred shares and perhaps consider the bonds if you are bullish.

Be the first to comment