z1b

The banking sector has become a source for great bargains in recent months. While the bigger names are all rather cheap, few companies are as cheap as Ally Financial (NYSE:ALLY). With a forward PE of just 4.4x, Ally trades at a multiple reserved for companies that are in terminal decline. In this article, I highlight why the market appears to be overly pessimistic on this name, setting it up for potentially highly rewarding long-term returns, so let’s get started.

Why ALLY?

Ally Financial is a digital financial services company that does business with consumers, commercial and corporate customers. It was originally called GMAC and was spun off from General Motors (GM) in 2006. The company has three main business segments: Consumer & Commercial Banking, Mortgage Banking and Corporate Finance. It’s also the #1 digital bank with over 2.5 million deposit customers and over 10.5 million total customer relationships (including borrowers).

The Consumer & Commercial Banking segment offers products such as retail deposit accounts, credit cards, personal loans, lines of credit and merchant services. The Mortgage Banking segment offers mortgage products and home equity loans. And finally, the Corporate Finance segment offers financing to middle-market companies.

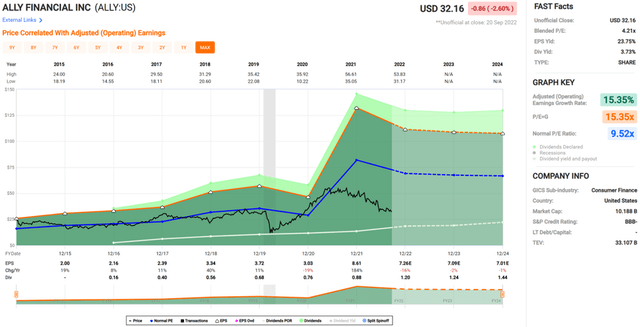

Ally’s stock has fallen materially over the past 12 months from a 52-week high of $56 to just $32 at present, representing a 43% drop. It currently also trades below its 50- and 200-day moving averages of $33.61 and $40.67, respectively.

One would think that the sky was falling for Ally based on this share price performance, but that simply is not the case. This is reflected by the respectable 14.7% return on common equity that Ally generated during the second quarter. It also generated consumer auto originations of $13.3 billion from 3.3 billion processed applications, representing the highest quarterly originations since 2006.

The surge in auto loans makes sense, as many workplaces have adopted return to office mandates for at least a part of each week, with this trend continuing in post-Labor Day and as COVID cases continue to decline. Moreover, Ally increased its retail deposit base by 6% YoY to 2.5 million customers, representing its 53rd consecutive quarter of customer growth.

Risks to Ally include the potential for a U.S. recession on the horizon, and this is likely the prime culprit behind Ally’s steep share price drop. While there is legitimate risk, I believe the concerns are overblown especially considering that outside of a home, the automobile is the most important physical asset for most American families.

Considering the fact that many people may not even own a home, the car is probably the last asset that a household would want to part with. Management also indicated nimble digital tools at hand to handle car auctions on re-possessed vehicles, as noted during the recent conference call:

The scale of our operations enables our full spectrum, adaptable approach to consumer and commercial auto lending that has proven resilient as operating and economic conditions change. Our all digital auto auction platform provides an attractive disposition channel and real-time data into used vehicle trends nationwide.

Our auto collections team has also enhanced its digital engagement with consumers. From here, we are focused on strengthening all of our customer relationships as higher engagement has significant benefits with a few examples just mentioned and also highlighted on the page.

Looking ahead, we know our customer-centric, modern, digital-first approach will position us to drive further customer growth, strong engagement and value in the years ahead. We also think car ownership was again proven to be a mainstay in consumers’ lives. Yes, we will have fluctuations in various quarters, just like everyone, but long-term, the company remains poised for substantial value creation.

Moreover, in cases in which a car is repossessed, Ally should be able to recoup its principal considering that the used car market should remain strong due to supply constraints in new car production. This is supported by the press release from Ford Motor (F), which expects to have about 40K to 45K vehicles at the end of Q3 lacking certain parts presently in short supply, and warned of $1 billion in higher than originally expected supplier costs.

Meanwhile, Ally sports a BBB- investment grade rated balance sheet and pays a very healthy dividend that’s well-covered by a low 17% payout ratio (based on Q2 adjusted EPS of $1.76). It’s also dirt cheap at the current price of $32.16 with a forward PE of just 4.4x, sitting well below its normal PE of 9.5x. Management has also demonstrated an aptitude for aggressively buying back shares and growing its dividend with a 5-year dividend CAGR of 26%. As shown below, Ally’s share count has been reduced by 26% over the past 5 years alone.

ALLY Shares Outstanding (Seeking Alpha)

Sell side analysts have a consensus Buy rating on Ally with an average price target of $45.37. This translates to a potential one year 45% total return including dividends.

Investor Takeaway

Ally Financial is demonstrating strong growth, and yet its share price is trading down in the gutter. While there are legitimate reasons for concern, I believe the risks are way overblown with the stock trading at what I see as being dirt cheap levels. With aggressive share buybacks and a high dividend growth rate, buyers at today’s prices could see potentially very strong total returns from here.

Be the first to comment